If you need money right away, the first thing that will come to your mind is to apply for a loan and look for a bank that will help you. Getting the right kind of loan that you can use to pay your bills, make some home improvements, buy a new car and other purposes will mean that you will not only be able to get the best offer but also get something that will not further hurt your budget. Getting a loan comes with obligations that you have to commit and you need to use it for the right reasons.

Equicom Savings Bank is one of the banks that every Filipino can consider in applying for a loan. With their presence in the major cities nationwide, people can have easy and convenient access to their products and services.

Written by: Big Piggyy

Personal Loan

Salary Loan

SME Business Loan

Home Loan

Auto Loan

Bank services

Equicom Savings Bank was founded in September 2008 and is a member of Equiqom Group. In the Philippines, the Bank was among the country’s top 20 thrift banks. It boasts a total of 10 branches nationwide, making banking easier and more convenient for its consumers.

Their corporate vision is focused on being the preferred savings bank of small and medium-sized enterprises (SMEs) and consumers in the country. Since their launch in 2008, they have committed themselves to serve the Filipinos with excellent customer service and competitive financial products and services.

The products and services that they offer include Deposits (Savings, Checking, and Time Deposits), Consumer Loans (Auto, Home, Personal, and Salary Loans), Business and Corporate Loans, Credit, Debit, and Prepaid Cards (Visa-branded products), Cash Management, Facilities (Check writing, Deposit Pick-up Service, and Payroll Account Arrangement), Online and Phone Banking Facilities, Fund Management.

The head office of Equicom Savings Bank is located at 6/F ODC International Plaza, 219 Salcedo Street, Legaspi Village, Makati City. Their customer contact center is open 24/7 at (632) 8241-5952 and (632) 8241-6711. If customers wish to contact their customer support, they may do so through the following:

Email: [email protected]

Trunkline (available Mondays to Fridays, 8:30 AM to 5:30 PM):

There is goals and finances that might be out of a person’s reach. It could be to fund a small business, pay for college tuition, or maybe to fund an important event. Equicom has made personal loans easy to apply for and affordable to pay back.

Among the loan purposes covered under Personal Loans are:

Loan Amount: Php15,000 to Php1,000,000

Loan Term: 12 months to 48 months

Interest Rate: Monthly add-on rate from 1.55% to 3.0%

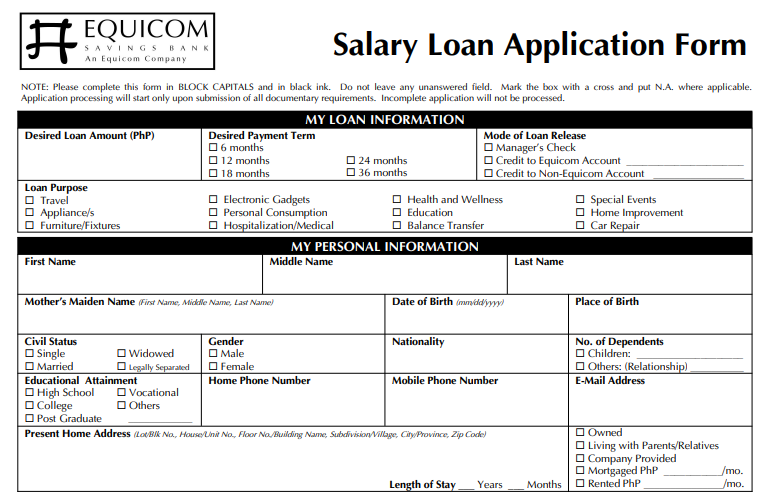

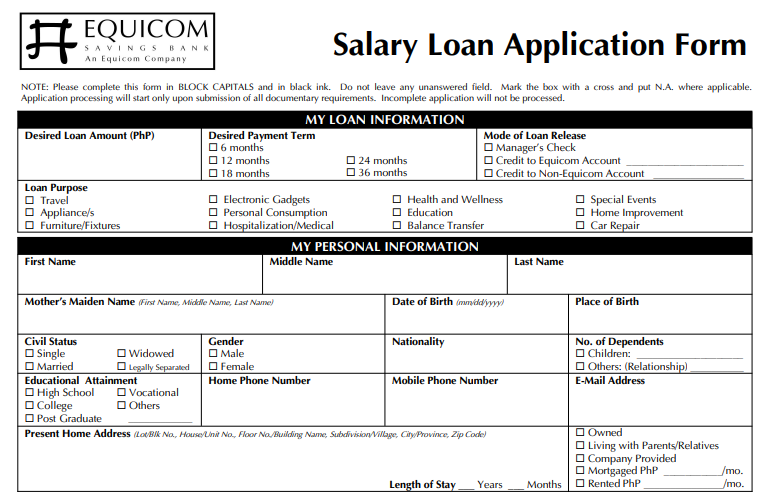

Salary Loan is available to the employees of Equicom’s accredited partners. Through this type of product, an employer’s employees are guaranteed a fast and easy approval process, flexible loan payment terms, and easy repayment.

Loan Amount: Php10,000 to Php1,000,000

Loan Term: 12 months to 36 months

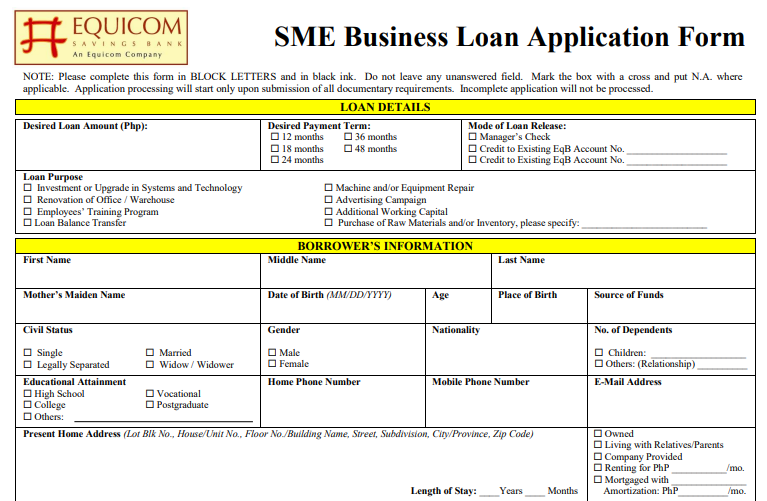

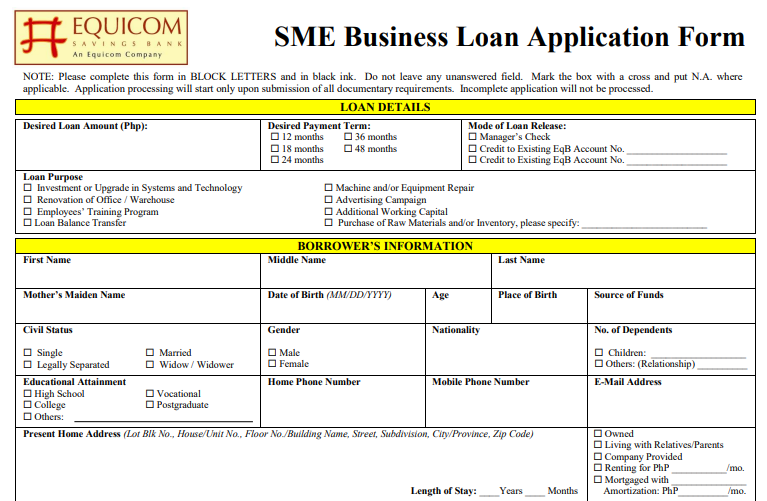

Small and Medium Enterprises are the bread and butter of a healthy economy in the Philippines. When they flourish, they can generate more jobs and improve the quality of life of many people.

Entrepreneurs will have different reasons for wanting to get a Business Loan but with Equicom, the loan purposes include the following:

Loan Amount: maximum of Php5,000,000

Interest Rate: prevailing interest rates at time of loan release

Loan Term: 12 months to 48 months

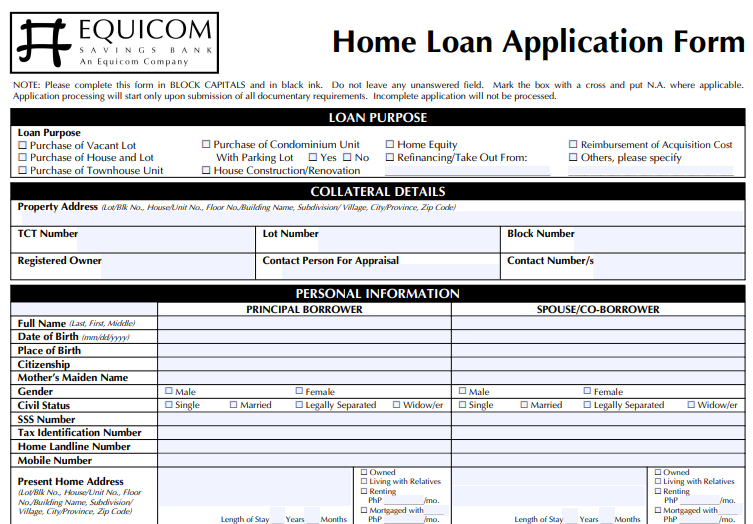

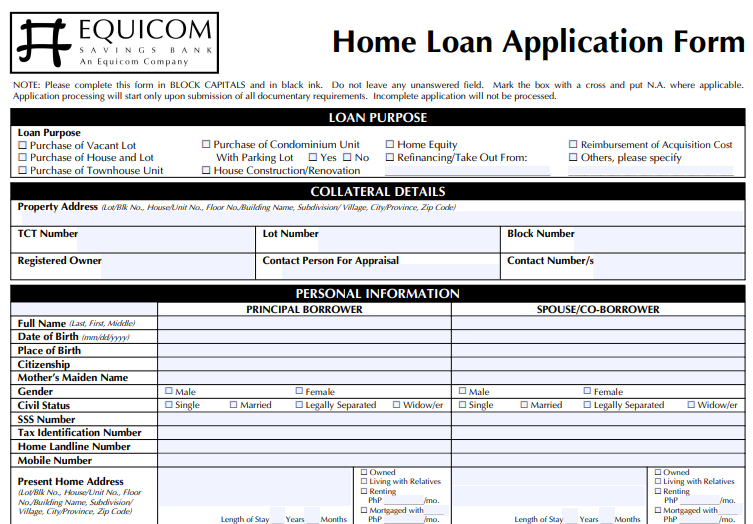

Every Filipino’s dream is to have a house they could call home. Undeniably, purchasing a house and lot can be very expensive. This makes home loans incredibly helpful for a lot of people – it helps them spread the payments of their home purchase until they could pay it off.

With Equicom, they offer one of the lowest interests in the market thereby allowing Filipinos to finally afford their dream home.

Loan Amount: Php300,000 to up to 60% of the appraised value of the property

Loan Term: up to 25 years

Loan Settlement Options:

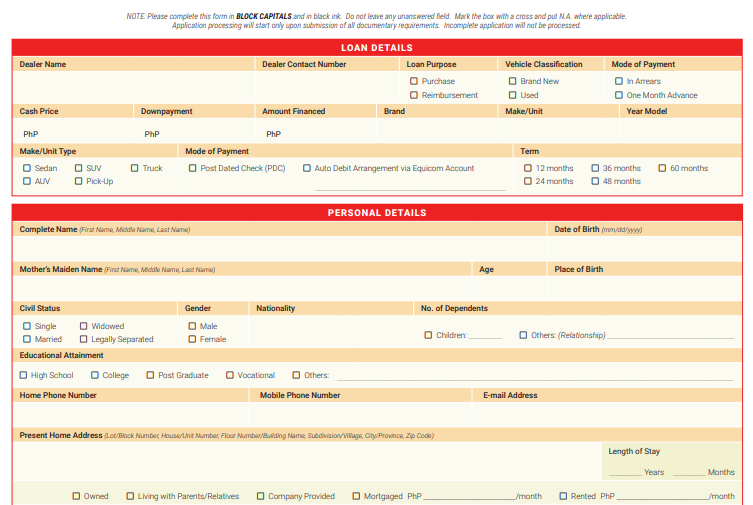

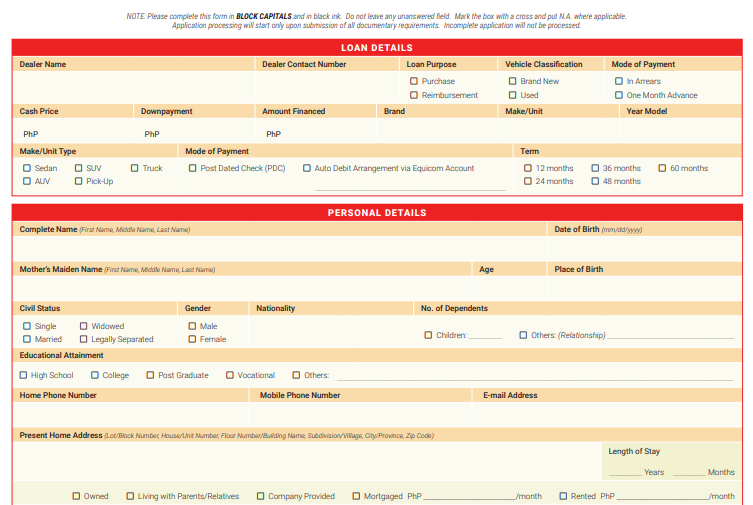

Comfort comes with owning your vehicle. What is more, you will be able to ensure the safety of your family when you drive and travel with them around. For this reason, Equicom has made it easy for people to purchase a brand new or used vehicle.

Loan Term: up to 60 months

Repayment Options:

For Salaried Individuals:

For Self-Employment Individuals (Sole Proprietor)

Other banks usually only have personal and home loan products to offer their customers. But with Equicom, they have 4 consumer products that their customers can avail themselves of Personal Loan, Salary Loan, Home Loan, and Auto Loan. This ensures that people will have the right option or the right loan to choose from that is specific to their needs.

Other than that, they also offer a business loan to entrepreneurs who are looking at increasing their working capital requirement or expanding their business operations.

Equicom Savings Bank has a total of 10 branches located nationwide. They have four branches located in Metro Manila: their Main Office Branch at Makati City, Alabang Branch, Diliman Branch, and Legarda Branch. In South Luzon, there are Calamba Branch and Lipa Branch. While in the Visayas they have branches in Cebu, Iloilo, and Mandaue. And in Mindanao, they have a Davao Branch.

Their presence nationwide ensures that Filipinos will be able to easily and conveniently access their financial products and services.

Equicom Savings Bank is the first bank that received the Pagtugon Award in 2012. Their mission is to provide responsive and innovative solutions and excellent service to every Filipino, which they have done day in and day out through their excellent customer service and competitive financial products and services.

In these trying times, all you want is to be safe and avoid any hassle that comes with constant traveling and waiting in line. Equicom Savings Bank has access to Online Banking which allows their customers to view their real-time balances for enrolled accounts and cards. Available services in their Online Banking are transfer money, view statements for enrolled accounts and cards and bank account holders can have a quick balance inquiry to their prepaid cards. If they have a loan, they will also be able to see their loan details.

The signing-up process is simple and easy. You can follow these steps below:

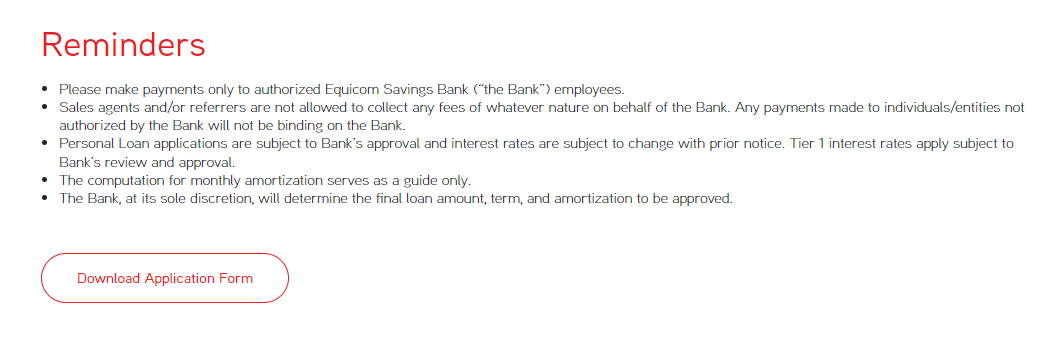

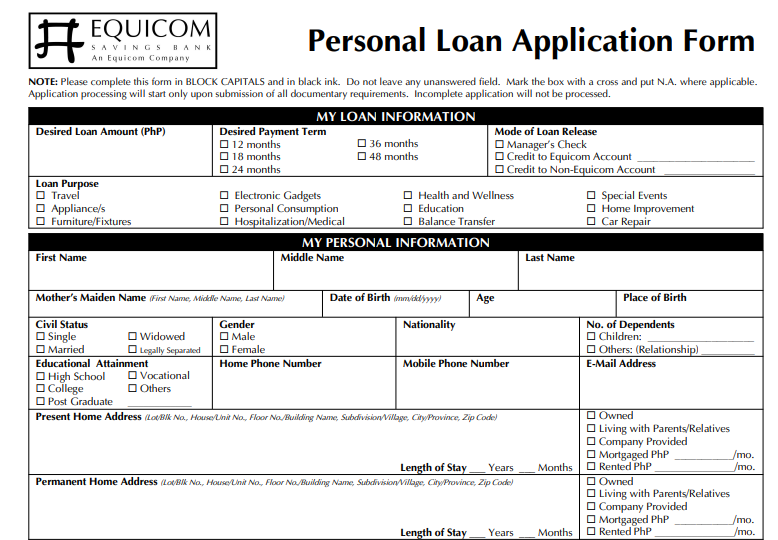

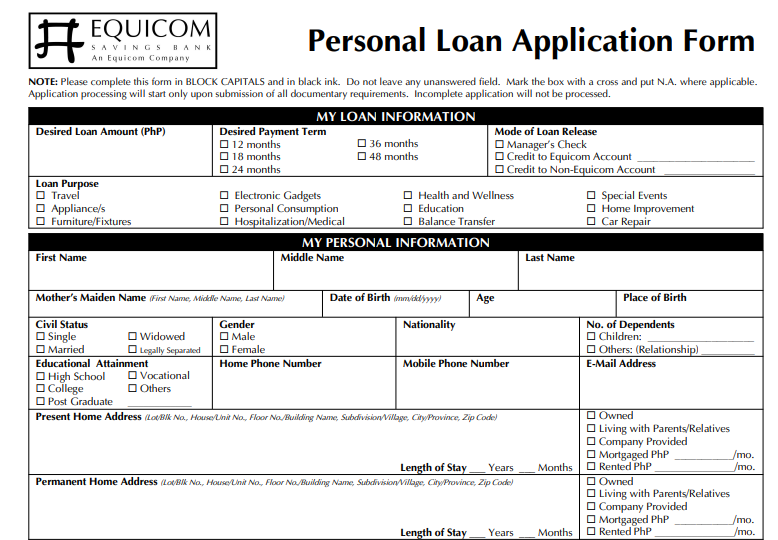

Visit the Equicom Savings Bank website and click on the loan product you wish to apply for.

Download the application form located at the bottom of the page.

Fill out the application form and prepare the requirements that need to be submitted along with the application form.

Once filled and the requirements are complete, they can be submitted to this email ID: [email protected] and maybe followed-up through these numbers: (632) 8828-EQUI (3784) locals 142 / 159 / 2013 / 2027 from Mondays to Fridays, 8:30 AM to 5:30 PM.

In these challenging times, having access to financial products and services through a bank you can trust may not always be easy. But with Equicom and their product offerings to Filipinos – both consumers and businesses – borrowers can rest assured that their needs will be addressed when they need them the most.

Coupled with an easy loan application process, people no longer have to worry that they will be alone in their search for financial help.

Table of Contents

Table of Contents