Loan Products and Pawning Services

Cebuana Lhuillier offers a wide array of financial services to many Filipino families – from quick loans, remittances, bills payment, load services, microloans, and insurance products to savings and more.

Pawning

Cebuana Lhuillier boasts a 30% higher appraisal rate than any other pawnshops in the country. Through pawning of acceptable items, their customers can quickly get access to cash loans when they need them. Customers can pawn the following items.

- Jewelry items such as gold, diamond, platinum jewelry, and watches

- Non-jewelry items such as cellphones and laptops

Due to the pandemic, the company introduced Cebuana from Home which allowed people to pawn jewelry items online through a simplified and safe process: customers need only to visit the Cebuana Lhuillier website and go to Cebuana from Home and fill out the form.

Personnel from the pawnshop will visit the customer’s home and appraise the jewelry item and negotiate. Once the pawn agreement has been signed, the cash will be released to the customer.

To complete the pawning process, only one valid government-issued ID is required to be submitted along with the pawned item.

Fees and Charges

Annual Percentage Rate (APR) – 54% to 66%

Service Charge – 1% of the principal loan amount but shall not exceed ₱5

Renewal Charges – 4% interest, 2% liquidated damages, and ₱5 service charge

Money Remittance (Pera Padala)

Pera Padala service is providing an easy, quick and safe process for both senders and receivers. From the time the sender completes the remittance process, the receiver can immediately visit any of their branches to collect the cash by providing the control number from the sender and a valid ID.

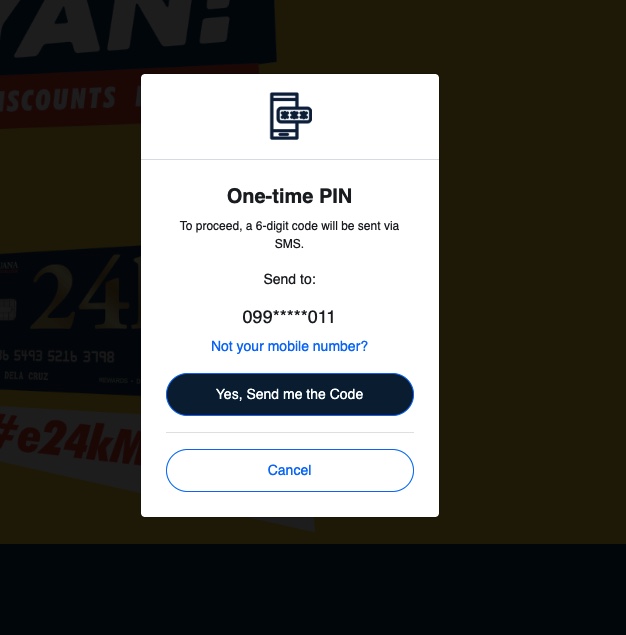

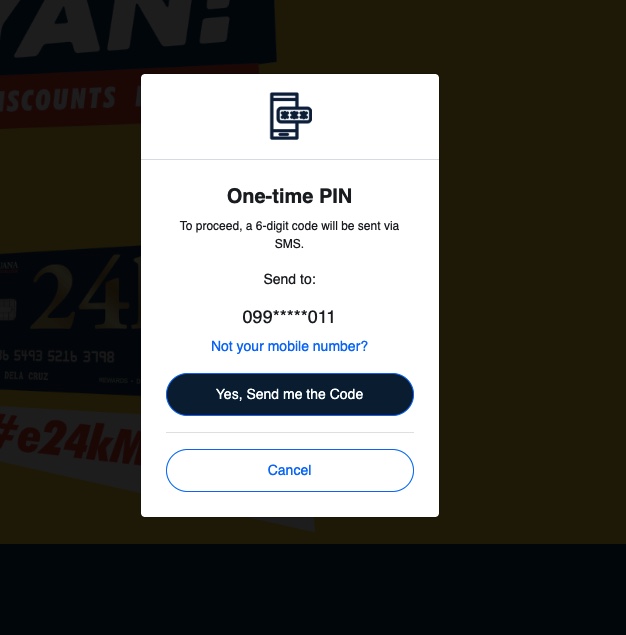

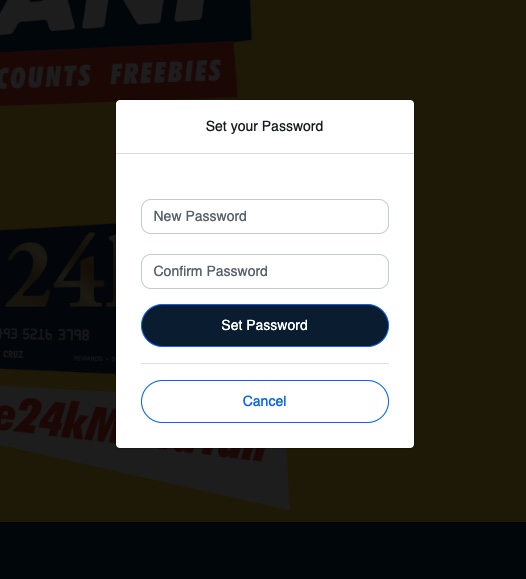

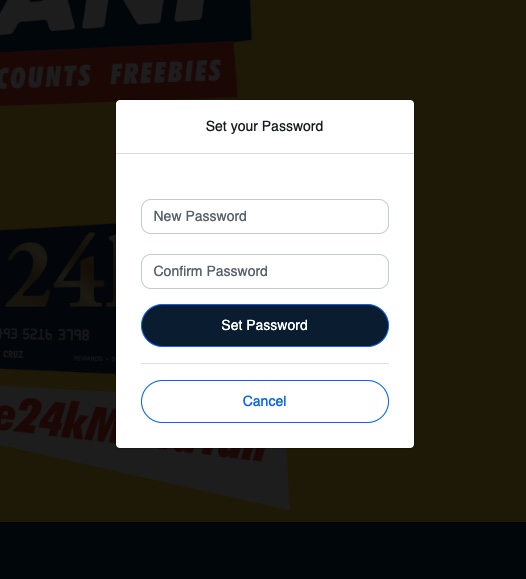

Senders can also send money without visiting any branch by simply using the eCebuana app or through the Cebuana from Home service.

Cebuana Lhuillier has remittance partners not just in the Philippines but also abroad. Now Overseas Filipino Workers (OFWs) can conveniently send money to their loved ones through the remittance or money exchange center partners of Cebuana.

The remittance charge starts at ₱1.00 for ₱100 money sent to up to ₱500 for ₱50,000. For international remittances, the remittance charge starts at ₱500 for transfer amounts up to ₱5,000 and a charge of ₱1,200 (Moneygram) and ₱1,100 (Western Union) for amounts transferred up to ₱500,000 (Moneygram) or above ₱100,000 (Western Union).

Loans

Home Loan

Customers can now afford to buy their dream home through Cebuana Bank’s home loan product and avail of the following features:

Loan Amount: up to 80% of the property value

APR: maximum of 164.38%

Loan Term: up to 15 years

Home to Cash Loan

Customers who need financing can put up their properties like a house as collateral. The terms of the loan are as follows:

Loan Amount: up to 40% of the property value

Interest Rate: 31.43% per annum (based on 36 months repayment term)

Loan Term: up to 36 months

Auto Loan

Customers can now drive their dream car and get financing of up to 70% of the vehicle value. Loan features are the following:

Interest Rate: 29% per annum

Loan Term: 36 months

Tsikot to Cash Loan

Customers who need cash financing to repair their existing vehicle can use their car as collateral and choose to pay back the loaned amount in 12 months and loan an amount equivalent to 40% of the car’s value.

Loan Amount: 40% of its value (for cars that is five years and below)

Loan Term: 12 months

Employee Salary Loan

This type of loan is available to regular employees of the PJ Lhuillier Group of Companies who need financial assistance in case of emergency or unexpected expenses.

Agricultural Loan

Small farmers and entrepreneurs in the agricultural sector can take advantage of this loan to increase their capital for business operations and improve their expertise.

Microfinance Loan

Microentrepreneurs can apply for this loan to help them generate additional financing for business expansion or uplift their living conditions.