Company Information

Digido is a fully automated online lending platform that offers quick loans and instant loans to customers who need immediate access to funds. Its automated loan lending portal expedites the loan process for each application and disburses the loan proceeds within a few hours.

Customers are attracted even more to instant loans because Digido only requires less documentation than banks and other financing companies. Borrowers need not worry about bad credit as instant loans serve as their ticket to building better credit.

Digido provides 0% interest promotional and non-collateral loans of up to ₱20,000. As a fully automated online lender, it is registered under Digido Finance Corp’s name with SEC Registration No. 202003056 and Certificate of Authority No. 1272.

Their main office is Unit 2/C, Murphy Center, 187 Bonny Serrano Road, Socorro, Quezon City Second District, National Capital Region, Philippines.

For inquiries and assistance, you can call (02) 8876 84-84. The customer service representatives are available from Mondays to Sundays, 8:00 AM to 5:00 PM. You can also drop a message on the website or on Facebook.

Type of Loans and Services Offered

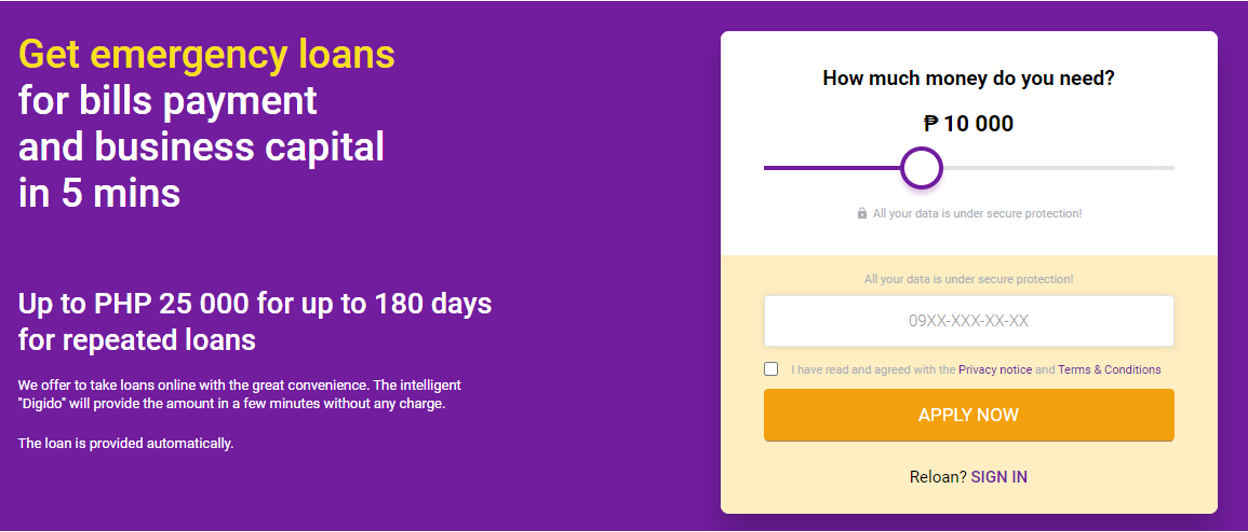

Digido offers non-collateral, emergency loans that borrowers can receive in as fast as five minutes upon loan approval but subject to the completeness and accuracy of information submitted. The whole process, from application to disbursement, may take several hours. However, since the entire process is fully automated, the system can decide on the loan approval instantly.

Loan Features

Loan Amount: ₱1,000 to ₱25,000 (only up to ₱10,000 for first-time borrowers)

Interest Rate: 11.90% per month

Repayment Terms: 3, 4, 5, and 6 months

Payment Method: Online banking, e-wallets, and payment centers

Eligibility

Before you apply for a loan with Digido, you must first check if you meet the following eligibility criteria:

- Must be a Filipino citizen and currently residing in the Philippines

- Must be at least 21 years old but not more than 70 years old

- Has an active and working mobile phone number

Requirements

If you meet all the criteria above, compile the necessary documentation for loan processing:

- A valid, government-issued identity card: Philippine Passport/Driver’s License/PhilHealth ID/SSS UMID Card/Postal ID/TIN ID/Voter’s ID/PRC ID/Senior Citizen ID/OFW ID

- Proof of Income (any of the following): Payslips/Certificate of Employment showing monthly remuneration/Income Tax Return/Company ID/DTI Certificate (if self-employed or with business)

Ensure that the documents you submit are accurate and must not bear any false information to avoid loan rejection. There’s a higher chance of getting your loan approved if you have complete and proper documentation and a loan application form.

Loan Repayment Options

You can choose from any payment methods below for your monthly repayments.

| 7-Eleven Payment Center | AUB Online / Cash Payment | Banco de Oro ATM |

| Bank of Commerce Online | Bayad Center | BDO Cash Deposit with ref. |

| BDO Internet Banking | BDO Network Bank Cash Dep | BPI Cash Payment |

| BPI Online Banking | Cebuana Lhuillier Bills Payment | Chinabank Cash Payment |

| Chinabank Online Bills Payment | Coins.ph Wallet / Bitcoin | EastWest Online / Cash Payment |

| ECPay (GCash / Payment Centers) | I2i Rural Banks | LandBank ATM Online |

| LandBank Cash Payment | LBC | Maybank Online Banking |

| Metrobank Cash Payment | MetroBank Online Banking | MLhuillier |

| Over-the-Counter UnionBank | PNB Cash Payment | PNB Internet Banking Bills Payment |

| PSBank Online | RCBC ATM / Cash Payment | RCBC Online Banking |

| RD Pawnshop | Robinsons Bank Cash Payment | Robinsons Bank Online Bills Payment |

| Robinsons Dept. Store | Ruralnet Banks and Coops | Security Bank Cash Payment |

| SM Dept Store / Supermarket | UnionBank of the Philippines | UCPB ATM / Cash Payment |

| UCPB Connect / Mobile | UnionBank Cash Payment | UnionBank Internet Banking |

Why Choose Digido

There are plenty of online lending platforms in the market, but they are not equally the same. One of the unique features of Digido is its fully-automated process. But there’s more. Here are the other reasons why you should use it.

Fully Automated Service

The fully-automated process makes it more convenient for borrowers to apply for a loan as it’s possible online and through its mobile app. You don’t have to visit a branch and waste your time in queues, and you can save time and focus more on the things that matter for the day.

No Guarantors or Co-Makers Required

Most lending companies and banks require guarantors and co-makers to share the liability of the principal borrower, and it’s a way to lessen the risk of providing credit. In contrast, Digido only approves loan applications based on the proper documentation and the declared source of income.

No Hidden Fees, Upfront Charges, or Commissions

Digido doesn’t charge any fees beyond what’s indicated in the loan agreement you sign before loan proceeds are released. Processing fees are not disclosed on the website, so make sure you ask for these things so you won’t be surprised each time you make your repayments.

Allows for Higher Loan Limits

First-time borrowers can apply for a loan with a maximum amount of ₱10,000 without interest for the first seven days. If repayments are on time, this is an excellent way to build a good credit history. The next time the borrower applies for a loan, it can max out up to ₱25,000 with interest charged at no more than 1.5% per day, or it depends on the loan amount and term.

How to Sign Up

Signing up for a loan with Digido is straightforward. You only need a mobile device, stable internet, and required documents.

- Ensure you have an active mobile number for the Digido team to contact you.

- Be sure to have the documents required for submission scanned and ready.

- Your internet connection must be stable not to lose any data already submitted.

Visit the Digido website and click the “Apply now” button below, located on the right side of the page, along with the loan calculator.

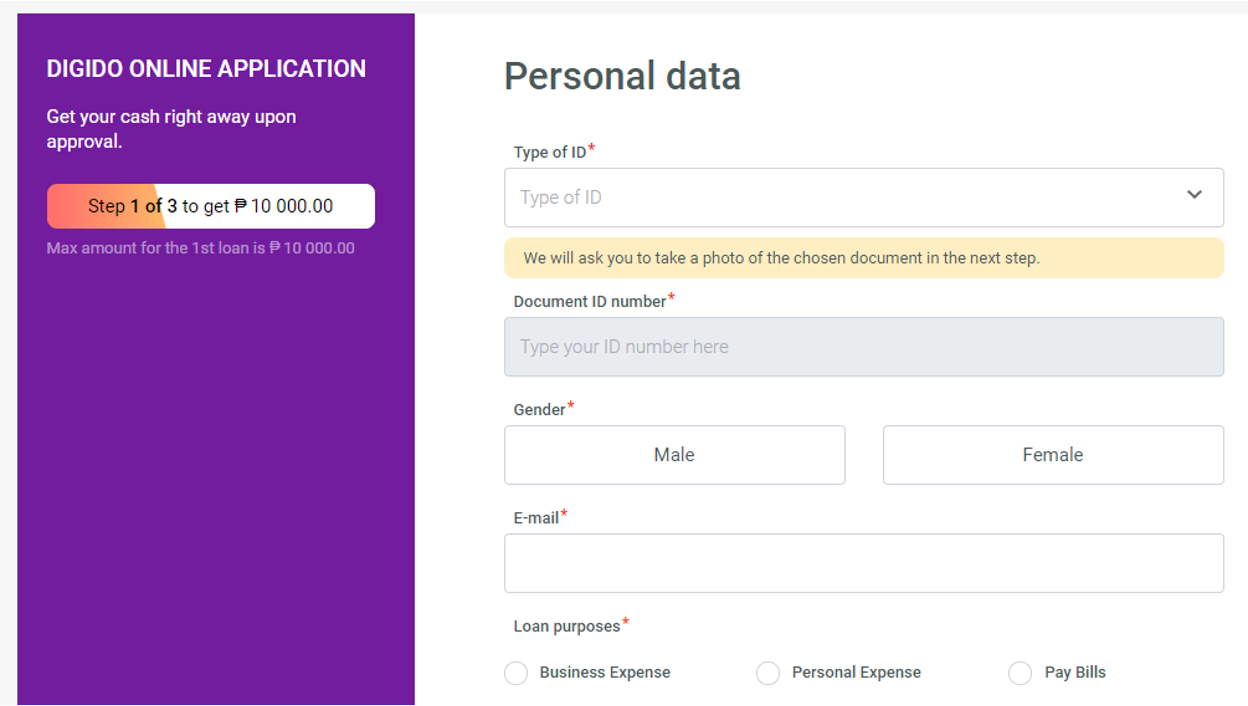

Provide your mobile number, proceed to the next step, and receive a One Time Password (OTP). From there, you will be asked to provide your personal information, including the loan purpose and for which payment the loan will be used.

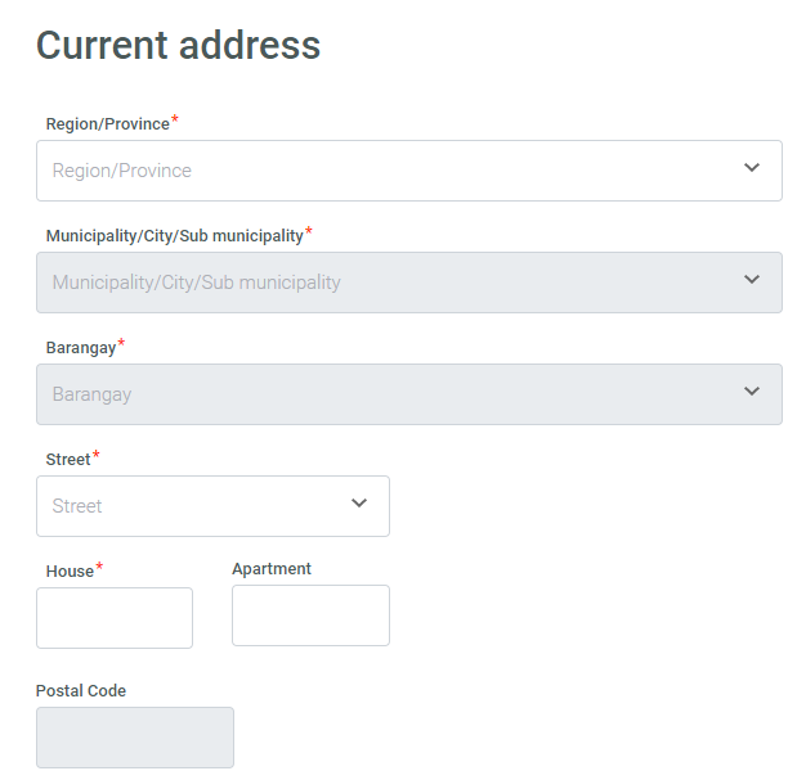

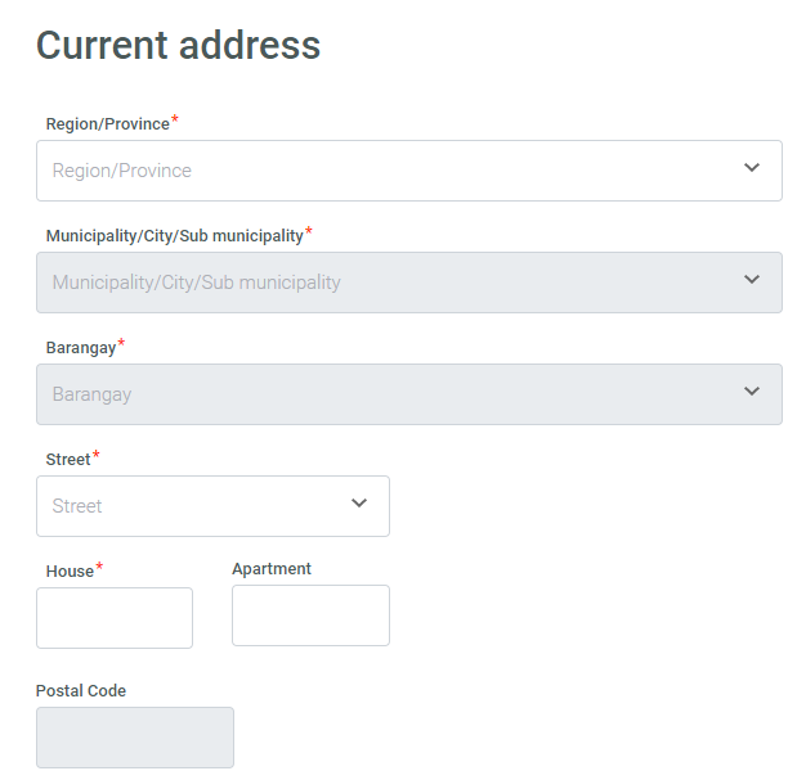

The next page will ask for your contact details, specifically your address.

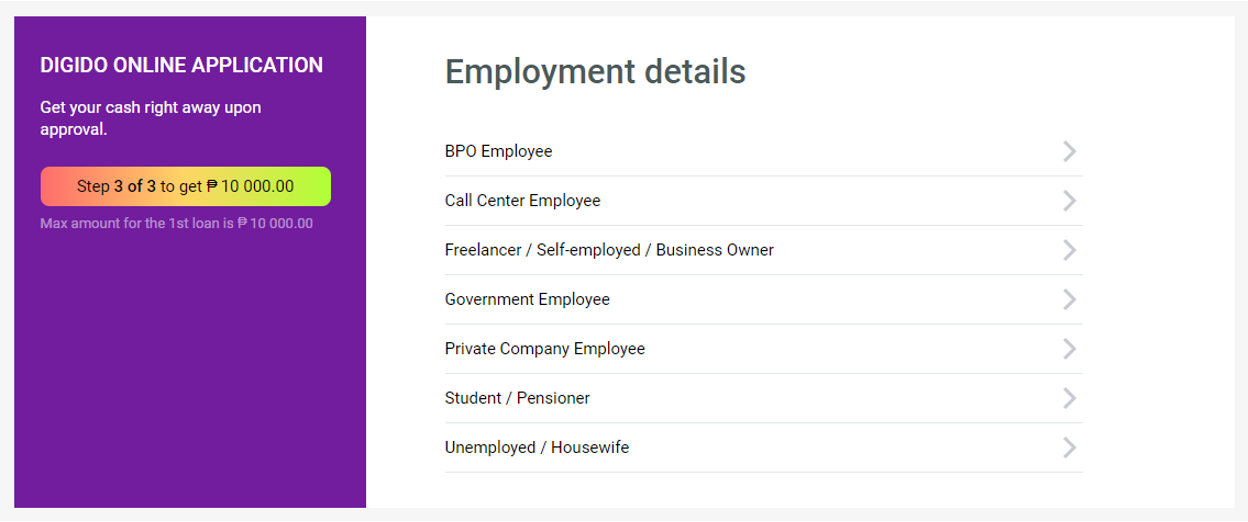

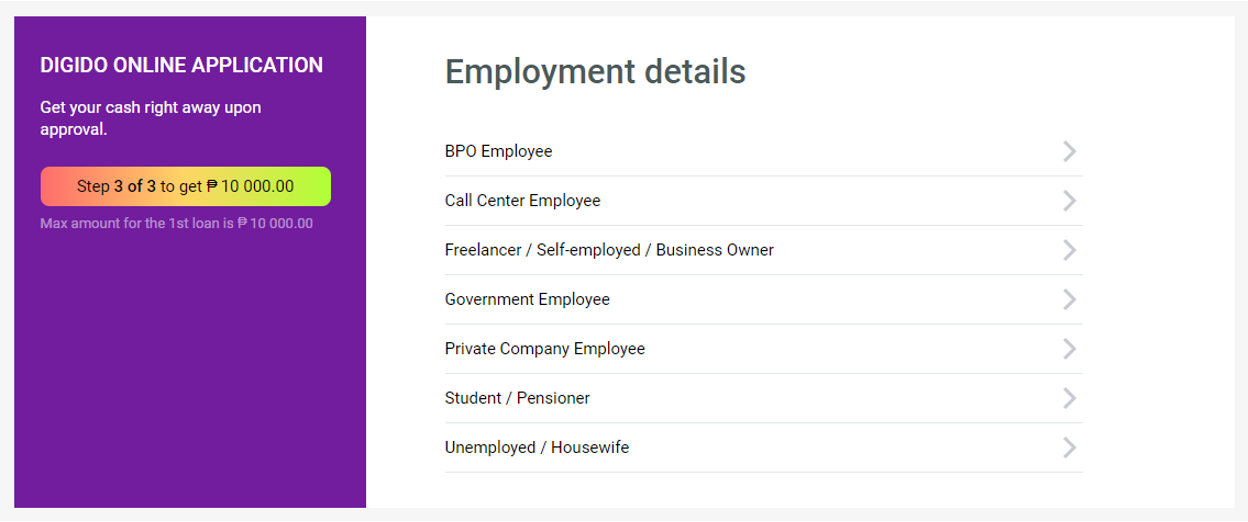

Fill out the employment form. Depending on your type of employment, Digido will ask for more information from you, such as gross monthly income and character references with their names and contact numbers.

After finishing the online application form and submitting all the documentation, wait for the Digido loan officer to contact you and verify the information you have provided.

You will be asked to provide your bank information details for the transfer of your loan proceeds. Make sure that the bank details are accurate to avoid any delays and rejection of your loan application.

When approved, they will be able to disburse the loan amount through your preferred method and after signing the loan agreement. Digido will transfer the funds as soon as you have signed the contract.

Frequently asked questions

How soon will I receive the loan proceeds in my account?

How do I know if my loan application is approved?

Will I be able to close the loan early?

Can I pay my loan through cash?

What is the Digido service and how often is the service available?

Conclusion

Applying for a loan or any credit can benefit anyone if the finances are managed wisely and responsibly. Just like how people manage their plans in life, financial planning that includes credit management is no exception.

Digido allows people to take care of their financial needs without making it hard for their customers to pay them back by allowing flexible repayment options that they can afford.