Company Information

Tala is located in four countries: India, Mexico, Kenya, and the Philippines. It is registered under the Securities and Exchange Commission (CS201710582) under the name Tala Financing Philippines Inc. with Certificate of Authority No. 1132. For inquiries, they can contact the Tala team through their website or the Tala app.

Tala is determined to provide a stepping stone for Filipinos to gain better control of their personal finances and thereby elevate their quality of life. The reason why they exist for Filipinos is their belief in the opportunities that providing credit brings by giving borrowers the freedom to do what they need to do with the money that they have been given as a loan.

Loans Offered

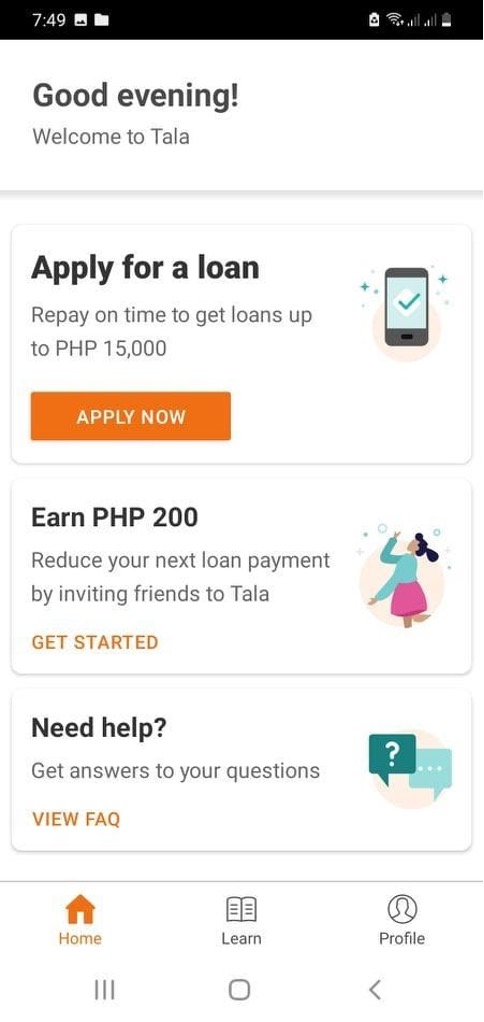

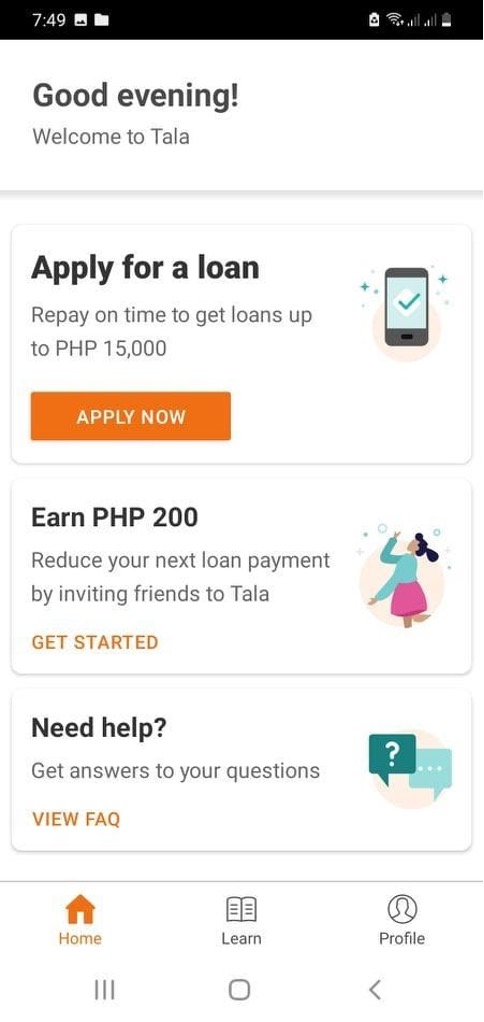

The loan that can be applied through Tala is straightforward. The loanable amount that any consumer can apply is a minimum of Php 1,000 up to a maximum of Php 15,000 depending on the credit history established with Tala but still subject to Tala’s credit and underwriting procedures. For first-time customers, the loanable amount is lower to establish trust between both parties.

With customers who make prompt payments, their Tala loan limit can potentially increase. That means good-paying customers are instantly rewarded for making payments on time.

Due to applications done through the app, consumers can apply for a loan any time of the day, anywhere you are in the Philippines as long as you have a smartphone and a decent internet connection.

Eligibility

Applicants, in order to get approved, will have to be Filipino citizens, of legal age and have a steady source of income.

Requirements:

There are only basic requirements needed to apply for a loan. One of them is a government-issued ID (UMID, Driver’s License, Passport, SSS ID, Voter’s ID, or Postal ID), smartphone, and an internet connection.

Application for a loan through the Tala app is typically done within 5 minutes and the approval is done in seconds after the submission. Once approved, they give you the loan amount offered which can be less than or equal to the loan amount you have applied for. Loan Disbursement is through your bank account, padala center, or Coins.ph wallet.

How soon you will be able to receive funds will depend on the method you select:

Bank Cashout Processing

Processed through PESONet.

Other Banks:

- Cashouts placed before 10 AM (Monday – Friday) are processed and will reflect in the applicant’s bank account within the day, not later than 6 PM.

- Cashouts placed after 10 AM (Monday – Friday) are processed and will reflect in the applicant’s bank within the next business day, not later than 6 PM.

Cashouts that were placed during the weekend or holidays, will reflect in the bank on the next business day. Fees and other applicable charges will depend on the receiving bank of the borrower.

Padala Center Cashout Processing:

Palawan and MLhuillier

- Cashouts placed before 12NN are usually processed within 1 business day.

- Cashouts placed after 12NN are usually processed the next working day.

Cebuana Lhuillier:Within 60 minutes.

Loan disbursements done through the Padala Center will mean that another SMS is sent to the customer after loan approval with the Sender’s name and mobile number. The service charge is paid for by the receiver and is deducted from the loan amount.

Fees and Interest rates

Tala does not have any hidden charges included in customer’s loan applications. As a matter of fact, the fees are communicated to customers upfront:

- 11.4% plus any applicable taxes for loans with a 21-day term or an Effective Interest Rate of 12% per month

- 15.2% plus any applicable taxes for loans with a 30-day term or an Effective Interest Rate of 16% per month

In cases of late payment, an additional 8% is charged on the total outstanding loan amount computed as of the date when the late payment fee is charged.

Loan Repayment

Loan payment can also be done through the Tala app. Payments can be done partially or in full, depending on the borrower’s preference, bearing in mind that full payment has to be done once the loan matures.

There are payment channels that will help borrowers facilitate the payment of their loans: 7-Eleven, GCash, Cebuana Lhuillier, MLhuillier, or Coins.ph app.

On the home page of the Tala app, just click on the “Make a Payment” button and enter the amount of the payment. Choose the payment method in any of the payment channels most convenient for you.

For loan payments through MLhuillier or Coins.ph, an SMS with the payment link will be sent to you. For Cebuana, 7-Eleven, and Gcash, the payment details will be shown in the app along with the reference number which is valid for 2 days. Once you have the reference number, you can visit any Cebuana or 7-Eleven branches, or make the payment through the GCash app.

Why Choose Tala

When people usually choose where to borrow money from, only a few consider the actual cost of borrowing and the time that they have to spend in processing their application.

That was before people had better and more accessible choices. An online platform like Tala has made it possible for a lot of Filipinos to have options that work for them and helps them in life.

There are many reasons why consumers should choose Tala but we have summarized them in 4 points:

Straightforward Process

You can be living on an island or in the mountains of the Philippines – as long as you have an internet signal and a smartphone, you no longer have to worry about traveling back and forth to get the loan you want to receive. Everything happens in the app and as long as you have all the information that Tala needs, there is nothing to worry about.

What is also impressive is the transparency of their whole operation. Within the app, you will know what you are getting into in terms of the money that you can borrow, the fees that are involved, and the terms of the amount that you will borrow.

Simple Documentation

Sometimes people are hesitant when things are made simple. They sometimes feel like it’s just another fraud or a scam. And that is usually brought on by the fact that back in the day, people had to work unnecessarily hard to get what they wanted. That also applies to loan applications.

With Tala, people will be surprised to know that all they need is a government-issued ID. There are no collateral requirements, no guarantors, no co-borrowers. This is what they mean with radical trust – they can take risks that others are not willing to take. It’s the trust that they have for Filipinos that helps them do better in life.

Quick Turnaround

Not many people have the patience to wait for a long time until their loan is approved especially if they have an urgent need for it. The great thing about Tala is that because applications are done online, submissions are done quickly and the same goes for the approval and disbursement. People do not even have to own a bank account in order to receive the amount of money borrowed.

By ensuring a quick turnaround time of the entire process, borrowers (both new and existing) know that they can rely on Tala to take care of them when an emergency arises.

Inclusive

Anyone eligible can apply for a loan with Tala. That means that most Filipinos are given better access to good and competitive loans – one that recognizes that people have different needs and different capacities to pay. It bridges the big gap between Filipinos and the financial products and services that are available for them.

Working-class Filipinos no longer have to worry about where to go for their needs, be it for personal expenses, business, or other emergencies. When most people are included, a collective group of people experiences financial elevation at the same time. That means creating better opportunities for most people.

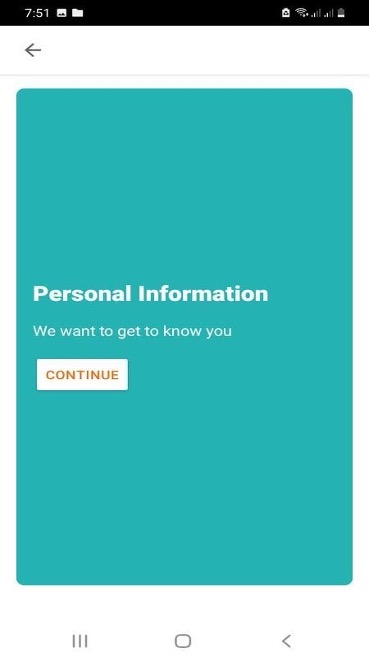

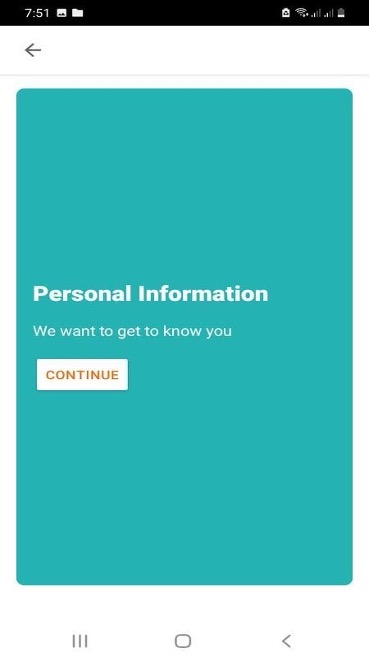

How to Sign Up

Signing up for a loan with Tala is simple. Anyone who knows their basic information will be able to fill in their details as quickly as can be.

Click the “Apply now” button below, Download the Tala app in the Google Play Store. Tala is only available to android phone users.

Enter your working mobile phone number to sign up. Make sure that the phone number you provide is yours because all important information will be sent there.

Choose your pin #. It has to be something unique to you and will not be guessed by strangers easily.

Your personal information will be required to sign up. Once you have filled in all the details towards the end of the page, just review all the information you have entered and click on submit. Your profile has already been created.

To apply for a loan, here is how you have to sign up:

Click “Apply Now” on the home page.

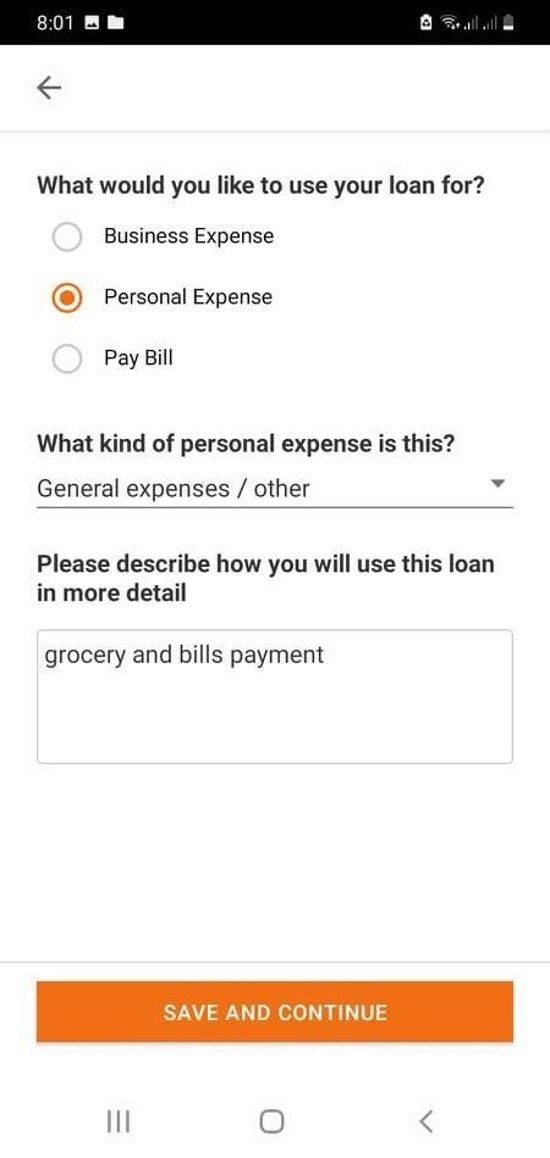

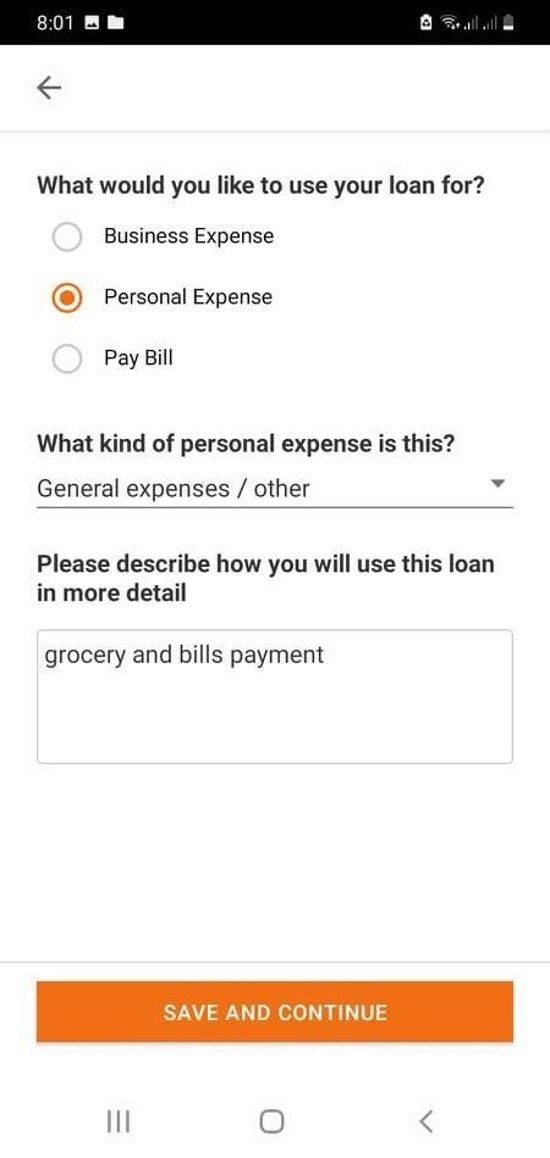

Select the purpose of why you are applying for a loan (Business Expense, Personal Expense or Pay Bill). You will be asked to describe why you are applying for a loan in detail. Remember to keep your entries clear. The approval will depend on this.

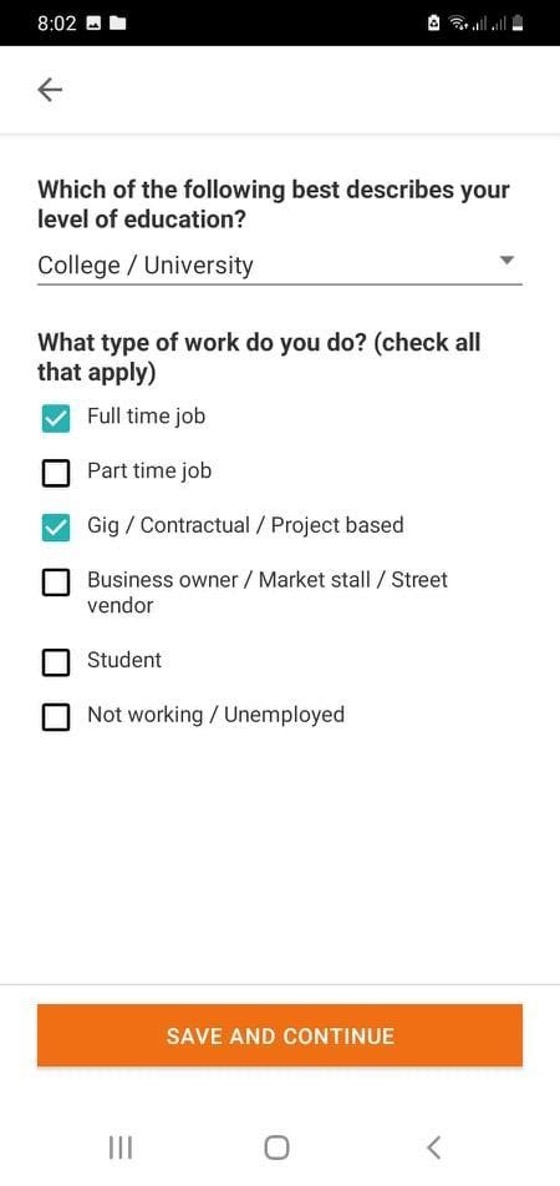

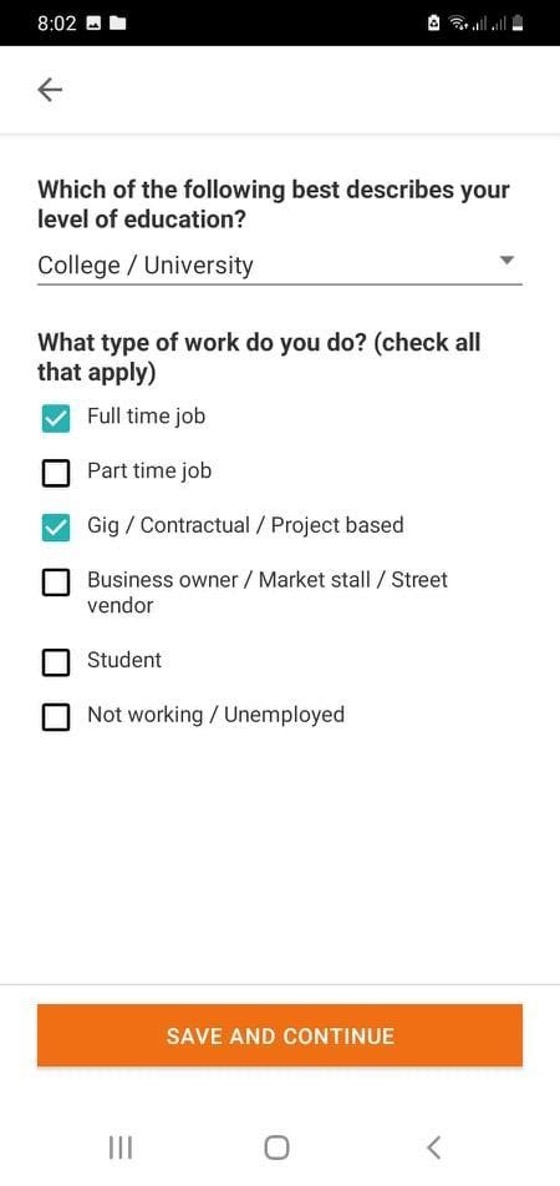

Enter your educational attainment and employment details for the Tala team to determine the loan amount they can approve you with.

You will be asked to specify other sources of income, and declare whether you owe money to other institutions or individuals. You will be taken to the last page of your application to review your entries and submit them. You will know then and there if you have been approved of a loan. The whole process will only take 3-5 minutes of your time.

Once your loan application is approved, you will be given an option to accept the loan amount offered and the payment terms. You will then be given instructions to submit your ID for verification. The ID review will take approximately 24 hours. You can check the Tala app for updates on the verification process. Post the verification process, you can then select the method of how you want to receive funds:

Bank account Padala Center (Cebuana Lhuillier, MLhuillier, or Palawan) Coins.ph app

Conclusion and Opinion on Tala

For people who do not have the luxury of time for applying for loans, Tala makes an excellent choice. It is very simple, straightforward, easy, and convenient. With less requirement for documentation, borrowers need not break their heads trying to keep all files together.

Not all financial or lending companies trust their borrowers enough to easily grant them loans. If anything, they would want to make sure that they incur little to no loss especially if the customer is new. With Tala, the needs and the importance of credit to the borrower are not taken lightly. It is validated and acted upon. That is what makes them unique in the market.