With the ever-changing needs of Filipinos when it comes to their financing needs, it is a relief to know that there are still friendly banks that offer convenience and accessibility to Filipinos from all walks of life. PSBank has been around for more than 4 decades in providing Filipinos access to financial services. They have led the innovation of banking and continue to do so.

Written by: Piggyy

Auto Loan

Home Loan

Business Loan

Personal Loan

Bank services

PSBank was first established on September 26, 1960, as a neighborhood bank located at Plaza Miranda, Quiapo, Manila, then the heart of the country’s commercial and business district. Its first four branches were in Divisoria, Carriedo, Blumentritt, and C. M. Recto.

They were the first bank to offer Monday to Saturday banking with no noon break, extended banking hours, an online electronic data system, and banking-by-mail. In 1991, PSBank became the first publicly-listed savings bank in the country.

According to The Asian Banker, in its AB500 Annual Ranking 2016-2017 edition, PSBank was listed as the second most substantial bank in the Philippines.

Customers can reach their customer support line through the live chat on their website, sending an email to [email protected] or calling them directly through the customer support hotline at (632) 8845-8888.

Those looking to buy their dream car, upgrade their family car, or add more cars to a business fleet are in for a treat with PSBank’s auto loan product. Borrowers will take advantage of fast loan processing, flexible payment terms, and affordable interest rates. Not only that, borrowers will earn rebates or savings each time they make advance or excess payments on their monthly amortizations.

Loan Amount: Minimum of Php100,000

Interest Rate: Based on the prevailing interest rate at the time of booking.

Loan Terms: 12 months to 60 months amortization

A filled out loan application form and the following additional documentation:

Employed Applicants

Self-Employed Applicants

Corporate Applicants

With PSBank’s Home Loan, borrowers will be able to find a solution for any of their financing needs when it comes to:

Loan Amount:

Interest Rate: Prevailing Home Loan rate at the time of loan approval

Loan Term:

For employed applicants:

For overseas Filipino applicants:

Additional requirements for refinancing:

Additional requirements for a construction loan:

PSBank has various loans and credit lines to address the financing needs of businesses.

This term loan offers businesses a specific amount of funds that is perfect for fixed asset acquisition, construction, or to boost the permanent working capital of the business. It is also an ideal option for companies to cover their organization’s long-term financing needs while preserving their own funds.

Loan Amount:

Interest: Based on the prevailing lending rate of the bank at the time of loan availment

SME Business Credit Line gives small and medium businesses the boost they need for their working capital requirements. This credit line can be used should SMEs wish to increase their working capital, stock their inventory, or expand their business square footage.

Line Amount:

Interest Rate: At competitive SME Business Credit Line rates

Modes of Availment:

The SME Credit Line is an excellent opportunity for Small and Medium Businesses to increase their working capital, bridge the gaps in their capital requirements, and take the opportunity to grow their business.

Line Amount:

Interest Rate: Based on the prevailing lending rate at the time of loan availment.

This product helps small and medium enterprises (SMEs) facilitate trade with their major clients by issuing a standby letter of credit. This document would confirm that the business has an available credit line drawn from by the beneficiary when the trade or service is completed. This assures that the firm has the means to conduct and complete a transaction.

Line Amount:

Fee: PhP2,000 or 1/8 or 1% per month (multiply by the number of months certification will be valid) whichever is higher, collect upfront upon issuance of certification

Availability:

Line Expiry: One year from date of implementation, renewable annually

PSBank Domestic Bills Purchase (DBP) Line is the right answer to every businesses’ expenses. It lets businesses maximize the use of their funds and replenish their day-to-day working capital requirements without waiting for standard check-clearing procedures. Instead, PSBank will purchase the dated checks or sales bills of businesses and advance the money to them pending payment from their clients and bank clearances.

Line Amount: Based on 50% of the Average Daily Balance for the past 6 months

Line Expiry: One year from date of approval; subject to renewal

Availability:

Interest Rate: Usual DBP charges. If the check is dishonored, prevailing lending rate + 36% of p.a. penalty to be collected from the date of clearing until fully paid.

Collateral:

To avail of any of the loans for businesses, including SMEs, the requirements to be submitted are the following:

For SME Loans with Real Estate Property Collateral:

For SME Loans with time deposit collateral:

Additional Documents (depending on loan purpose):

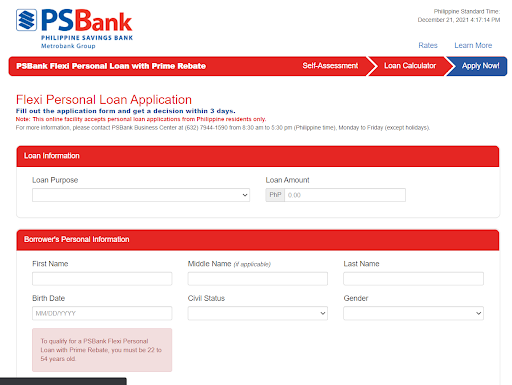

The PSBank Flexi Personal Loan is the first and only collateral-free personal loan product with a revolving credit line and a fixed-term loan. Through this loan, the borrower is provided a debit card which will allow them to access banking ATMs anytime.

Loan Amount: Minimum of Php20,000 and maximum of Php250,000

Interest:

Loan Payment Options:

Loan Term: 24 months or 36 months

PSBank is present all over the Philippines, with over 250 branches nationwide and over 500 in-branch and offsite ATMs. They also make available to their customers PSBank Online which is accessible 24/7.

Businesses, especially SMEs, comprise most enterprises in the Philippines, which accounts for significant job opportunities for the people. Therefore, when banks empower SMEs, more jobs are open for Filipinos. And with PSBank, their multiple loans and credit line options for businesses ensure that they will have access to finance their business goals.

PSBank has multiple ways for customers to contact them for whatever support they need.

PSBank offers payment terms designed to make it easy for borrowers to pay them back. In addition, their credit lines are also designed so that businesses will have ample time to pay them back as well.

Customers can visit the branch or apply online for auto and home loans to apply for a loan. Customers can visit the website, go to the loans section, and click apply now. The page will be redirected to the online application form.

The applicant will be asked to provide personal, contact, spouse and other information to proceed with the loan application. Once done, he or she will be redirected to the loan calculator to have an idea how much the loan amortization will be. Once confirmed, the borrower will have to submit the loan application.

Upon receipt of PSBank of the application and documents, they will verify the information provided and contact the borrower for the approval or rejection of the loan.

PSBank is truly a bank for Filipinos. With their wide reach of Filipinos nationwide, many people are able to access quality banking and become financially included. They have also proved since the time that they were established that they are committed to providing Filipinos an innovative banking service that can match those internationally.

Table of Contents

Table of Contents