When a bank has been operating for decades-long, it is an indicator that they are doing something right in serving the community where they operate. This is true for PBCOM, which has provided financial services to Filipinos for over 7 decades.

Both individuals and businesses can benefit from the banking products that help them improve their quality of life and turn their goals into realities.

Written by: Piggyy

Auto Loan

Home Loan

Personal Loan

Business Banking

Bank services

The Philippine Bank of Communications (PBCOM) was founded in 1939 and started its operations at the Trade and Commerce Building on Juan Luna Street, Binondo, Manila. Since it was founded, they opened 93 branches in the Philippines’ major group of islands – Luzon, Visayas and Mindanao. When it opened in 1939, PBCOM was the first non-American conglomerate to open in the Philippines as it was a branch of PBCOM headquartered in Taiwan.

In 1974, the ownership of PBCOM transferred to a Filipino named Ralph Nubla, after he purchased a majority of the shares of the company.

Their main address in the Philippines is at PBCOM Tower, 6795 Ayala Avenue corner V.A. Rufino St. 1226 Makati City. Their customer care operates on weekdays from Monday to Friday, 8:00 AM to 4:00 PM with their other customer support channels open until 5:30 PM and can be contacted through these different channels:

Under Personal Banking, PBCOM offers Auto Loans, Home Loans, and Personal Loans.

For some people, a vehicle is a necessity and getting your first car means that financing is an option when you cannot pay for it upfront. With PBCOM, borrowers will have the advantage of fast loan approval and personalized service.

Loan Features

Loan Amount: Php200,00 to Php10,000,000

Loan Term:

Eligibility

Requirements

For Salaried Individuals:

For OFWs:

For Self-Employed:

Additional Documents Needed for Second-Hand/Used Vehicle:

PBCOM home loans are for borrowers considering purchasing a house and lot, townhouse, a residential condominium, or a vacant residential lot. Also, you have the option of refinancing or taking out an existing home loan or reimbursing a home purchase or construction cost.

Loan Features:

Loan Amount: Php500,000 to Php20,000,000

Loan Term: up to 20 years

Other Fees & Charges:

Documentary Stamp Tax

DST on Real Estate Mortgage = Php20 for the first Php5,000 & Php10 for the succeeding Php5,000 or a fraction thereof, based on loan amount

DST on PN = Php1 for every Php200 or a fraction thereof, based on loan amount

Note: The loan amount and term will vary depending on the loan purpose.

Eligibility

Requirements

People who need help financing seeing their personal goals through will be able to find that with PBCOM’s personal loan product. A borrower might need a loan for the following purposes:

Loan Features:

Loan Amount: Php40,000 to Php1,000,000

Interest Rate: as low as 1.68%

Loan Term: 12 months to 36 months

Eligibility

Requirements

Businesses need cash in order to expand their operations. In order to do so, applying for financing from PBCOM might be a necessary solution.

Here are the features and benefits that businesses can avail of when they apply for a Working Capital Loan from PBCOM:

Eligibility

SMEs and large corporations

Requirements

It is easier to trust a banking institution when they have been in the banking industry longer. With the experience that PBCOM has in the Philippine banking industry that spans decades, people are always sure to get the most out of their experience.

PBCOM’s loans offer higher amounts than most banks in the country – with Auto Loans available for up to P10M, Home Loans up to P20M, and Personal Loans up to P1M. This means that people will not be limited to the amount they can borrow and will have enough to be approved of what they need.

When talking about bank loans, the idea intimidates many people because of the lengthy documents that are typically required. PBCOM has made loan applications easy for the borrowers, acknowledging that people have real needs that need to be addressed.

By making the documentation process easy, they have also made it possible for people to have access to financial products without worrying about being rejected when they find themselves lacking complicated requirements.

One of the things that PBCOM offers their customers is that they provide fast approval of loan applications, thereby addressing the needs of people when they need it fast.

One of the things that make loan repayments affordable is the interest rates. PBCOM offers one of the lowest interest rates for their loan products, making it easy and affordable for borrowers. This ensures that people will still have the means to pay back the loan without hurting their personal finances and making significant adjustments in their budgets.

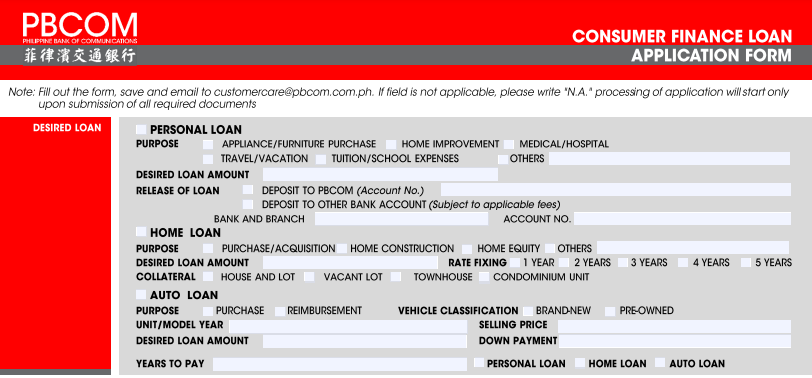

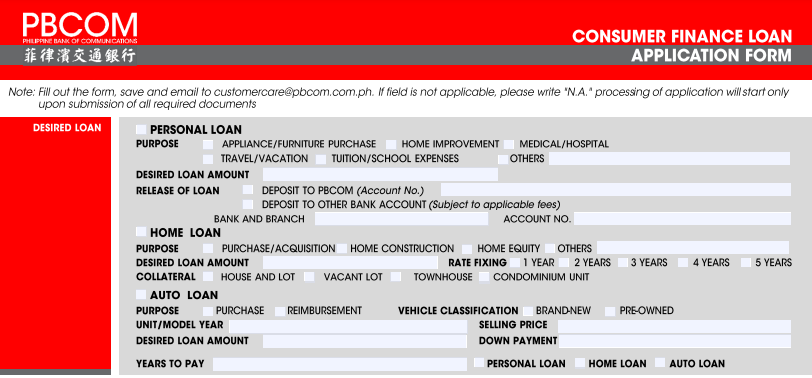

To apply for a PBCOM loan, borrowers can follow these steps:

Visit the PBCOM website and proceed to the bottom of the page where the Apply for a Loan option can be found and click on it.

Select the type of loan that you wish to apply for.

Once you are taken to the specific loan product’s page, scroll at the bottom of the page. Download the loan application form.

Borrowers can either fill the form on their computers or they can download and print it, and then fill the details manually. The information required for the loan application are the loan details, personal information of the borrower, employment details, spouse / co-maker information, personal references, etc.

Once all the details are filled up, the borrower can either submit the form along with the requirements to the branch nearest them or email it to [email protected]

Choosing PBCOM for the financing needs of Filipinos for their business, home, vehicle, or for other personal reasons will greatly benefit them in the long run because of their competitive loan offers. They also make it possible for a lot of people to have access to financial products and services that are not only easy to apply for but provide them with the best services.

Table of Contents

Table of Contents