Company Information

The harsh reality about Filipinos is that the majority of them have been in a scenario where they only had a little cash left in their pocket, particularly a few days before their next salary – this after working day in and day out just to have enough to support their families. Their reasons for a lack of finances may differ from person to person, but if they have one thing in common, it is the desire to be financially free. Unable to rely on their companies or banks, some turn to fast-cash lenders for financial aid.

Fast Cash is one of the country’s legitimate and reputable microfinance organizations. It is a first-class Cash Loan platform in the Philippines that operates entirely through a mobile APP and is a subsidiary of Fcash Global Lending Inc., which is registered with the Securities and Exchange Commission (SEC) with No. CS201729284 and Authority Certificate No. 1149.

Fast Cash is dedicated to supporting Filipinos — employees, or business owners — who are going through financial difficulties and are unable to meet other strict requirements of traditional lenders such as banks, investment, or credit card companies. It allows its clients to get a collateral-free loan in the shortest amount of time. It boasts over 100,000 satisfied customers, many of whom are served through the use of the Internet for easier and more convenient transactions – which is crucial considering today’s pandemic.

But at the end of the day, the main goal of Fast Cash is to persuade the general public that online lending is authentic, convenient, trustworthy, and far more beneficial than traditional lending organizations. So, Filipinos do not need to be fearful of seeking assistance from microfinance companies such as Fast Cash. As the company does not only help its clients improve their social standing, but it also believes in treating its clients with dignity and faith, and it incorporates honesty, integrity, and business ethics into all facets of its business operations.

Fast Cash can be contacted through the following:

Email: [email protected]

Service Hotline:

- Globe – 0967 277 5442 / 0967 277 5445

- Smart – 0923 087 1921 / 0961 477 4987

Products and Services Offered

Cash Loan

Fast Cash’s Cash Loan is one of the fastest and easiest financing sources that Filipinos can avail of when they face financial difficulties that need to be immediately addressed. Whether it is for medical emergencies, tuition fee payments, utility bill payments, etc., they can rely on Fast Cash to deliver when they need it the most.

Loan Features:

Loan Amount: Php1,500 to Php23,000

Interest: 1% daily

Eligibility & Requirements

- Must be a Filipino Citizen

- At least 18 years of age

- Employed or Self Employed

- Proof of Income

- Government-issed ID

Repayment Method

Borrowers will have different payment options. They can choose the method which is most convenient for them. Among these options are the following:

- 7-Eleven

- Online Bank Transfer

- Over-the-Counter

- Others

Once the borrower has made the payment, he or she can send the proof of payment to Fast Cash in order to facilitate faster posting on their side.

Minimum Credit Score: Not Indicated

Why Choose Fast Cash

Offers Quick and Easy Applications

The process of a loan application with Fast Cash is simple and fast as applicants only need to download the Fast Cash App, which is available on App Stores, fill out all the required fields, select the desired loan offer, and upload the required documents, which should only take about five (5) minutes.

Also, it is important to read the loan terms thoroughly to ensure that the applicant fully understands and enjoys what he or she has agreed to.

Convenient

Because Fast Cash’s loan application to disbursement process is available online, there is no need to go through all the hassles of going outside and waiting in line, which is incredibly convenient given the global pandemic – unless the applicant has chosen the cash pick up option and they have to visit the nearest cash pick up point.

Furthermore, the application can be completed at any time and from any location, using only the applicant’s phone or laptop and a stable connection to the Internet.

Fast Cash

Fast Cash loans can be reliable in desperate times of need. Once the applicant have finished answering the application form, the funds will be deposited directly into the applicant’s registered bank account or made available for cash pick up at the nearest Padala Center – the entire procedure usually takes less than 24 hours.

However, the applicant must ensure that they have submitted all of the necessary information in order for the loan to be approved quickly.

Safe and Secure

It is solely the responsibility of online lenders to ensure that their clients’ information is being kept safe. As for Fast Cash, they are committed to protecting its clients’ personal information with the latest technology. Fast Cash employs firewalls, data encryption, and it never discloses user information to third parties; it only authorizes its employees to access its clients’ data to deliver their works. Fast Cash is fully compliant with the Philippines’ data privacy laws and regulations.

Fewer Requirements

Aside from the fact that there is no collateral needed, anyone who requires immediate cash is welcome to apply for a loan from Fast Cash, provided that the applicant has met all the criteria. A bank account will not be an issue since cash pick is one of the fund distribution alternatives. All the applicant has left to do is provide proof of employment and a stable income, including a valid government-issued ID for guaranteed approval.

How to Sign Up

Applying for a loan with Fast Cash can be done 100% online. That means that their customers can take up a loan using the Fast Cash mobile app. They can download the app through Apple App Store or Google Play Store.

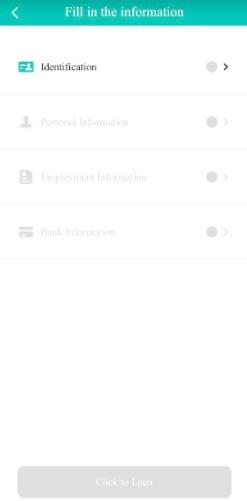

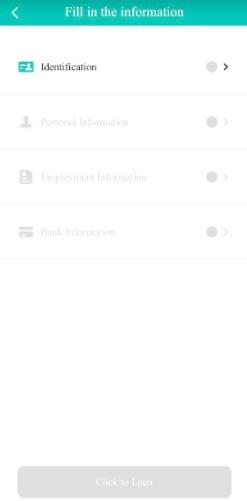

Once the borrower has signed up and created their Fast Cash account, they can proceed with their loan application and follow these steps below:

On the Fast Cash dashboard, the borrower can choose the amount that they intend to borrow, which is usually an amount between Php1,500 to Php23,000.

Provide your active mobile number and then enter the verification sent to the number you have provided. Mark the “I have read, understood and agreed with Privacy Policy” button below the page to proceed to your Fast Cash account creation.

Provide the loan information requirements such as your personal information, valid ID, employment information, and bank information.

Once all these are provided, you may submit your loan application and wait for verification and approval.

Frequently asked questions

What is the maximum amount that I can borrow?

How long will it take before my loan is approved and how soon can I get the loan amount?

How will the interest on the loan be computed?

Are there any hidden fees?

How will I know the status of my loan account?

Can I pay my loan before the due date?

Can I apply for a new loan even if I still have an existing loan with Fast Cash?

What is the penalty for late payment on my loan?

How do I claim my loan amount from Cebuana Lhuillier or M Lhuillier?

Conclusion

As long as the job market remains challenging in today’s age, so does one’s pursuit of financial security. And despite the fact that life in the middle of a pandemic has become more expensive, their income has remained stagnant, while others found themselves with reduced salaries. But rather than constantly surrendering to Petsa de Peligro, Filipinos are offered the choice to make use of microfinance organizations in the Philippines.

Fast Cash for one is willing to provide financial assistance to every Filipino. It may offer some loans with high-interest rates, but relying on Fast Cash can be the simplest and quickest approach to avoid the possibility of further financial troubles.