Company Information

The idea behind LEND is very simple. There are vendors in the market that are willing to provide loans to those who require an interest, and there are people in the market who need money for their personal or business needs. Through LEND, these two can meet. A vendor earns interest, and the borrower addresses their financial need. That means two people who can get a solution for each of their needs.

The lenders or loan vendors at LEND could be from the United States, Canada, Germany, Australia, and the United Kingdom. With a wide array of loan vendors, Filipinos are sure to have someone out there who would be willing to help them financially.

For concerns or inquiries, LEND can be contacted via email at [email protected] or message them via their website.

Types of Loans Offered

LEND provides a virtual place for a fast, reliable, and simple solution for borrowers to find the perfect creditor before their payday. For borrowers to become eligible for a loan with LEND, they must at least be 20 years of age and currently residing in the Philippines.

Other pertinent details with regards to the loan can be seen below:

Fees and Other Charges

The typical fees for short-term loans that are no more than $500 are in the range of $10 – $40. However, lenders may charge higher fees for loan amounts higher than $500. This is understandable because lending a higher amount means the lender is taking more risk from a loan defaulting.

It is also vital for borrowers to carefully read the terms of the loan agreement before signing because the interest rate, repayment term, and other details are mentioned there.

Why Choose LEND

One marketplace where lenders and borrowers meet hits two birds with one stone. Those who have excess money and are looking at earning interest on it can offer it to those looking at borrowing money and are willing to pay interest. Both parties can mutually agree on the terms and make a judgment based on what they think is perfect for their needs.

Simple and Easy to Use

LEND makes it easy for borrowers and lenders to post advertisements on their needs. The great thing about it is that they can post ads of their loan needs or loan offerings for free. In addition, creating an account is very simple and requires only very minimal information. With just an email ID, mobile number, and other personal details, you can proceed with the account registration using your laptop or smartphone.

Reliable

Both borrowers and lenders can be rest assured that they can trust LEND to conduct a legitimate financial transaction that can benefit them. Their information is secure. Any other verification that a lender needs to do, they will be able to as long as it is done for the primary purpose of verifying the borrower’s ability to pay.

Provides a Variety of Options

Signing up with LEND means that a borrower will post up an ad for loan requirements and will have more than one lender show interest in financing their needs. In the same way, lenders posting an ad will have more than one borrower show interest in what they are offering.

Based on the criteria set by a lender, they will be able to screen which borrowers match what they are willing to offer and, consequently, the earnings they target to gain. On the borrower’s side, they will be able to choose which lender will charge the lowest interest rate according to the period that they will need that loan.

Flexible Payment Terms

Having flexible payment terms means that a borrower does not get burdened for paying off their loan within a short period. Instead, they will determine the repayment term for themselves that will not cause further financial stress. And with a variety of options to choose a lender from, borrowers will be able to maximize the benefit they can get – interest against the term of payment.

How to Sign Up

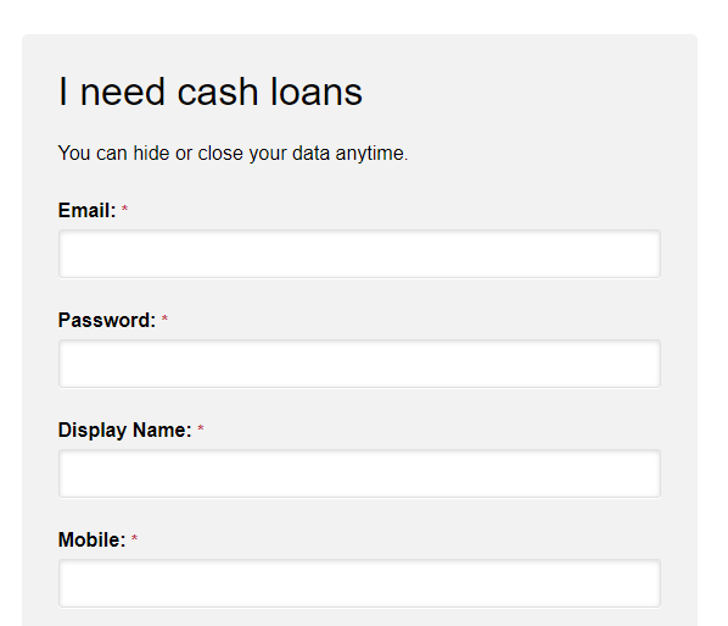

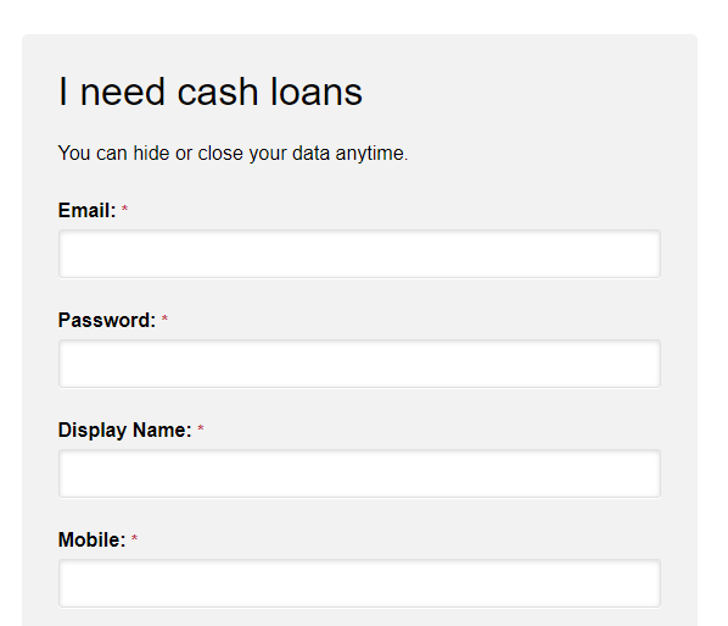

LEND is a virtual marketplace where all transactions happen online. For a borrower to gain access to the available loan offers with LEND, they must first create an account. The same is true with lenders. To make loan offers to borrowers, they must also create a lender account. Simply click the button below and follow the detailed instructions.

As a Borrower

On the LEND website, simply click on JOIN which can be located at one of the headings on the page.

Create a user account and provide basic personal information such as name, mobile number, email, etc

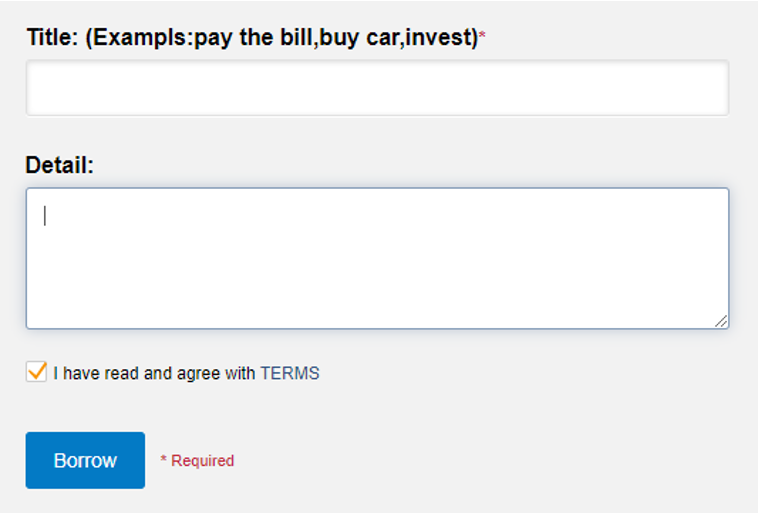

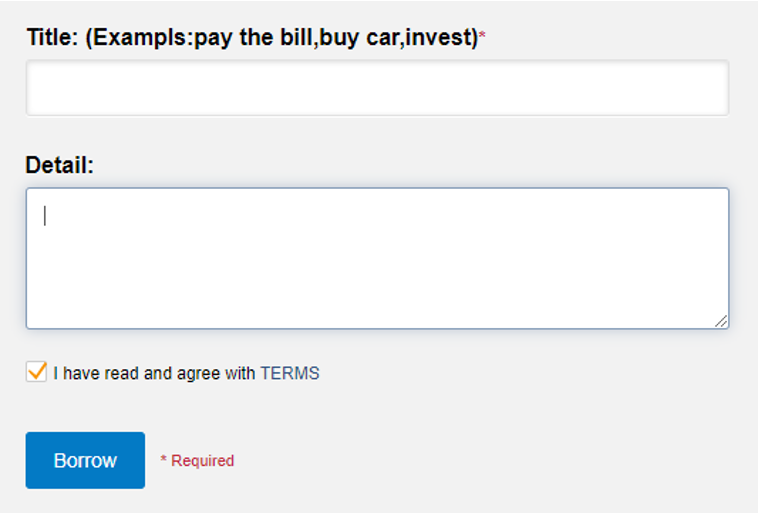

Provide details on the loan amount needed (i.e the amount and details on the loan required.) Accept the terms and conditions, and then click on borrow to proceed.

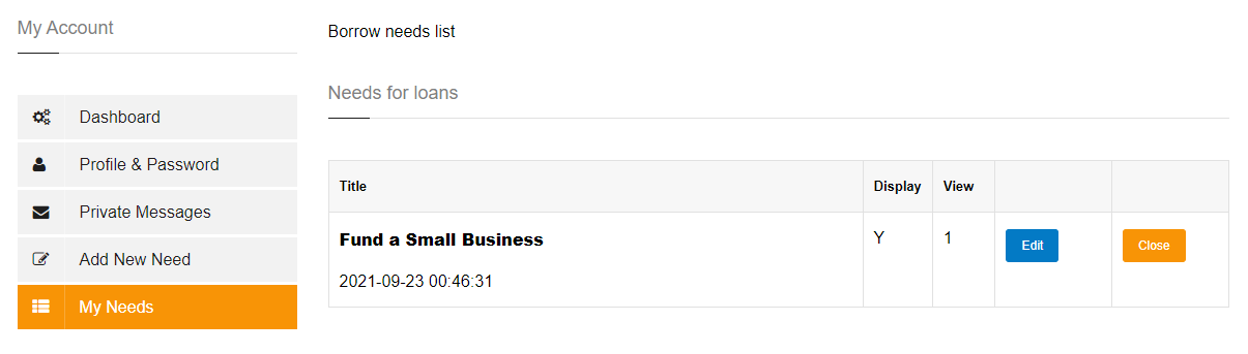

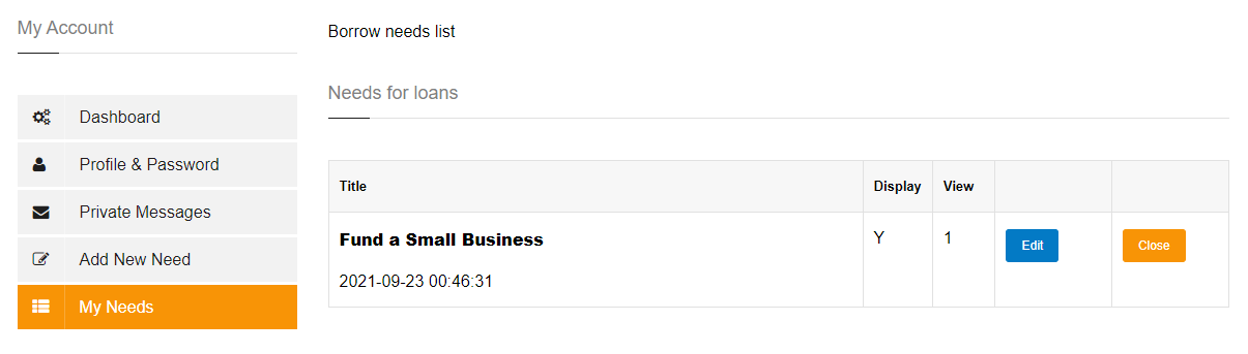

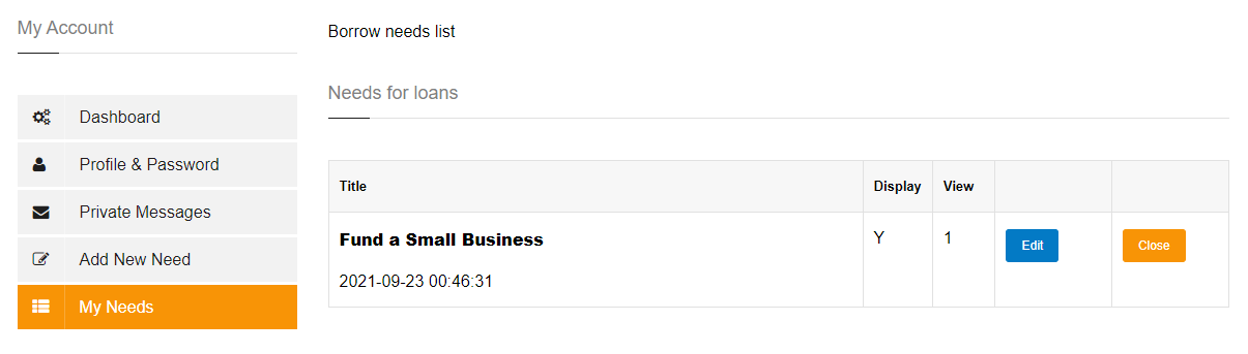

Once your details are submitted, your account is created and your need for a loan is published like an ad. When you click on edit, you can add more details to your loan requirement and even indicate if you are willing to put up collateral on your loan.

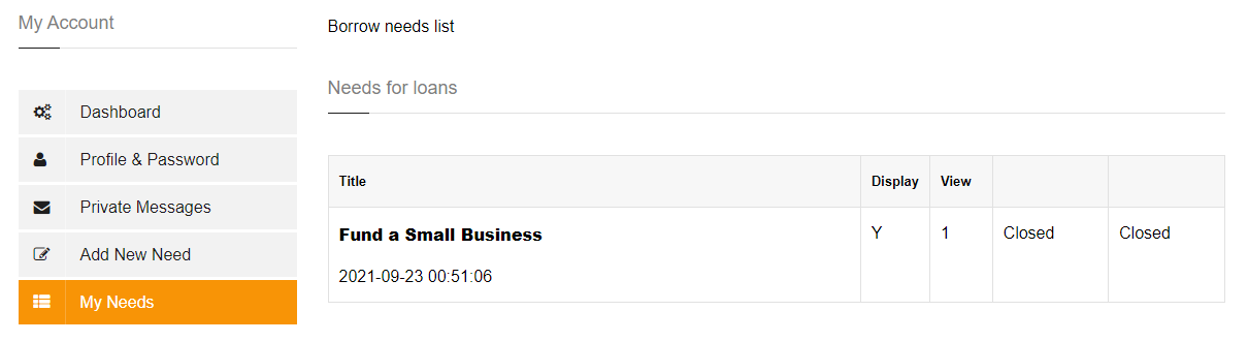

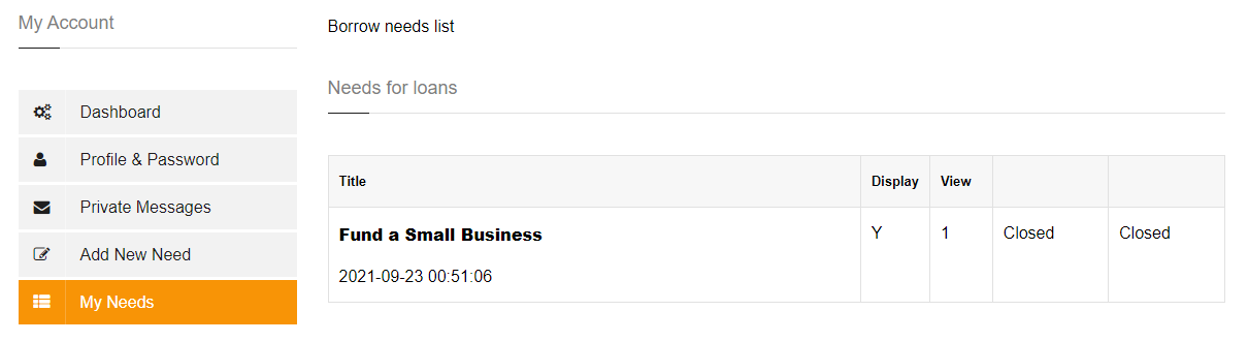

Once your need is addressed or if there is no longer a need to get a loan, you may simply click on close and the ad for your need will be removed.

If lenders are willing to make you an offer, you will be able to see these in the private messages section of your dashboard.

As a Lender

On the LEND website, simply click on JOIN which can be located at one of the headings on the page.

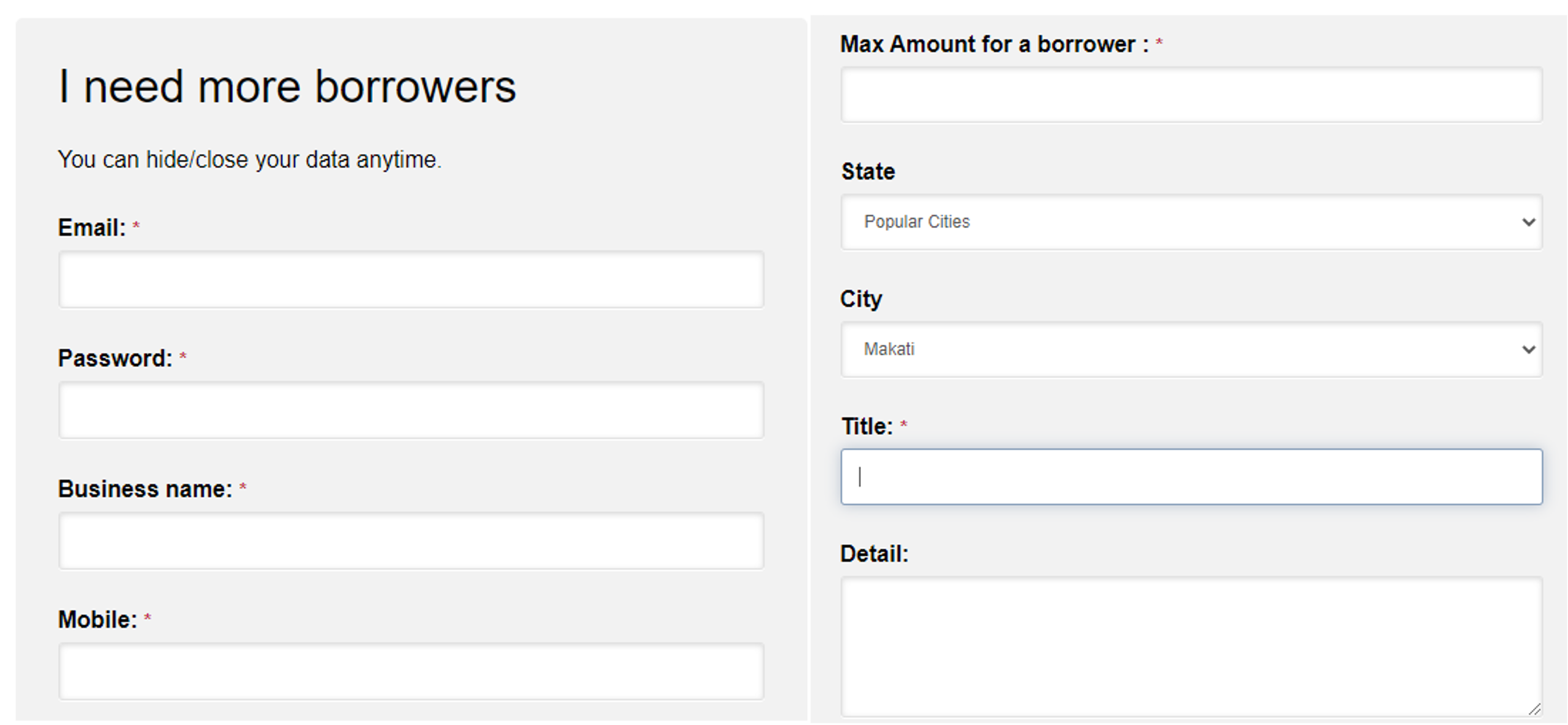

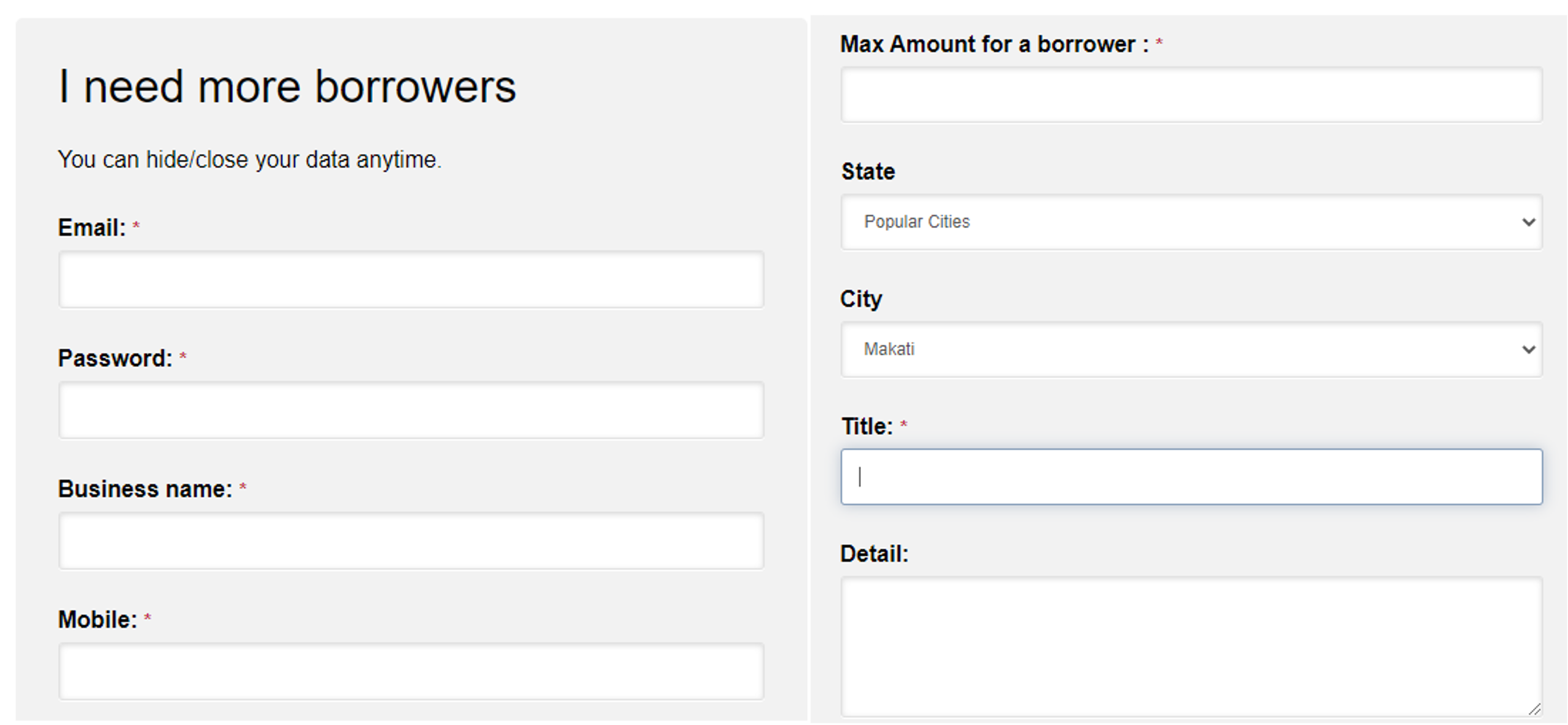

Provide your email ID, create a user account and enter your business name, password, mobile number, the loan amount you are willing to provide and to which city or province, and other pertinent details.

Once the account is created, the loan amount that you are willing to offer is then posted as an ad and your dashboard will show like this:

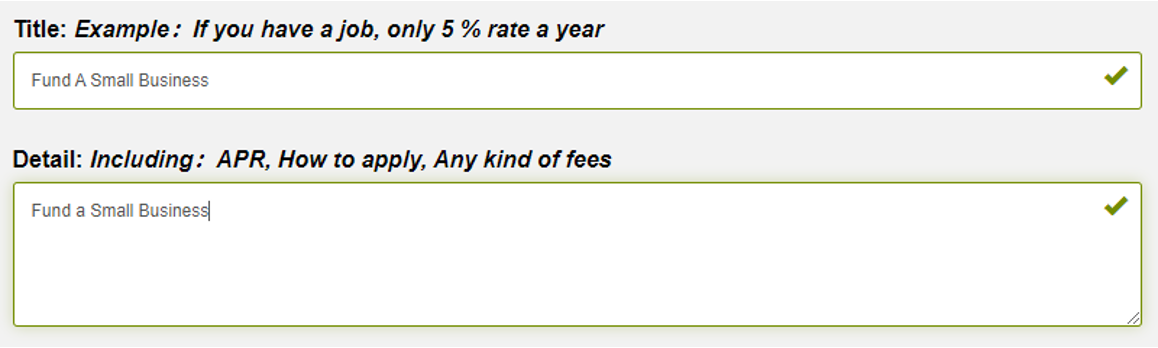

When you click on edit, you will be able to indicate the rate that you are willing to provide for the loan and any other fees you think are necessary. For example:

If borrowers are willing to take you up on your offer, you will be able to see these in the private messages section of your dashboard.

Frequently asked questions

Is there a fee to sign up as a borrower?

Is there a fee to sign up as a lender?

Will LEND provide me the loan?

How do I hide my loan listings or disable the ads I see?

What happens if a borrower defaults on a loan?

Will my credit score be affected if I fail to pay on the due date?

Conclusion

As a borrower, what you would always look for in the loan that you want to apply for is the loanable amount, the length of time that you have to pay it and the interest that you have to pay for taking the loan. The amount should be just how much you need – not way below or not too much. You would still want to consider your ability to pay. After all, the loan should be able to provide you with temporary financial relief and not burden you further.

From a lender’s point of view, you are essentially investing your money with the expectation that it will bring your income on interest over time. With the right verification process, you would want to make sure that you will be paid back the money lent.

With LEND, a borrower looking at the best rates and a lender looking for a borrower to allow him or her to earn a return on their investment are able to meet.