Only a few commercial banks offer easy-to-apply loans for working-class Filipinos due to the strict requirements and eligibility criteria. However, when leading banks provide quick cash loans to consumers, it makes the process all the more convenient for those who need immediate access to funds. If there’s an emergency, you can experience real-time processing and disbursement of loans, subject to pre-qualification criteria.

Instead of resorting to loan sharks and microfinancing companies that charge unbelievably high fees on interest and processing fees, you can apply for a loan with UnionBank Quick Loan. You may facilitate the application process online without visiting any of its branches and get the loan amount within minutes. Find out more about UnionBank Quick Loan in this brand review on how to get started, key features of the loans, benefits, and other requirements.

Written by: Piggyy

Quick Loans

Car Loans

Home Loans

Business Loans

Bank services

UnionBank Philippines is one of the leading banks in the country and an early adopter of digital banking services. Through the years, it has remained committed to technological innovations to empower its customers better. It consistently delivers superior customer experience and promotes inclusive prosperity in the Philippines.

Just recently, the proposal of the UnionBank to acquire Citibank Philippines, Citicorp, and Citi Square was approved. The acquisition includes Citibank Philippines’ assets and liabilities of its consumer banking business, 100% of Citicorp’s outstanding capital stock, and Citi Square’s real estate interests in Quezon City and its bank branches.

Several institutions have renowned UnionBank as the “Best Digital Bank” through the years. It operates strictly in its corporate governance, founded on its fairness, transparency, and accountability culture and demonstrated by consistent ethical business conduct.

UnionBank is regulated by the Bangko Sentral ng Pilipinas and their head office is located at UnionBank Plaza Building, Meralco Ave. corner Onyx St., Ortigas Center, Pasig City, Philippines.

For your concerns or if you need customer support, the customer service hotlines are available 24/7:

Customers can email [email protected] from Monday to Friday (9:00 AM to 5:00 PM) for concerns or inquiries about Quick Loans. Include the following details in the email so that the customer support team can assist you better:

Quick Loans is a fully digital loan program for pre-qualified UnionBank account holders that lets you receive the cash in your account within just 60 seconds.

If you need to address short-term financial needs like paying for a downpayment on a car, tuition fee payments, buying a gadget or an appliance, or even funding a small business, you can apply for this loan right from your UnionBank mobile app.

The UnionBank’s Quick Loan program is available to current account holders with the invitation code.

Loan amount: ₱1,000 to ₱1 million

Est. APR (Annual Percentage Rate): this will depend on the amount and payment term of the loan as indicated in the loan contract.

Loan Term: 1 to 12 months

To avail of this product, you must be a pre-qualified UnionBank account holder. You will receive an invite code via SMS and email notification, which you will use to log in to the website. Alternatively, you may log in on your UnionBank mobile app and check the dashboard to see if there’s a button that says, “You qualify for a loan.”

The processing fee depends on the approved loan amount and shall be collected prior to the release of the loan. Here are the corresponding processing fees according to the loan amount availed:

You must pay the late payment fee if you fail to make payments on the due date. The fees are as follows:

Ready to buy your first car? Turn your dream into a reality with UnionBank auto loans. Browse and compare the prices of your preferred car model in the marketplace for the estimated selling price. You may also get the best deals and discounts when you buy cars and motorcycles from the bank’s affiliated dealers.

Vehicle Type: Brand New Cars, Second Hand Cars, Brand New Light Trucks

Loan Amount: Depends on the vehicle and model

Interest Rate: 5.68% to 31.76%

Down Payment: 20% to 50%

Loan Terms: 12, 18, 24, 36, 48 and 60 months

Nothing beats the joy of achieving your goal once you buy your ultimate dream home. If you think this is the right time to buy yours, UnionBank can provide you with competitive rates when you apply for a home loan. Choose from accredited and non-accredited developers and sellers to get the best deals.

Loan Amount: Based on Property Value

Interest Rate: 7% to 11%

Loan Term: up to 20 years

Loan Amount: Based on Property Value

Interest Rate: 8% to 12%

Loan Term: up to 20 years

Small and medium enterprises (SMEs) play a significant role in strengthening the community’s economy. Supporting them as they grow their businesses is pivotal. You can apply for SME loans to help scale your company if you’re a business owner. SMEs generate jobs, uplifting the communities’ quality of life.

Loan Amount: ₱50,000 to ₱1 million

Interest: 3% per month

Loan Term: 3, 6, 12, and 36 months

Customers prefer to bank with UnionBank for several reasons. When it comes to Quick Loans, it’s one of the best ways to access instant cash directly deposited to your account, especially if you’re already an existing account holder.

On top of that, you get to enjoy the following benefits and perks:

Applying for loans can be tedious as most banks require proper documentation before processing the application. There’s also the risk of getting rejected, especially if you have a poor credit history. However, with UnionBank Quick Loans, you won’t experience any of these inconveniences.

Customers are already pre-qualified, and thus the process is much faster and more automated. You are already eligible to apply for a loan and only need to use the invitation code. Enjoy 60 seconds of processing time, and the loan proceeds will be directly disbursed to your account.

Applying for Quick Loans is straightforward as you can do it through UnionBank mobile app or website. Fill out the online application with your personal information and employment details.

For other loan products, visit the website and fill out the online application.

Enjoy the convenience and fast loan processing in the comfort of your home. You only need to submit a few documents, and their customer service representative will call you regarding their application.

Quick Loans and Business Loans don’t require collateral as long as you submit the proper requirements. Upload them at the end of the application process, and ensure you have clear scanned documents.

There’s no need to worry about late payments and penalty fees if you miss the due date or forget to set aside the monthly amortization. Payments are auto-debited on the 15th or 30th of the month or your payday.

In case UnionBank’s system doesn’t recognize your deposit or ADA from the account as a loan payment, you may send an email to [email protected] indicating the following details:

Subject: Manual Debiting Request

Full Name

Payroll Account Number

Loan Account Number

Amount to be debited

Quick Loans or Cash Loans can address short-term cash needs. As such, the typical maximum loan amount is also minimal. However, with UnionBank, the maximum loanable amount is set at ₱250,000, subject to the account holder’s gross monthly salary.

Auto Loans and Home Loans also have loanable limits depending on the vehicle’s value or the property that you prefer to purchase. You no longer have to apply for a loan in other financial institutions and wait for several days for approval and disbursement.

You can choose to visit the branch to apply for a loan or submit your application on the website. For example, you can follow these steps in applying for a Quick Loan if you already have an invitation code.

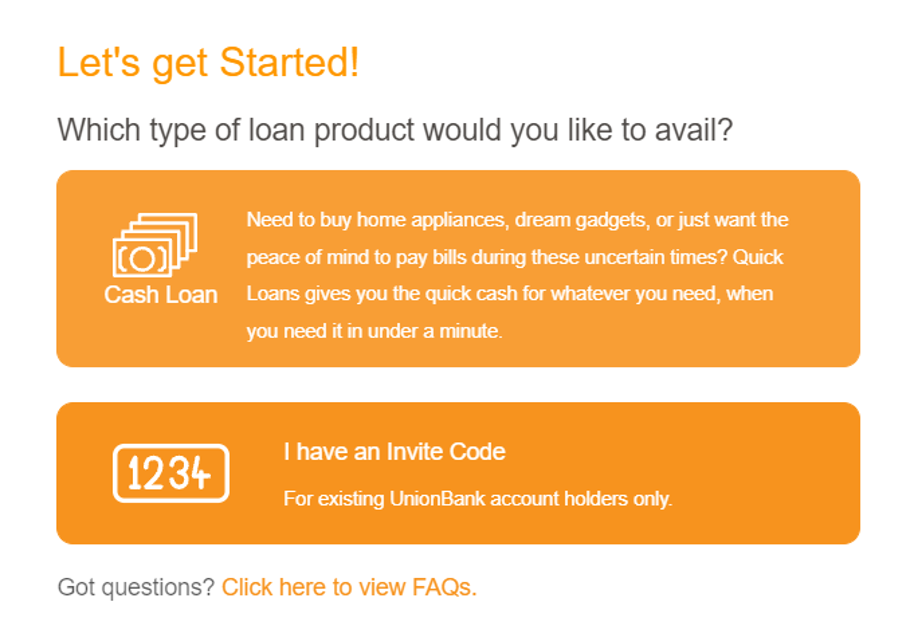

On the Quick Loans page, click one of the orange boxes under Let’s Get Started.

The next page will take you to the application screen. Indicate the loan amount you wish to apply for (this should not be more than the maximum loan amount indicated in the pre-qualification process), monthly income, type of employment, and your preferred loan term.

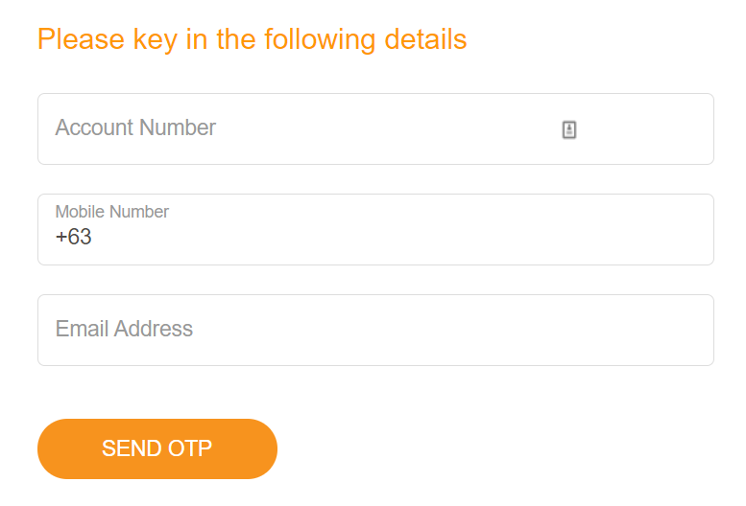

In the following section, enter your account number and generate the OTP for verification. Enter the OTP to validate the security of your loan application and keep your documents ready (1 valid ID, payslip, income tax return, or BIR Form 2316).

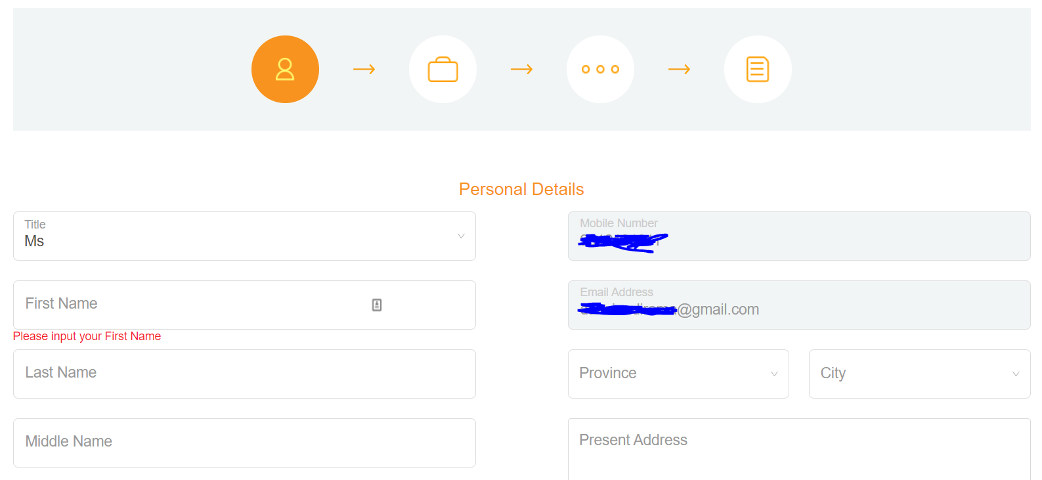

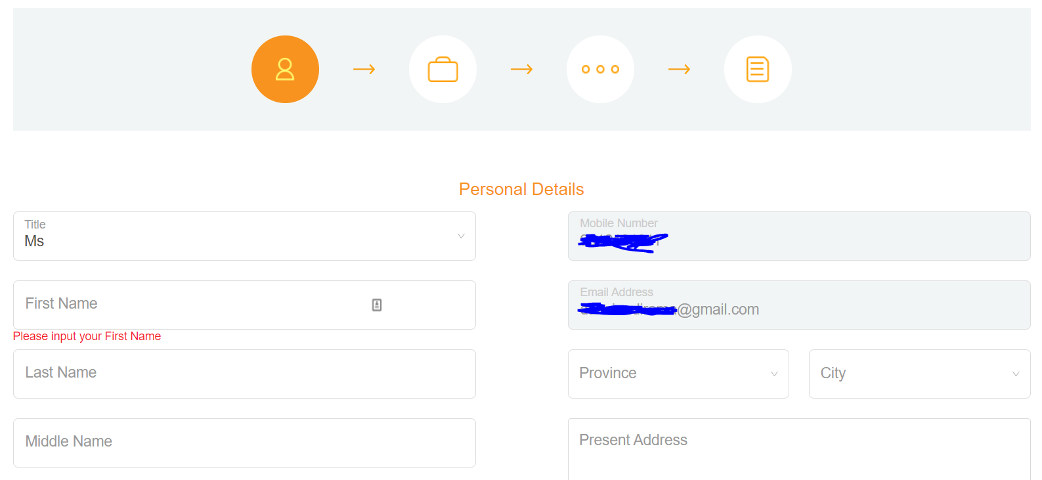

Once validated, proceed to the next step and provide your personal details.

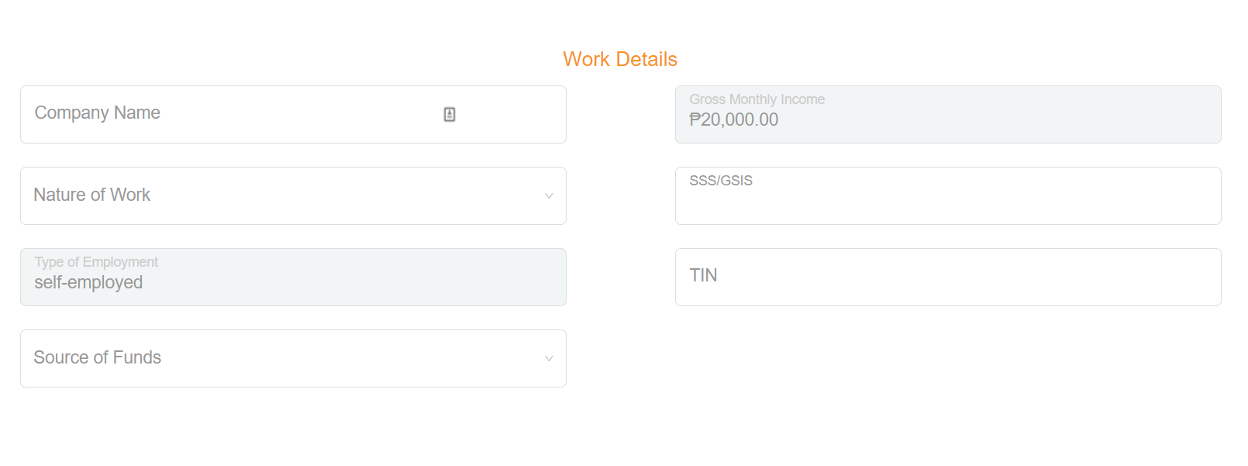

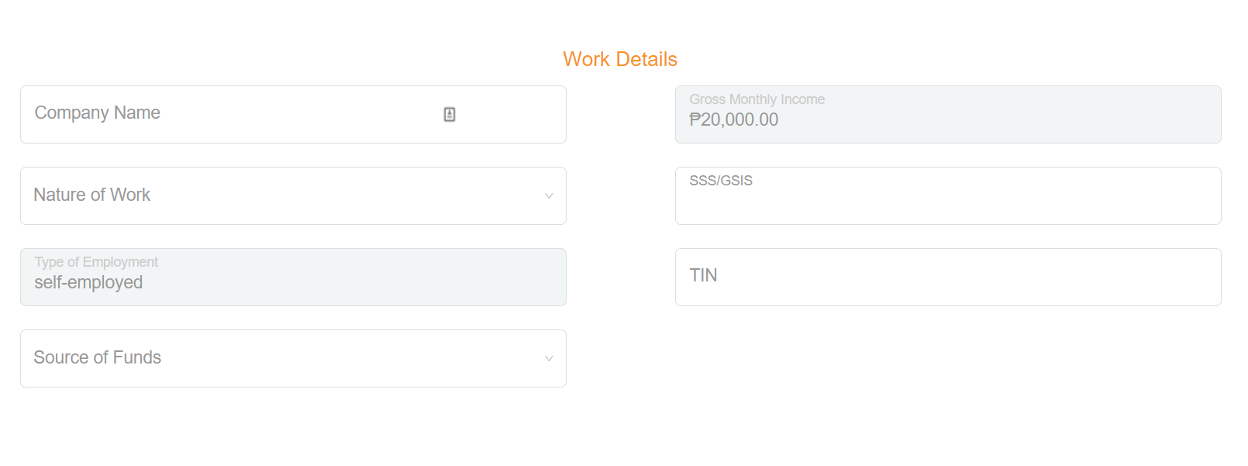

Fill out the form with your employment details such as SSS/GSIS and Tax Identification Number. Take note that the minimum requirement of the Gross Income is ₱10,000.

Continue through the rest of the steps and upload your documents in the final stage. Once approved, the money will be transferred to your account only within 10 minutes.

Having access to Quick Loans and having the loaned amount in your bank account within just a few minutes is a great thing, especially when you urgently need cash to address your emergencies.

With UnionBank’s initiative to offer this type of loan to their pre-qualified customers, they truly are transforming how their customers experience digital banking. Imagine not having to visit their branch to apply for a loan and wait a few days to be approved for one.

Table of Contents

UnionBank offers different credit cards that fit the lifestyle of the cardholders and allows them to take advantage of great offers and rewards.

| Credit Card | Principal Card Annual Fee | Supplementary Card Annual Fee |

| Classic | ₱1,500.00 | ₱750.00 |

| Gold | ₱2,500.00 | ₱1,250.00 |

| Visa Platinum | ₱3,000.00 | ₱1,500.00 |

| Mastercard Platinum | ₱3,000.00 | ₱1,500.00 |

| Miles+ Platinum | ₱3,000.00 | ₱1,500.00 |

| PlayEveryday | ₱1,500.00 | ₱750.00 |

| Lazada | ₱3,000.00 | ₱1,500.00 |

| Cebu Pacific Gold | ₱3,000.00 | ₱1,500.00 |

| Cebu Pacific Platinum | ₱5,000.00 | ₱2,500.00 |

| Corporate Card | ₱1,500.00 | n/a |

Table of Contents