Company Information

CTBC (Chinatrust Commercial Bank Limited) Bank is an international corporation established in 1966. It’s one of Taiwan’s largest and most well-established, privately-owned financial institutions.

CTBC has service outlets in the U.S., Canada, Japan, India, Indonesia, Hongkong, Singapore, Malaysia, Thailand, Myanmar, Australia, Vietnam, and China. It has expanded its operations in the Philippines through its subsidiary, CTBC Bank (Philippines) Corp.

CTBC Philippines head office is located at 16th to 19th Floors, Fort Legend Towers, 31st Street corner 3rd Avenue, Bonifacio Global City, Taguig City. It is regulated by the Bangko Sentral ng Pilipinas and is compliant with Philippine laws.

Customers can reach out for any concerns and inquiries to the customer service during banking hours from 9:00 AM to 4:00 PM. Other contact details include:

Tel (Manila): +63 (2) 8840 1234

Toll-Free (Other Provinces): 1 800 10 840 1234

International Toll-Free: IAC + 63 + 2 + 840 1234

Email: [email protected]

Email inquiries should include your full name, company name, landline, mobile number, and the Product(s) and/or Service(s) you’re interested in.

Types of Loans and Services Offered

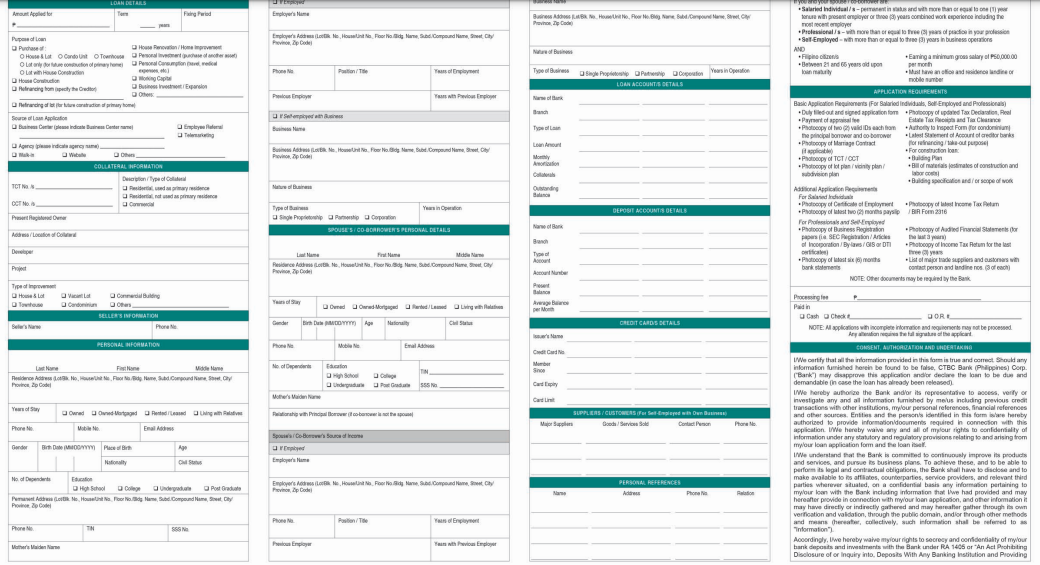

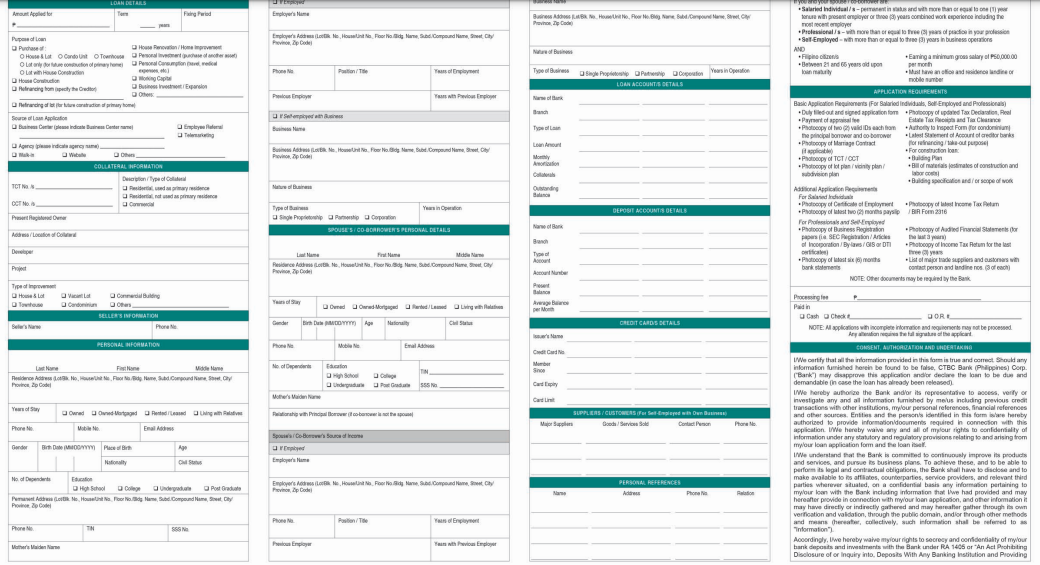

My Family Home Loan

Buying a new home or property for your growing family can be delayed due to financial constraints. However, CTBC Bank provides a straightforward, hassle-free process for housing loan applications.

Loan Purpose

- For the purchase of:

- House and Lot

- Condominium Unit

- Townhouse

- Lot Only (for future construction of primary home)

- Lot with house construction

- House Construction

- Refinancing

- Refinancing of a lot (for future construction of primary home)

- House Renovation / Home Improvement

- Personal Investment (purchase of another asset)

- Personal Consumption (travel, medical expenses, etc.)

- Working Capital

- Business Investment / Expansion

- Others

Loan Amount: ₱500,000 up to ₱50,000,000

Loan Term: up to 20 years

Interest: prevailing home loan rate at the time of availing

Loan Processing Time: 5 banking days

Eligibility

Salaried Individuals, Professionals or Self-Employed who:

- are between 21 and 65 years old upon loan maturity

- are earning a minimum gross monthly family income of PhP50,000.

- are Filipino citizens

- must have an office and residence landline or mobile number

- must have the following employment/business status and/or tenure:

- for salaried individuals – permanent in status and with at least six (6) months tenure with a present employer or two (2) combined work experience including the most recent employer

- for professionals – with more than or equal to three (3) years of practice in the profession

- for self-employed – with more than or equal to three (3) years in business operations

Requirements

For Salaried Individuals:

- Duly filled-out and signed application form

- Payment of appraisal fee

- Photocopy of two (2) valid IDs each from the principal borrower and co-borrower

- Photocopy of Marriage Contract (if applicable)

- Photocopy of TCT / CCT

- Photocopy of lot plan / vicinity plan / subdivision plan

- Photocopy of updated Tax Declaration, Real Estate Tax Receipts and Tax Clearance

- Photocopy of Certificate of Employment

- Photocopy of the latest three (3) months payslip/s

- Photocopy of latest Income Tax Return / BIR Form 2316

- Authority to Inspect Form (for condominium)

- Latest Statement of Account of creditor banks (for refinancing / take-out purpose)

- For construction loan:

- Building Plan

- Bill of materials (estimates of construction and labor costs)

- Building specification and/or scope of work

For Professionals and Self-Employed:

- Duly filled-out and signed application form

- Payment of appraisal fee

- Photocopy of two (2) valid IDs each from the principal borrower and co-borrower

- Photocopy of Marriage Contract (if applicable)

- Photocopy of TCT / CCT

- Photocopy of lot plan/vicinity plan/subdivision plan

- Photocopy of updated Tax Declaration, Real Estate Tax Receipts, and Tax Clearance

- Photocopy of Business Registration papers (i.e. SEC Registration / Articles of Incorporation / By-laws / GIS or DTI certificates)

- Mayor’s Permit / Business Permit

- Photocopy of the latest six (6) months bank statements

- Photocopy of Audited Financial Statements (for the last 3 years)

- Photocopy of Income Tax Return for the last three (3) years

- List of major trade suppliers and customers with contact person and landline numbers (3 of each)

- Authority to Inspect Form (for condominium)

- Latest Statement of Account of creditor banks (for refinancing / take-out purpose)

- For construction loan:

- Building Plan

- Bill of materials (estimates of construction and labor costs)

- Building specification and/or scope of work

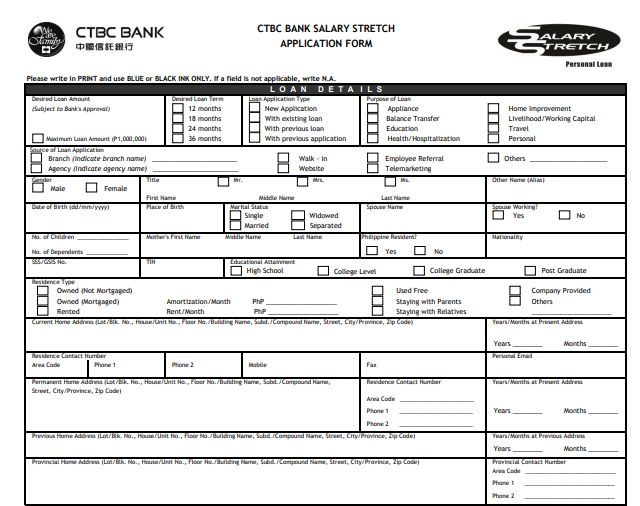

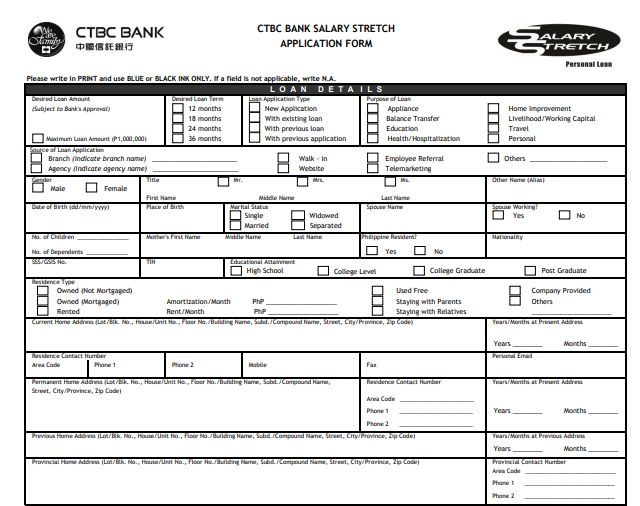

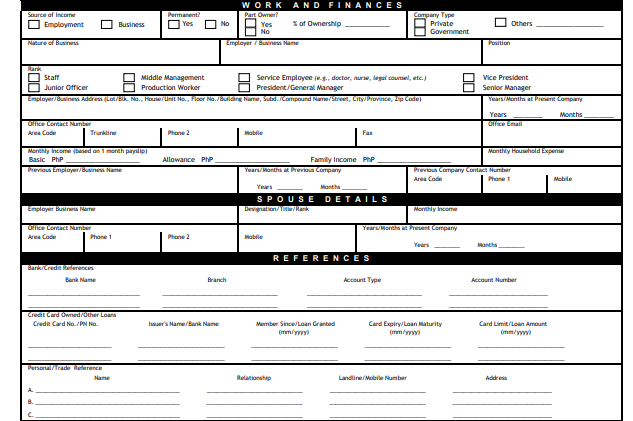

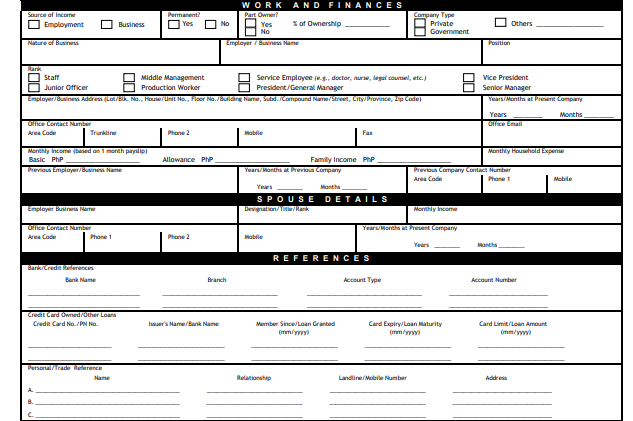

Salary Stretch Loans

This is an unsecured loan for salaried individuals, salaried individuals in the call center industry, self-employed individuals, employed doctors, self-employed doctors or consultants that can be availed for a short-term or mid-term purpose. The repayments for this loan are through post-dated checks (PDCs).

Salaried Individuals

| Eligibility | Requirements |

- Must be between 23 and 65 years old* upon loan maturity

- With a minimum gross monthly income of PhP15,000. for Metro Manila-based applicants or PhP10,000. for provincial-based applicants within the Bank’s serviceable area

- Must have at least six (6) months work tenure with current employer or a total of two (2) years working experience, including work on a regular/permanent status

- With office landline

- Must be a Filipino citizen

| - Completely filled out the application form

- Photocopy of latest ITR / BIR Form 2316

- Photocopy of ID issued by the employer (with photo and signature)

- Photocopy of one (1) month latest payslip

Original copies of the requirements may be required prior to loan release. Other documents may also be required by the Bank. |

Self-Employed Individuals

| Eligibility | Requirements |

- Must be between 25 and 65 years old upon loan maturity

- With minimum gross monthly income of PhP15,000. for Metro Manila-based applicants or PhP10,000. for provincial-based applicants within the Bank’s serviceable area

- Have a business registered in existence of operation for at least three (3) years for Service Industries or five (5) years for Trading and other industries

- With office and home landline and/or mobile number

- Must be a credit cardholder

- Must be a Filipino citizen

| - Completely filled out application form

- Photocopy of latest BIR Form 1701 / 1702

- Photocopy of unexpired Certificate of Registration from the Department of Trade and Industry (DTI)

- Photocopy of latest two (2) months credit card statements

- Photocopy of latest six (6) months bank statements of account/s

- Photocopy of the face of credit card

- Photocopy of two (2) government-issued IDs with photo

|

Employed Doctors

| Eligibility | Requirements |

- Must be between 25 and 65* years old upon loan maturity

- With minimum gross monthly income of PhP25,000.00 and working within the Bank’s serviceable area

- Employed with the current employer for at least two (2) years on a regular/permanent status

- Have a hospital landline and residence landline or mobile number

- A Filipino citizen

| - Completely filled out application form

- Photocopy of company / hospital ID

- Photocopy of PRC ID or Proof of Renewal

- Photocopy of latest one (1) month payslip

- Photocopy of Credit Card / Bank Clearance or Certification (if applicable)

|

Self-Employed Doctors or Consultants

| Eligibility | Requirements |

- Must be between 25 and 65 years old upon loan maturity

- With minimum gross monthly income of PhP25,000.00 and working within the Bank’s serviceable area

- Must be a registered doctor/dentist for at least three (3) years based on Professional Regulatory Commission (PRC) ID

- Have a clinic and residence landline or mobile number (for clinic-based doctors)

- Must have a residence landline and mobile number (for consultants)

- A Filipino citizen

| - Completely filled out application form

- Photocopy of company / hospital ID

- Photocopy of PRC ID or Proof of Renewal

- Photocopy of One (1) valid government-issued ID

- Photocopy of latest three (3) months bank statements

- Photocopy of Credit Card / Bank Clearance or Certification (if applicable)

|

Salary Stretch Loans for Corporate

A type of multi-purpose unsecured personal loan to employees of accredited companies where employees can avail of competitive loan amounts and flexible terms. Loan repayments are done via a salary deduction.

Eligibility Criteria for Companies to be Accredited

- Registered with the Securities and Exchange Commission (SEC) or Department of Trade and Industry (DTI)

- Should be in operation for the past five (5) years

- Operating profitably (net income) for the past two (2) years

- Must have at least one hundred (100) regular employees

- Agreeable to salary deduction scheme; or if the company’s payroll is with the Bank, mode of payment can be via Automatic Debit Arrangement

Requirements

Company Pre-Accreditation- Company Profile

- Audited Financial Statements for the past three (3) years with Notes

- Latest Corporate Tax Return

- Latest General Information Sheet

- Articles of Incorporation & By-Laws

- Registration at the Securities and Exchange Commission

- Duly Accomplished Company Action Form

- Audited Financial Statements with Notes and Profile of each Subsidiary/Affiliates (should the company have subsidiaries/affiliates)

| Company Post Accreditation- Letter of Agreement

- Secretary’s Certificate

- Signature Cards

|

Back to Back Loan

Existing depositors on savings and time deposits may sometimes face financial gaps in their businesses or personal finances. If they need extra funds for personal use or expansion of business, they can borrow against their account through this type of loan.

Loan Amount: minimum of ₱100,000 and borrowed against the account holder’s Savings or Time Deposit account.

Requirements:

- Conforme

- Offering Ticket (OT)

- Auto Debit Arrangement (ADA)

- Two (2) copies of notarized Promissory Note with Deed of Assignment (PNDA)

- Marital consent shall be required unless waiver for such condition is stipulated in the Offering Ticket (for assignors who are married)

- In case of corporate borrowers, a Secretary’s Certificate on the Corporation’s Board of Approval:

- authorizing the Officers of the Corporation to secure a loan from the Bank

- authorizing the use of the deposit as a collateral for the loan

- specifying the authorized signatories for the documents related to the transaction

- Certificate of Time Deposit duly endorsed by the depositor/assignor or passbook stamped “With Hold-Out”

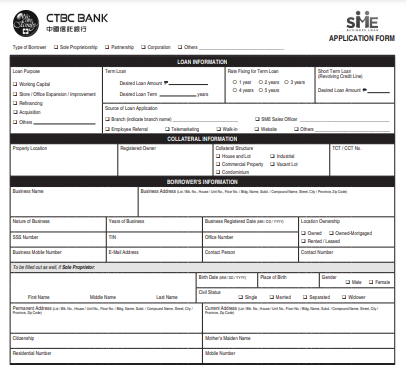

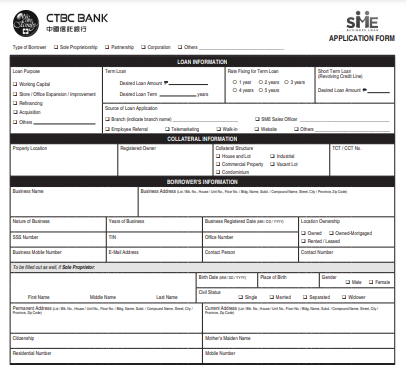

SME Business Loan

SME Business Loan is available to small and medium-sized enterprises looking at secured financing to address their business needs. Currently, CTBC offers two types of SME Business loans: Short-Term Loan or Revolving Credit Line and a Term Loan.

Loan Purpose:

- Business Expansion

- Acquisition

- Working Capital

- Refinancing of existing credit facilities

Short-Term Loan (Revolving Credit Line)

For SMEs whose main concerns are the short-term funds needed for the company to operate on a daily basis or for working capital requirements, this is the type of loan that SMEs should go ahead with.

Term Loan

When a SME’s business goal requires long-term financing, the loan term is the most ideal option for them. They can pay the loan in monthly amortizations for a term that could go up to 10 years.

Loan Features

Loan Amount: ₱500,000 to ₱70,000,000

Loan Term:

- Term Loan – up to 10 years

- Short-term Loan – 30 days to 180 days

Processing Time: 21 banking days

Interest rate: Prevailing SME business loan at the time of availing

Interest rate fixing:

- Term Loan – 1 to 5 years

- Short Term Loan – 30 to 180 days

Collateral: Real estate properties

| Eligibility | Requirements |

| Proprietorships, Partnership and Corporations who: - are Filipino-owned

- have been in business operations for at least three (3) years

| - Duly filled-out and signed application form

- Payment of appraisal fee

- Photocopy of two (2) valid IDs of each authorized signatory

- Business registration papers issued by the Department of Trade and Industry (for sole proprietors)

- SEC Registration Certificate, Articles of Incorporation, By-Laws and latest General Information Sheet (GIS) (for corporations)

- Latest six (6) months bank statement

- Audited Financial Statements for the last three (3) years

- Income Tax Return for the last three (3) years

- Photocopy of TCT / CCT

- Photocopy of lot plan / vicinity plan / subdivision plan

- Photocopy of Tax Declaration

|

Business Loans

There are different types of products under Business Loans:

Short-Term Loans

It is established to facilitate short-term business operations and cover the expenses during normal business operations before a company realizes cash.

Term Loan Financing

Long-term financing that company engages in for plant expansion and purchasing non-current assets for the company’s long-term operations.

Syndicated Financing

This type of financing is composed of two or more banks or investors to facilitate large-scale loan borrowings where each bank or investor participates as a lender in the facility.

Omnibus Facility

A multi-purpose credit line may be drawn on a one-time or multiple basis.

Discounting Facility

A type of credit line granted by the bank against an assignment of post-dated checks issued by the bank-customer’s vendors. Repayment of the loan is taken from the proceeds of the matured post dated checks.

Domestic Bills Purchase Line

A type of financing product where the bank purchases current dated checks.

Why Choose CTBC Bank

Committed to Providing Outstanding Service

CTBC Bank has proven its excellent service over the years by establishing over 152 branches in Taiwan and 260 branches worldwide. With its dedication to promoting sustainable sources of financing, it conducts various banking practices such as lending, borrowing, investing, and even cash management that help customers become financially stable.

CTBC Bank’s commitment to providing outstanding service has gained the trust and confidence of its customers aside from its numerous achievements and awards in the Philippines and overseas.

Legal and Regulated by Philippine Laws

CTBC Bank (Philippines) Corp. is regulated by the Bangko Sentral ng Pilipinas (BSP) and a member of the Philippine Deposit Insurance Commission (PDIC) and BancNet.

Provides Multiple Financing Options for Businesses

CTBC Bank offers a wide array of financing products that enable clients to get all the financing they require, whether for operating capital increase, day-to-day business expenses, or growth.

Conclusion

Different types of loan borrowing are suited for your financial needs. CTBC Bank is a reputable financial institution that offers great deals and the best customer service.

It has carried out its promise to achieve sustainable growth and to be a trustworthy brand that provides a uniquely personal and fulfilling customer experience through differentiated products and services. Filipinos looking at the best offers for financing cannot go wrong with CTBC Bank.