Company Information

Radiowealth Finance Company started its operations more than 50 years ago as a radio repair shop which then transformed into an appliance financing and became a full-fledged financing company in 1996. From then on, it became a leading loans provider to the underserved Filipinos who exemplify the virtues of hard work, patience, and industry.

Because of the motivated, competent, and professional workforce that they lead, it is without question that the service provided by their employees to the customers they serve is also outstanding, employing only their best practices in order to achieve their goal of becoming a significant player in the financial services industry, not just in the Philippines, but in the ASEAN region.

RFC’s main office can be located at The DMG Center, D.M. Guevara St., Mandaluyong City and is registered with the Securities and Exchange Commission (Registration No. AS9600005A and Certificate of Authority No. 173).

Their offices are open from Mondays to Fridays, 8:00 AM to 6:00 PM, and their customer support can be contacted through:

- Landline at: (+632) 8584-6033

- Mobile at: (+63) 961-136-1660 or (+63) 995-307-9062

- Through email at [email protected].

Types of Loans Offered

When looking for a loan, customers are most concerned with how fast the turnaround time is from the time of the application to the disbursement of the loan. Not only that, but they are also concerned with how hassle-free the need for the documents is.

With Radiowealth Finance Company, there are specific loans for a customer’s specific need.

| Personal Loans | |

| Education Loan | Designed to help parents provide the best education they can give their children. RFC acknowledges the importance of assisting children in working towards their dream without worrying about their financial challenges. |

| Medical Assistance Loan | For people who have a dire need for medical assistance but are short on cash, this is their loan. Unfortunately, emergencies happen, and sometimes people are not always prepared for them. |

| Home Improvement Loan | With a growing family or a home that needs renovation or expansion, money should not be a cause for hindrance. Your family deserves to live in a comfortable and well-organized home. |

| Take-Out Loan | Some of your lenders may charge higher than average interest fees that hurt your budget and in turn, your financial health. You may take a loan from RFC to pay previous lenders to give yourself breathing space from interest payments and focus on growing your financial health. |

| Travel & Vacation Loan | All work and no play are not good for our health. So plan your dream vacation and do not worry about funding that vacation by applying for a travel and vacation loan with RFC. |

| Vehicle Modification Loan | Your business should not stop just because your business vehicle broke down and you do not have the cash for its repair. This loan is what every entrepreneur needs. |

| Recovery Assistance Loan | The Philippines is home to natural disasters because of its strategic location. That being said, people have to suffer through calamities that visit the country every year. Sometimes, other disasters are more devastating than others. Helping Filipinos recover from accidents and natural disasters is the aim of this loan. |

| Equity / Down Payment Loan | Get the financing you need to pay for the down payment of a vehicle – be it for personal use or business use. |

| Special Occasion Loan | Filipinos go big in celebrating the significant milestones of their loved ones. However, the experience is not just for the person celebrating a special occasion but also for their loved ones to experience it. Therefore, this loan is for every family to make the most of the event to make memories more special and worth remembering. |

Business Loans

The products of RFCs are not just for each Filipino family to fund for their personal goals. Businesses – new and established – will also find financial products and services that could help them grow their businesses.

| Working Capital Loan | This loan is meant for businesses to finance their business expenses while working on generating more revenue for their business. |

| SME Micro Loan | It is ideal for small and medium businesses that need the extra boost to keep their businesses going and need additional funding to grow their business. |

| Contractor’s Loan | Designed for professionals who work on project-based contracts, ensure that you can cover your operational expenses while you focus on completing projects or services. |

| Inventory Financing | A loan is ideal for those who sell goods and need to increase their inventory to generate more sales. |

| Franchising Loan | For entrepreneurs who wish to buy a new franchise or grow their existing franchise, the need for capital should not be a problem. This is the loan perfect for that need. |

| Capital Expenditure Loan | Purchasing more assets to expand and grow your business can be a bit expensive. However, entrepreneurs should know that this should not stop them from letting their business reach new heights. This loan will enable entrepreneurs to purchase new assets or upgrade existing ones. |

Financing

More financing options help customers purchase a vehicle or non-vehicle needs for personal and business improvements.

Vehicle

| Vehicle Loan | Perfect for those looking at buying a new car or replacing their old one for both personal and business use. |

| Truck Loan | If your business needs a truck, RFC has the loan product precisely for this type of need. |

| Farm Equipment Loan | For farm owners struggling to buy new farm equipment, upgrade existing ones, or replace the old ones. This loan is perfect for improving or growing your farm operations. |

| Motorcycle Loan | Motorcycles have become an essential part of Filipinos’ lives for their personal use (to avoid the standstill traffic) and business use (delivery or transport). |

| Public Utility Vehicle Loan | For business owners in the transportation business or those who plan to be in the transportation business. Give your business a boost by adding another vehicle to increase your profits. |

Non-Vehicle

| Application Loan | Don’t let cash problems get in the way when you require appliances for your home or business. Instead, apply for an application loan with RFC. |

| Gadget Loan | Electronics have been a necessity for learning and work. However, when your gadget breaks down or you need to upgrade the existing one, this loan product is the right fit for you. |

| Machinery & Equipment Loan | Business owners know that machinery and heavy equipment do not come cheap but are necessary for their business operations. Therefore, funding shouldn’t get in the way. |

Eligibility

- You should be a Filipino citizen, not lower than 18 years of age.

- Residency of at least two (2) years, except if you are a new homeowner.

- Good character and reputation.

- A source of income.

- If employed, you should have been connected with your current employer for at least 2 years with a minimum basic monthly salary of Php 18,000.

- If you are a professional or self-employed, you should have been in the same profession or the same business for at least 3 years. In addition, your business should have been operational for at least 2 continuous years with profitable operations.

Basic Requirements

The loan requirements typically depend on the type of loan applied for. The interest rates and fees also vary depending on the loan. But here are the basic requirements that are needed for applying for a loan with Radiowealth Finance Company:

- 2 valid government IDs (if employed, pls include company ID)

- Proof of Billing

- Proof of Income (3-month payslip)

- Residential, Business, or Employment Address Map

- Certificate of Employment

- Business Barangay/ Business/ DTI Permit (for business owners)

Why Choose Radiowealth Finance Company

They Support Businesses

RFC is not just a financing company for individuals – they also understand the varying needs of businesses across different industries and strive to help them attain their goals without worrying about where to get additional capital to get their businesses going.

Applications can be completed online or in the branch

The convenience of their loan applications process allows for business owners and working professionals to choose which can work around their busy schedules.

Provide plenty of loan options to choose from

The best thing about Radiowealth Finance Company is that they have a loan product for the different needs of Filipinos. Customers can rest assured that RFC got it covered whatever the need may be.

How To Sign Up

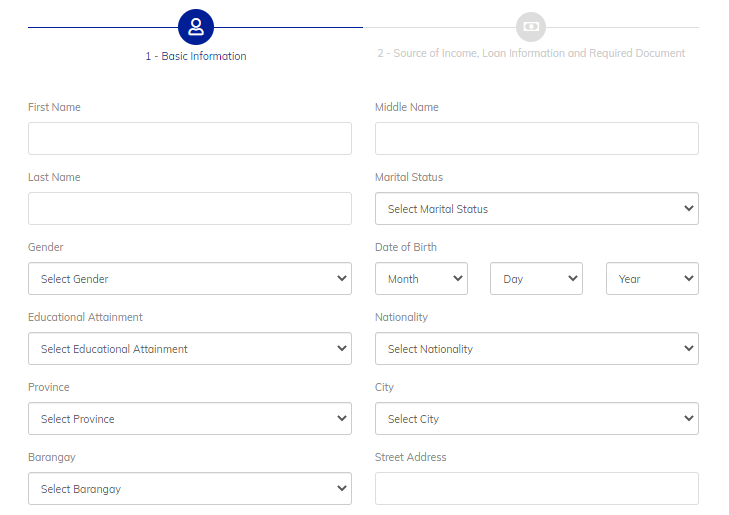

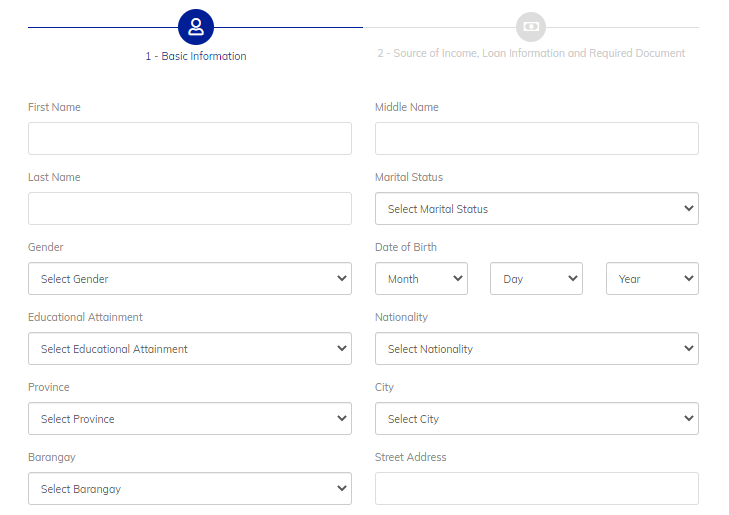

For customers who are interested in applying for a loan, they may go to the Radiowealth Finance Company website (click the Apply button below) and fill out the application form as seen below. There are only two sections that need to be filled: Basic Information and the Source of Income / Loan Information / Required Documents.

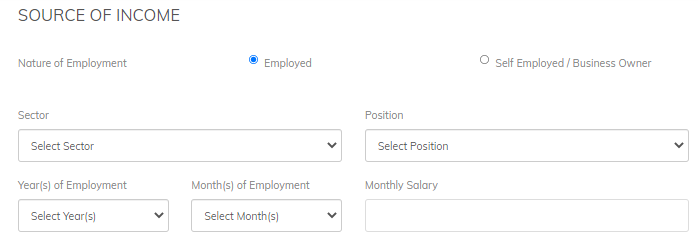

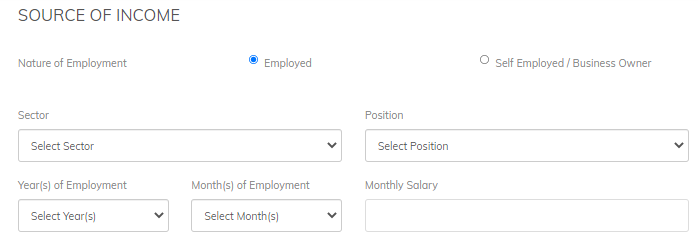

In the next section, there are 3 things that you will need to accomplish, The section required for your source of income:

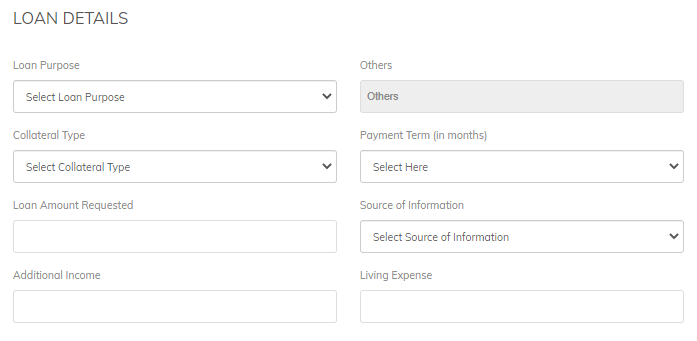

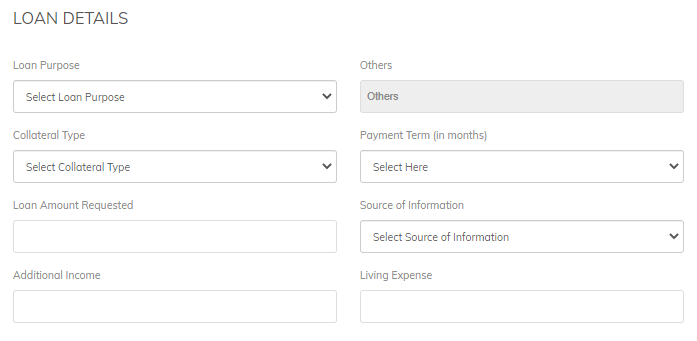

The next one is the Loan Details where you have to indicate which of their loan products you are interested in, also choose your preferred payment term, etc.

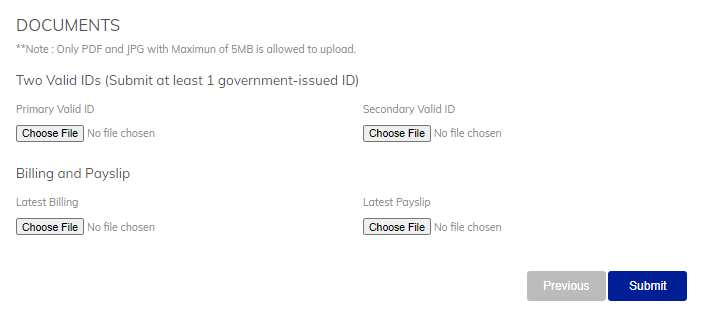

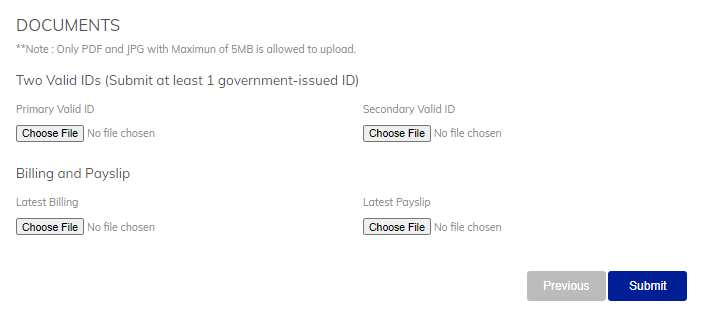

The last section will require the basic requirements to be submitted. Scan the documents or take a clear picture of them and uplo

If further assistance is required, RFC’s account executives may be contacted at Globe: +63945-833-7483 | Smart: +63 961-136-1160 Landline: (+632) 8584-6033 to further assist you.

Once the initial verification is completed and the application is approved, RFC’s representative will contact the customer to complete the submission of the documents required according to the loan type. They will also inform the customer on how the loan amount can be claimed.

Frequently asked questions

Is collateral required? If yes, what are the accepted collaterals by RFC?

Can I renew my loan if I still have an outstanding loan?

How can I renew my loan?

Is there an application fee?

How are the loan amounts disbursed when approved?

Conclusion

With the multitude of needs of Filipino families nationwide, it is a comfort to know that a financing company like RFC exists to help uplift the lives of the customers they serve by offering financial products and services with the highest level of customer service and competitive offers.