With the many banks and financial institutions in the Philippines that promise to cater to every need of the Filipinos, it is sometimes difficult to determine which ones perfectly meet the needs of the people. But what UCPB promises to deliver to the Filipinos is a partnership that intends to improve their quality of life through the financial products and services that they offer.

Written by: Big Piggyy

Auto Loan (DrivEasy)

Home Loan

Salary Loan

Small Business Loan

Bank services

The United Coconut Planters Bank (UCPB) was first established in the Philippines in 1963. Since then, they have become the leading provider of financial products and services to corporations, private and government institutions, middle-market companies, small– and medium-sized businesses, and individuals in the Philippines.

They take pride in the 4 strengths that they live by every day:

The registered office of UCPB is at UCPB Corporate Offices, 7907 Makati Avenue, Makati City. Their customer service for general concerns may be contacted at (02) 8811-9111 or 1-800-1-888-9777 (toll-free from any PLDT landline), customers may also drop an email at [email protected] during weekdays, from 7:00 am to 6:00 pm.

Driving your own car when you travel to take care of your day-to-day needs has been a necessity considering the safety and comfort that each one must take to accomplish what they must do. And with UCPB, owning your own car has been made a lot easier through an auto loan that is made easy.

There are currently three loan offerings for those who wish to apply for an Auto Loan:

When applying for a loan, it is a given that borrowers should provide their personal and income information, and the completed loan application with the signature of the applicant / all the applicants of the loan. Apart from that, these requirements need to be submitted:

Insurance

Having your own home – is an exciting step for newly married couples or those who have a growing family. But, your dream house should not only be just a dream. With this loan offer from UCPB, more and more families will be just a step away from having a place they can call home.

Payment Options: Post Dated Checks (PDCs) / Auto Debit Arrangement

Borrowers must submit their home loan application and send 2 government-issued IDs. Apart from that, these other income documents need to be submitted:

Sometimes, working on your budget and managing household obligations can be a challenge – one that needs extra help in some cases. When the budget runs low, due dates approach, and with the salary still a few days away, the salary loan will help meet obligations that are due and still work on their goals.

Small businesses make economies grow. And with every small business that thrives and succeeds, the need for expansion is inevitable. Likewise, every small business, when supported, has the opportunity to grow. With UCPB extending loans to these small businesses, entrepreneurs can make their businesses grow without worrying about the additional capital needed.

Your sole proprietorship, partnership, or corporation is registered with the DTI and SEC and has been profitable for the last three (3) year

Loan valuation is in accordance with existing guidelines.

UCPB has 188 branches, over 300 ATMs, and electronic banking facilities nationwide. This ensures that customers from all over the country have access to superb banking experiences and take advantage of competitive loan rates.

UCPB is the first Philippine Private Bank to become a universal bank in 1981 and obtain its expanded commercial banking license. In the late 1980s, it was one of the first banks to introduce the ATM service, staying true to their commitment to constantly bringing banking innovations.

UCPB has a customer service group focused on providing a superior customer experience for every Filipino who banks with them. After all, their goal to always provide total customer satisfaction is very important.

UCPB spearheaded the most successful reforestation initiative on a 33.3 hectare site in Antipolo City, earning them the “Most Outstanding Award for Environmental Excellence”. This only proves that they care not with the partnerships that they form with their employees and customers, but also with the environment we all need to take care of.

To start your loan application, download the application available at the UCPB website and send by email to [email protected] or fax to (02) 8811-9106.

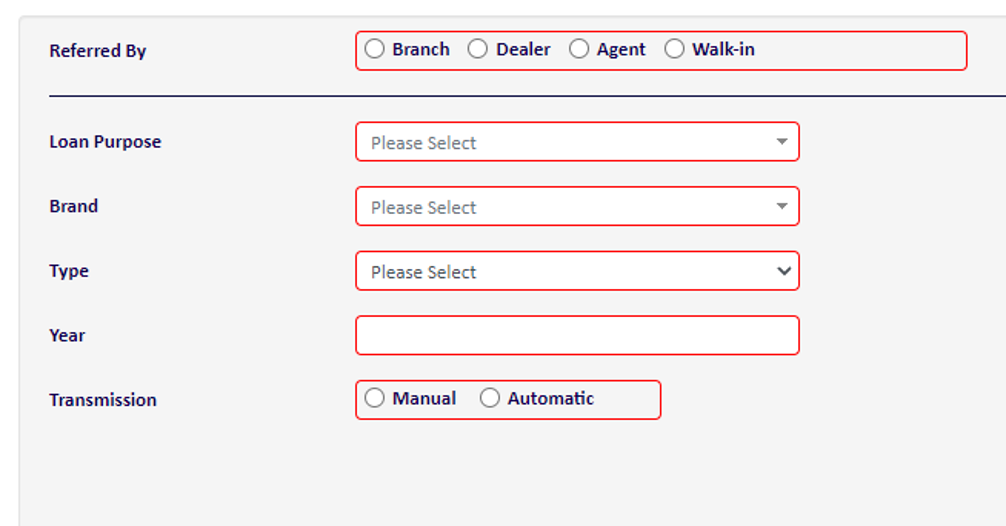

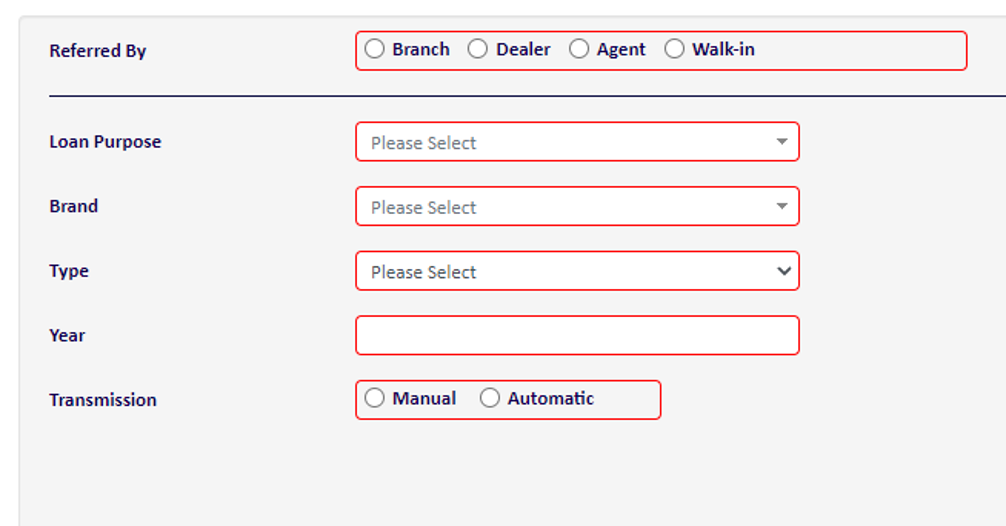

Another method of submitting a loan application will be to do it online and complete 4 easy steps through their LoanEasy Online Loan Application:

Provide the loan information.

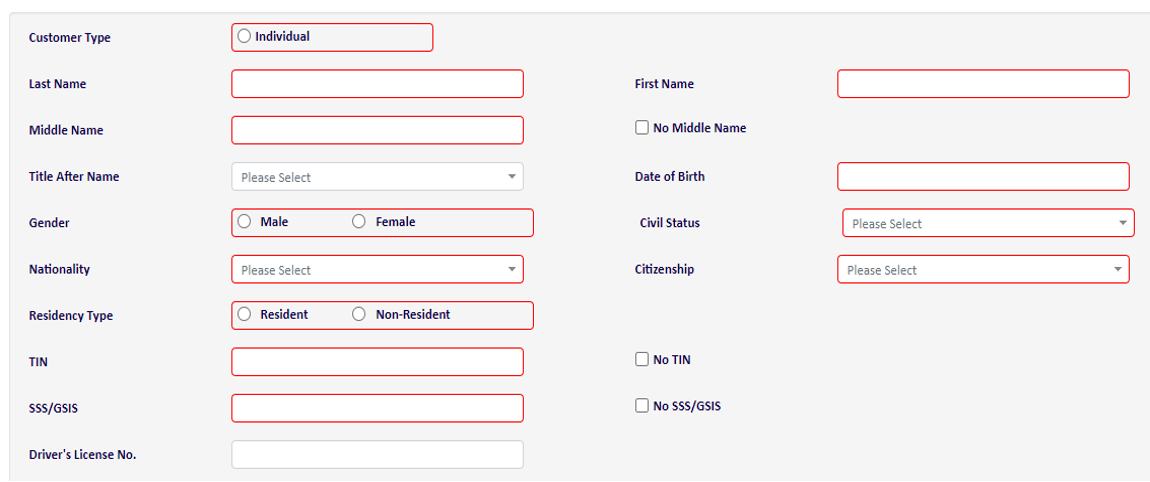

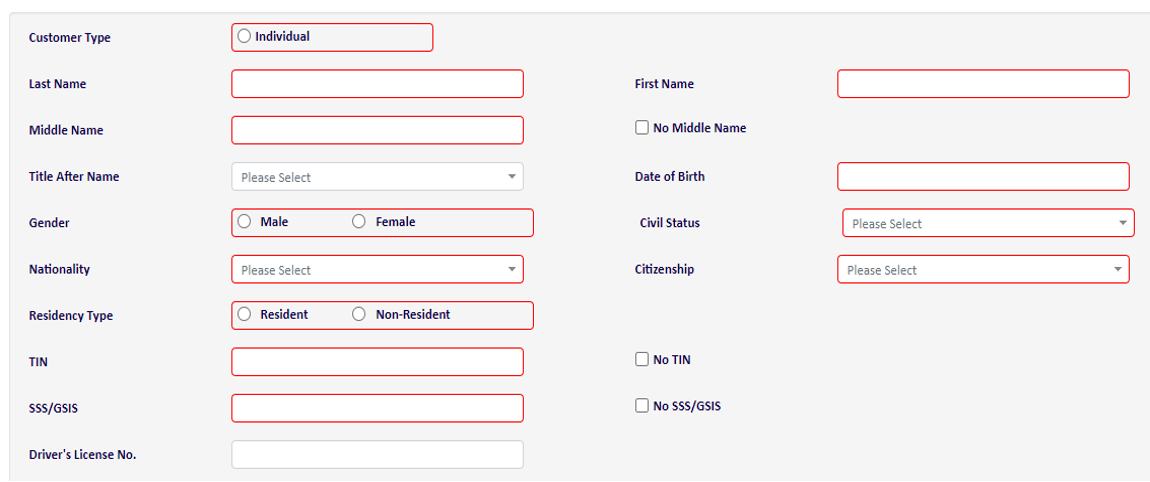

Provide your information as a borrower. This also includes your contact information as well as information on your current employment.

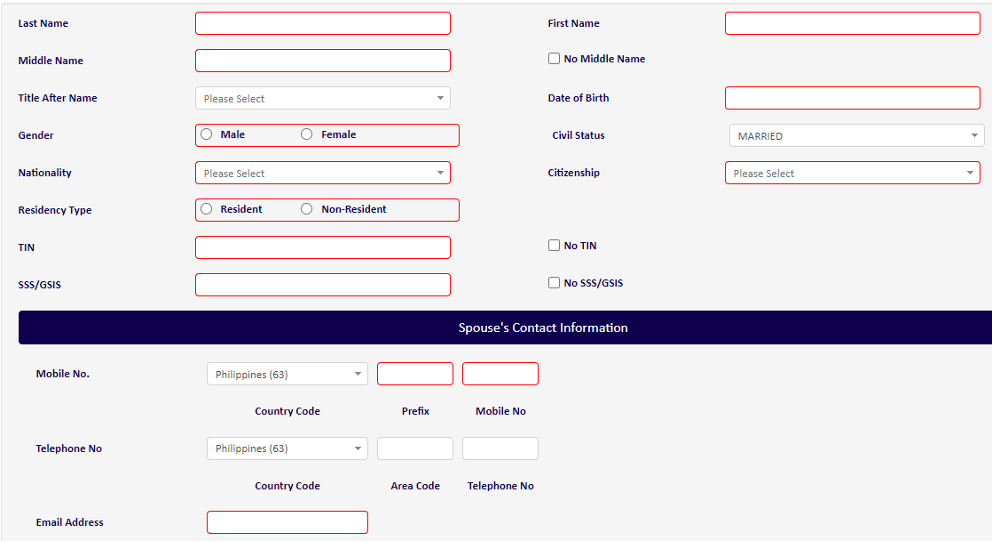

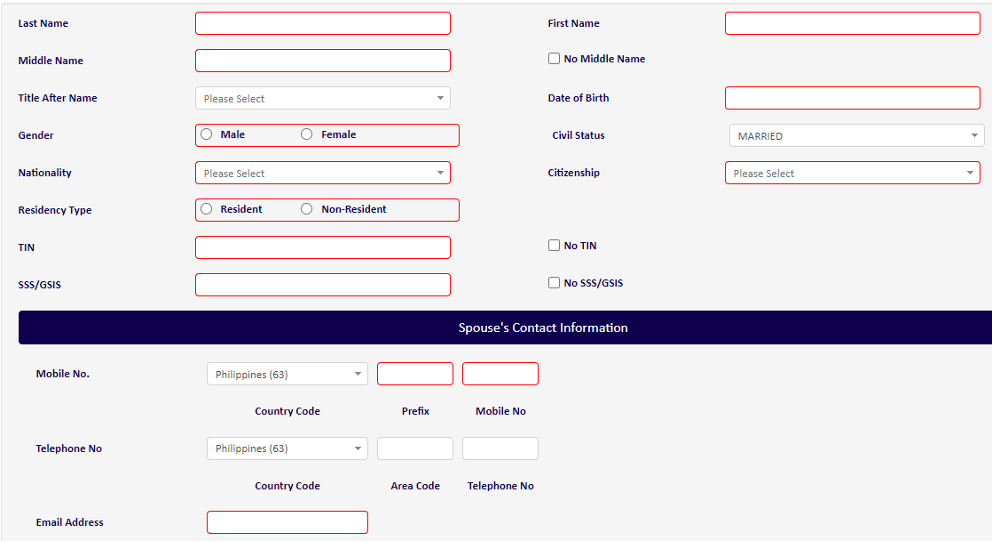

For married borrowers, spouse information is an added requirement to be filled. This also includes the contact information of the spouse as well as their employment information.

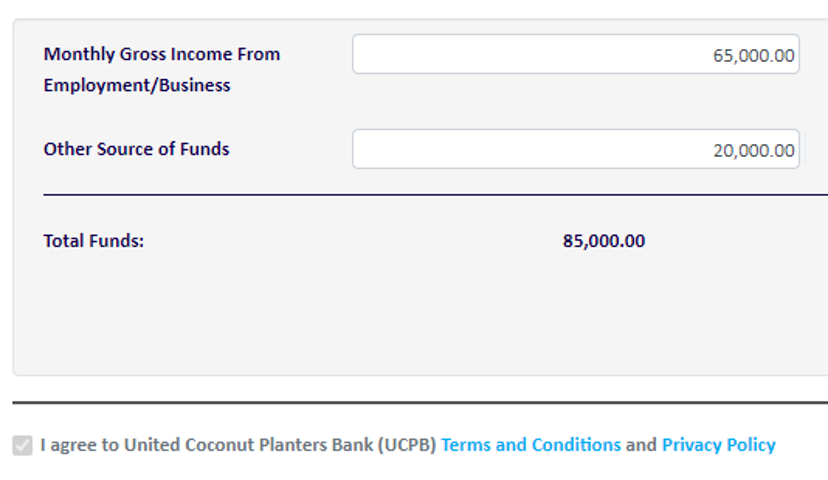

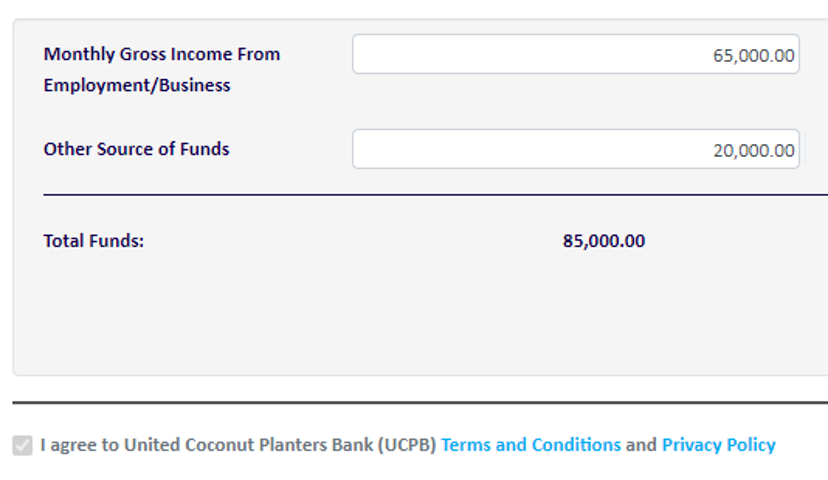

Provide financial information. This basically just requires that you provide the gross monthly income you receive plus any other allowances.

Submit the required documents. Do remember that the files you upload must not be more than 3MB. Files that can be uploaded in the online loan application portal are the certificate of employment, DTI / SEC business registration, and a government-issued ID.

Being in partnership with a bank that you can trust means that you will be able to fully focus on attaining your personal and business goals without having to worry that the bank you put your trust in will turn its back on you financially. It is always great to have your goals met, your needs addressed and your emergencies taken care of. What makes it even greater is the fact that you are taken care of, while your bank takes care of your needs.

Table of Contents

Table of Contents