Company Information

BillEase is an excellent choice for Filipinos looking for a way to shop at their favorite online stores and pay in installments without a credit card. It offers a simple and easy way to pay merchants on Lazada and other online stores such as Fresh Buys, Flower Store PH, and over 600 merchant partners through installment plans.

BillEase is the flagship product of First Digital Finance Corporation, often known as FDFC, a financial technology corporation specializing in developing innovative and effective retail credit products for Southeast Asia. Formerly, BillEase was known as Loan Ranger.

In 2017, BillEase was launched, making financial services more affordable and accessible for all Filipinos.

BillEase is regulated by the Bangko Sentral ng Pilipinas (BSP) and has a Certificate of Authority No. 1101. Their main office is open on weekdays from 9 AM to 6 PM. Customers may reach them through

- Their email: [email protected]

- +639159039339 (for Globe)

- +639999804333 (for Smart)

Products and Services Offered

Buy Now, Pay Later

BillEase has provided a Buy Now, Pay Later (BNPL) product for customers who cannot make a one-time payment for their essential purchases. It allows people to address their urgent financial needs and choose a more convenient way of paying for what they have bought. They can also select the installment term and total amount of downpayment to make it easy for them to pay for the remaining balance.

Loan Features

- Loan Amount / Order Value: Php2,000 to Php40,000

- Down Payment: Php0 to Php32,000

- Interest Rate: 3.49% per month

- Approval: on the spot or within 1 banking day

- Installment Term: 2 months to 24 months

Eligibility

- At Least 18 years old

- Have a stable source of income

Requirements

- 1 valid ID

- Proof of Income

- Payslips

- Screenshots of bank transaction history

- Upwork Certificate of Employment

- Paypal Transaction History

- Remittance Slips

- Etc.

- Proof of Billing

- Meralco Bill

- Credit Card Bill

- Water Bill

- Cable TV Bill

- Post-paid Plan Bill

- Etc.

Acceptable ID Cards with BillEase:

- National ID (PhilSys)

- Passport

- Alien Certificate of Registration (ACR) / Immigration Certificate of Residence (ICR)

- Driver’s License

- GSIS e-Card

- Integrated Bar of the Philippines (IBP) ID Card

- NBI Clearance

- Professional Regulation Card (PRC) ID

- Senior Citizen Card

- SSS Card

- Unified Multi-purpose ID (UMID)

- Voter’s ID

- Postal ID (new)

Why Choose BillEase

Filipinos consider many factors before availing any financial products such as interest rates, loan amount, speed or processing, and the credibility of the lender. That said, BillEase guarantees excellent customer service at incredibly affordable interest rates. Below are the following reasons why Filipinos looking for financial services and products should consider BillEase:

Fast and Easy Application

The process of application with BillEase is done 100% online, so borrowers expect a smoother and faster transaction. There’s no need for them to visit the local bank and other lenders to fund their purchases. With BillEase, they only need to fill out and submit the application form, then submit the required documents online – it is that fast and easy, all from the comfort and safety of their own home.

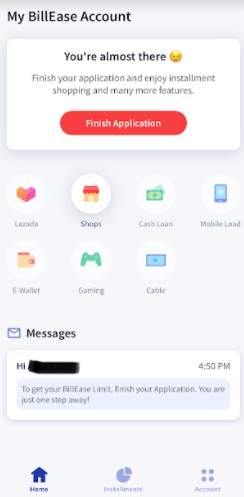

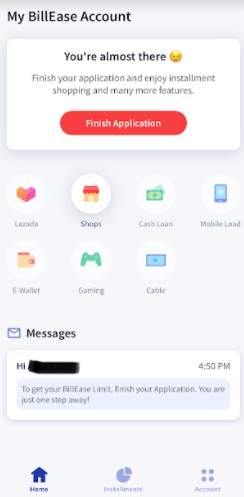

Gives An Instant Acces To Exclusive Features

One of the things that Filipinos consider when getting financial products is the speed with which they can get a response, and BillEase does not disappoint its customers. Customers who wish to avail BillEase financial products and services will be guaranteed 24-hour approval. It allows its customers’ instant access to exclusive features – from e-Wallet top-ups to mobile loading to bill payments – all through the app!

Payments are Made Quickly and Without Difficulty

BillEase ensures that its customers can settle repayments in several convenient and efficient payment methods. For example, customers can send their payments via GCash, Coins.ph, and mobile banking, which is the most suitable for users given the current pandemic.

Moreover, customers no longer need to mark their calendars or set a reminder because BillEase notices customers’ emails before their due date.

Shop Now and Pay Later at Your Favorite Stores

BillEase is committed to meeting the financial needs of its customers. The company has been working with over 600 merchants around the country to ensure that everyone, especially those on a tight budget, has the opportunity to purchase big ticket items at their favorite stores.

Whatever comes to mind, from meals and necessities to vacation expenses, BillEase has it covered for them. All there is left to do is sign up and select BillEase at checkout to take advantage of the company’s Buy-Now-Pay-Later services.

Sell More with BillEase

The thing with BillEase is that it is consumer-friendly and also benefits businesses seeking to convert visitors into buyers. Through its Buy-Now-Pay-Later option, BillEase guarantees a 50% boost in average order value. Furthermore, BillEase settles transactions via automated bank transfer, allowing businesses to meet their target sales without taking any risks effortlessly.

Flexible Credit Line

BillEase allows its customers to shop online without needing a credit card by offering them a quick credit of up to Php 40,000, and they can also apply for a personal loan with repayment terms ranging from 30 days to 12 months, whichever suits their needs.

Positive Customer Feedback

They say customer experiences determine a company’s profitability and efficacy. BillEase has consistently received a lot of great comments from customers and has always been recommended. The majority of them have been using BillEase for many years and are pleased with their services.

How to Sign Up

To sign up with BillEase and apply for their product, follow these very simple steps:

Download the BillEase app through the Google Play Store or Apple App Store.

Click on Sign up to start the registration process. Provide your name and contact number to begin. Remember to provide your mobile number in the application process.

Provide more contact and personal information and create your user profile. Set up your user password.

Enter the One Time Password (OTP) sent to your email ID.

Enter the One Time Password (OTP) sent to your mobile number.

Provide your complete address.

Set up your 4-digit PIN and your Face ID for added security.

Complete your BillEase account application by clicking on “Finish Application”.

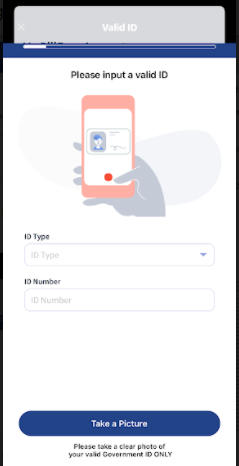

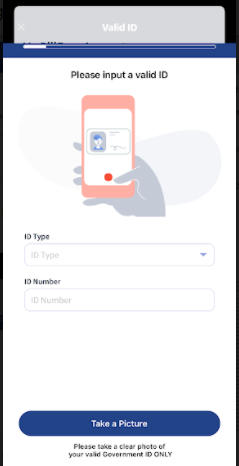

Upload a government-issued ID.

Wait up to 5 minutes while BillEase verifies the information provided.

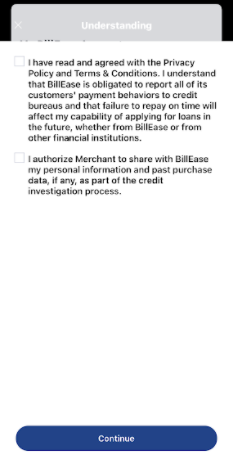

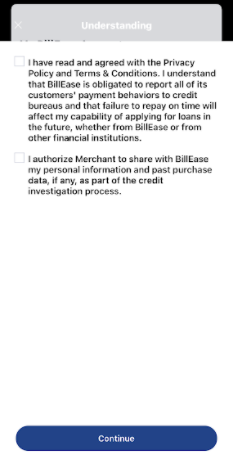

Tick the boxes to agree to the terms and conditions of use and then click on Continue.

Provide details on the Source of Income by ticking on the most appropriate box.

Enter the salary information required.

You will be notified of the successful approval of your BillEase account.

Frequently asked questions

How do I make payments?

How will I know if my application is approved?

How long is the loan processing time of BillEase?

I do not have proof of billing under my name. Can I still apply?

Do I need a credit card to apply?

Can I re-avail?

Conclusion

BillEase’s Buy Now, Pay Later arrangements have truly helped Filipinos address their needs instantly without having to go through much loan processing. This form of financial assistance is tempting, especially to those who have no extra money or simply do not want to pay for their purchases all at once, to still set aside cash in case of emergencies.

Thanks to BillEase’s financial products and services with low interest rates and flexible repayment plans, Filipinos can manage their finances and pay for their purchases online even without a credit card.