Company Information

Acom Consumer Finance Corporation was established in the Philippines on the 27th of July 2017. Its parent company Acom Company Ltd holds 80% of the stocks, making it the company’s major shareholder. In Japan, Acom is recognized as one of the largest and most innovative consumer finance companies. In 1993, it was the first to provide 24/7 financial service via ATMs and introduced the MUJINKUN automatic loan application machines.

With its success in Japan, Acom intends to replicate the same success in the Philippines by providing excellent services in the finance industry. When they first began operations in the Philippines, Acom started with Php500M in capital. Its mission is to contribute to the Philippine economy and financial business development.

Acom Philippines is registered with the Securities and Exchange Commission with SEC Registration No. CS201724897 with their office address registered at the 10th Floor, 45 San Miguel Bldg, 45 San Miguel Ave, Ortigas Center, Pasig.

For customer service inquiries or other concerns, you can reach them through their contact details:

- 02-5304-5200

- 0917-713-9761 (Globe)

- 0919-077-6787 (Smart)

Types of Products & Services Offered

REVOMAX Loan

Currently, this is the only loan product is available for Filipinos. Loan applicants can get as much as Php500,000 credit limit depending on the credit assessment. This loan offers low interest and longer payment terms.

Eligibility

For you to qualify for the REVOMAX loan, these are the following criteria:

- Must be a Filipino citizen between 21 to 65 years old.

- Currently employed and working for the same employer for at least three months.

- Minimum salary of Php7,000.

- Can be contacted through the company landline number and their mobile number. (If a freelance ESL teacher/partners driver or rider, no need for a landline number)

Requirements

Once you’ve verified all of the requirements for the loan application, you may proceed to gather all of the necessary documents for loan approval, which are as follows:

- 1 Valid Government ID: TIN/SSS/GSIS/UMID/Passport/Driver’s License/Postal ID/Voter’s ID/PRC/NBI Clearance

- Proof of Employment:

- Original latest payslip within 15 days or BIR2316 (ITR)

- Original Certificate of Employment issued within three months or Employee ID

- Tax Identification Number (TIN) Proof

- Any Document or ID with TIN (TIN Card, Recent BIR2316, Company ID, Payslip)

Requirements for Freelance ESL Teachers (1Talk, ACADSOC, Weblio, Rarejob, Bizmates, etc.) and Partner Drivers / Riders (Grab, Angkas, Lalamove, Foodpanda, etc.):

- Valid Government ID

- List of valid IDs are: TIN/SSS/GSIS/UMID/Passport/Driver’s License/Postal ID/Voter’s ID/PRC/NBI Clearance

- Income Certificate- Screenshot of the applicant’s company app reflecting consecutive pay periods that will make up one 1-month worth of pay.

- <Tax Identification Number (TIN) Proof- Any Document or ID with TIN (TIN Card, Recent BIR2316, Company ID, Payslip)

Loan terms

- Minimum Credit Score: Not Indicated

- Est. APR (Annual Percentage Rate): 39.78% – 54.756%

- Loan Amount: Php 3,500 to Php 500,000

- Loan Duration: 6 – 10 Flexible Months

Other Fees and Charges

Apart from the interest charged on the loan amount, other charges are applicable for every loan approved and disbursed:

- Processing Fee – Php 1,000

- Lending Fee – Php 500

- The processing fee is waived for repeat loans, but a Php 500 lending fee will still be charged.

Loan Disbursement

Once the loan is approved, borrowers will be able to receive the loaned amount through these channels:

- LBC Branch

- Personal Bank Account via Dragonpay

- GCash

You will receive an SMS from LBC or Dragonpay once the funds are credited to your account or available for pick up.

Loan Payment

Repayment is now made more accessible through various channels that borrowers can choose whichever is more convenient to them:

- EC Pay (7-eleven)

- Bayad Center

When paying, make sure that you use the same mobile number provided in the loan application. The amount that you will pay will have to be exact as well. Choose the biller ACOM Consumer Finance Corporation in these payment channels.

Why Choose Acom

Deciding where to get a loan is not easy, given there are a lot of financial institutions available. Acom presents many advantages in terms of flexibility and the type of services they offer. Here are some of the reasons why you should choose Acom.

Collateral or Loan Co-Maker is Not Required

Not many Filipinos can provide collateral to get approval on their loan applications. Sometimes a co-maker is needed in certain situations. But finding someone else to also sign off on your loan application can be challenging because not many people will be able to take on the liability of somebody else’s loan.

The good thing about Acom is they do not need collateral or a co-maker to give you the approval. Their decision on your loan application is based entirely on the documents you have submitted.

Offers Higher Loan Amount

Financing companies typically offer unsecured loans at a lower amount than most. The logic behind that is reasonable and understandable because only very few companies are willing to take the risk. So the team at Acom checks and verifies the documents that they receive and makes decisions on the maximum loan amount they can provide accordingly.

All approvals take into consideration the loan applicant’s capacity to pay. After all, the borrower should not be paying more than the income they receive or reduce the quality of life they can provide for themselves or their families.

Convenient Online Loan Application

Loan applications can be a tedious process that entails preparing loan requirements and, in some cases, waiting and going back and forth in the branches. When applying for a loan application with Acom, borrowers can have the option to submit their loan applications online. By doing this, borrowers will be able to save the time they have to travel and the waiting time until a representative processes their loan application.

Fast Loan Approval

Acom guarantees loan approval as fast as one business day when you have submitted all the requirements they need. A typical loan application takes up to 7 banking days to process, but with Acom, they will not make you wait long and give you a loan decision right away. This is particularly advantageous for those who have emergencies and require cash immediately.

Loan Applications Can Be Made Through a Branch

If borrowers are not comfortable submitting their loan applications online, they can always visit any of the branches of Acom and complete the loan application with their complete loan requirements. Borrowers will receive notification regarding the status of their loan, whether they submit applications through the branch or not.

You can view a list of their branches and business hours on their website. Currently, they have branches available in Metro Manila and its neighboring provinces. Considering that they had just started operations in the Philippines in 2017, they have been able to open more than 20 branches that are easily accessible to Filipinos.

How to Sign Up

Signing up with Acom Philippines is simple. There are two ways to submit your loan application: through a branch or online.

Branch Applications

The same sets of requirements will have to be submitted when submitting your loan application through the bank. For easier reference, here are the Acom branches you can access:

| Alabang | Pasay |

| Alimall | Pasig |

| Eastwood | Quezon City |

| Metropoint | Valenzuela |

| Ortigas | Bulacan |

| Caloocan | Cavite |

| Makati | Laguna |

| Malabon | Nueva Ecija |

| Mandaluyong | Pampanga |

| Manila | Pangasinan |

| Muntinlupa | Rizal |

| Parañaque | Tarlac |

Online Applications

Online applications are convenient for those who do not have the time to visit any branches. It is the ideal option for those who cannot take time off from work and spend a lot of time in the branch waiting.

To start the online loan application, borrowers can visit Acom’s website:

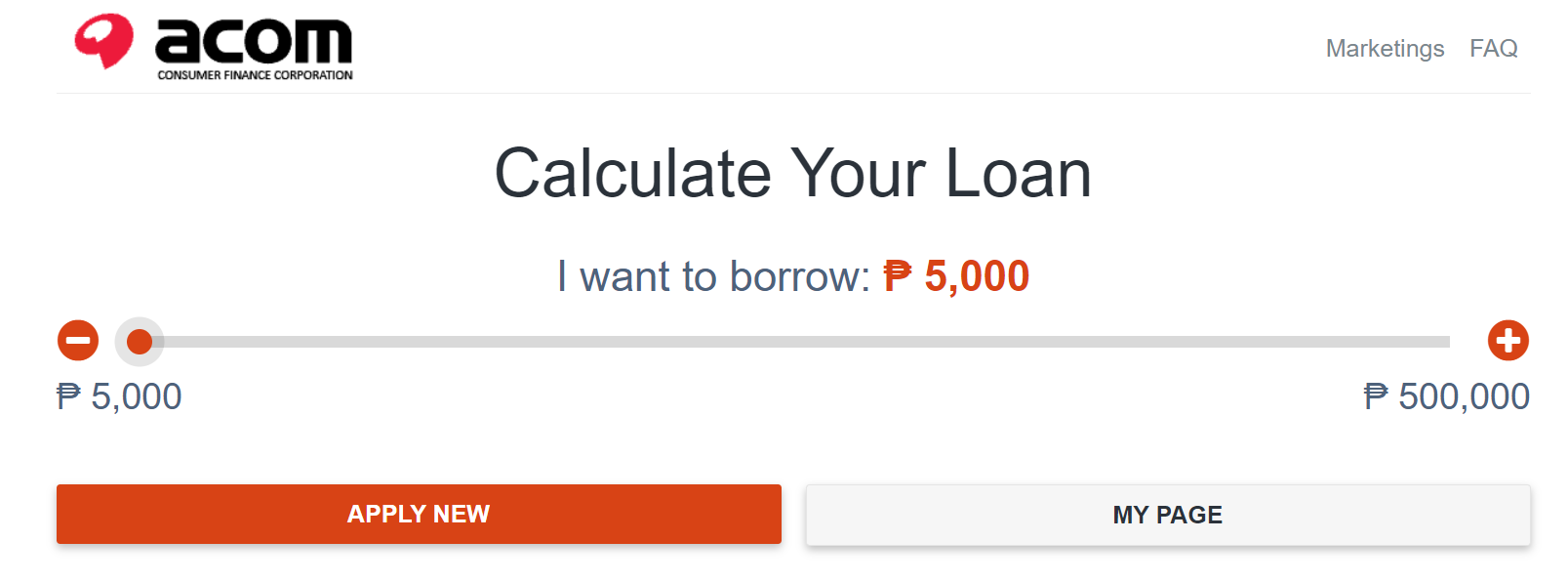

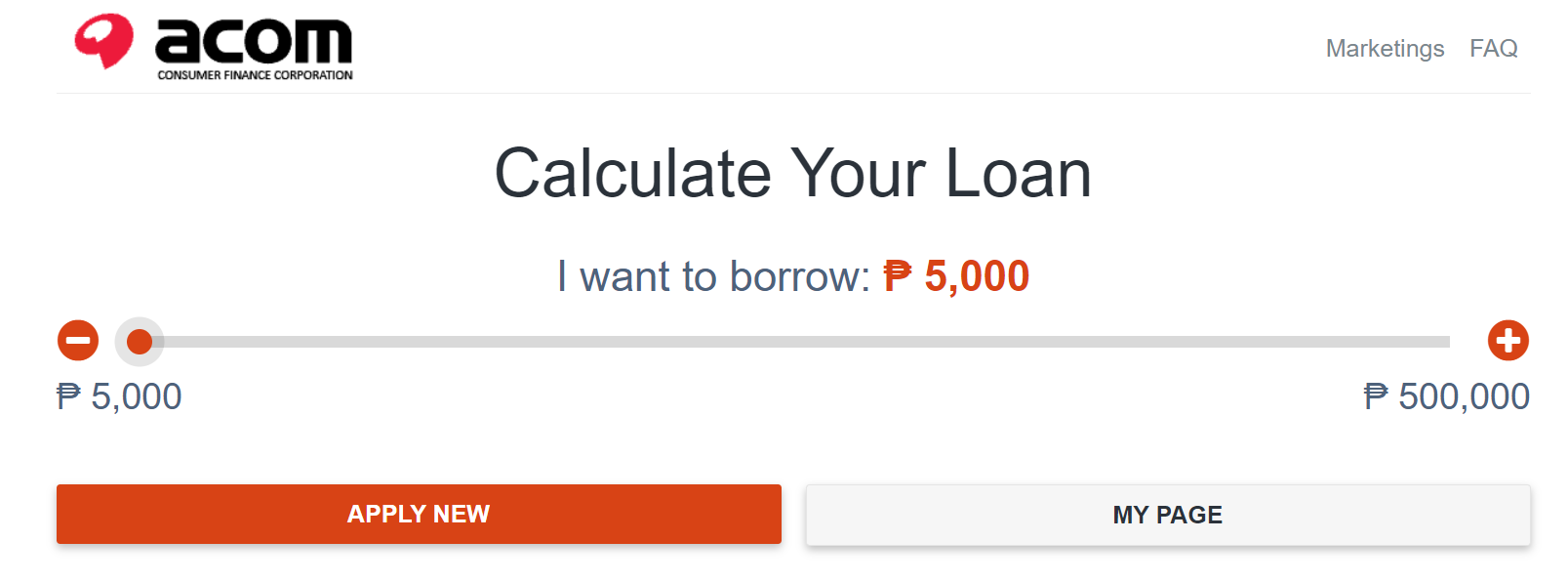

The first screen will allow you to use the loan calculator to foresee how much you have to pay based on the amount you want to borrow and the period you choose.

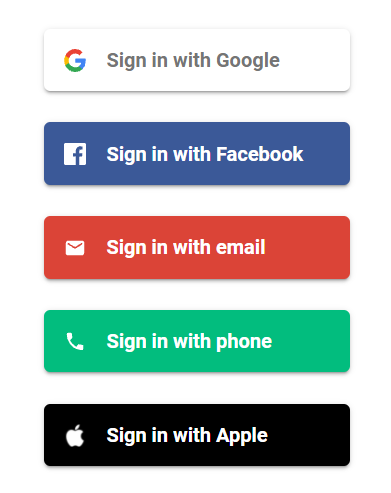

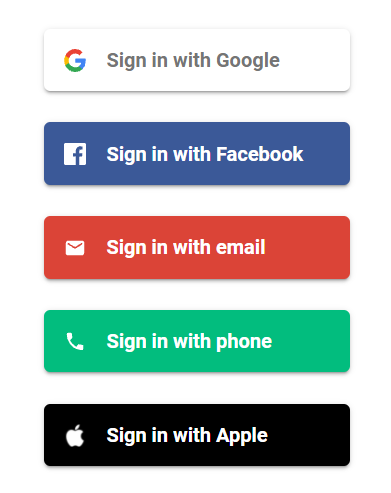

If you do not have an account with Acom yet, you can choose to log in through these methods.

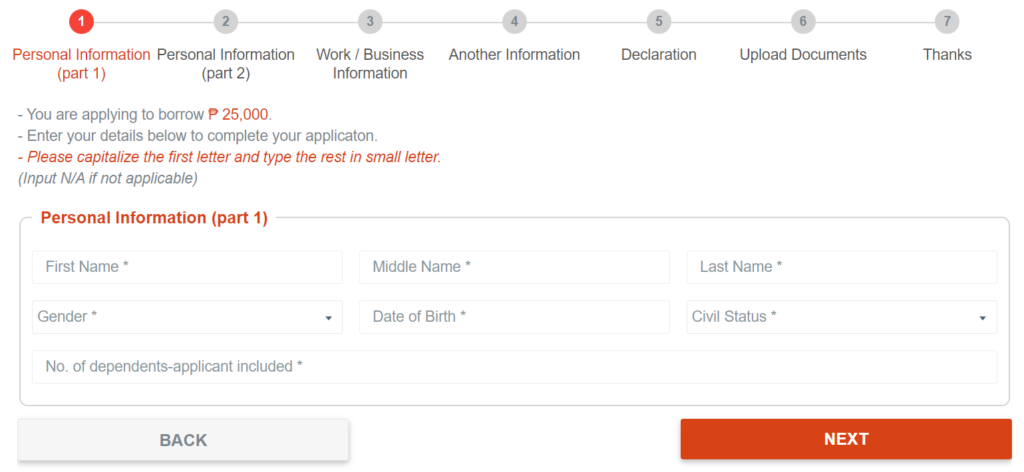

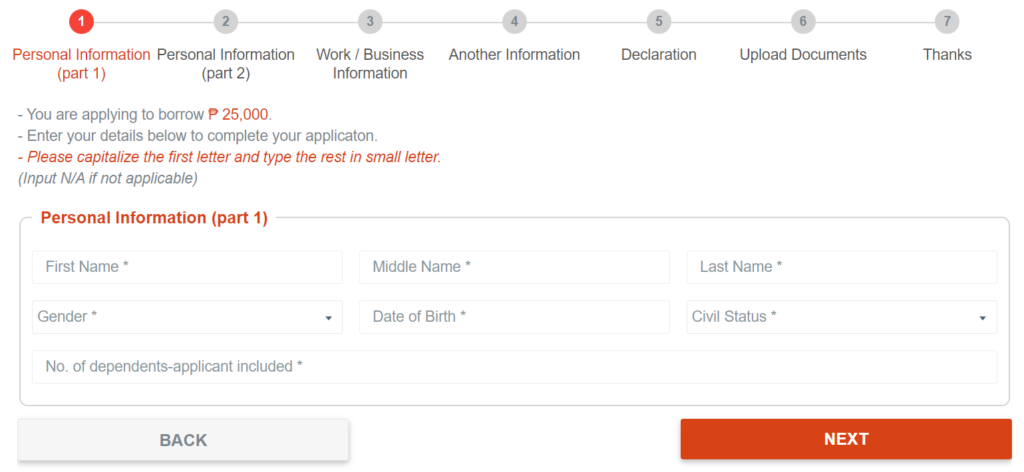

When you are in the online form page, you will have to provide the details regarding your personal information, work or business information and upload the required documents. Once that is completed, you will have to wait for the decision of the Acom team regarding your loan. If the documents are complete, you will be able to hear from them within 1 business day.

Frequently asked questions

How long does the loan approval process take?

How do I know that my loan application is approved?

Do I need a bank account to get approved of a loan?

I made a late payment. Is there any penalty?

Is there any incentive for good payers?

Conclusion

Suppose you are a borrower looking for a loan that requires minimal documentation, does not require collateral or a co-maker, and will get you a fast approval of your loan application. In that case, Acom is the right company for you. Furthermore, you would not want to pay a lot of interest for the loan you borrowed and cripple you financially.