Company Information

In February 1994, Pure Gold Finance came about in the Philippines as a financial institution. At that time, it had only one main branch located in Binondo, Manila. Now, it is expanding to more than 30 branches in Manila and other provincial locations including North and South Luzon, Metro South District, and Metro-North District. To date, they have already served over 11,800 client mixes which are of different private groups and business sectors.

The main office of Pure Gold Finance is Located at Sri Building, 2444 F.B. Harrison St, Pasay, 1302. For general inquiries, customers can contact them at (02) 8353 2900 or through their website puregold-finance.com.ph.

Pure Gold Finance commits to become a dependable financial solution provider not just in the present but in the coming years ahead. It is a proud member of the Philippine Finance Association and affiliates with a group of companies, including Pure gold Price Club Inc, S&R Membership Shopping, and all companies under the umbrella of Cosco Capital Inc. It has already served the employees of these companies, among others.

In the same commitment that they have to provide quality and efficient service to their customers, they make the same commitment to their employees – fostering not just professional growth but also their personal growth.

Types of Loan Offered

Salary Loan

Making ends meet is a problem that most Filipinos face, especially for the working-class population. Some people do not need vast amounts of loans to address their needs – others need a little financial help to get by and allow them to get back on their feet financially. For necessities such as tuition fee payments, monthly groceries, medicines, funding a small business, etc., they need not approach the traditional banks if it can be addressed right away with a simple salary loan.

This type of loan is available to salaried employees who have been employed for one year or more and must be at least 18 years old at the time of application.

This salary loan provides employees the flexibility of payment terms of the loaned amount with a low-interest rate. This means that borrowers are not necessarily approved of the loan amount they applied for because the loanable amount will depend on the applicant’s salary. This is to make sure that employees can still afford a quality lifestyle after the deduction of their loan payments.

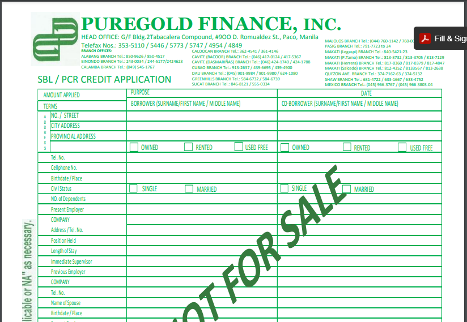

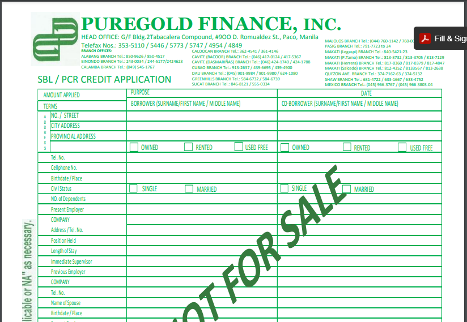

To avail of this loan, you can submit an accomplished form along with the below-listed requirements:

- Fully Accomplished Salary Loan Application Form

- Copy of SSS ID

- Copy of Government Issued ID (Front & Back)

- Original Copy of Certification of Employment

- Copy of One Month Latest Payslip

- Copy of One Month Latest Bank Statement (Personal Current Account)

- Proof of Billing Address (Utility Bills)

- 2×2 Photo with Signature

- Post-Dated Check Payment (upon approval of the loan)

Why Choose Pure Gold Finance

Pure Gold is a name already established in the market and can be associated with a credible and legitimate brand. These are not just the qualities that make Pure Gold Finance a sound choice for those looking at financial solutions for both their short-term and long-term needs.

Here are some of the reasons for Filipinos to choose Pure Gold Finance:

No Hidden Charges

Why pay more when you already need money and have limited resources to spend? Loans from Pure Gold Finance have no hidden charges, and they provide a standard monthly rate so that borrowers know exactly how much it is that they are paying each month through the post-dated cheques that they issue.

They Have Strategic Locations

Pure Gold Finance has over 30 branches in Metro Manila and its neighboring provinces. Having a wider reach ensures that more customers are better served with a product that helps Filipinos elevate their financial status in life. More branches also mean that Filipinos living in these areas will choose where they are closest to save travel time and transportation expenses.

Non-Collateral

A non-collateral loan ensures that future customers are not hindered from getting a financial solution for their requirements. Sometimes, the average working-class Filipino will not have the means to provide collateral.

By removing the need for collateral, Filipinos no longer have to approach loan sharks, which will only put them in an even worse debt situation. And usually, when a person is employed and is a regular employee, that is enough for simple loans.

Easy to apply

With the option of applying for a loan online or in the branch, Filipinos are given the option that best suits them and is made more convenient. However, some people are still not so used to providing their personal and sensitive information online, while some simply have no time to travel back and forth all the time in applying for a loan.

When applying for a loan online, borrowers no longer have to endure long lines, borrowers will only have to visit the branch once the loan is approved and it is time to collect their cheque.

How to Apply for a Salary Loan

There are two ways to apply for a salary loan: personal or online. A borrower’s method for the application does not mean that one method processes the loan faster than the other. Both ways go through the same process and will take the same processing time. However, it can differ in the time that the borrower spends in the actual application: one will require travel time and waiting in line, while the other can be done anywhere as long as there is a working internet connection.

Here’s how the application process works:

Personal Application

Those who prefer face-to-face transactions with the Pure Gold Finance team and prefer the traditional way of a loan application are free to proceed with this method of application.

- Just visit any of the 30 branches near you (North Luzon, Metro Manila – North Area, Metro Manila – South Area, and South Luzon).

- Their customer service representative will guide you on your loan application. Ensure that you already have all the requirements needed to proceed with the loan to ensure that you do not have to keep coming back to the branch and for a faster loan processing time.

Apply Online

You apply at any time of the day; it is ideal for employees who cannot leave their jobs or take leave any day of the week. Simply follow these steps:

Click the button below and Go to puregold-finance site.

In the right-hand section of the home screen, you will immediately see the loan application box.

Click on the download icon to download the application form. Once you click on that, you will be redirected to the application form where you have to fill in all the necessary information to proceed with the loan. It is typically a 4-page document that will require your personal information, financial information, a section for the promissory note, and consent for Pure Gold Finance to conduct a credit investigation on you.

You can either fill in and sign the form online or you can print, fill in all the details, sign and scan the form. If you are tech savvy enough to fill in all the details online, you can proceed with this option. Otherwise, just print the form and begin filling in the details.

Double-check all the details, scan, and send back the filled application form. Once received, a customer service representative will contact you to verify all the information.

The loan processing will take 2 weeks and then all you have to do is wait for the approval and release of the loan amount through a cheque that Pure Gold Finance will issue in your name. You will have to personally visit the branch to collect your cheque.

Frequently asked questions

Who can borrow?

How long is the processing time?

Is a Co-maker/Borrower required?

How to know the status of the loan?

How to receive your loan?

How will you pay for your amortization?

Conclusion

Pure Golf Finance is ideal for those who are looking for non-collateral loans and are living in the Metro Manila area and its nearby provinces. Having a brand that Filipinos can trust and can rely on, they will not think twice when they apply for a loan. With its flexible payment options, lower interest rate, and convenient repayment option, it poses no further concern for borrowers.