Company Information

The working force behind CashMart has its values rooted in three principles: integrity, responsibility, and excellence. Trust that the people behind CashMart will always provide utmost professionalism in all their dealings with clients, a commitment to deliver expert service consistently, and a drive not just to meet their goals but to exceed them as they serve both clients and colleagues.

Their operations are open every Monday to Friday between 8:00 AM to 6:00 PM. Their loan officers are always ready to ensure a quick turnaround from the time they receive the loan application to disbursement, typically between 24 hours.

CashMart is available in Manila and the National Capital Region (NCR) and its office is located at 53 Bayani Road, Fort Bonifacio Taguig City in Metro Manila.

Other pertinent information to contact CashMart is available on cashmart.ph and can be contacted through:

- Email – [email protected]

- Phone – 02 829 0000

Types of Loans Offered

Applying for a loan at CashMart is prided on three great qualities: Fast, Flexible, and Affordable. Getting one should not be complicated especially if it does not require a huge amount of money. Another great thing about getting a loan from CashMart? It does not require collateral as long as you submit the complete requirements.

CashMart Philippines offers four products to meet your financial needs:

Personal Loan

The personal loan is available for salaried or commission-based employees, self-employed (including business owners), and Taxi or Grab Drivers. A personal loan, in itself, is meant to be a solution for any qualified individual who needs funds for personal use.

Loan Amount: Php 5,000 to Php 50,000

Qualifications:

- At least 21 years old

- Filipino citizen

Repayment Terms:

- Weekly (every 7 days)

- Bi-Weekly (every 14 days)

- Monthly (every 28 days)

Interest Rate: 0.0571% to 0.8% per day depending on the term chosen (weekly, bi-weekly, or monthly)

Processing Fee: 10% of the principal loan

Requirements:

- Government-issued ID

- Latest 1 month payslip (if salaried or commission-based employee) / latest bank statement (self-employed) / latest one month statement of account (taxi or grab drivers)

- The latest proof of billing

Salary Loan

A salary loan is typically used to cover unexpected expenses and due bills or to consolidate debt. It may serve as a cash advance where you can get funds even before your payday. If you’re running out of cash or short on budget, a salary loan can be a viable option for you to survive and buy basic needs until your payday.

Fortunately, with this CashMart product, those who are currently employed and taxi drivers will have easy access to credit for whatever emergency arises because of its simple requirements.

Loan Amount: Php 5,000 to Php 30,000

Qualifications:

- At least 21 years old

- Filipino citizen

- Currently Employed

Repayment Terms:

- Weekly (5 payment periods every 7 days)

- Bi-Weekly (5 payment periods every 14 days)

- Monthly (Once after 28 days)

Interest Rate: 0.0571% to 0.8% per day depending on the term chosen (weekly, bi-weekly, or monthly)

Processing Fee: 10% of the principal loan

Requirements:

- Government-issued ID

- Latest 1-month payslip (if a salaried or commission-based employee) / latest one month statement of account (taxi drivers)

- The latest proof of billing

Car Loan

Having your own car can be a necessity especially if you’re workplace is far from home. It’s also a privilege to have one because you can drive in the city without experiencing the sweltering heat while commuting in congested public transportation systems. Moreover, if you travel with your family and children, you would always want to ensure safety and comfort.

Getting a car requires a 10% – 30% down payment upfront. You shouldn’t break your head to come up with a down payment. CashMart will release your funds within 24 hours and those who are employed, self-employed, grab, or taxi drivers can apply.

Loan Amount: Php 3,000 to Php 30,000

Qualifications:

- At least 21 years old

- Filipino citizen

- Currently Employed

Repayment Terms:

- Weekly (5 payment periods every 7 days)

- Bi-Weekly (5 payment periods every 14 days)

- Monthly (Once after 28 days)

Interest Rate: 0.0571% to 0.8% per day depending on the term chosen (weekly, bi-weekly, or monthly)

Processing Fee: 10% of the principal loan

Requirements:

- Government-issued ID

- Latest 1 month payslip (if salaried or commission-based employee) / latest bank statement (self-employed) / latest one month statement of account (taxi or grab drivers)

- The latest proof of billing

OFW Loan

Contrary to the idea that OFWs have a lot of money, most of them work overseas to meet their families’ basic needs, and some still fall short because of the increasing expenses. It can be because of school fees or medical bills, but the loved ones left in the Philippines need not wait for their husbands or relatives abroad to find a solution. CashMart extends its product offerings to OFW land-based and seafarer allottees (wife/husband or relatives).

Loan Amount: Php 5,000 to Php 30,000

Qualifications:

- At least 21 years old

- Filipino citizen

Repayment Terms:

- Weekly (5 payment periods every 7 days)

- Bi-Weekly (5 payment periods every 14 days)

- Monthly (Once after 28 days)

Interest Rate: 0.0571% to 0.8% per day depending on the term chosen (weekly, bi-weekly, or monthly)

Processing Fee: 10% of the principal loan

Requirements:

- Government-issued ID

- The latest proof of billing

- Employment Contract

- Proof of Relationship (Birth Cert., Marriage Cert, etc.)

- 6 months latest Remittance Slip

- POEA validated contract (land-based allottee)

- Colored Passport ID (land-based allottee)

- Colored Working Visa (land-based allottee)

- Seaman’s (seafarer allotted): Passport, Book, Registration Certificate, Overseas Employment Certificate, Employment Contract w/ POEA validation

Why Choose CashMart?

Convenient

When there is a dire need for immediate cash, one should not worry about how to access funds because there are different options to get them. Getting a loan from CashMart ensures that every client is given the convenience of applying for a loan online.

Fast and Reliable

An urgent requirement has to be dealt with urgently. For example, taking a loan from banks will not be completed within 24 hours and you’ll be lucky if it gets approved within 5 working days. Choosing CashMart will take away the burden of waiting and uncertainty of approval because when you have submitted all the documents they require for approval, it’s most likely that cash will be available when you need it.

Reasonable Fees & Charges

There’s always a borrowing cost but the cost should never be more than the actual amount borrowed. While some people may argue that lending money is a business, it should never be at the expense of the borrowers. One of CashMart’s goals is to provide affordable online loans with flexible repayment terms.

Outstanding Service

CashMart thinks most of the customers’ interest, ensures they give them world-class service, and meet their financial needs right away. The company’s commitment to providing affordable loans in the shortest possible time is a great relief for Filipinos looking at solutions for their day-to-day problems.

Simple Documentation

Borrowers don’t have to go to government agencies for official documents because most of the required documents for a loan application in CashMart are easily accessible and very basic such as a valid ID, proof of billing, and payslip.

Options for Payment Centers

Missing a repayment is a headache for any borrower because of the hefty penalty fees. While most payments can be automated through online banking, not everyone has access to mobile banking. This is the reason why CashMart has partnered with different payment channels:

- 7-11

- LBC

- Cebuana Lhuillier

- Bayad Center

- Robinson Payment Center

- EC pay

- SM Payment Center

- M Lhuillier (has P20 transaction charge)

You Can Always Reapply

Borrowers can apply for a new loan if they already settled the current loan. When it comes to reapplying, the process is much simpler because your information is already in their system. You only need to send your latest payslip and update any information.

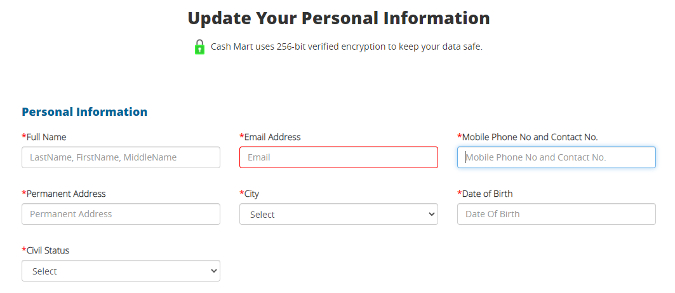

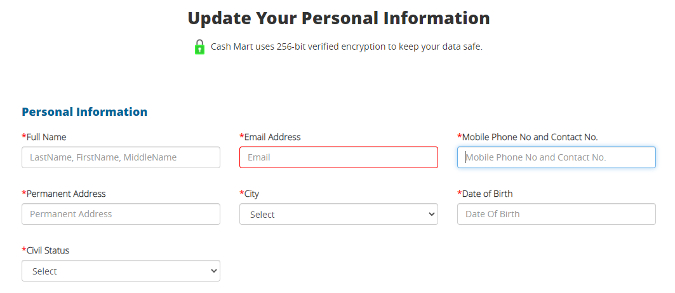

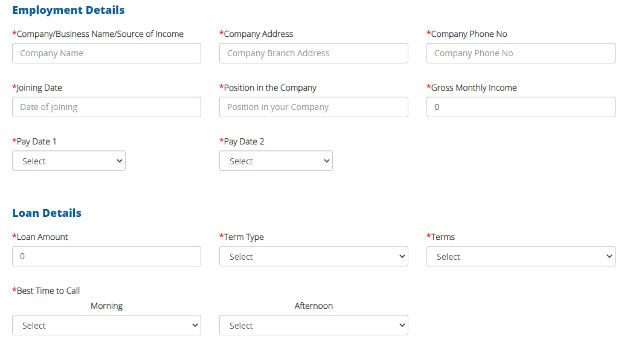

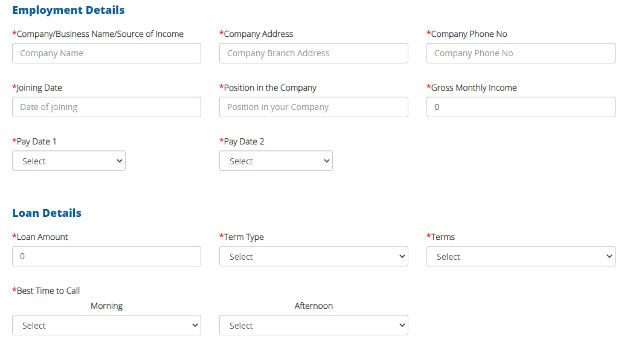

How to Sign Up

Here’s a convenient way to avail a loan online. All you need is a computer or smartphone and an internet connection to sign up on CashMart.

Click the button below and Go to cashmart’s site.

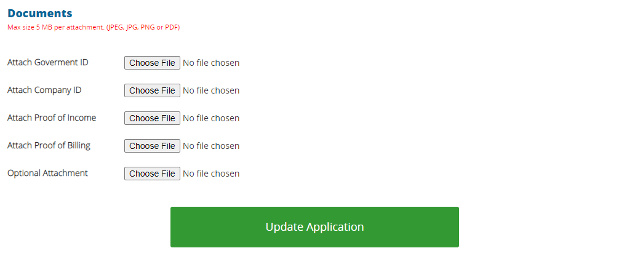

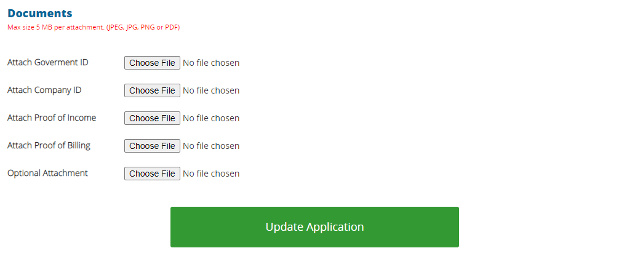

Create an account and signup.

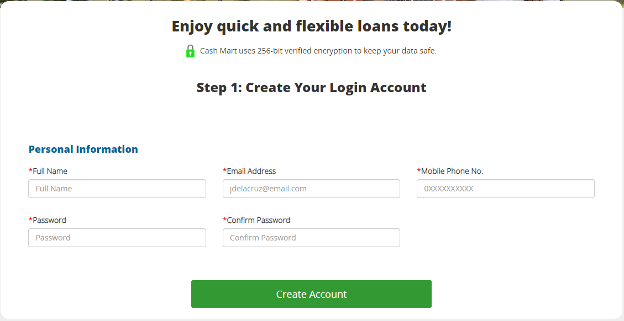

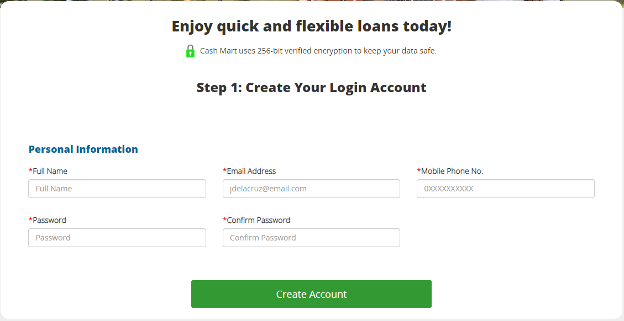

Fill up the loan application and make sure that you have all the needed documents scanned and ready to upload.

Once your application is received by CashMart, their loan officers will contact the applicant for verification of the information sent and the documents attached.

Approval and disbursement of the loan applied for happens within 24 hours. Once approved, the disbursement of the loan amount is credited to the applicant’s bank account.

To secure the transactions between CashMart and clients, CashMart only transfers funds to their approved bank partners.

Conclusion

Filipinos desire the opportunity to achieve financial independence and security, yet while someone works towards this, daily expenses may mount up and crises might develop. When lending companies’ goal is to only make money, borrowers fall deeper into debt.

The reason why CashMart is an excellent choice for affordable loans is its desire to help people who have emergency needs. Not everybody can qualify to get a loan from a bank and other lending companies charge high interest rates.

The presence of CashMart in the Philippines has opened another avenue for people to find a solution that works for them.