Company Information

Cashalo is a leading financial technology company that operates through its mobile app to enable fast, affordable, and secure access to credit for its clients. Cashalo offers digital credit to Filipinos to help them elevate their financial well-being.

Paloo Financing Inc. finances the loans that Cashalo offers to its clients with SEC Registration No. CSC201800209. Cashalo is a wholly-owned Hong-Kong based Oriente subsidiary whose founders are behind Skype and LU.com.

Cashalo’s main office is located at 16F World Plaza, Bonifacio Global City (BGC), Taguig City. Clients can contact them through their email ([email protected]) or their hotline number (02-8-470-6888).

They are open every day from 9:00 AM to 8:00 PM on weekdays and from 9:00 AM to 6:00 PM on weekends.

Loans Offered

Cashalo offers loans for the different needs of Filipinos – from needing cash to pay for personal needs to buying electronics or appliances for the home or business use – they have options to choose from.

Applying for loans is not a complicated process. You only need to be a Filipino resident, at least 21 years old and have a steady income stream to qualify.

You also need to have the Cashalo App downloaded on your phone and fill up all the details required in your profile. Also, you need to include 1 valid government-issued ID (Unified ID / Driver’s License / SSS ID / TIN ID / Voter’s ID / Philhealth ID (PVC type) / PAG-IBIG Loyalty Card / Passport).

The more details you fill in your profile, the higher the loan amounts available.

Here are the different loan options to choose from:

Cashaloan

Cashaloan allows clients to borrow from Php 2,000 to up to Php 7,000. But, again, the amount you can apply for depends on the completeness of the information you enter on your profile app. Repayment terms will also depend on your preference, but usually, for Cashaloan, the repayment is after 14 days.

A processing fee will be charged at 20% of the loan amount, insurance towards COCOLife, and an interest of 0.9% per day will also be charged until the loan is due.

Cashing out options are through the bank, Paymaya, or Gcash. When you choose Gcash, make sure that the mobile number you entered to complete your profile is the same as your Gcash number.

Lazada Loan

The pandemic has limited the opportunity to go shopping in malls, which led to the rise of online shopping and has benefited a lot of consumers. One of the online shopping apps that consumers rely on nowadays is Lazada. It has everything anyone would need, and with the Lazada Loan, shoppers can buy items using Cashalo.

Simply go to the Cashalo app and choose Lazada Loan. You will be required to activate your Lazada Wallet and input your Lazada account in the cash-out options on the app. Ensure that the email ID and mobile number in your Lazada account are the same as the details you entered to complete your profile on the Cashalo app. Once this is done, you can choose the loan amount to apply for (up to Php 7,000), the repayment terms (up to 90 days and a maximum of 180 days with other partner merchants) and the interest rate starts at 5.99% monthly. Approval is usually within an hour.

Repayment of the loan can be made through over-the-counter payments in 7-Eleven, ECPay, Robinson’s Bank Bills Payment, Robinson’s Business Centers in Robinson’s Department Stores, Digipay, or across BDO branches.

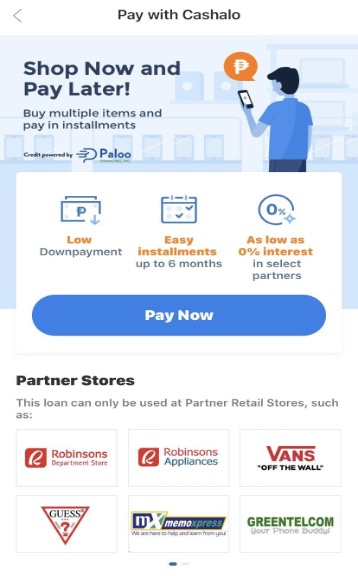

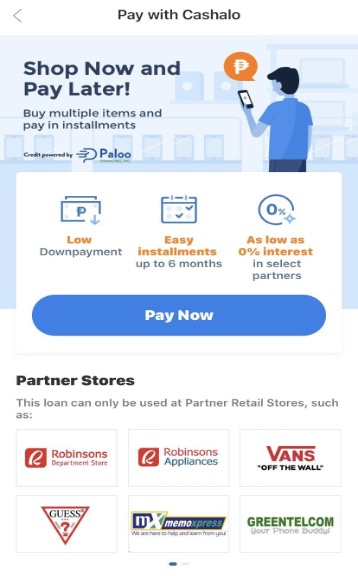

Shop Now & Pay Later

The beauty of Shop Now and Pay Later as a product is not having to pay interest when you shop in selected partner merchants. Cashalo partner stores that offer 0% interest include Spyder, Gear Up, Vans, Fila, Centroplay, Bikelane, Motoactive, Bny Jeans, MonkeyMike Safety Gears, and KW Oro Optica. They also have over 850 merchant partners nationwide. That gives any client access to purchase electronics and appliances that they need.

To avail of this loan, you will have to complete your profile and get approved in advance through the mobile app. You may want to check the participating stores in your App in advance, too.

The maximum loan amount is Php 7,000, and repayment can be in installments of up to 6 months. You will be asked to pay a downpayment of 20%. The processing fee is 10%, a monthly interest rate of 5.99%, and a maximum effective APR of 49.68%.

Once you have done your shopping, you can manage your loan through the Cashalo app and pay your installments via participating payment channels.

PayLater

PayLater functions like a credit card – clients can apply for a flexible credit line that can be used for everyday purchases. You may use the amount in the credit line to purchase from the Cashalo e-store or their partner merchants offline.

You can apply for the credit line approval through the app, and the maximum amount that can be applied for is Php 2,000. 0% interest will be charged when the amount used is paid before its due date. In addition, a 10% processing fee will be paid on top of the used amount from the credit line.

Why Choose Cashalo

Cashalo’s product offerings and services are true to what they envision for financial inclusivity in the Philippines – ordinary citizens are granted access to simple loans.

Here are the reasons why choosing Cashalo is the most beneficial for you:

Uncomplicated

Getting a simple loan should not require complicated documentation and application. The great thing about Cashalo is that you can apply for a loan with just a few clicks on your phone. A smartphone and internet are enough for you to get started.

For Your Everyday Needs

We mostly think of loans when we buy big-ticket items and emergency needs. But that’s not the only reason why people need a loan. Sometimes, purchasing our daily needs can become a challenge, and Filipinos should not be left to deal with this problem independently. A simple loan with a simple repayment plan and minimal interest can significantly help those in need.

There should be a simple solution to an everyday challenge, from groceries to electronics.

Easily Accessible

Why go to loan sharks when you have a better choice, right? And with an app that caters to your needs immediately, you no longer have to worry about where to go. Applying for a loan through a mobile app is so much easier. There’s no long queue to worry about, you don’t have to travel, and you do not have to wait for a long time to get approval for your loan because it is within 24 hours.

Affordable

Taking a loan should not leave the borrower with massive debt. We are all in favor for responsible borrowing, but companies should also be considered lenders. Having access to financial products that offer installment and zero interest is a big help. This is something that Cashalo understands.

Flexible

Borrow as needed and pay with repayment options convenient to you, whether on an installment basis or a lump sum amount at the end of your loan term. What is an even better loan option than the one you can choose based on what you need exactly? That’s why Cashalo is a good choice – you can only borrow according to how much you need.

How to Sign Up

Signing up and applying for a loan is easy and fast because everything can be done through the mobile app. Here are the steps to sign up:

Click on the “Apply now” button below, and search for Cashalo. You will find an icon similar to the one below:

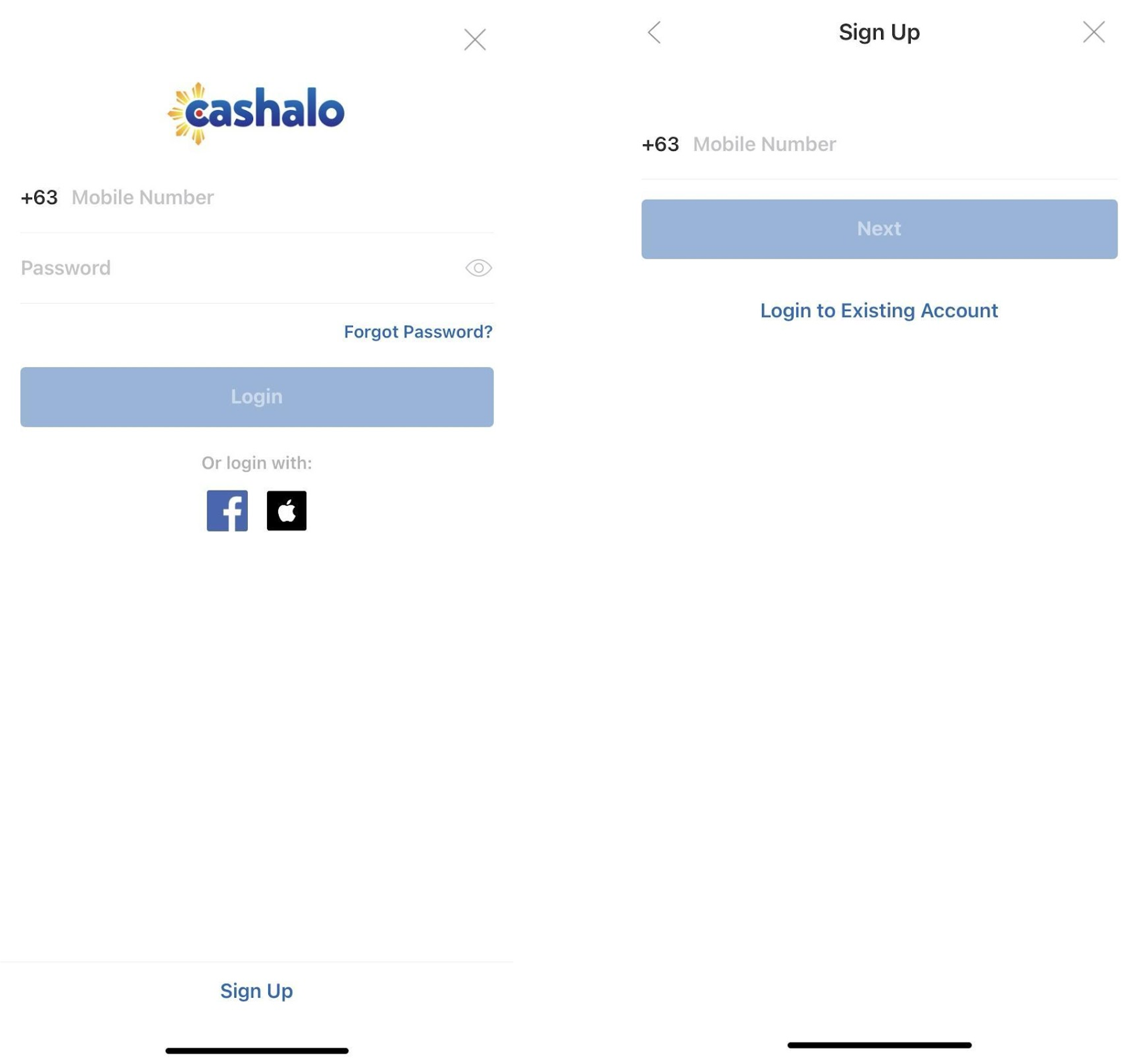

Once downloaded, you can start to sign up. On the landing page, you will see the log-in and just below that, the signup button for you to create your Cashalo account.

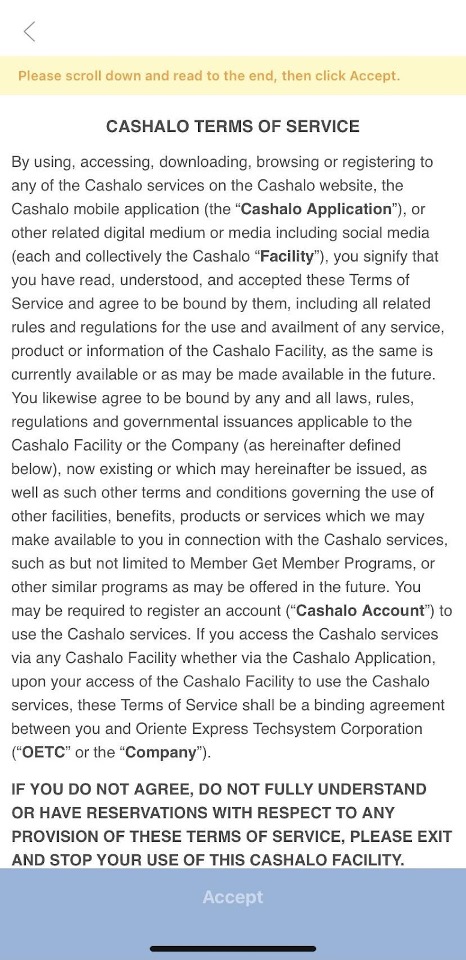

Once your account is created, you will be asked to accept the terms of service for using the Cashalo App and the Cashalo Privacy Policy.

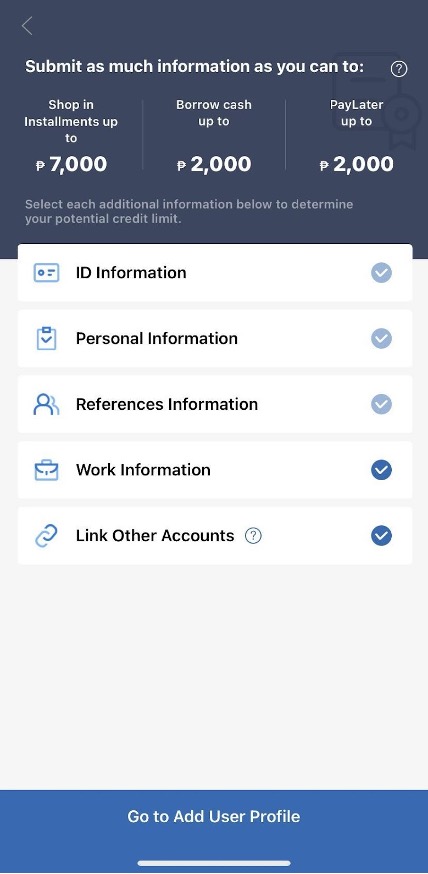

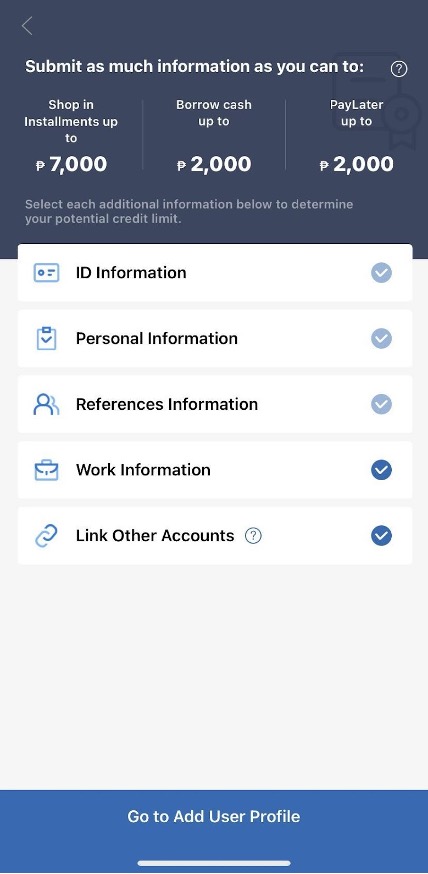

The next step will ask you to complete the information in your profile. This is a very important step because completing this section and uploading supporting documents will allow you to get higher loan amounts and credit.In the ID information, you will be asked to upload 1 valid government-issued ID. Personal Information will include your marital status, nature of your work, your present and permanent home address, household bill, gross monthly income, etc. References information will ask for at least 1 reference (spouse/relative/friend) including name and mobile number. Work information will ask for details about your current employment including uploading your latest payslip.

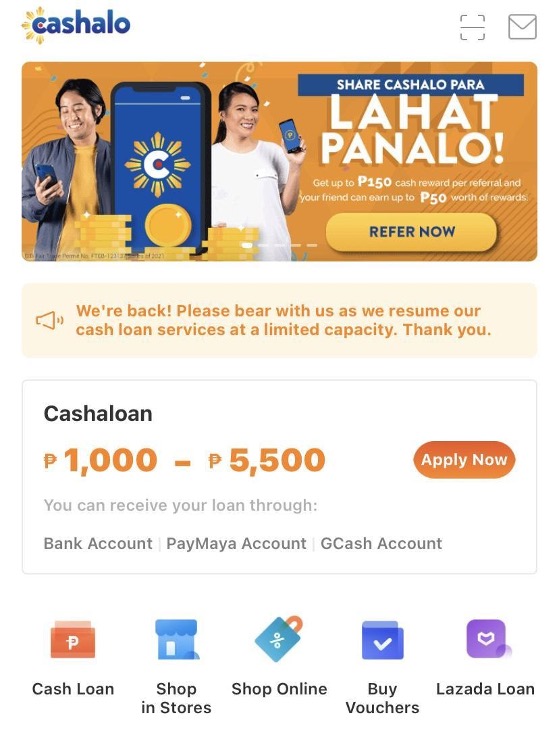

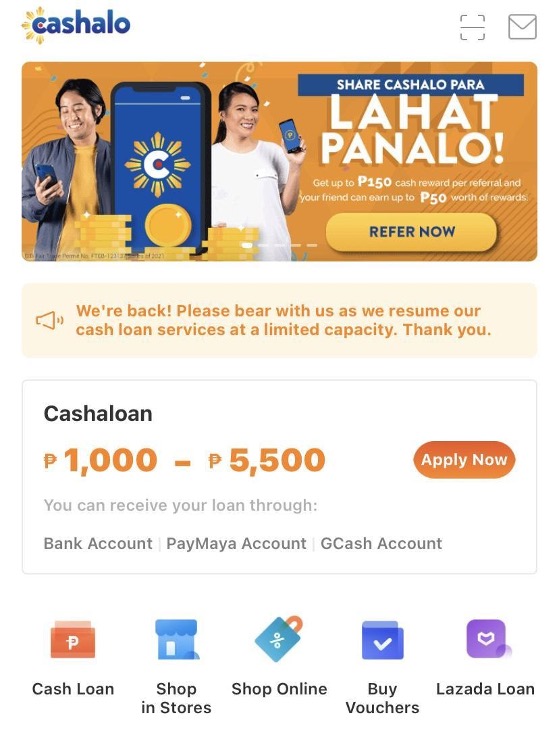

When all the information is uploaded, you may now begin using your Cashalo app and apply for the different product offerings. On the Home page, you will immediately see the product options as shown below:

Applying for the different products will take you to these pages:

Once your loan application is approved, you will be able to manage your loan and its repayments through the app. You may pay your loan directly through BPI or other payment options. Disbursement of the loan amount approved will typically be done within 24 hours and you will receive an SMS or email notification of the approval and availability of the money.

Loan payment can be done in three ways: Online Banking, Over the Counter, or Remittance & Payment Center (via Dragonpay). A more detailed process of repayment of your loan is available in the App under the My Loan icon. There, you will be able to choose your preferred payment method.

Signing up with Cashalo is very simple. You only need your smartphone and an internet connection. Just fill in all the details required and upload the needed documents and you’re good to go.

It must be noted though that products in the Cashalo app cannot be used all at once. You can only avail of one product at a time. Once you have paid your existing loan, only then can you apply for the other products.

Conclusion

Being able to have access to financial products and services is an excellent opportunity for the ordinary Filipino, especially the ones who would want to create opportunities for themselves out of the loan amount they are approved with. One person could be opening a small sari-sari store, and one could be starting a reloading business. The very existence of Cashalo might just be the boost that small business owners are looking for or the answer to every breadwinner’s daily struggle of providing food on the table.

What makes Cashalo a very convenient choice for applying for a loan is the availability of all its product offerings within a single mobile app containing all the information you need for applying for a loan or paying for your loan.