Company Information

Dragonpay is one of the fastest-growing payment gateways for online payment transactions that partners with different payment service providers such as banks, payment centers, e-wallets, and installment payments.

Dragonpay is an online payment platform that allows consumers to buy online from e-commerce merchants without using traditional forms of payments. Instead, a buyer can use his online banking facility, e-wallet, or pay cash over-the-counter at physical retail channels.

What Dragonpay does is it automatically monitors the online and offline payments done and notifies merchants of a completed payment so they can ship the goods or render the service. Dragonpay has over 2,000 partner merchants, has more than 50,000 payment partner channels, and has been in the business since 2010.

These statistics have helped businesses add more payment channels to their business to attract more customers and add more sales, while customers get a safe and secure way to have access to alternative payment channels.

The office hours of Dragonpay are open from Monday to Friday, 8:00 AM to 6:00 PM, and Saturday to Sunday from 9:00 AM to 6:00 PM. Their office is located at 3/F Builders Centre 170 Salcedo Street, Legaspi Village, Makati City. Customers will be able to reach the customer support of Dragonpay through the following:

Customer Support:

- (02) 8655 6820

- 0915 246 5045 – Globe

- 0961 325 6153 – Smart

- Email: [email protected]

Merchant Support:

- (02) 8967 6275

Email: [email protected]

Type of Services Offered

Consumer Services

Pay With Dragonpay

Making online payments through Dragonpay is easy and straightforward. When customers make an online payment at check out, they can choose Dragonpay as the payment method, and they will receive and use the reference number that has been sent to their email ID. They don’t need to have a credit card or PayPal account to complete the transactions but instead make payments through local e-wallets, online banking, or over-the-counter.

Dragonpay Credits

DragonPay Credits works just like a prepaid card. The consumer can use the amount already available in the app to pay for purchases at merchant stores partnered with Dragonpay by scanning the QR code available at the store upon payment.

RFID Top-up

Consumers have the option of topping up their Autosweep or Easytrip RFID through DragonPay. They can simply choose the type of RFID account to top up, enter the email ID for the instructions of the purchase transaction to be sent, the Plate number or Autosweep Card number, and the amount of top-up, which has to be a minimum of ₱500.

Prepaid Load Top-up

Purchasing a mobile load for yourself or anyone has been made easy now through the top-up option offered through the Dragonpay app. The available mobile load options are for the subscribers of the following telecom providers:

- Globe

- TM

- Smart

- TNT

- Sun

Internet data top-up is also possible for Globe and PLDT.

Merchant Services

Online Payments

Businesses can boost their revenues when they have many payment options to offer their customers. Not all customers can afford to pay or carry cash with them all the time. Where Dragonpay offers the benefit is in the multiple payment channels it offers.

The main benefit that businesses will get from signing up with Dragonpay’s online payments service is that it allows them to grow their businesses. The different payment channels are:

Banks (Online Banking):

| Asia UnitedBank (AUB) | Metrobank |

| Banco de Oro (BDO) | Philippine National Bank (PNB) |

| Bank of Commerce | PSBank |

| Bank of the Philippine Islands (BPI) | Rizal Commercial Banking Corp (RCBC) |

| Chinabank | Robinsons Bank |

| EastWest Bank | Unionbank |

| Landbank | United Coconut Planters Bank (UCPB) |

| Maybank | any bank with Instapay capability |

Over-the-Counter Via Payment Centers

| 7-Eleven (Optional) | M Lhuillier |

| Bayad Center | Palawan Pawnshop |

| Cebuana Lhuillier | Robinsons Department Stores |

| ECPay | RD Pawnshop |

| Ever Superstores | SM Payment Counters (Department Stores, Supermarket, Savemore, and others) |

| Gaisano | Philippine National Bank (PNB) Remit |

| NCCC | Selected Smart and Cignal Distributors |

| Via Express | Selected Petron Gas Stations |

| ExpressPay | Selected Tambunting Pawnshop |

| Selected Western Union Remittance Centers and many more |

Supported E-Wallets

| Dragonpay Credits | GCash |

| AliPay | Moneygment |

| Coins.ph | ShopeePay |

| GrabPay | WeChatPay |

| PayMaya | Cryptocurrencies (Bitcoin, Ethereum & Tether) |

| Paypal |

Credit Cards

- Xendit

- Global Payments / BPI

- 2C2P / Metrobank

Installments

- Billease

- Tendopay

Recurring Payments

Recurring Payments are effective for the management of payments that recur regularly so that it is scheduled easily and the merchant will not miss any of the recurring collections.

A unified API (Application Programming Interface) allows a merchant to easily accept monthly recurring debits from different banks without having to deal with them individually.

The supported channels for Recurring Payments are:

| Banco de Oro (BDO) | Chinabank |

| Bank of the Philippine Islands (BPI) | Unionbank |

| Metrobank | Security Bank |

| Philippine National Bank (PNB) |

Mass Payout

Companies and businesses that frequently make multiple payments, can save a lot of time if they are able to make payments to entities and individuals all at once rather than doing the transactions one by one. The services charges for a mass payout are the following:

- ₱20 – BDO, BPI & BPI Family Savings

- ₱15 – Other banks and mobile wallets

The supported channels with leading banks, disbursement centers, or e-wallets for a Mass Payout are the following:

Bank Credit

| Asia United Bank (AUB) | Metrobank |

| Banco de Oro (BDO) | PBCom |

| Bank of the Philippine Islands (BPI) | Philippine National Bank (PNB) |

| Bank of Commerce | PSBank |

| BPI Family Savings Bank | Rizal Commercial Banking Corp (RCBC) |

| Chinabank | Robinsons Bank |

| Chinabank Savings | Security Bank |

| Chinatrust | Sterling Bank of Asia |

| Development Bank of the Philippines (DBP) | Unionbank |

| EastWest Bank | United Coconut Planters Bank (UCPB) |

| Landbank | Veterans Bank |

| Maybank |

Cash Pick Up

- Bayad Center

- Cebuana Lhuillier

- LBC

- M Lhuillier

- PeraHub

- RD Pawnshop

- Villarica Pawnshop

E-Wallets

- Coins.ph

- Gcash

- GrabPay

- PayMaya

Why Choose DragonPay

Provides Customers Convenient Options for Payments

Dragonpay provides multiple payment options whenever you make transactions online. It can process your payments with low service fees on the merchants’ side. Save money without sacrificing the safety and security of your online transactions. Here’s the reality, when you make online payments, you will also have to pay some extra charges. But you can avoid that with Dragonpay services.

Supports Many Payment Channels

Dragonpay has over 50,000 payment partner channels, making it the perfect payment gateway for consumers all over the Philippines. With their partner payment channels, merchants can choose the best way to lessen the fees and charges when receiving (and sending) payments.

It Allows for the Scheduling of Payments for Merchants

Merchants can easily set up a recurring payments option for bills payment and other transactions. Instead of manually collecting money from customers, they can keep track of monthly collections and only pay Dragonpay with a fixed fee for this service. This feature requires merchants to use the API (Application Programming Interface) to accept recurring debits from major local banks without manually collecting them.

It is Safe and Secure

Dragonpay uses the same encryption technology as the other financial institutions worldwide, which is the industry-standard Secure Socket Layer (SSL) to protect the transmission of the customer’s data from their browser to the Dragonpay’s server. Customers don’t have to worry about putting their data on the internet because Dragonpay doesn’t store or collect user IDs and passwords.

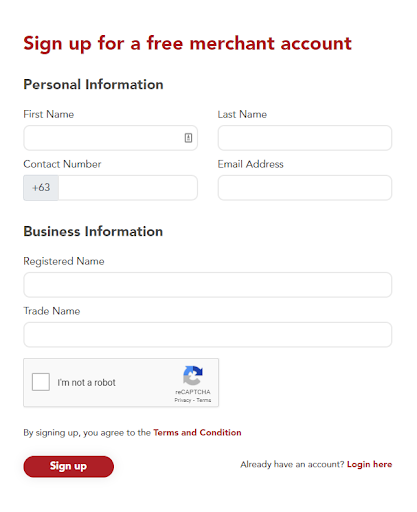

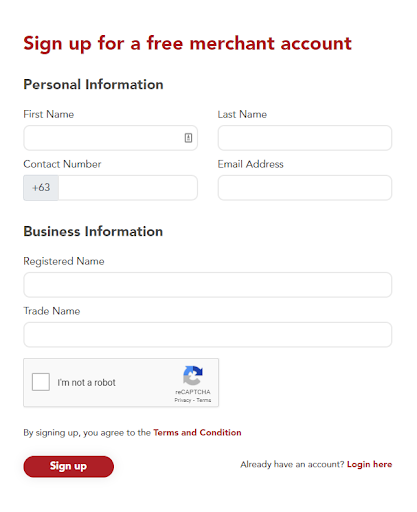

How to Sign Up

Dragonpay is a digital wallet payment channel that you can use for the payment of your online purchased items. There are two alternative ways to choose from: from the payment options tab of the partner’s merchant website or by downloading Dragonpay Credits into your mobile phone.

Partner’s Merchant Website

Upon check out, select DragonPay at Merchant’s payment option and enter the required details. The reference number will be sent to your registered email.

Dragonpay Credits

Download the Dragonpay app on your mobile phone available for iOS and Android phone users:

Sign up by registering your basic personal information and account information such as your name, contact details such as mobile phone number and email ID.

A UserID will be sent to your email together with a verification link so that you can start using the Dragonpay app.

Once you click on the verification link for a successful registration, you will also be able to get a confirmation of the successful verification.

Frequently asked questions

Is Dragonpay safe?

Do I need to create an account to use the service?

How do I verify my Dragonpay payment?

Who are the Dragonpay Partners?

How can I top up my credits?

I paid the wrong amount. What will I do?

What if I made a payment but did not receive a confirmation?

What if I was not able to pay on the given time (deadline)?

Where can I use my credits?

How much is the transaction fee?

How long does Dragonpay process?

How do I get my money from Dragonpay?

Can I transfer money from Dragonpay to GCash?

How do I email DragonPay?

Where is DragonPay in Maya?

How does DragonPay Credits work?

Conclusion

Accessing a lot of payment options is good for both customers and merchants because they will be able to unlock a lot of opportunities – one where customers have the option to pay less and one where the merchants can sell more.

Dragonpay’s safe and secure payment option allows Filipinos to have access to payment channels they can trust and be confident enough even when they have to provide their personal information.