Company Information

Online Loans Pilipinas is a microfinancing and consumer financing company that operates through its digital platform so that every Filipino, wherever they are in the Philippines, can access their financial services.

They are registered under the Securities and Exchange Commission with Registration Number CS201726430 and Certificate of Authority Number 1181. This essentially means that Online Loans Pilipinas follow the SEC’s rules and regulations in the Philippines.

The registered office address of Online Loans Pilipinas is in Unit 1402-06 14th Flr Tycoon Centre, Pearl Drive, San Antonio, Pasig City. Customer support-related inquiries may be contacted through the website or click here.

Online Loans Pilipinas aim to uplift the financial well-being of every Filipino through the financing services that they offer. Their solution to this is to make sure that all transactions they deal with are dealt with in a fast and easy service that removes entirely the need for a borrower to visit the branch or office, submit collateral, and wait for long hours in a queue.

Types of Loans Offered

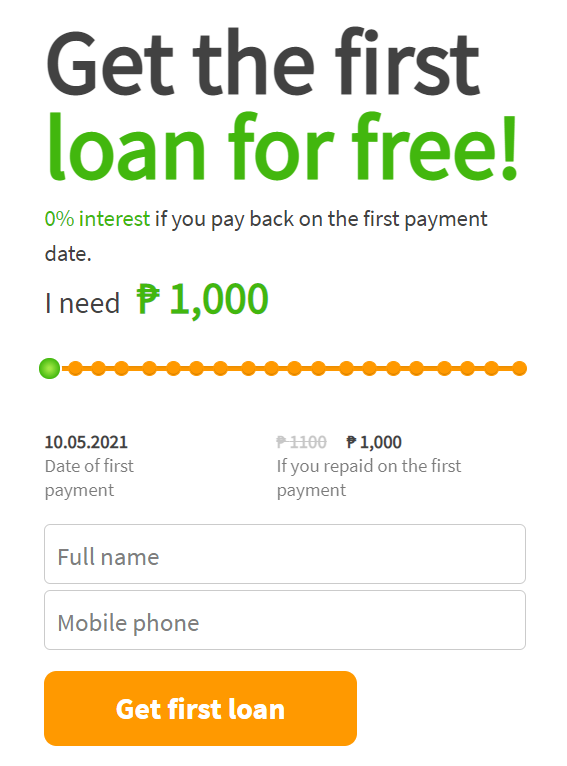

Online Loans Pilipinas provides microfinancing for every Filipino in need. All loan applications are made online, and right off the bat, the borrower will be able to see the interest rate they will be charged for the loan amount they wish to obtain. The good news is that first-time borrowers will not be charged any interest when they pay on the due date. That means you only pay for the amount you borrowed, nothing more.

To become eligible for a loan with Online Loans Pilipinas, the following criteria must be met:

- Borrowers must be between 22 to 70 years old.

- Is currently employed or with a steady source of income.

- Have any of the following IDs: Tax Identification Number (TIN), Passport, Professional Regulation Commission (PRC), UMID, SSS, or Driver’s License.

- All customers should have a valid Bank or E-Wallet (Gcash, Paymaya, or Grabpay) account.

Loan Repayment

With the convenience of their customers still in mind, loan repayments are designed so that customers will be able to choose from different options of paying back their loans. Always make sure that you have the loan reference number with you at all times because this will be required. Loan payments can be made in any of the methods mentioned below:

Over The Counter

- 7-Eleven (Cliqq touch screen machine or the Cliqq Mobile App)

- Bayad Center (Make bills payment to Dragonpay)

- SM (Go to the SM Bills Payment Center located at SM Department Store/SM Supermarket/ SM Hypermarket/Save More branches and make bills payment to Dragonpay)

- Cebuana Lhuillier (Make bills payment to Dragonpay)

- LBC (Make bills payment to Dragonpay)

- Robinsons (Make bills payment to Dragonpay)

- RD Pawnshop (Make bills payment to Dragonpay)

- Palawan Express (Make bills payment to Dragonpay)

GCash or Coins.ph

For those who wish to make payments instead through their GCash or Coins.ph accounts, they can follow the respective steps shown below:

Through GCash

- Click Pay Bills

- Click Loans

- Select Dragon Loans

- Fill out these details:

- Reference Number – Your 8-digit OLP Reference no.

- Contact Number – Your Mobile number with OLP

- Amount – payment amount

Through Coins.ph

- Fill out this information:

- Invoice no. (reference number – it is indicated on the SMS that you have received upon your approval)

- Your OLP Account Name

- Your Email Address

- Amount to pay

- Remarks: Online Loans Pilipinas

- Choose which method you wish to make the payment for:

- BDO Interbanking

- BPI Online/Mobile (NEW)

- Metrobankdirect

- Landbank ATM Online

- Maybank Online Banking

- PSBANK online

- RCBC Online Banking

- Robinsons Bank Bills Payment

- Unionbank Internet Banking

- UCPB Connect

- Coins.ph wallet/bitcoin

Online Banking

The following information will be necessary for making a loan payment through online banking:

- Invoice no. (reference number – it is indicated on the SMS that you have received upon your approval)

- Your OLP Account Name

- Your Email Address

- Amount to pay

- Remarks: Online Loans Pilipinas

Late Payments / Penalties

- Late Payment Interest Rate: 2% each day of account in default

- Late Payment Fee: Php700 on every occurrence of late payment

- Prolongation Fee: Php700

Why Choose Online Loans Pilipinas

Online Loans Pilipinas may not be the only microfinancing company in the Philippines with a digital platform. Still, it is one of the most convenient, most accessible, and reliable financial service providers in the country.

Here are the reasons why opting to avail of their service is the best choice for Filipinos:

Fast

The entire application process up to the disbursement happens only within a few minutes. There are no long queues, no waiting for approval the next business day, no waiting for the loan amount to be available after a few days. Instead, the application takes approximately 5 minutes, approval happens a few minutes after that, and the disbursement is completed within 10 minutes from loan approval.

Simple

The documentation is straightforward: a government-issued ID and proof of income as added documentation. Collateral is not even required.

Convenient

Not having to constantly travel to process your loan application when you have an urgent need for money, waiting in queues, and further waiting for the decision on approval and disbursement is the most convenient.

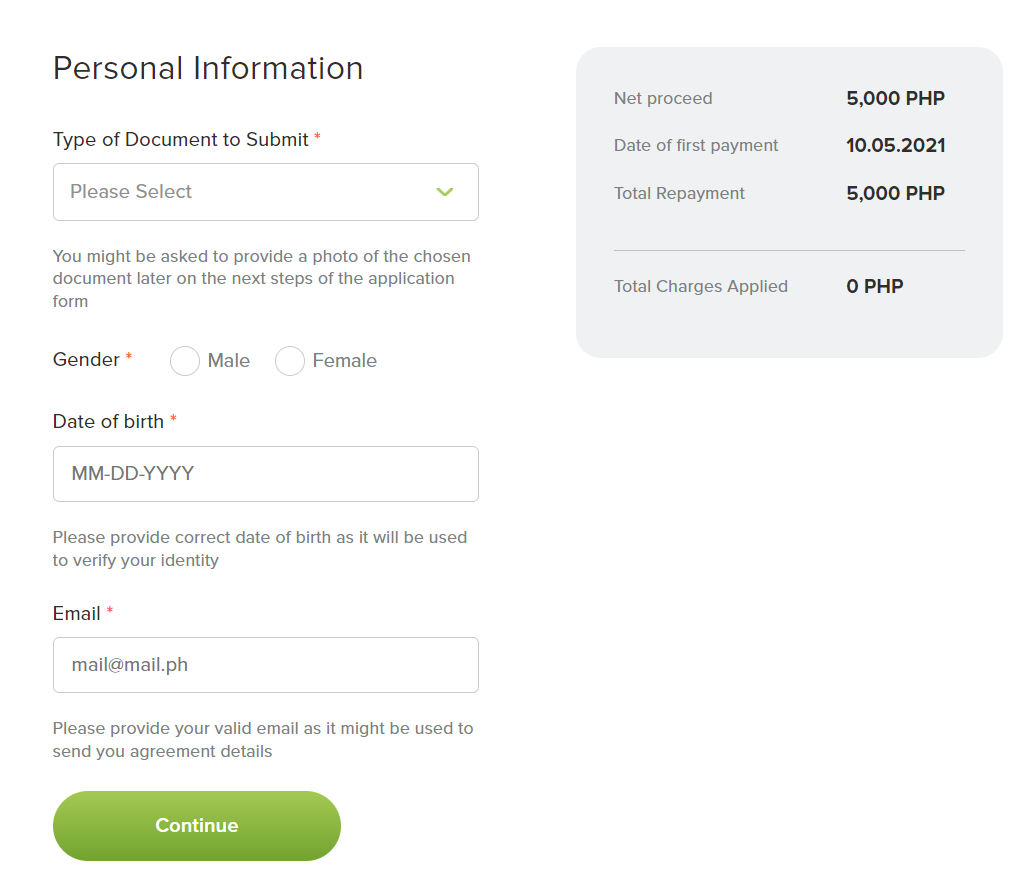

Transparent

The fees you will have to pay will be seen right from the time you start the application process. Other information on fees and penalties can also be seen before you agree to the terms and conditions of your loan application.

Provides Incentives to Repeaters

This is probably what makes Online Loans Pilipinas more enticing to customers than the others – repeat borrowers who have a good credit history are given higher loan limits, better interest rates, and probably an option to apply for Installment Loans.

How to Sign Up

Signing up for a loan with Online Loans Pilipinas only requires very easy steps:

Click the button below and you’ll kand on the home page.

The loan application screen will be shown immediately. Borrowers can enter the amount they wish to borrow by moving the toggle button of the amount.

- First-time borrowers may apply for a loan between Php1,000 to Php7,000 interest-free.

- For repeat borrowers, the amount they can apply for is up to Php30,000 depending on how good their credit history is with Online Loans Pilipinas.

Fill in the personal information required

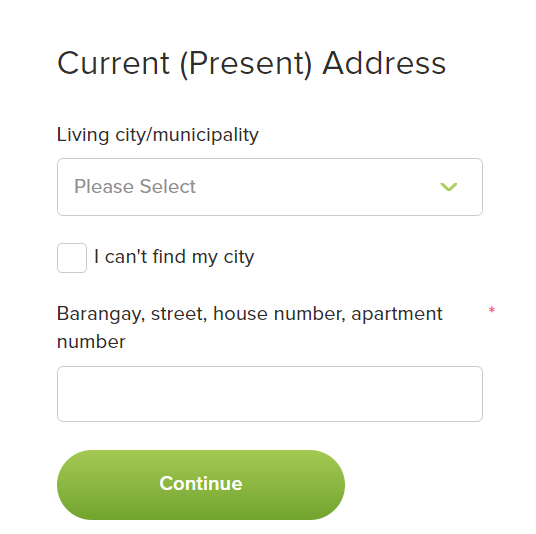

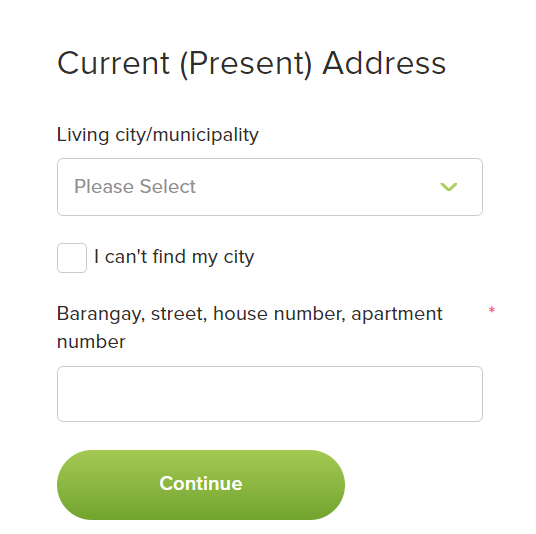

Provide your current or present address. Ensure that you provide your complete address in this section

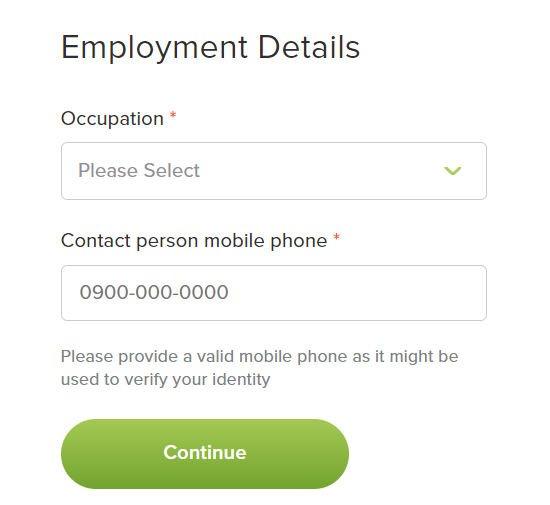

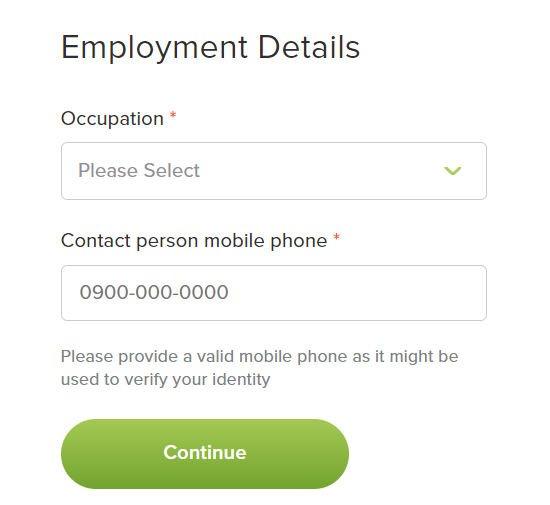

In the employment section, you will only be required to provide your occupation, salary net of taxes, and the contact number of the person you work with. This is required in case verification of your identity is conducted before your loan approval.

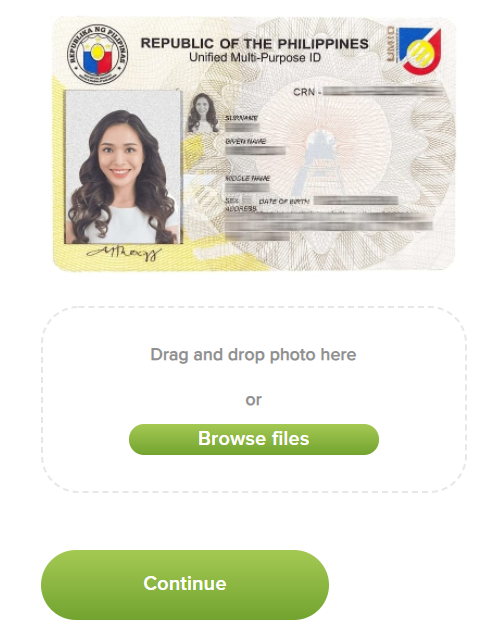

Take a photo of your valid ID that you wish to submit. Take note of these points when you submit a photo of your ID:

- The uploaded document should occupy at least 90% of the ID.

- The front side of the photo should be clear and visible.

- The validity of the submitted ID has not expired.

- Do not crop the document parts. There should be no highlights

Take a selfie with your ID next. When taking a selfie with your ID, make sure that:

- Your face and the ID are clear and visible

- There are no other objects or persons included in the selfie

- The document parts of the ID are not cropped,

- There are no highlights in the photo.

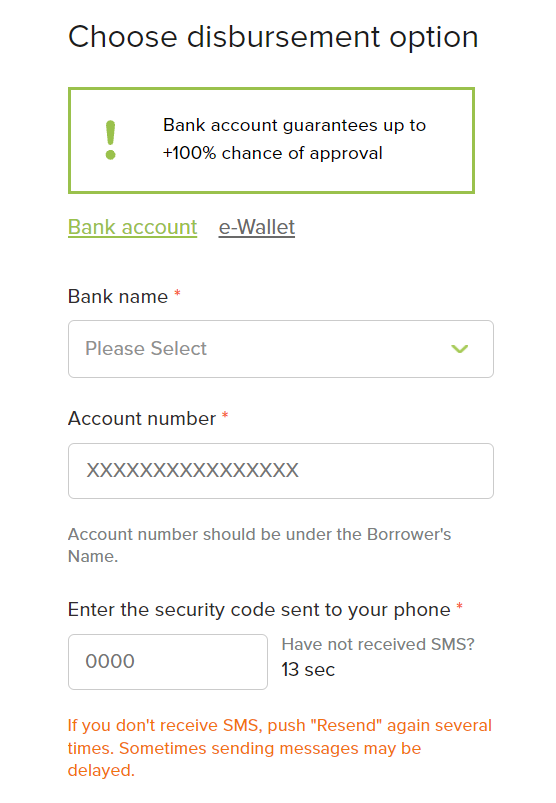

The last part of the application process is choosing the disbursement option you wish to receive your loaned amount. This can either be through your bank or e-wallet.

Double-check and make sure that you have provided accurate data to ensure swift and fast transfer of funds when approved.

Before agreeing to the terms and conditions, make sure that you have carefully read through the terms of the loan you are applying for. The penalties and interest payments are detailed.

After submission, Online Loans Pilipinas will decide on your loan application in just a few minutes. The decision will be communicated through a call or an SMS.

Once approved, receipt of the money will only be within 5 minutes using Instapay.

Frequently asked questions

How will I know once my loan is approved?

How do I know the total amount that I have to pay?

What happens if my loan application is declined?

How long do I have to wait for my loan amount to be disbursed?

Can I settle my loan early?

Is there an option for Installment Loans?

Conclusion

With Filipinos needing a quick financial fix for their short-term financial problems, having Online Loans Pilipinas allows for them to address their financial challenges just before their salary arrives or the money they are waiting for is in their hands. With the convenience of the loan application, no working-class Filipino should have to struggle for them to work on their financial well-being.