Uploan is now SAVii!

You can read all about the new brand in our review here.

You are also welcome to Read all about Uploan in our detailed review bellow:

Company Information

Uploan is a company that aims to empower HR leaders by providing them the right tool to empower and provide employee wellness that will address the needs of employees both professionally and personally through salary linked wellness services because let’s face it – when employees have financial problems, their performance is almost always affected.

By having this tool to help employees, employee engagement is enhanced and overall company goals become achievable.

Located at 16F M1 Tower, 141 HV Dela Costa Street, Salcedo Village in Makati City, it has already served more than 300,000 employees with products related to salary loans, salary advances, and insurance products and has received a 4.9 out of 5 satisfaction rating to the employees it has already served. Uploan is registered with the Securities and Exchange Commission with registration number CS201628816 and Certificate of Authority number 1288.

For any concerns, Uploan can easily be contacted through their Help Center found on the website or be contacted at 0919 170 0061 every Monday to Friday from 9:00 AM to 4:00 PM.

Products Offered

Uploan’s products are offered both to Employees and Partners (through the employers). For Uploan to reach the employees, employers first need to become a partner. By doing so, they are exposed to benefits for their employees that are otherwise not available in the market.

Become a Partner

Uploan.ph is open to employers who wish to register and avail of their easy, fast, and reliable services with benefits such as a Financial Wellness Hub to help improve the employee’s overall financial health and On-site Financial Seminars that is organized by the Uploan team to initiate personal interactions with the employees. These programs are geared to meet Uploan’s vision of empowering over 10 million employees across the Philippines.

The concern that HR Leaders often have is the accessibility of the employee benefit programs that companies offer. The great thing about Uploan is that all of its offerings are made digital – which means employees and employers can access it at any time of the day at their convenience.

When employees avail of Uploan’s services, employers will be able to monitor and track the employee’s loan status, manage the employee’s repayment through the employer dashboard, and if technology can be a little bit of a problem and going through all the processes can be overwhelming, there is always the advantage of having a dedicated relationship manager to assist and guide.

Benefits of becoming a Partner includes:

- No Cost and Liability to Employer

- Hassle-Free Admin Process

- No Over-Indebting of Employees

- Interest Rates Lower than Credit Card Rates

- Dedicated Relationship Manager

Uploan makes sure that it is not just the employers who are benefitted from becoming a partner. Employees are also guaranteed a low-interest rate of 0.5%, salary loans and advances are approved within 24 hours, loan repayments are done through salary deductions and great customer service.

Salary Loan

Lowest interest rates at 0.5% with approval as fast as 24hours. You can apply for an initial loan requirement that is equivalent to your 1 monthly salary and get an affordable repayment term of up to 36 months, depending on your credit assessment. Since your HR will monitor the repayment via payroll deduction, there’s no reason to be worried about missing your payments, or make adjustments to your monthly budget because there is no need to set aside money for repayment – you get the net salary after your deduction.

Salary Advance

Salary Advance is another service that provides an instant fund with 0 interest and does not require a minimum amount to apply for one. You can apply only for whatever it is that you need. If you have an emergency or a quick financial need, this is the best loan for you. And with a guaranteed 24-hour fast approval, your needs are addressed right away.

The only setback for this type of service is that you will have to repay the borrowed amount in the next month.

Loanable Amount

There is a simple criterion that is followed to measure the maximum loanable amount that an employee can apply for and be approved of but it is mostly affected by two things:

- The applicant’s credit score – it tells the loanable amount an applicant can apply for. But if the loan amount applied for is higher than what the credit score implies, the application will have to consider only what the loanable amount can be disbursed based on the credit score.

- Invalid and misleading personal and work information in the application of the loan.

Before granting loans and advances to employees, their current financial situation is assessed not only to make sure that they will be able to repay what they will borrow but also to help them maintain a healthy balance of paying for their loans without sacrificing the quality of their life. After all, Uploan exists to help empower employees and not cripple them financially.

Eligibility

To become eligible for a salary loan or advance, your employer must first be an Uploan partner. If unsure, employees can check through the website through the employee sign-up and search for the name of their employer on the drop-down menu.

If the name of the employer is there and the applicant is already a regular employee, he or she can immediately proceed with their first application at Uploan.

To avail of the loan, employees need only to prepare the following requirements:

- Latest 2 Months Payslip.

- primary government-issued ID (Passport, Driver’s License, PRC ID, SSS ID, UMID Card, or Voter’s ID) or if you do not have any valid government ID, you may submit 2 secondary government IDs (Postal ID, TIN ID, Philhealth ID, Integrated Bar of the Philippines ID, PWD ID with back copy, Barangay Certificate of Residency, NBI Clearance, PSA Birth Certificate, or PSA Marriage Contract).

- Company ID (front and back copy), and make sure that the picture and signature are visible.

Why Choose Uploan

Most financing companies only cater to address a person’s personal needs. But with Uploan, they provide more of a holistic approach to a person’s financing challenges – one that does not compromise the quality of their work and their life because after all, people need to be doing well in their personal lives to be productive at work.

Easy Application

Most of the initial step for employees to be able to access to Uploan’s services is taken care of by employers. Once this is done, employees can easily fill out the application form, scan and save all the needed documents and they can submit their loan application.

Fast Approval

When people need financial assistance, that means that their need is urgent and immediate. Having access to loans with fast approvals and disbursements can greatly help people address the financial challenges they face. This is why the 24-hour processing of loan applications will prove to be a relief for those applying. They will not be left to wonder if they get approved for a loan or not.

Effective & Easy Loan Repayment Scheme

The automatic salary deduction of loan payments will make the lives of employees easier. They do not have to worry about due dates and making it to payment centers in time because when people have to manage both a job and their family, some schedules can fall through the cracks. But with automatic salary deductions, their loan payments are already settled and what they get is their net salary.

Promotes Healthy Work-Life Balance

Having employees who are motivated is a win-win for both the employer and employee. When employees are happy, so are employers. There are many employee wellness programs available for HR leaders to apply in their respective companies, but very few also cover financial wellness. Employees should not be left to feel that they are alone in dealing with financial difficulties because when companies say their employees matter to them, that means also helping them in challenges that may be personal to them.

Helps in the Productivity of Companies

A lot of companies now measure the effectiveness of their employees through productivity. Productivity can be a measure of a lot of different factors but mostly, when employees are effective and efficient in their jobs, they are productive. They are especially productive when every aspect of their life is in the right place – both personally and professionally.

How to Sign Up

Although we have already established that companies need to be partners with Uploan first so that employees can take advantage of the benefits and apply for their services, employees who have heard of Uploan may refer their employers to Uploan. Uploan will then get in touch with their employer and their HR can make the announcement to the employees about Uploan and what they can offer.

Signing up with Uploan for a salary loan is simple and easy. There are only three steps that you can follow and you will hear from Uploan regarding the approval of your loan within 24 hours.

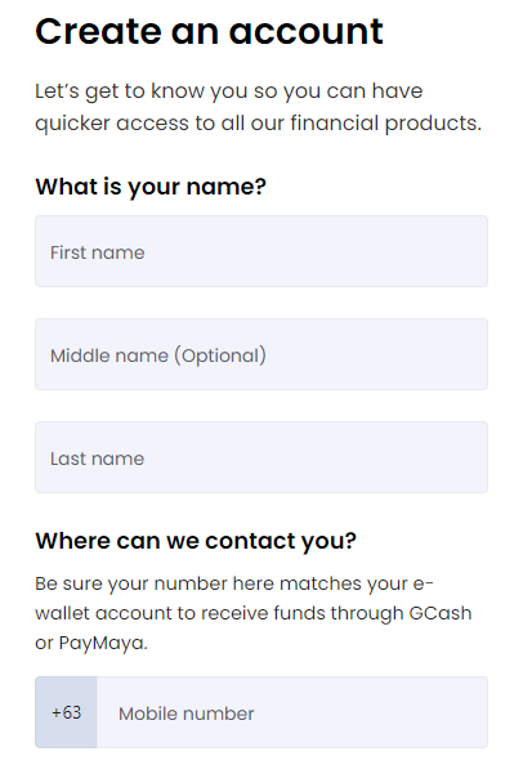

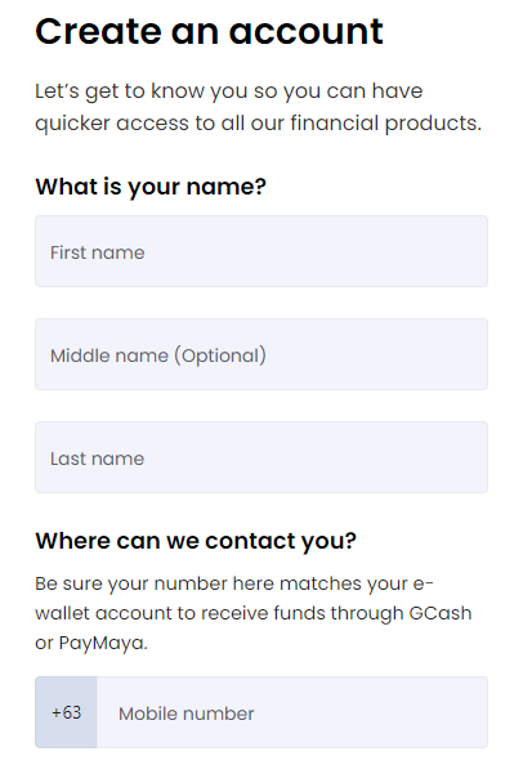

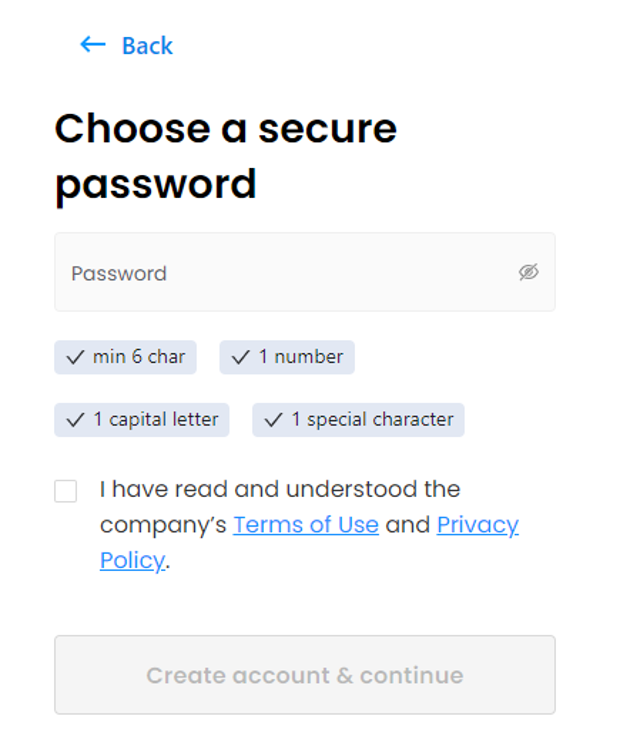

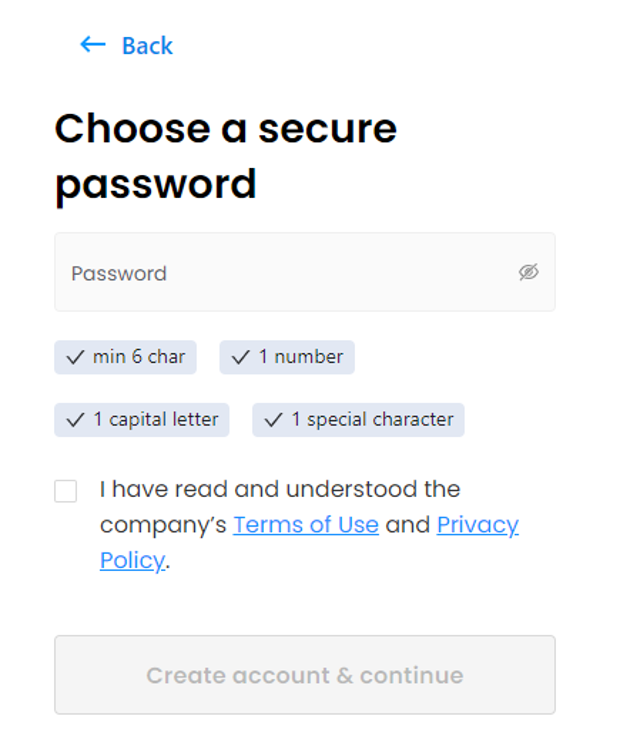

1. Create an Account. Account creation with Uploan requires personal information to be entered by employees. To ensure that the account created is secure, an email and mobile number verification will be required to proceed with the loan application. Also, you may want to have your SSS and TIN numbers ready.

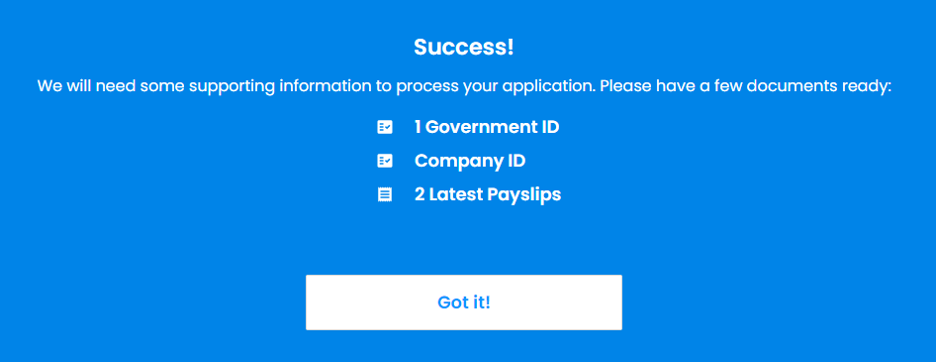

2. Submit Documents. There are only 3 documents that employees need to be able to scan and upload: 2 months’ latest payslips, 1 primary government-issued ID or 2 secondary government-issued ID, and company ID.

Make sure that all scanned documents are clear and visible before you submit them. Once you do, you can start uploading the documents.

3. Accept Loan Terms and Conditions and Submit. When applying, there are three items that employees need to agree on and give their consent to: Authorization of Voluntary Payroll Deduction Promissory Note Terms and Conditions

Once agreed to, employees can complete the application process. The status of the loan applied for can be viewed on the dashboard of your Uploan account.

Because loan repayment is done through automatic salary deduction, there will be cases when employees resign with an outstanding loan with Uploan. Your employer will send an email to Uploan notifying them of your resignation and you will be given 5 days to settle your outstanding obligation. Loan payments can still be done in three ways:

- Over-the-Counter or Internal Banking. All payments to be made for New Cross Credit and Financing Gate PH, Inc. Here is the list of banks:

- Security Bank (SBC)

- Philippine National Bank

- Bank of the Philippine Island

- EastWest Bank

- United Coconut Planters Bank (UCPB)

- Union Bank of the Philippines (UPB)

- Banco de Oro (BDO)

- Metrobank

- Via GCash Bills Payment

- Via Bank Transfer through your GCash or Paymaya Accounts.

Once the payment is made, be sure to send a copy of the proof of payment to [email protected] with the subject: Full Name | Loan ID.

Conclusion

Uploan is a perfect partner for companies who are looking at boosting the morale of their workforce and at the same time ensuring that their employees are well taken care of not just professionally but also financially. When people have financial problems, it can take a toll on their physical and mental health, thereby pulling their focus from their jobs.

People need their jobs to get through with life and with companies who choose to partner up with Uploan, they make sure that there is nothing that gets in the way of any employee reaching their full potential at work while having a healthy balance of their personal lives.