Consumers prefer to bank digitally for different transactions these days, whether for bills payment, money transfers, or withdrawals. The convenience and efficiency make the process appealing to digitally savvy users. As consumers rush about their day-to-day lives, finding a bank that offers mobile banking services makes the most sense.

CIMB Bank is one of the fastest-growing digital banks in the country that provides easy access to financial products and services through its mobile app. Since it was established in 2018, it has onboarded over 5.6 million customers. It has been recognized as the Best Digital Bank 2021 by the Global Banking and Finance Review. In this brand review, find out more about the bank’s products, such as loans, savings, bills payment, and more.

Written by: Piggyy

Personal Loan

UpSave Account

Fast Plus Account

GSave Account

0% Fixed Term Loan

GCredit

REVI Credit

Bank Services

CIMB Bank is one of the pioneers that introduced digital banking in the Philippines. It offers a convenient way to bank through its mobile app and since its launch in 2018, it has onboarded over 5.6 million customers.

The fully digital bank has also been recognized as the Best Digital Bank 2021 given by the Global Banking and Finance Review and has been awarded 75 prestigious international awards.

CIMB Bank aims to provide Filipinos with the knowledge on how to navigate the new age of digital banking by giving them the tools that will help them make smarter and better financial decisions.

CIMB Bank falls under the umbrella of the CIMB Group which is one of the leading banks in the ASEAN region and has a presence in over 16 global markets. It’s regulated by the Bangko Sentral ng Pilipinas and operates as a Commercial Bank.

For concerns or inquiries, their customer care team can be contacted from 6:00 AM to 10:00 PM daily by simply dialing #CIMB (#2462) on your mobile phone. Customers can also email them at [email protected] for general inquiries on their products, services, promos, or questions on how they can bank with CIMB Bank.

The Personal Loan product of CIMB Bank is an all-digital product that customers – both existing and new – can apply for by simply downloading the CIMB Bank app through the App Store or Google Play Store.

Apply for a CIMB loan as fast as 10 minutes and submit one valid ID and a payslip on the mobile app. The process, which includes the approval of the loan, can be done within 24 hours as long as the requirements are complete.

The approved loan amount will be disbursed immediately to your CIMB Bank account, or within 1-2 banking days if disbursed to other banks.

Loan Amount: ₱30,000 to ₱1 million

Loan Term: 12 months to 60 months (multiples of 12 months)

Maximum Annual Percentage Rate (APR): monthly add-on rates range from 1.12% to 1.95% (Corresponds to annual contractual rates of 24%, 30%, or 36%)

If you are Employed, you may upload any one of the following:

If you are Self-Employed, you have to upload/provide all of the below:

This type of loan allows borrowers to apply for a loan and not be charged with interest at all. However, only existing CIMB bank customers who have received this promo via email or SMS can avail of this loan. To avail of this promotion, the borrower will only be required to submit a valid ID and apply through the CIMB Bank PH app.

Loan Amount: ₱30,000 to ₱100,000

Interest Rate: 0%

Loan Term: fixed at 12 months

Other Fees & Charges: 8% of the principal loan amount and documentary stamp tax (DST)

GCredit functions like a credit card, but the credit line or the credit limit is set on the GCash app, which the account holders can use to pay for purchases to merchants and stores that accept GCash, online purchases, or pay for bills under the Pay Bills feature of GCash.

Maximum Credit Line: ₱10,000

Interest: 1% per month

There is no need to submit any documents to be approved for a credit line since only those with a fully verified GCash account can avail this product. The documents submitted in GCash will be the basis of document verification.

There are several places for you to use your credit line with GCredit. There are over 17,500 partner merchants nationwide for you to make purchases and use it. You may be able to use your GCash app through the QR Option when you make your payments in any of the leading stores in Ayala Malls and merchant partners such as Puregold, Robinsons, and SM Malls. You may also pay for your online purchases through GCredit.

A list of the partner merchants of GCredit can be viewed on the website or mobile app.

Revi Credit is a revolving credit line available to selected customers, allowing Filipinos to have faster access to credit and financial flexibility.

Maximum Credit Line: ₱250,000

Interest: 1% per month

Applicable only for selected customers. Selected customers will be informed via SMS and/or email if they can apply. You can refer to the FAQs for reference.

If Employed, any of the following:

If Self-employed, provide all of the following:

This saving account allows account holders to maintain and save through their GCash account, powered by the GCash app with zero annual fees. The interest rate to be earned from this savings account is 2.6% per annum.

Upon the opening of the account, the account holder will have the GSave Lite account which is the entrant saving account under GCash. Later on, the account can be upgraded to a GSave Full Account.

Account Features

Other Benefits

Account-holders who are able to maintain ₱5,000 for a month will be able to get free life insurance for the next month with a maximum limit of ₱250,000 based on the stated factors under the terms and conditions.

Eligibility

With an UpSave account, account holders will be able to grow their money by 2.5% per annum in interest. There is no initial deposit required and no maintaining balance. With a minimum of ₱5,000 daily average balance, the account holder will get a free life insurance coverage with a ₱250,000 maximum limit.

To open an account, the following criteria and requirements must be met by the applicant:

This savings account can be opened using only the applicant’s phone, in as fast as 10 minutes. Initial deposit and maintaining balance are also not required. Once the account is opened, the account holder will be able to receive a Visa PayWave debit card after accumulating ₱100,000 in the account. Using the card, the account holder can make a withdrawal from anywhere.

Account Features

Eligibility

Minimum Credit Score: Not Indicated.

CIMB Bank may have just been present in the Philippines for a few years, but already they are leaving a mark in the industry with its growing customer base. Here are several reasons why Filipinos should choose CIMB Bank:

Digital finance products and services offer more than just convenience to people. They also provide a competitive edge to financial institutions because more and more Filipinos are looking at an easier way of transacting their business. Imagine the time and money one can save by being able to bank anywhere in the Philippines and at any time of the day.

In just under three years since CIMB Bank was established, they have already won 51 prestigious awards recognized internationally, thereby cementing its place in the financial industry.

CIMB Bank offers loan products to Filipinos looking at personal loans and other types of credits like the GCredit, which can help Filipinos make small purchases and bill payments, or the revolving credit line that offers easy access to financial credit to selected Filipinos.

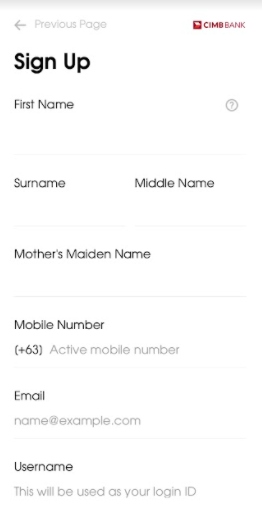

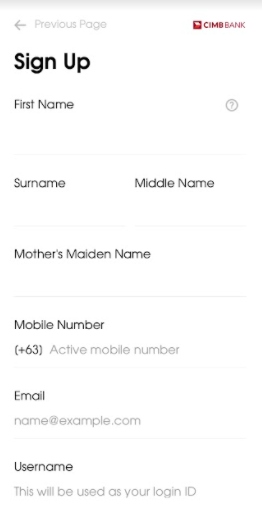

For new customers who wish to apply for a personal loan with CIMB Bank, they can start the application by downloading the CIMB Bank app on Google Playstore or the App Store.

Once the app is open, click on the “I Need A Personal Loan” button and then the Apply Now button.

You will be asked to make a few declarations before proceeding and then you can start signing up for a loan. You will be asked to provide your personal and income details and input the amount of loan you wish to apply for and the tenure.

A few more personal details will be required from you including your employment information and emergency contact details. Once this is done, you can agree to the terms and conditions of the loan. You will then be asked to upload your income documents and proceed to the virtual verification.

When the steps above are completed, CIMB Bank will send the loan contract and details via the email ID that you have provided so be sure that you will also verify your email address.

Digital banking is one of the most convenient ways to bank and transact these days. Consumers prefer convenience instead of queueing in branches, which is a time-waster. Digital banks like CIMB Bank is one of the game-changers in the banking industry. Without question, CIMB Bank has the interest of the Filipino people looking at financial security and freedom at the core of their operations.

Table of Contents

Table of Contents