Company Information

PayMaya Philippines Inc. is regulated by the Bangko Sentral ng Pilipinas (BSP) and has its registered office at 6th Floor Launchpad Building, Sheridan corner Reliance St., Highway Hills, Mandaluyong City.

PayMaya is considered the largest digital payments processor in the country for key industries through their enterprise business. PayMaya is also the only end-to-end digital payments ecosystem enabler in the Philippines. Now with its more than 35 million users, that means that there are 35 million Filipinos who now have access to financial services through their over 250,000 digital touchpoints.

In 2016, PayMaya was recognized as the World’s Best Online Payments Solution at the 9th Emerging Payments Awards given in London, United Kingdom.

For customer support concerns, issues and inquiries can be logged through the PayMaya app. They can also visit the website and provide their customer support issues there or send an email to [email protected].

Type of Services Offered

Being the only end-to-end digital payments ecosystem enabler in the Philippines, the various services allow their customers to do everything in the mobile app – shop online, buy tickets, buy games, book flights, stream music, pay bills, or even send remittances.

Buy Games

PayMaya has a lot of gaming partners and provides deals and an upgraded gaming experience when customers buy gaming pins. They can do so by going to the “Gaming” option and choosing the package the customer wishes to buy.

The following gaming partners of PayMaya are the following:

| Astral Fable | Life After | Ragnarok |

| BIGO Live | Light of Thel | Raser Gold |

| Blizzard | Marvel Super War | Roblox |

| Cherry Credits | Minecraft | Rules of Survival |

| Codashop, Diablo III | Mobile Legends | SOFTNYX |

| Dragon Nest | MU Origin | Starcraft |

| Excash | Nintendo Eshop | Steam |

| Gaia | One Punch Man | War of Rings |

| Game Club | Onmyoji Arena | WarpPortal |

| Garena | Overwatch | World of Dragon nest |

| Genshin Impact | Playpark | World of warcraft |

| Hearthstone | Playstation Network Credits | Xbox Live |

| Laplace Mobile | Pubg Mobile |

Buy Load

Customers can buy prepaid mobile loads for themselves or send prepaid loads to other mobile users using the PayMaya Buy Load feature available for all Telco providers at discounted load packages. There are also different data packages that customers can choose from that are most suitable for their needs.

Cash In

With Payamaya’s Spend less to spend more feature, you can Cash-In to your PayMaya account with no additional charges, or you can get a cashback of the service fees using different Cash In Channels available Nationwide.

Those who do not have a bank account linked to their PayMaya can still use other cashing-in methods available such as:

- Convenience Stores

- Self Service Kiosks

- Department Stores & Supermarket

- Remittance Centers

- InstaPay Partners

- PESOnet Partners

- Other Partners

- Smart Padala

- iBayad

- Bayad Center

- Smart

- Sendah Direct

- Global Access

- ExpressPay

- DigiPay

- ECPay

- DA5

Pay Bills

PayMaya offers cashless transactions in payments of your bills. The different Billers Categories you can choose from are Airfare, Cable and Internets, Credit Cards, Charity, Electric Utilities, Government, Healthcare, Insurance, Loans, Memorials, Real Estate, Schools, Telecom, Toll, Water Utility and Others. Customers can now skip the lines and pay for their bills directly from the PayMaya app or website.

Scan to Pay

When people do not have cash on hand with them when buying items at PayMaya’s partnered merchant physical grocery store, that can be a big problem. But with PayMaya’s Pay Contactless using the PayMaya QR Code, customers can use their PayMaya E-Wallet to pay for purchased items by just scanning the Store’s QR Code and following a few easy steps.

There are two way for customers to pay using a QR code:

Through a Static QR display

- Tap “Send Payment” or “Pay” at the bottom part of the home screen of your PayMaya app

- Scan the merchant’s QR code

- The merchant name will be reflected in your screen, where you can input the amount

- Click “Send Payment” or “Pay”

- You will receive a confirmation message in the app and via SMS for your successful transaction

- Present the confirmation message to the merchant

Via the PayMaya One device

- Tap “Send Payment” or “Pay”

- Scan the merchant’s QR code displayed in the PayMaya One device

- The merchant name and total amount to be paid will be reflected in your screen

- Click “Send Payment” or “Pay”

- You will receive a confirmation message in the app and via SMS for your successful transaction

- Present the confirmation message to the merchant

Send and Receive Remittances

Not having to visit banks or other remittance centers to send or receive money is a significant relief, especially for those who live far from the nearest bank branches or remittance centers.

Send Remittances

With just a tap away, you can send money electronically to your loved ones to different locations in the Philippines. There are three different options you can choose when sending cash to others:

- From your PayMaya account to another PayMaya account holder.

- From your PayMaya account to Smart Padala – An additional service fee of 1.5% is computed based on the amount you sent when you opt to transfer money to Smart Padala

- From your PayMaya account to a Bank

Receive Remittances

When you have a PayMaya account, you will conveniently receive money wherever you are in the world. Even if you are just in the comfort of your home, you will be able to do so and you can decide which method you wish to withdraw your funds from. Remittance receipts can be from Western Union or Moneygram.

For either of these, the receiver should be able to receive their money through the following steps:

Western Union

- Open your PayMaya app and tap Add Money near the top right of your screen.

- Tap Western Union ® from the list of Add Money Partners.

- Enter the 10-digit Money Transfer Control Number (MTCN) from your sender’s Western Union ® transaction.

- Tap Receive on your confirmation screen after verifying the correct transaction details (e.g. MTCN, Sender Name, Amount)

- Check for the in-app and SMS confirmation of the successful receipt of your money.

Moneygram

- MoneyGram.com sender will send money to your PayMaya with a VISA virtual or physical card.

- Check for the in-app confirmation of the successful receipt of your money!

Travel with PayMaya

With PayMaya, customers can transfer loads to different electronic travel toll cards at the comfort of their homes with different toll card companies and avoid the long queues when buying train tickets or when loading electronic payment toll cards.

The merchants already partnered with PayMaya are the following:

- BEEP

- Auto Sweep RFID

- EasyTrip

- and more companies available soon

Use Abroad

Filipinos who are mostly abroad because of work or other reasons can be challenged to manage their finances back home. One of the excellent features of PayMaya is the ability for those who transact as if they were still in the Philippines.

To be able to use this feature, customers can do the following:

- Download PayMaya app

- Enter the necessary personal information such as name, Philippine roaming SIM mobile number, Philippine address, date of birth, and email address

- Tap “AGREE”

- Wait for the verification SMS that will be sent to your registered Philippine roaming SIM number

- Enter the verification code in your app once prompted

- Tap “PROCEED”

- Input an invite code for additional rewards

Why Choose PayMaya

Convenience – No Need to Wait in Line

The most attractive feature of PayMaya is undeniably, the convenience they offer their customers. They can save them time traveling and waiting in line – a reality that many Filipinos still face. With the time it consumes from traveling to waiting in line to finish your transactions and then traveling again to get home to your loved ones, people are losing valuable time they could instead spend precious moments with their families or pursue more meaningful endeavors.

Many Partner Merchants Nationwide

PayMaya has hundreds of partner merchants across the Philippines. This allows their customers to have access to convenient payments for their different needs, whether to pay for their utility bills, government contributions, pay for prepaid load, or even pay for tickets. They have a payment solution for almost every Filipino’s daily payment needs.

Accessible Financial Services

Not all mobile wallets in the Philippines have the feature to be used abroad. This makes PayMaya competitive and excellent in providing services to its customers. Moreover, with easy access to financial services, customers do not have to be challenged when dealing with their finances.

How to Sign Up

Signing up for a PayMaya account is straightforward. Customers can follow these simple steps:

Download the PayMaya app to your mobile phone available for Android, Apple and Huawei phone users.

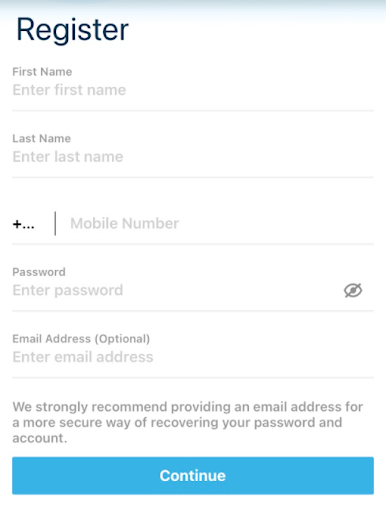

Register your account using your basic information then click Continue. Make sure that your mobile number is an active number.

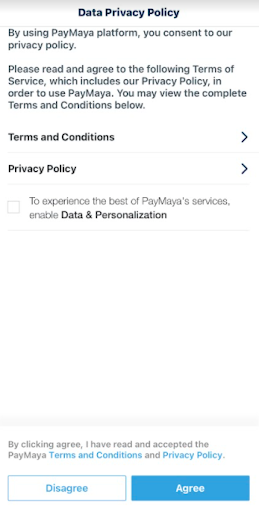

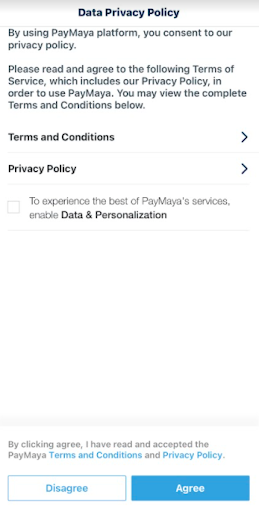

Accept the Data Privacy Policy to continue with your account registration.

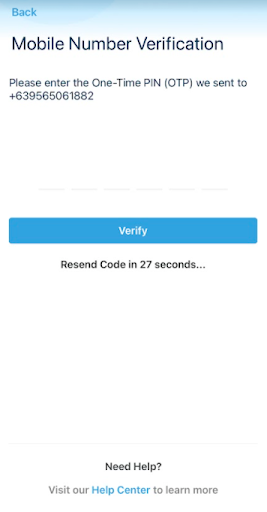

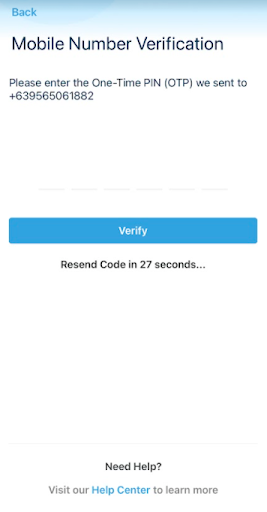

Enter the mobile verification number sent via SMS then click Proceed.

Note: The mobile number you used in the registration process is also your official Paymaya account number and will be used each time you use the PayMaya app.

Frequently asked questions

How do I start using PayMaya?

How to Cash in to Your PayMaya Account

Is there a limit for the transactions?

How to upgrade an account?

How to pay government dues through PayMaya?

Conclusion

Customers who are looking at maximizing their mobile wallet experience will be able to experience all that when they sign up with PayMaya. With their extensive financial services, Filipinos are able to get access to services which they would have had a challenge getting access to if they were unbanked. PayMaya makes it possible for people to experience convenience, accessibility and excellent services.