Company Information

Right Choice Finance Corporation is a duly registered finance company in the Philippines registered under the Securities and Exchange Commission with SEC Registration No. CS201612058 with SEC Authority No. 1189. It is a wholly-owned subsidiary of Right Choice Capital Pte. Ltd. headquartered in Singapore, which has been doing business for more than 50 years.

In 2016, Right Choice Finance was established and had since offered the following range of products for Filipino individuals and businesses: a market-leading HRIS SAAS platform, customizable personal and business loans, an e-wallet with full digital banking functionalities and flexible investment options.

The products and services of Right Choice Finance are currently available within Metro Manila, North Luzon, South Luzon, and Cebu province. Their offices can be found at the following addresses:

Main Office – 5E-1 Electra House Building, 115-117 Esteban St., Legazpi Village, Makati City

Cebu Office – 20th Floor ACC Tower Cebu Business Park Ayala Access Rd., Cebu City

For customer service concerns, their customer service team can be contacted at +632 8843-6057 or emailed at [email protected].

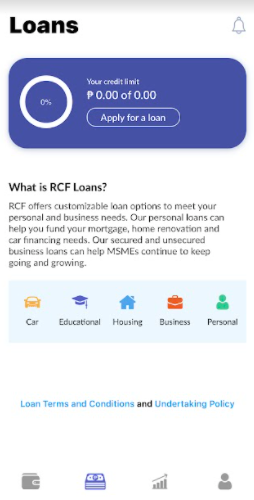

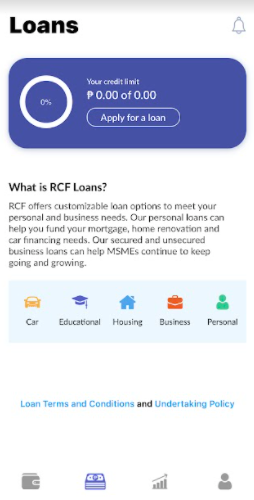

Products and Services Offered

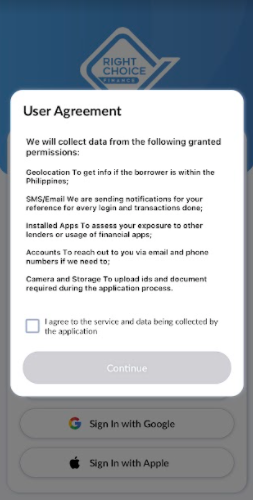

Right Choice Finance offers four different types of loans: Business (MSMEs) Loan, Personal Loan, Car Loan, and Home Loan.

Business (MSMEs) Loan

Business Loan solutions help businesses generate financing to help their business generate additional funds for their day-to-day operations or further expand their business and grow their sales. Entrepreneurs have the option of taking either a secured on a non-secured business loan.

Loan Features

Non-Collateral Business Loan:

- Loan Amount: up to Php 3M

- Interest Rates: 1.5% to 3.5%

- Loan Term: 12 months to 24 months

Secured Business Loan:

- Loan Amount: Php 300k up to Php 3M

- Interest rates: 0.99% to 2.5%

- Loan Term: 12 months to 24 months

Eligibility

- Filipino, 20-60 years old.

- Tenured at least 1 year and up.

- Business should have been running for at least 1 year

Requirements

- Completely filled-out online loan application form

- 2 Valid IDs, 1 Primary(TIN/Company ID/Philhealth/Pag-IBIG) and 1 Secondary(UMID/Driver’s License/PRC/Voter’s ID/Passport)

- Business Permit (DTI/Mayor’s Permit, etc.)

- Latest ITR and Financial Statement

- SEC Papers (for Corporation)

- Bank Statement (6months latest) – Checking / Savings

- PDC (Post Dated Checks)

- Additional requirements may be required.

Personal Loan

For individuals who need financing to fund their personal goals and dreams, this loan product is the right fit. In a way, this product can also be considered a multi-purpose loan because the borrower has the complete discretion with which they can use the proceeds for.

Loan Features

- Loan Amount: minimum of Php10,000 and up

- Interest rate: 1.5% to 5% with rebate of up to 1.5% (subject to terms and conditions)

Eligibility

- Filipino Citizen

- 20 – 60 years old

- Salaried or employed for at least 1 year

Requirements

- Completely filled-out online loan application form

- 2 Valid IDs (1 Primary and 1 Secondary)

- Payslip (3 months latest)

- COE (latest)

- Bank statement (6 months latest) – checking/savings

- Proof of billing (Brgy. Clearance is needed if the place is rented)

- Post Dated Check (PDC)

- Additional requirements may be required, if necessary.

Car Loan

Buying your dream car can sometimes be too elusive because they do not come cheap. This is why getting a car loan to help you realize this dream is just as important. For getting a brand new car or a second-hand vehicle, Right Choice Finance makes this easy for you.

Loan Features

- Loan Amount: up to 70% of the appraised value

- Interest: 0.99%

- Loan Term: up to 3 years

Eligibility

- Filipino Citizen

- 20 – 60 years old

- Salaried or employed for at least 1 year

Requirements

- Completely filled-out online loan application form

- 2 Valid IDs (1 Primary and 1 Secondary)

- Payslip (3 months latest)

- COE (latest)

- Bank statement (6 months latest) – checking/savings

- Proof of billing (Brgy. Clearance is needed if the place is rented)

- Post Dated Checks

- Collateral documents (latest Official Receipt / Certificate of Registration, etc.)

Mortgage Loan

Owning your own house and lot has many advantages – one of which is a place that you can call home. Mortgage Loan allows individuals to access simple and secure online financing that is easy to pay back.

Loan Features

- Loan Amount: up to 70% of the appraised value

- Interest: 0.99% to 2.5%

Eligibility

- Filipino Citizen

- Must be between the ages of 20 – 60 years old

- Salaried or employed for at least 1 year with the same employer

Requirements

- Completely filled-out online loan application form

- 2 Valid IDs (1 Primary and 1 Secondary)

- Payslip (3 months latest)

- COE (latest)

- Bank statement (6 months latest) – checking/savings

- Proof of billing (Brgy. Clearance is needed if the place is rented)

- Post Dated Checks

- Collateral documents (copy of TCT or CCT / Tax Clearance / Lot Plan w/ vicinity Map, etc.)

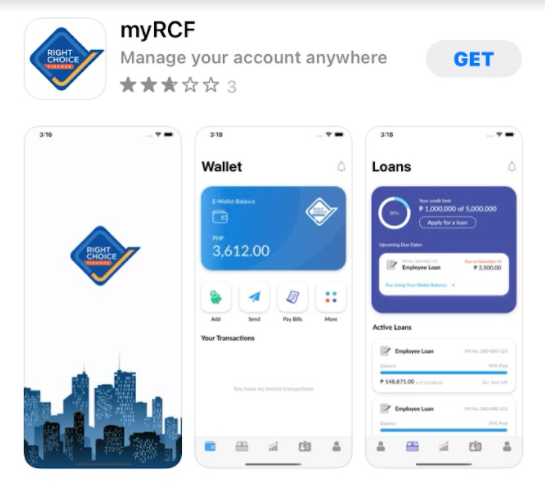

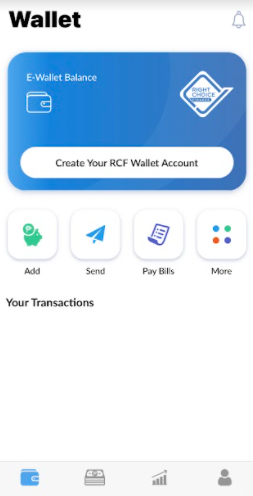

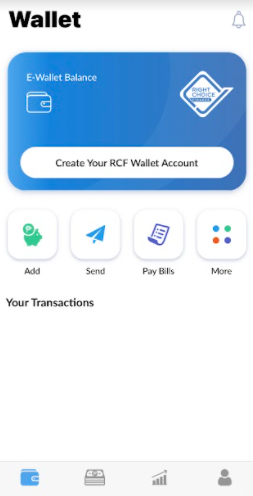

RCF Wallet

With the presence of many mobile wallets in the Philippines today, RCF’s entry into the market has provided many Filipinos with another product that allows for cashless transactions that are affordable, effortless and secure.

Product Features:

Affordable transaction fees

Pay less on transaction fees using RFC Wallet when transferring funds to banks or other merchants.

Secure online transactions

Customer information is safe and secure – the App is also password-protected, ensuring that their account is not hacked.

Do more with the App

With many services available within the App, the user will be able to save more than just their time and their money.

Investments

RCF does not just help their customers get easy and simple access to financing, they help them grow their money. Within the App, customers can earn through the different investing options available.

Advantages of Investing with RCF

Build Your Wealth

Micro-investments are guaranteed to build the wealth of investors that are geared to provide them with healthy returns.

Unique Option

For investors to build a healthy portfolio that will protect them from losses, several investment options are available through the RCF platform or their e-wallet app.

Competitive Capital Returns

Every good investment means investors get a competitive capital return. Through RCF investments, the investors will be able to achieve this.

Why Choose Right Choice Finance

100% Digital Financing

All the products and services of Right Choice Finance can be accessed through the RCF mobile app – even loan applications. This means that borrowers and investors have the convenience of doing everything within the app without the need for traveling or visiting their offices. By having the option to digitally complete all the transactions, people can save their resources such as their time and money.

Also, people can start their applications from the comfort of their homes, or wherever they are at whatever time of the day, just as long as they have a working internet connection, a smartphone and have the requirements uploaded.

Provides Avenue to Grow Your Money

Investing is a concept that not too many people are keen on starting especially when they are barely able to get by. But for those who have a little wiggle room in their finances, they can choose to invest their extra money instead of using it to purchase stuff they do not necessarily need.

RCF assures investors that they get competitive capital returns – a guarantee that the money invested will not go to waste but will instead provide an avenue to increase it.

Diversified Products and Services for Individuals and Businesses

RCF not only serves individuals for whatever financing needs they have – they also make financial products available for businesses to help them grow their business and generate more revenue. When a company expands, communities also flourish because it creates more jobs for people.

Outstanding Client Relationship

Customer support is essential for customer-centered businesses and in this case, RCF ensures their clientele that they will be taken care of with excellence that they deserve. Customers can also rely that they will immediately be responded to should they have any queries or concerns regarding the RCF products and services.

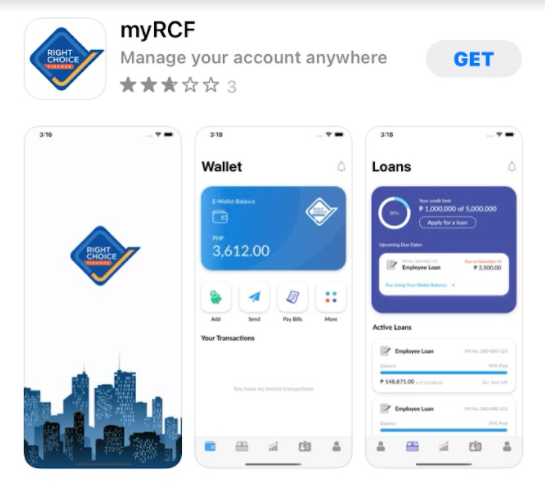

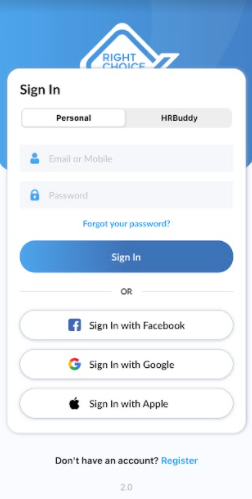

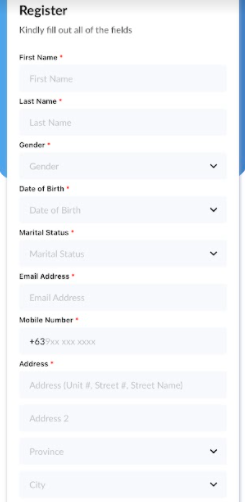

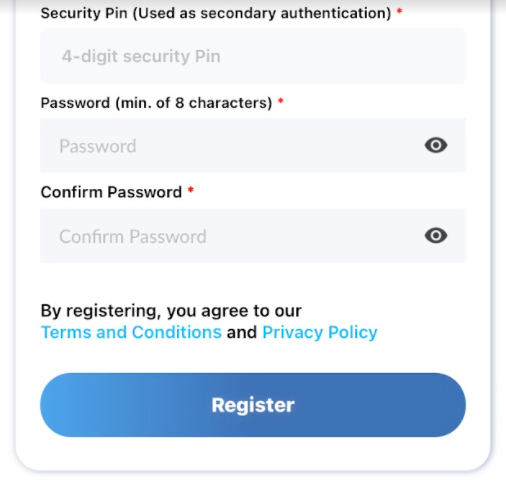

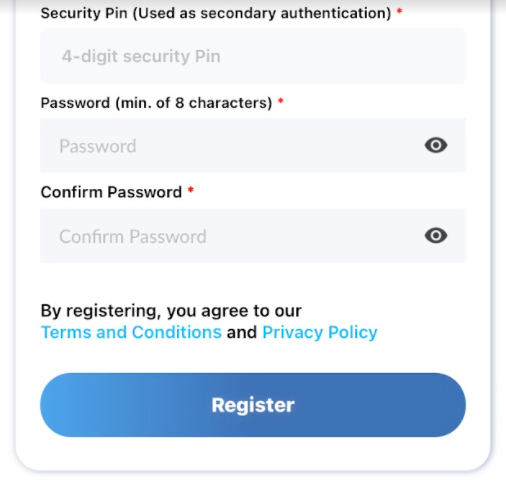

How to Sign Up

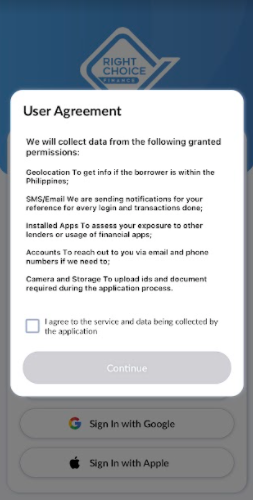

To start availing the products and services of Right Choice Finance, their customers can do so by installing the Right Choice Finance mobile app through the Google Play Store / Apple App Store and proceed with the following steps:

Click the button below and go to their site.

Install the myRCF app on your mobile phone.

Tick the box to agree to the terms and conditions set out in the User Agreement to proceed.

Click on Register, located at the bottom of the page.

Enter your personal information, active mobile number and address.

Set up your account and create your PIN and password.

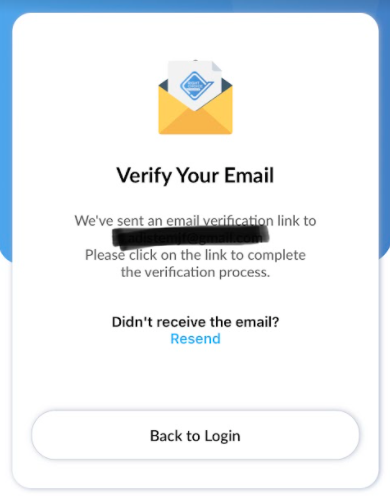

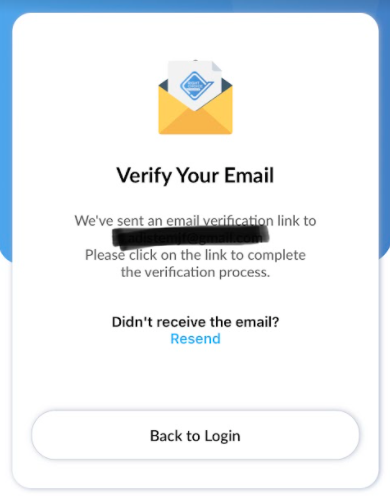

Verify your email ID and go back to the login page in order to proceed using the app.

Once signed in, you will be taken to the main page of the app which will allow users quick access to the Mobile Wallet, Loans, Investments and the user account profile.

Frequently asked questions

How can I access and manage my funds?

Is there a limit to the amount that I can withdraw?

How can I withdraw funds from my RCF account?

Is there a fee to apply for a loan?

What if the funds were not transferred to my bank account?

Is refinancing available?

What if I do not have a co-maker?

Conclusion

To be able to have access to digital finance ensures that many Filipinos will have access to safe and reliable financing in helping them turn their financial goals into a reality. With the many finance products being offered in the market, it is sometimes very difficult to choose the best fit in terms of the loan limit, interest amount and period of repayment. With RCF, they make it possible for many Filipinos to not only apply for financing in a simple and fast manner but also to make it easy for them to pay back their loans.

With the introduction of mobile wallets and investments in their portfolio, they also make it possible for people to be exposed to diversified product offerings of a financing company so that they also will have exposure to cashless transactions and grow their money.