Company Information

Vidalia Lending made its entry in the Philippine Financing market in 2008. With the proven industry experience of the people who back Vidalia Lending in the local finance industry, it has since grown into a brand that has catered millions of loans to Filipinos in need.

Vidalia Lending is registered with the Securities and Exchange Commission with SEC Registration No. CS200813771 and Certificate of Authority No. 279 issued October 2008. The registered office of Vidalia Lending is located at 6/F Aster Business Center Mandala Park, 312 Shaw Boulevard, Mandaluyong City Metro Manila.

For existing and new customers, they may be contacted through their website at:

or through their customer contact lines at:

- Landline Numbers: (02) 8534 2556 / (02) 7718-0358 / (02) 534 5482

- Mobile Numbers: 0917 328 4072 (Globe) / 0939 927 2375 (Smart)

Types of Loans Offered

Vidalia Lending offers 5 different types of loans for the varying needs of Filipinos for both their personal and business requirements: Lite Loan, Personal Loan, Salary Loan, Business Loan, and Small Business Loan.

| Loan Type | Loan Description | Loan Amount | Daily / Monthly Rate | Annual Percentage Rate | Loan Term |

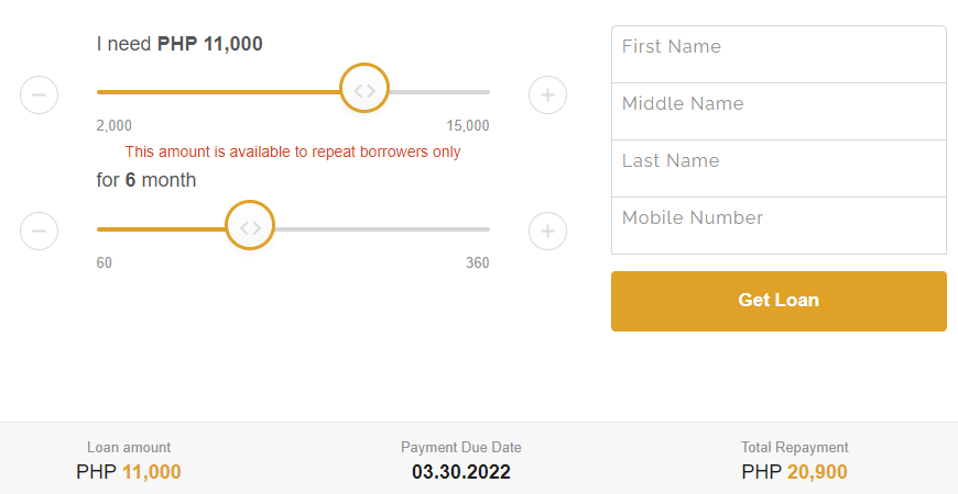

| Lite Loan | Lite Loans are designed for customers who need urgent money to pay off bills that are due or for other personal reasons. Lite Loan Applications are 100% online. | Php2,000 to Php15,000 | 0.5% per day | 185% | 1 mo, 1.5mos, 2 mos. |

| Salary Loan | It is ideal for employed individuals who require urgent cash to care for their bills and other needs. This loan does not require collateral or a guarantor. | Php20,000 to Php50,000 | 6% per month | 80.60% | 2 to 12 mos. |

| Personal Loan | Whether it is for a debt settlement, payment of a credit card bill that is already due, tuition fee payments, or home improvements, this is the loan that is perfect for you. | Php15,000 to Php100,000 | 6% per month | 80.60% | 2 to 12 mos. |

| Business Loan | For entrepreneurs who want to focus on growing their business and on activities that will help with revenue generation, this loan can help them focus and not worry about the day-to-day activities. Unsecured business loans and collateral business loans are available. | Php100,000 to Php500,000 | 4% per month | 80.60% | 2 to 12 mos. |

| Small Business Loan | The Small Business Loan is for cash flow management, managing the daily cash flow of the business, and for payment of urgent needs. Entrepreneurs can apply for a non-collateral loan. | Php15,000 to Php100,000 | 5% per month | 80.60% | 2 to 12 mos. |

Eligibility

- Filipino, 21 – 40 years old living in Metro Manila

- At least ₱15,000.00 monthly salary

- Permanent employee

- Entrepreneurs with stores operating for at least 1 year

Requirements

- 1 valid ID (Passport, Driver’s License, SSS)

- 1 Proof of Billing (electricity, water, landline)

- Latest 1-month payslip or proof of income

Fees & Charges

A processing fee of 7% is deducted from the net loaned amount for each processed loan. In addition, for late payments, the total loan amount outstanding will be charged at 0.5% per day plus a late payment fee of Php500.

Payment Options

- Bank Deposit (Over the counter, Online Banking, ATM)

- Dragon Pay (7-11, Cebuana, LBC, SM Robinson Payment Centers and Bayad Centers)

Borrower Responsibilities During Loan Application

- Read the contract carefully and make sure you understand the terms before signing.

- Do not overstate your income, employment duration, and assets.

- Be honest about past or current credit problems; report all your debts.

- Do not list fake details on your loan application, and do not give false supporting documents.

Why Choose Vidalia Lending

Vidalia Lending may only be available to customers in the Metro Manila area. Still, undeniably, their loan products are designed to uplift the lives of their customers by taking care of their financial needs. With plenty of financing companies in the Philippines, there are several reasons why customers will want to choose Vidalia Lending.

Offers no Prepayment Penalty

With some loans penalizing customers that want to pay for their loaned amounts in advance, customers are welcome to settle their loans earlier than their due dates with Vidalia. They understand that some customers want to get rid of additional worries and interest payments, and they support them.

Quick and Easy Process

Some loan applications with Vidalia Lending can be completed 100% online. Regardless of how customers want to process their loan applications, the approval process is fast, and customers will know the result of their loan application within 48 hours.

Offers Non-Collateral / No Guarantor Loans

The headache that most people face when applying for a loan is collateral or a guarantor. Not many customers will be able to present collateral when the need comes. And to also approach friends or relatives to be a guarantor can sometimes be a headache. Not many would want to share the same legal obligations as the borrower without gaining anything other than a potential liability.

Available for Individuals and Businesses

The great thing about Vidalia Lending is how they make loan products available not just for individuals but also for businesses looking at expanding businesses. What makes their business loan even more attractive is that they offer non-collateral business loans.

Secure Transactions

Vidalia Lending adheres to strict data privacy guidelines for its customers. It ensures that all the data and information shared with them will not be shared nor sold to outside parties.

No Hidden Fees or Charges

The charges that customers will have to pay will be shown at the beginning of the process. They have agreed to and signed up for the exact fees and charges that they will have to pay within the duration of their loan term. They do not even have to pay any fees when they settle their loans early.

How To Sign Up

Applying for a loan is very simple and fast. Customers can directly visit the website of Vidalia Lending to start the application process by clicking on the redirect button at the top of the current page and then clicking on the loans section.

For first-time customers, the maximum loanable amount is Php10,000 but for repeat borrowers, the maximum loanable amount is Php 15,000.

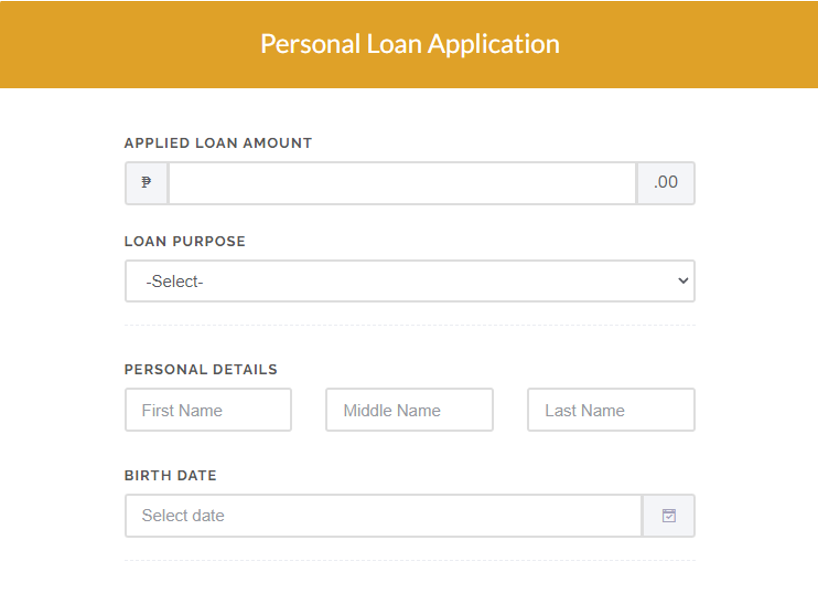

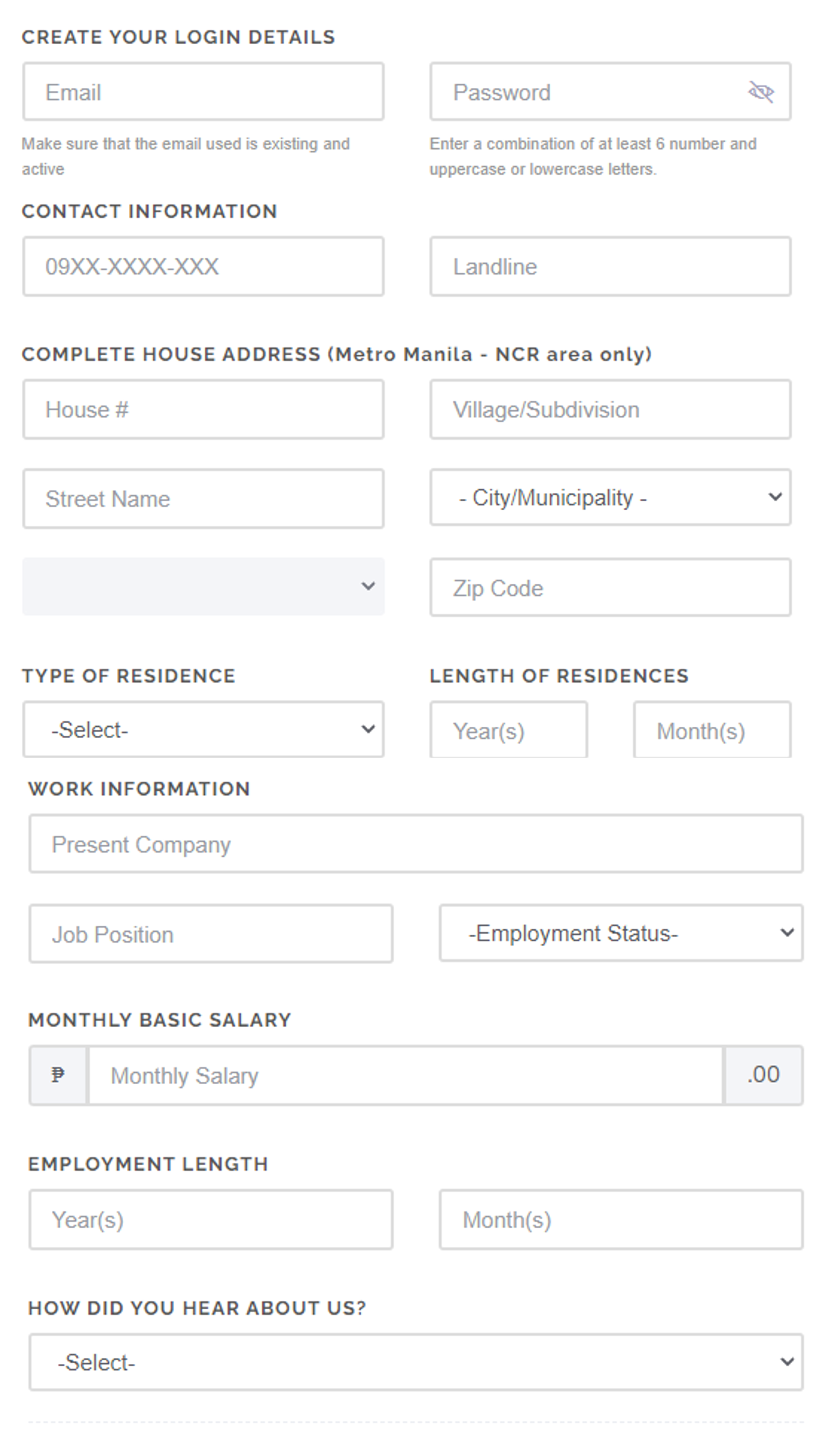

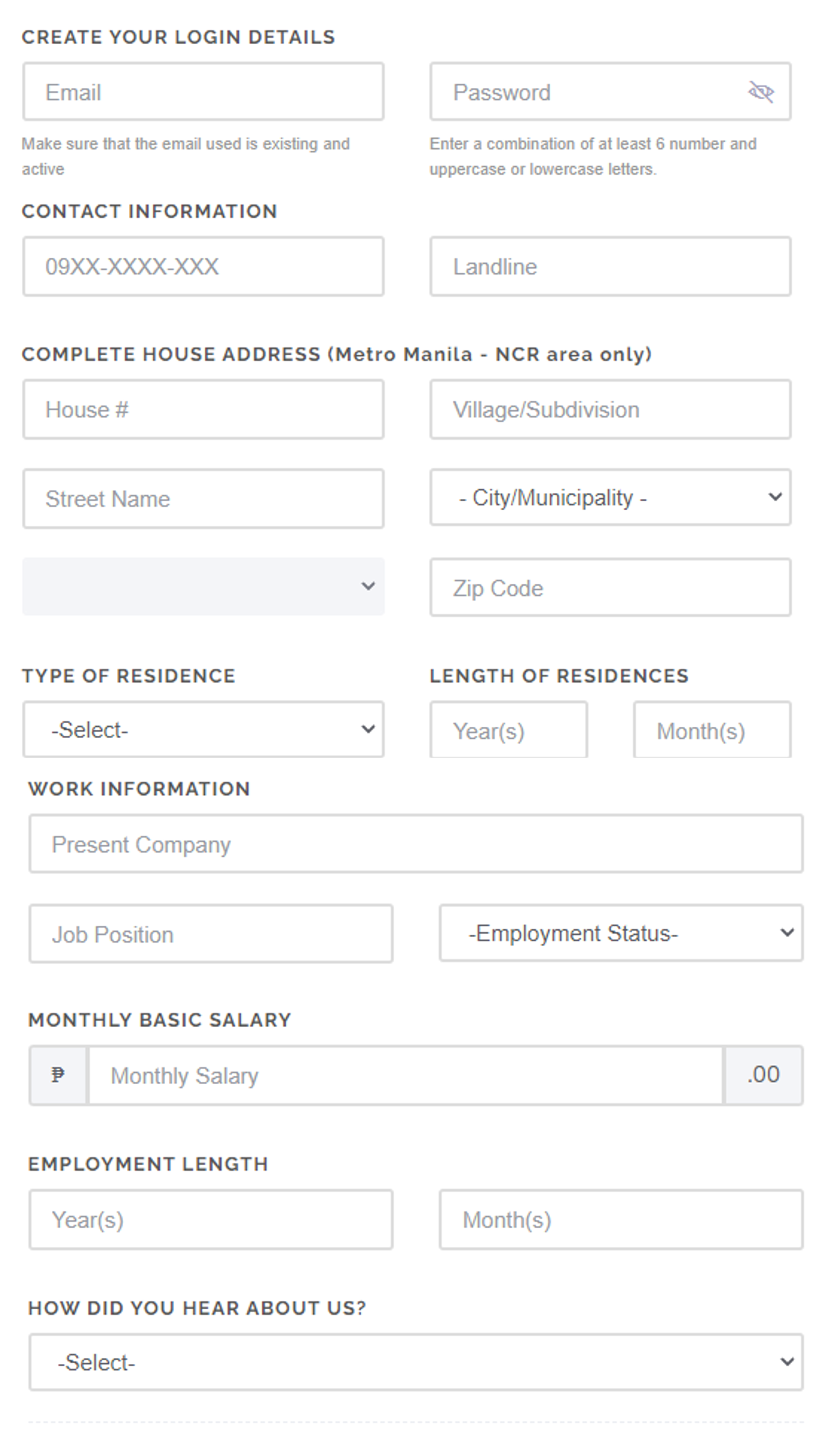

For Personal Loans or Salary Loans, customers may directly visit the site’s Personal loan section to apply for Personal Loans or the site’s Salary loan section to apply for Salary Loans. Then, start the loan application and start filling in the details.

Create your account with Vidalia and provide contact and work information to proceed.

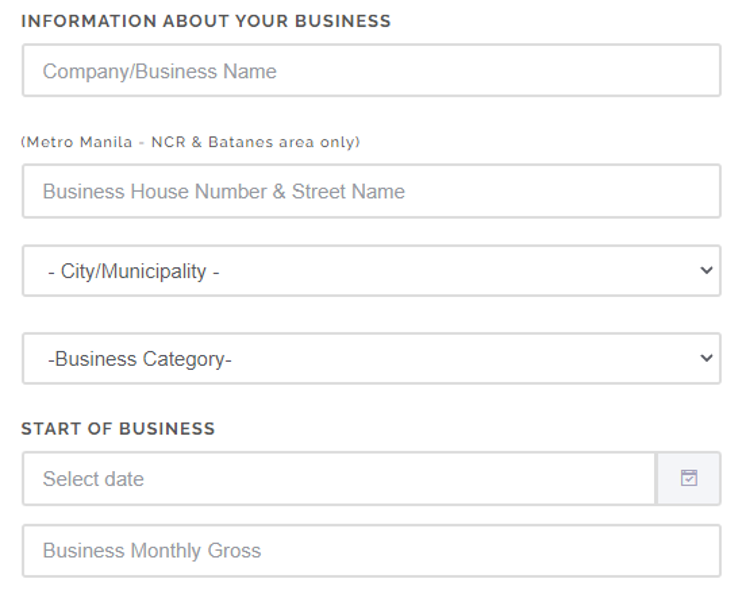

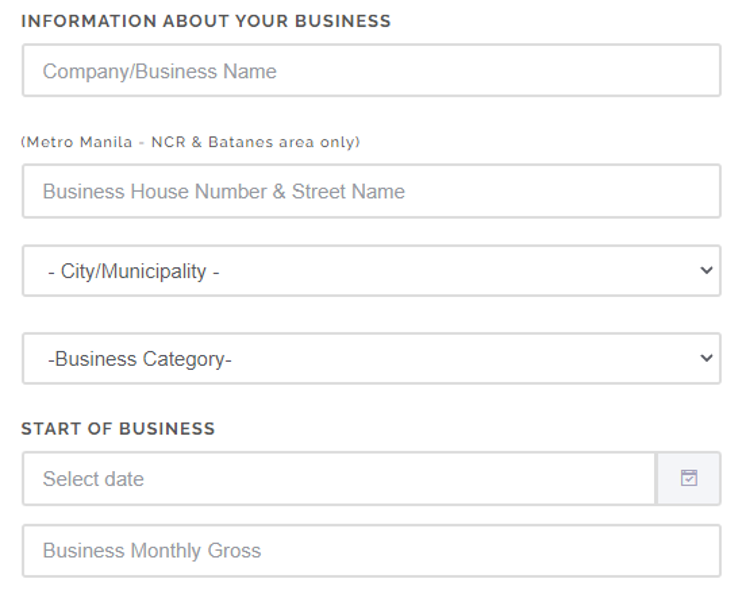

For Small Business Loans and Business Loans, the application process is the same but instead of customers filling in their work information, they have to fill in their business information instead.

Once the loan application is submitted, the dedicated team at Vidalia Lending completes the credit evaluation where they contact the customers to confirm the information given, conduct phone interviews, and check the documents they have submitted online. Upon completion of the credit evaluation, the approved loan amount is then disbursed as a check to the customers. The customers can collect their checks in the Vidalia Lending office from Mondays to Fridays during office hours. For customers who wish to have the check deposited directly to their bank accounts, they can request the same.

Frequently asked questions

How long is the application process?

How is the money going to be disbursed to me?

How do I repay my loan?

I am an OFW. Can I apply for a loan?

Is collateral required?

Conclusion

It is comforting to know that for the major financial needs of Filipinos who are living in the Metro Manila area, a financing company exists that offers lower interest rates, flexible payment terms, and non-collateral loans that have higher than average loanable amounts. The presence of Vidalia Lending in the market has paved the way for Filipinos to have access to competitive financial products to address their needs both short-term and long-term.

There may be a lot of companies who offer 100% online loan applications and fast approval and disbursement of loans but the real measure is what the customers have to pay for in the long run.