When it comes to banking services, Filipinos prefer to transact with an established bank like EastWest which has been around for more than two decades. It’s one of the largest privately-owned banks in the country in terms of assets, the fifth-biggest as credit card issuer, and the fourth-largest auto loan provider.

As one of the fastest-growing banks today, it’s keeping up with the latest technologies that allow its customers to make transactions through its digital banking services. Furthermore, it offers accessibility nationwide through its branches spread across the country. Read more about its core services in this brand review to help you make some informed decisions as you compare the rates and features.

Written by: Piggyy

Credit Cards

Auto Loans

Home Loans

Personal Loans

Bank services

The name of EastWest Bank is a combination of the bank’s desire to combine the traditional prudence, warmth, and hospitality of the east and the efficiency and progressive thinking of the west.

EastWest Bank is committed to servicing consumers, especially the middle market corporates and mass affluent, with a vision to be a world-class bank through traditional and alternate delivery channels. The products and services are more accessible through its online banking facilities, and consumers can facilitate any transaction from the mobile banking app.

EastWest Bank is a subsidiary of the Filinvest Development Corporation (FDC). The corporate office of EastWest Bank is at The Beaufort, 5th Avenue corner 23rd Street, Bonifacio Global City, Taguig. You can reach out to the customer service team with the following contact numbers:

Customer Service Hotline: (+632) 8888-1700

Domestic Toll-Free: 1-800-1888-8600

US Toll-Free: 1-866-828-6296

Corporate Office Trunkline: (+632) 8575-3888

Customer Service: [email protected]

EastWest Bank offers various credit cards packed with features and perks according to your spending habits. Depending on your credit card, you can enjoy exclusive rewards, rebates, and access to 24/7 cash for all your purchases.

| Credit Card Type | Annual Membership Fee (Principal) | Annual Membership Fee (Supplementary) | Interest Charge | Late Payment Charge | Overlimit Fee | Card Replacement Fee |

| EastWest Priority Visa Infinite | waived perpetually | waived perpetually | 1.99% per month or 23.88% effective rate annually | ₱1,500 or the unpaid Minimum Payment Due, whichever is lower | ₱500 | Php500 |

| EastWest Platinum Mastercard | waived perpetually | waived perpetually | 2% per month or 24% effective rate annually | ₱500 | Php400 | |

| EastWest Visa Platinum Credit Card | ₱2,750 | ₱1,375 | ₱700 | Php500 | ||

| EastWest EveryDay Titanium Mastercard | ₱2,800 | ₱1,400 | ₱700 | Php500 | ||

| EastWest Dolce Vita Titanium Mastercard | ₱2,000 | ₱1,000 | ₱500 | Php400 | ||

| EastWest Visa and Mastercard | Gold – ₱2,500 Classic – ₱1,500 | Gold – ₱1,250 Classic – ₱750 | ₱500 | Php400 | ||

| EastWest Practical Mastercard | ₱1,400 | ₱700 | ₱500 | Php400 | ||

| EastWest 1st Mastercard | ₱1,200 to be billed quarterly at ₱300 | ₱600 to be billed quarterly at ₱150 | ₱500 | Php500 | ||

| EastWest Singapore Airlines KrisFlyer World Mastercard | ₱5,000 | ₱2,500 (FREE for life for the 1st supplementary) | ₱500 | Php500 | ||

| EastWest Singapore Airlines KrisFlyer Platinum Mastercard | ₱4,000 | ₱2,000 (FREE for life for the 1st supplementary) | ₱500 | Php500 | ||

| Hyundai Mastercard | ₱2,000 | ₱1,000 | ₱500 | Php400 |

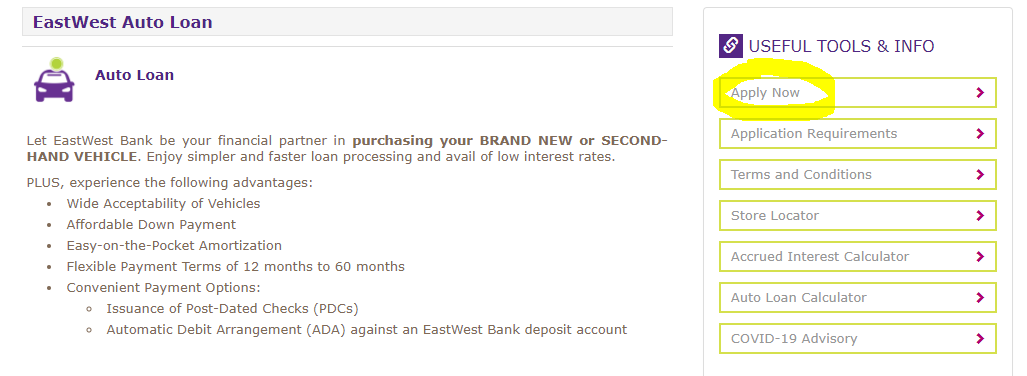

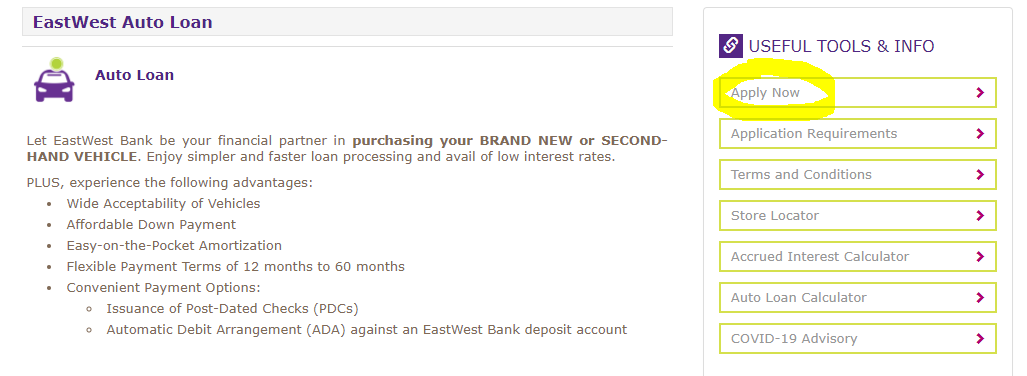

EastWest Bank offers affordable and flexible payment schemes for auto loans. Purchasing your dream car is now possible as you can choose your preferred model, brand new or second-hand, and enjoy affordable downpayment options according to your budget.

Loan Amount: 60% to 80% of the vehicle value

Loan Term:

Interest Rates:

| TYPE | INTEREST PAYMENT | 12 Mos. | 18 Mos. | 24 Mos. | 36 Mos. | 48 Mos. | 60 Mos. |

| Brand New | In Arrears | 5.99% | 8.35% | 11.86% | 17.32% | 24.13% | 31.00% |

| In Advance | 5.20% | 7.54% | 10.93% | 16.36% | 23.05% | 29.85% | |

| Second Hand | In Arrears | 7.19% | 11.45% | 16.37% | 25.68% | 36.04% | |

| In Advance | 6.04% | 10.16% | 14.93% | 24.08% | 34.25% |

Payment Options:

Down Payment: 20% – 40%

Once you have decided on the car model and brand, you can apply for an EastWest Bank auto loan with the following requirements:

Individual

Corporate

Bank Documents

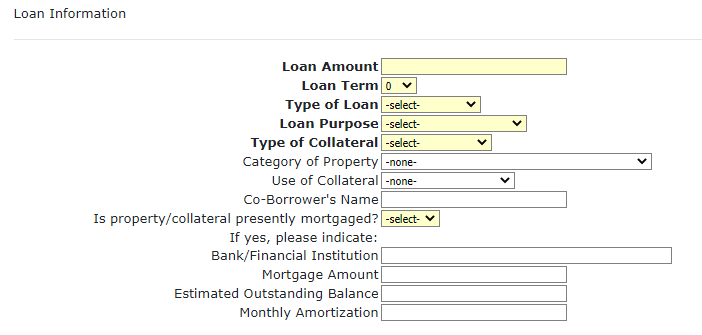

Purchasing your dream home could present a few roadblocks for you, mainly if you have a limited source of funds for the downpayment. Paying in cash is downright expensive, but when you apply for EastWest Bank Home Loan, you can take advantage of flexible payment options and fast processing.

Loan Terms: 1 year to 30 years

Interest: starts at 5.750% to 9.750%

Loan Purpose:

General Documents

For Loan Refinancing / Loan Take Out

Self-Employed

Locally Employed

OFW Direct Hire

OFW Seaman

Practicing Doctor

Earning From Rental Properties

Earning From Transport Business

Earning From Commissions

EastWest Bank’s personal loan is designed for the achievement of one’s financial goals and dreams. It is a multipurpose loan and does not require collateral which makes this loan type to be more accessible to those who need it.

Loan Amount: ₱25,000 to ₱2 million (subject to approval)

Loan Term: 12, 18, 24, and 36 months

Annual Percentage Rate (APR): 41.67% to 53.21%

Other Fees & Charges:

To be able to qualify for a personal loan, the loan applicant must satisfy the following criteria:

Upon Loan Application

Employed

Submit any of the following:

Self-employed

Submit all of the following:

Upon Loan Release

For Delivery and Credit to Account Option

With over two decades of expertise in the Philippine banking industry, EastWest Bank helps Filipinos achieve major financial milestones in their life by providing easy access to financial services. Here’s why Filipinos should choose EastWest Bank:

As long as you meet the required gross monthly income and have complete documentation, you can apply for a personal loan without collateral. While you can specify the loan amount you want to borrow, it will be subject to the bank’s approval.

Whether you need funds to start a business, pay for your tuition, or travel with your family, you can enjoy this unsecured loan with reasonable interest rates.

Depending on the loan type, EastWest Bank gives you an option on how long you want to pay for your loans, usually up to three years for a personal loan, five years for an auto loan, and up to 30 years for a home loan.

Convert your credit card purchases into zero-percent installment with partner merchants and enjoy flexible terms so you can stretch out your finances when buying big-ticket items.

EastWest Bank has strategically positioned itself across the country with nearly 500 stores or physical branches and almost 600 ATMs that you can access 24/7. Depositing and withdrawing cash is convenient, just visit the nearest branch for your transactions.

For any concerns or inquiries, you may reach out to the customer service team of EastWest Bank at any time of the day. The bank ensures the support team can address your concerns right away.

Online banking is the most convenient way to transact with people and other businesses. No more waiting in line as you can even pay for your purchases online right from your mobile phone. With EastWest Bank, pay your bills on time, shop online, or send money to your family.

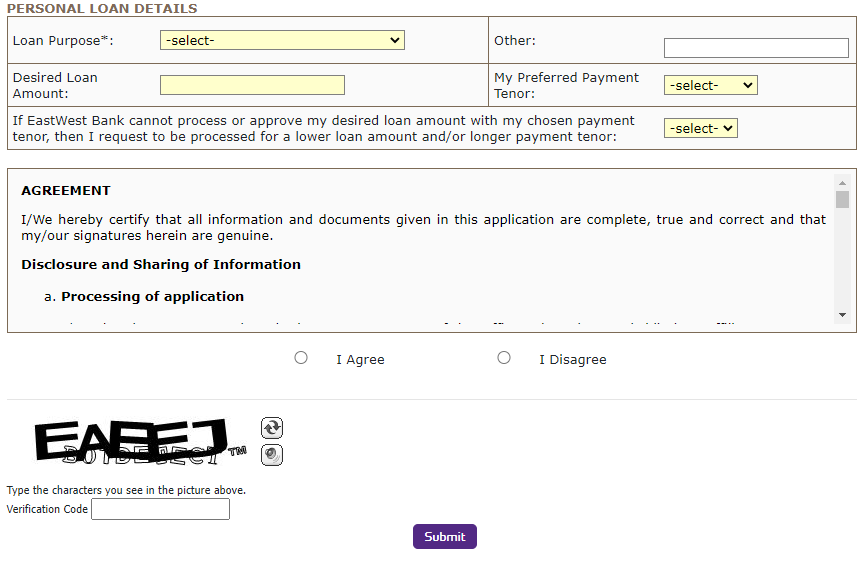

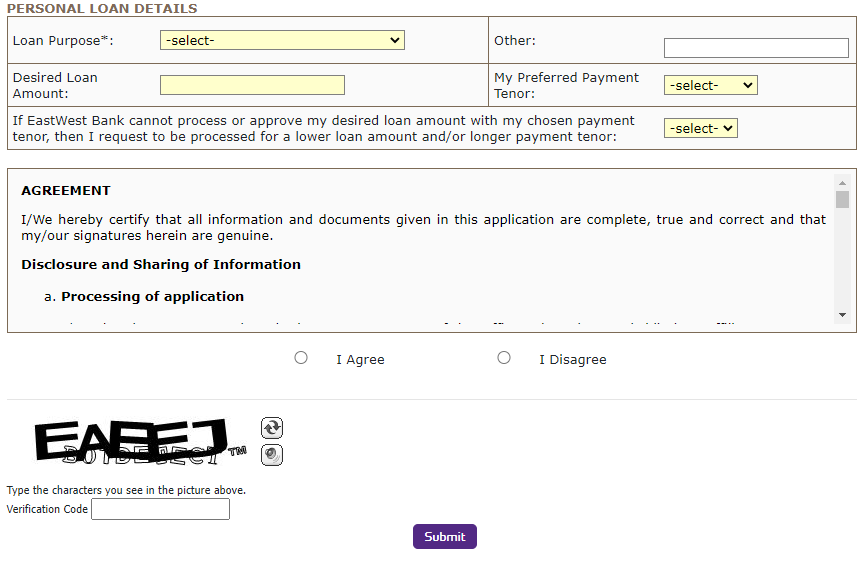

Loan and credit card applications are available via branch visit or you can submit them directly on the website. Here are the following steps below:

Visit the EastWest Bank online, just click the button below.

Click on the Credit Card or Loans section.

Credit Card Application

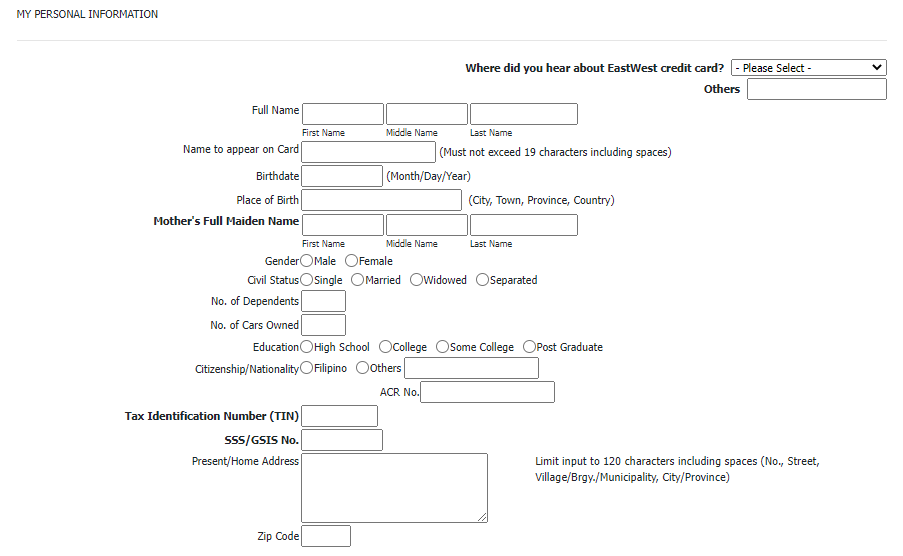

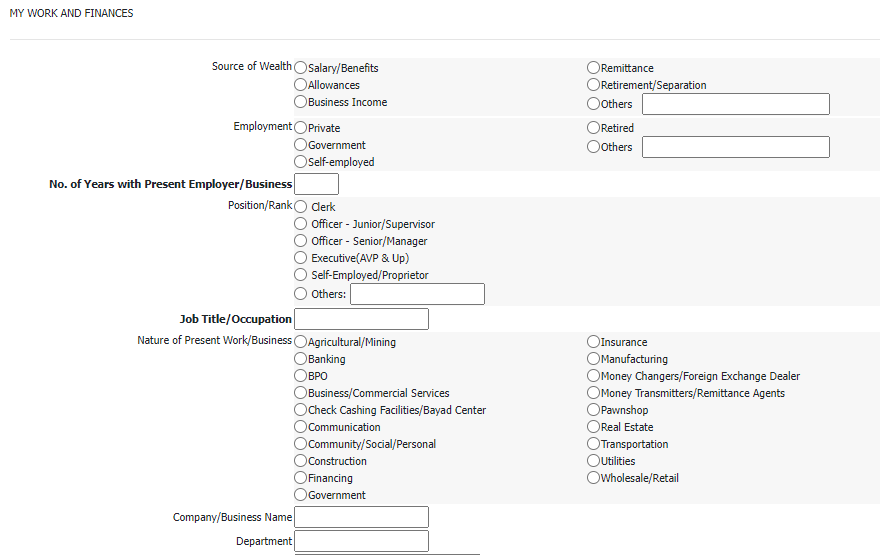

When you have checked out your eligibility and prepared all the documents necessary to proceed with your application, you may begin to fill out the required details regarding your personal information, work, and finance information, including work and personal references and spouse details if you are married.

When all the details have been provided and documents are uploaded, you can submit your application and wait for the bank to get back to you should they require additional documents or if they have made a decision on your application.

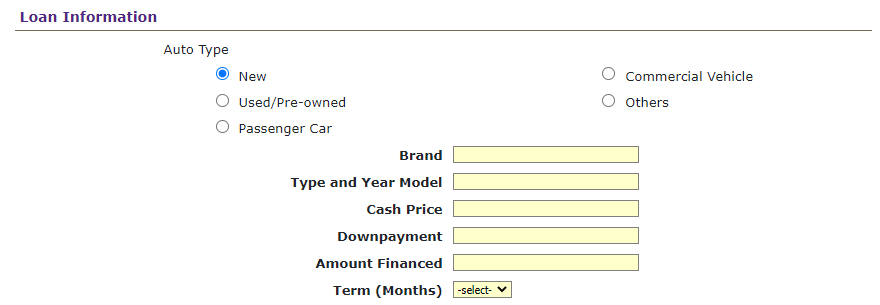

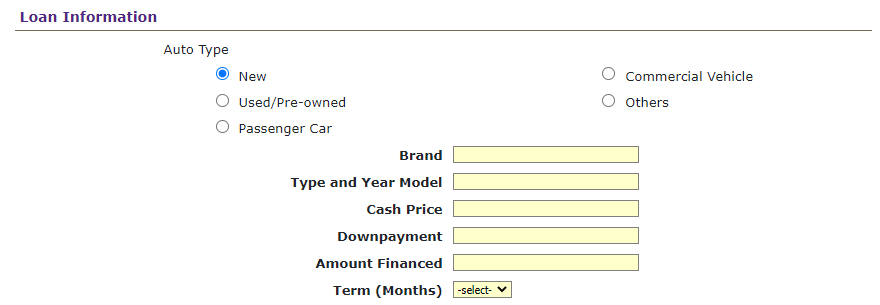

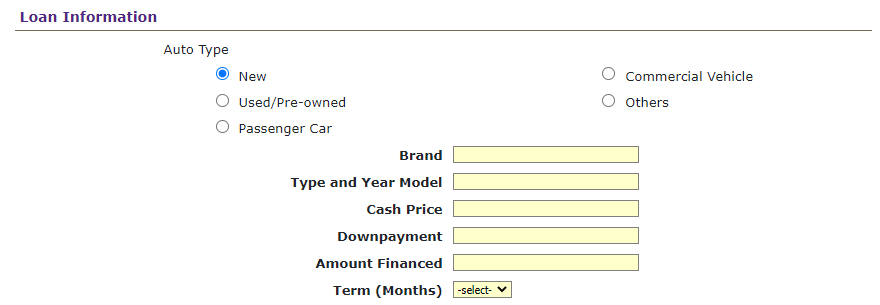

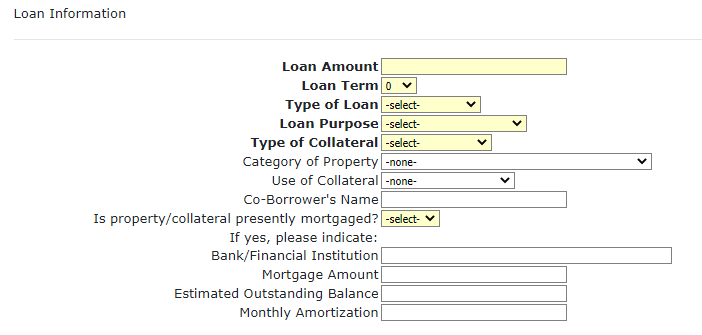

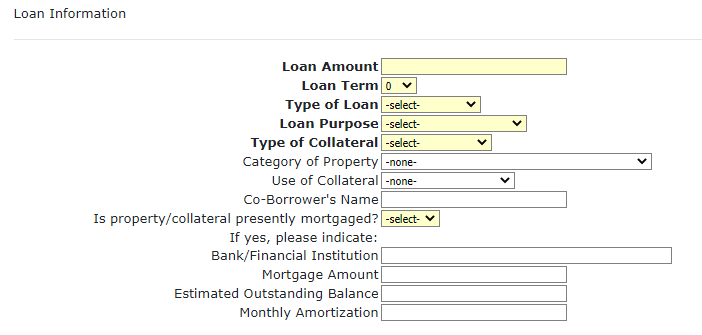

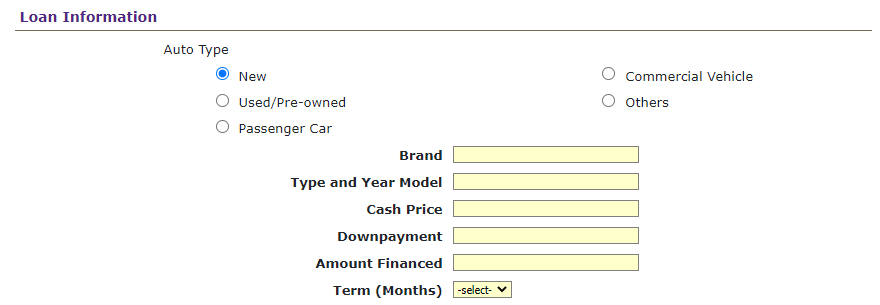

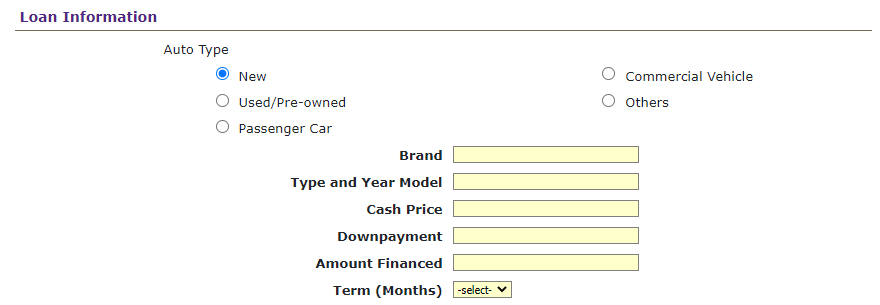

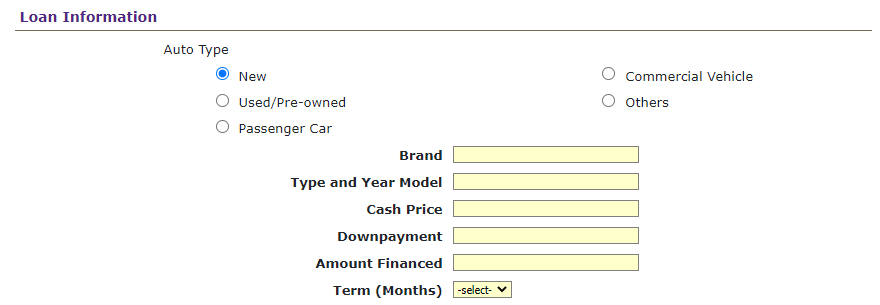

Auto Loan Application

Auto Loans can be submitted online by simply clicking on Auto Loans under the Loans section and clicking on apply now.

Inside the application page, provide your personal information and the details of the vehicle you wish to purchase.

Once all the details are supplied, click on submit and wait for a verification call from the bank.

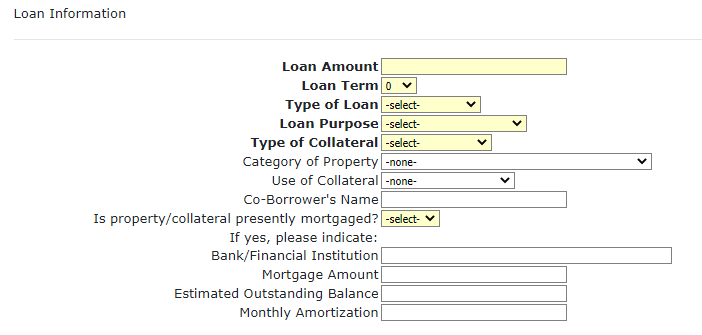

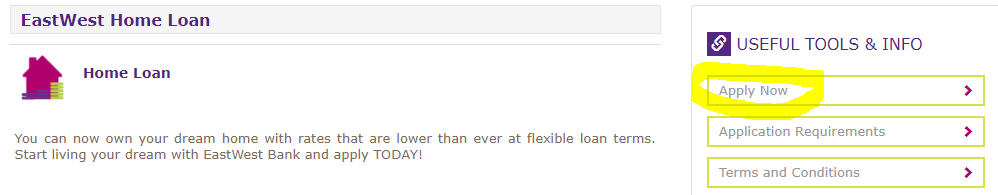

Home Loan Application

Just like in the Auto Loan Application, loan applicants can click on Home Loan under the Loan section and click on Apply Now.

Provide the home loan applications for the property that you are interested in and once all the details are entered, you may click on submit.

Personal Loan Application

Just like in auto and home loan applications, simply go to the personal loan application, click on Apply Now, provide all the details and submit your application once you’re done.

Those who are looking at accessibility and convenience will surely be able to get that with EastWest Bank’s products and services and their growing presence in the Philippines. With various loan options and credit cards to choose from, you will not have to worry about where to go to address your goals or emergency needs.

Table of Contents

Table of Contents