BDO Unibank is a premier bank that has become a household name and has been part of the daily lives of many Filipinos. Its branches are located in major cities and small provinces all across the country, which makes it easier for many unbanked Filipinos to become financially included.

Written by: Piggyy

Personal Loan

Auto Loan

Home Loan

SME Loan

BDO Personal Loan

BDO Kabayan

Basic Credit Cards

Premium Credit Cards

Elite Credit Cards

Secured Credit Card

Bank Services

BDO is a member of the SM Group, the country’s biggest conglomerate, and is a full-service universal bank that caters to individuals and businesses. BDO also offers digital banking services allowing customers to transact from anywhere in the world.

BDO was established in 1968 as a thrift bank and was known then as ACME Savings and just had two branches. Now, they have more than 1,500 branches and over 4,400 ATMs nationwide.

Their customer service is available 24/7 through the mobile app, website, or customer contact hotlines. Thecorporate center is located at BDO Corporate Center, 7899 Makati Avenue, Makati City.

For customers who wish to contact them, here are the different contact options:

E-Mail: [email protected]

BDO Contact Center:

Metro Manila:(+632) 8631-8000

Domestic Toll-Free Nos:

BDO is regulated by the Bangko Sentral ng Pilipinas (BSP), and the deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to P500,000 for each depositor.

The loans available are BDO Personal Loans and BDO Kabayan Personal Loan. Here’s an overview of each type of loan to understand which one is most suitable for you.

The loan addresses any of your financing needs such as tuition fee payments, home renovations, purchase of electronics or furniture, travel, medical emergencies, etc.

A non-collateral loan product for OFWs with a fixed income.

The Peso or Dollar Savings or Currents Accounts, or a Peso or Dollar Time Deposits are the only types of security allowed for this type of loan. The offer is made against the joint or individual accounts as security.

Loan Amount: P10,000 to P1,000,000

Loan Term: 6 months to 36 months

Interest: starts at 25.98% per annum

Repayment Method: Auto Debit Arrangement (ADA) or Over-The-Counter at any branches nationwide.

Proof of Income For Salaried Employees:

For Self-Employed Professionals:

Photocopy of at least two (2) valid photo-bearing identification documents, front and back, issued and signed by an official authority such as:

Loan Amount: minimum of P10,000 or maximum of 90% of deposit account balance

Loan Term: 6 months to 36 months

Interest: starts at 17.06% per annum

Repayment Method: Auto Debit Arrangement (ADA) or Over-The-Counter at any of the branches nationwide.

For Overseas Filipino Workers (OFWs):

For Seaman/ Domestic Helpers:

The requirements are just the same as the BDO Personal Loan but will need the following additional requirements:

Buying your first car can be expensive, and it is for this reason, that BDO offers a car financing option for personal use or business use.

Loan Amount: Vehicle Price

Down Payment: 20% to 40%

Loan Term:

Home loans can cover different types of properties and purposes. Most people think it is just financing to purchase a house and lot or condominium. With BDO, here are the different purposes used for a BDO Home Loan:

Purchase of House and Lot / Townhouse Unit:

| Type of Property | Min Amount | Max Amount vs Appraised Value of Property | Loan Term |

| House & Lot/ Townhouse/ Construction | P500,000 | 80% | 20 years |

| Condo Unit | P500,000 | 70% | 15 years |

| Vacant Lot | P300,000 | 70% | 10 years |

At least 21 years old but not exceeding 70 years old at the end of the loan term

SMEs are slowly gaining ground in the Philippines. Filipinos are now more inclined to support small to medium-size businesses. And because of this, SMEs are given the opportunity to expand. However, the expansions always require extra capital, so BDO is offering loans to SMEs looking at financing to achieve their business goals.

This is ideal for SMEs planning to purchase real estate properties or new equipment and machinery. This is a long-term loan where borrowers can opt to pay for equal monthly installments or a fixed term.

Loan Amount: P1M to P20M

Loan Term: up to 10 years

This is a type of a revolving credit line that allows businesses to have access to credit whenever they need it.

Loan Amount: P3M to P20M

Term: 1 year validity with option to renew

Other documents may be required upon evaluation

BDO is undoubtedly providing its clients the quality customer service they deserve. Customers can reach out to customer support anytime through phone banking, chat, and email for their concerns and account-related issues.

With over 1,500 branches and over 4,400 ATMs nationwide, Filipinos are afforded better access and convenience to banking services.

Customers can bank anywhere in the world and at any time of the day, thanks to the digital banking service that BDO offers. Customers can simply download the BDO app or log in to their BDO accounts on the website to make transactions.

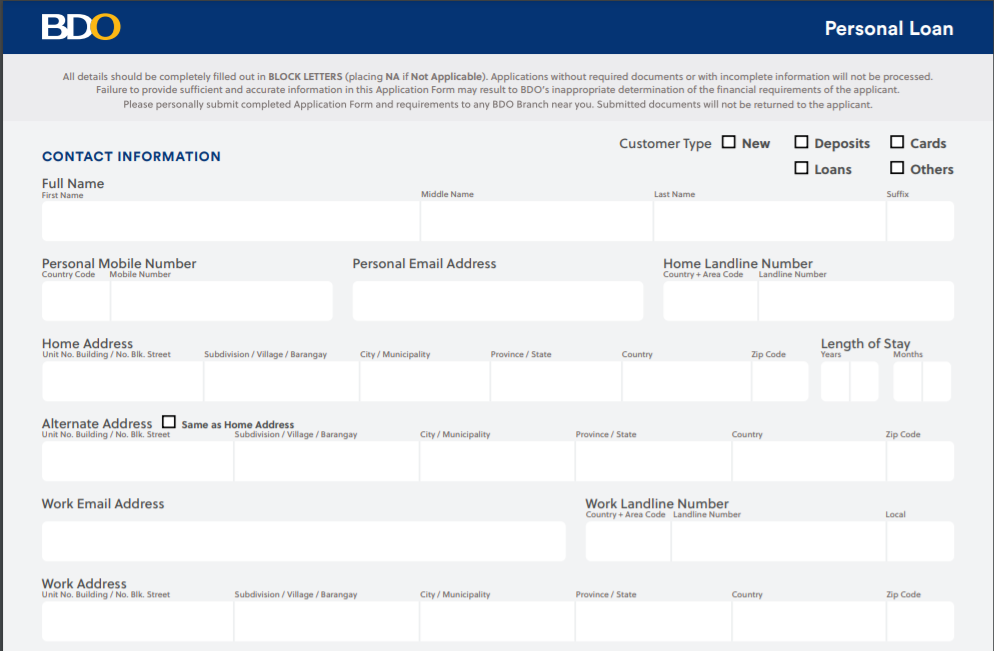

To apply for any BDO loans, borrowers can simply download the loan application form through the website. Here are some examples.

Here’s the Personal Loan application page.

After downloading and filling out the application form, the borrowers must submit this to the nearest branch, including all the requirements.

Here’s the Auto Loan application page.

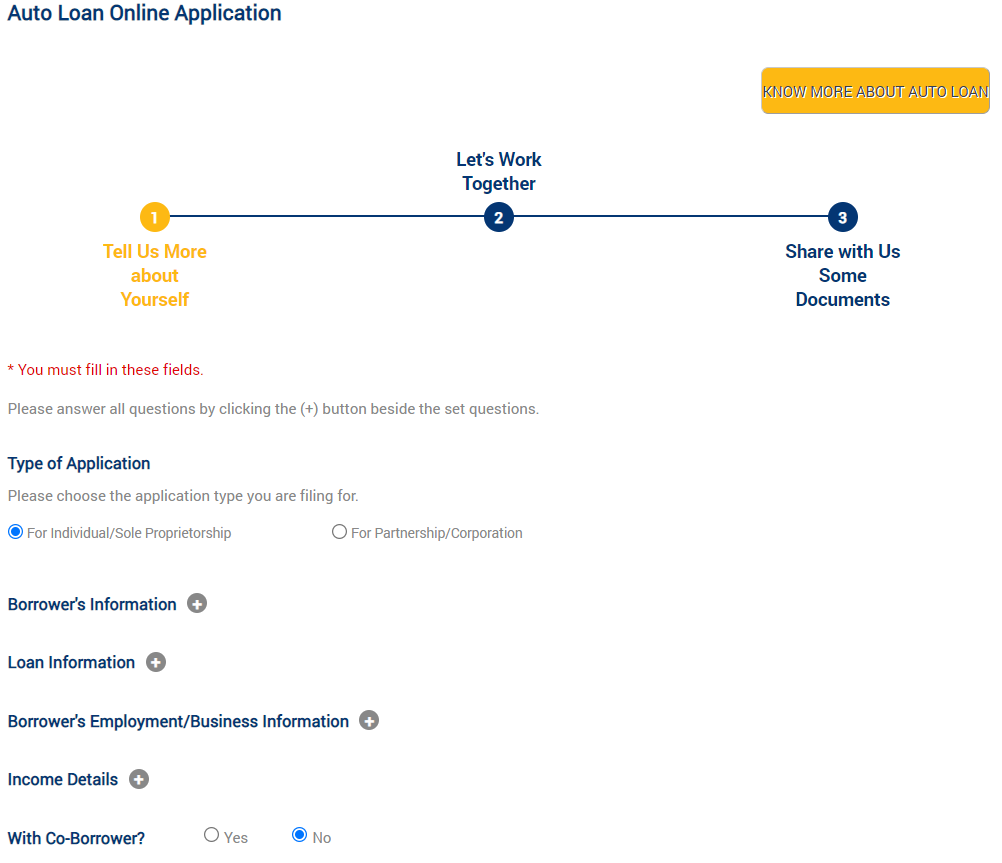

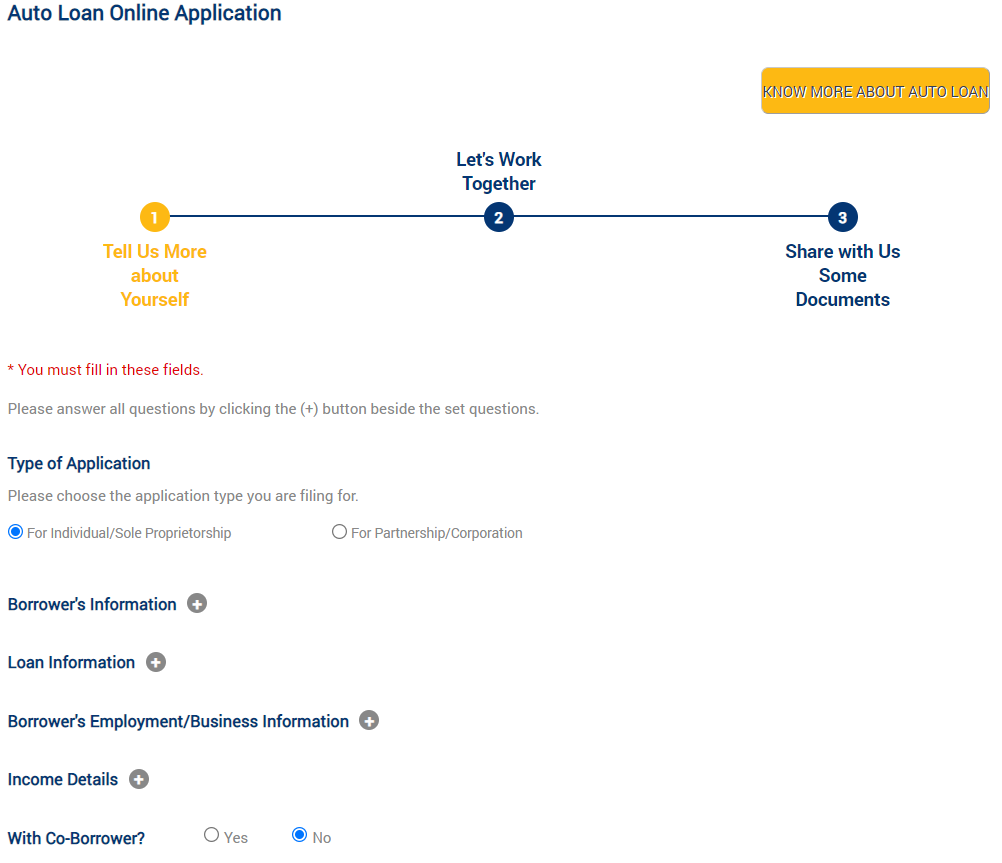

Borrowers can complete this type of loan either online or through the nearest branch. For online applications, borrowers can follow these steps:

Visit the BDO website, click on Auto Loan, and then Apply Online. You will be taken to this page where you have to provide all the necessary information.

Once all the details have been provided, just simply click on submit and a member of the BDO will contact you for the verification and instructions on the next steps for you to take.

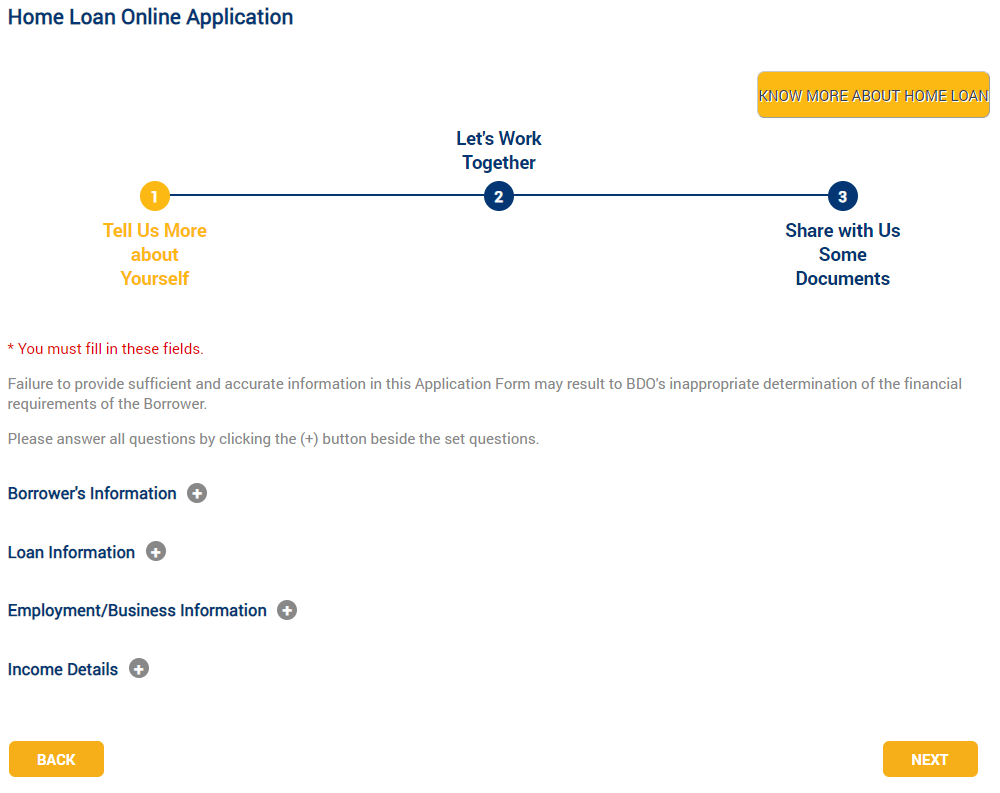

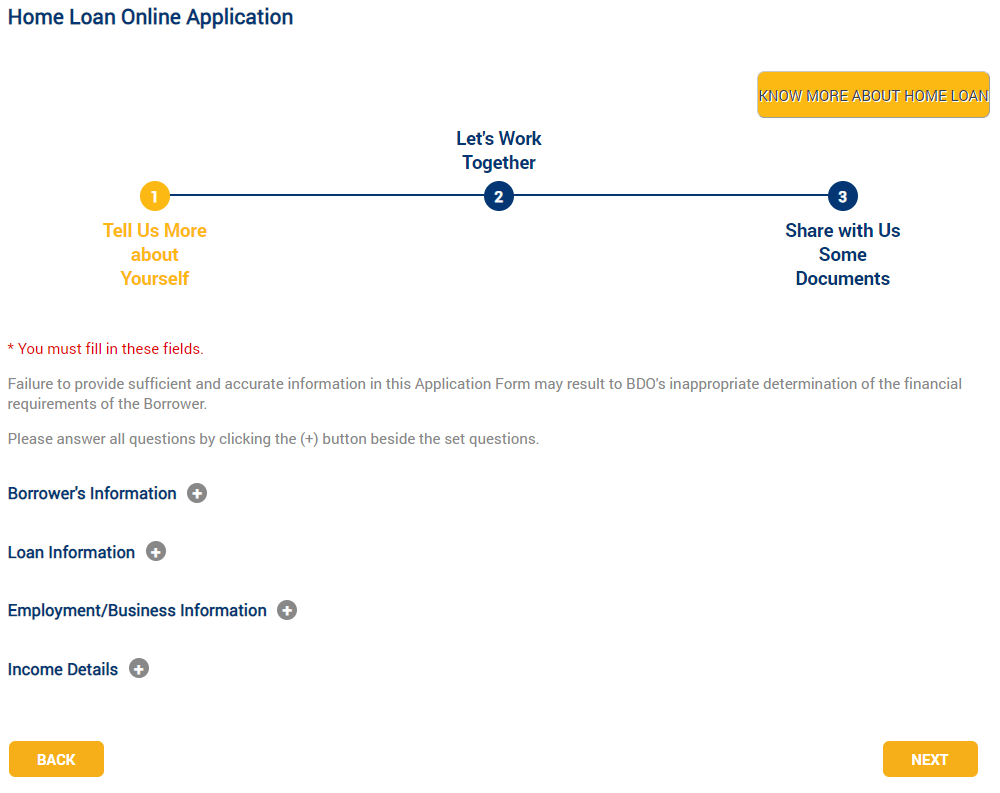

Here’s the Home Loan application page.

Borrowers who are looking at a home loan application can complete the process online through the website. Just like the auto loan application, they must simply provide all the necessary details to proceed, and a member of the BDO team will get in touch for the next steps.

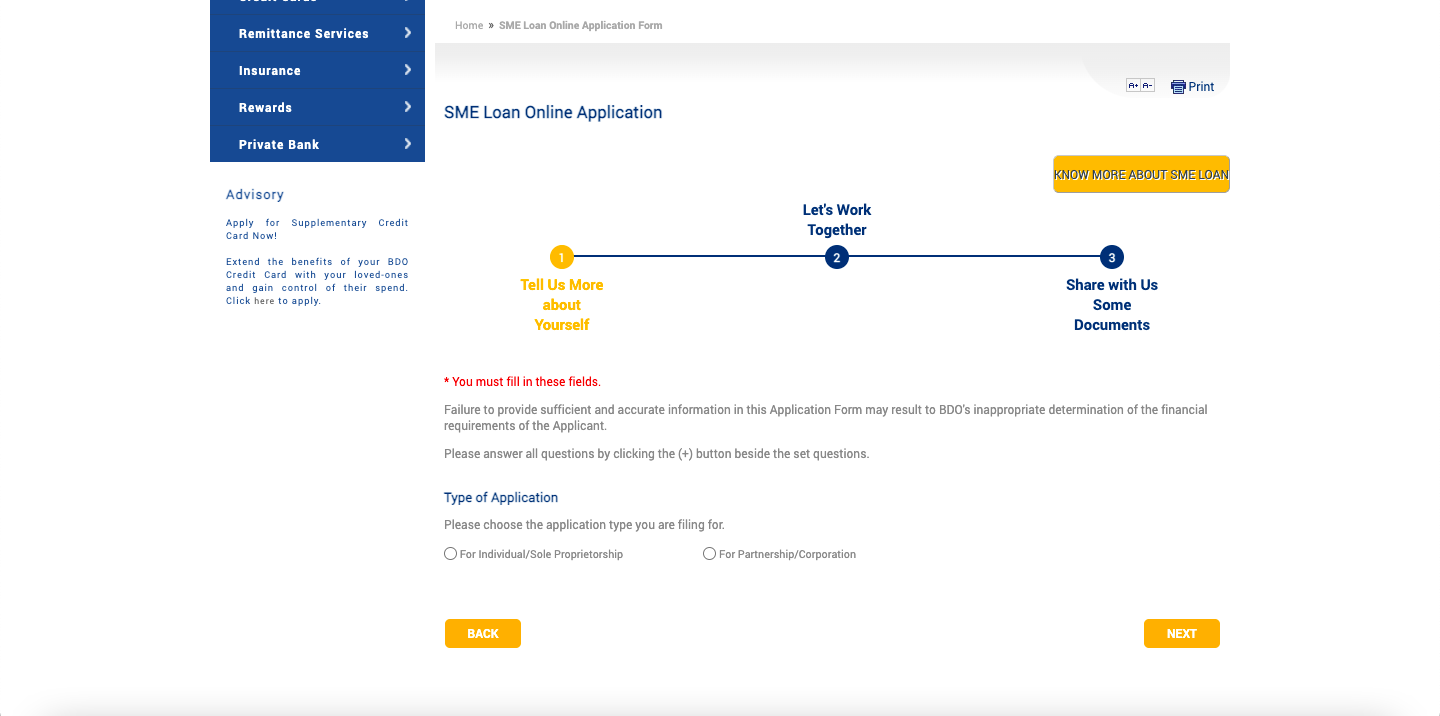

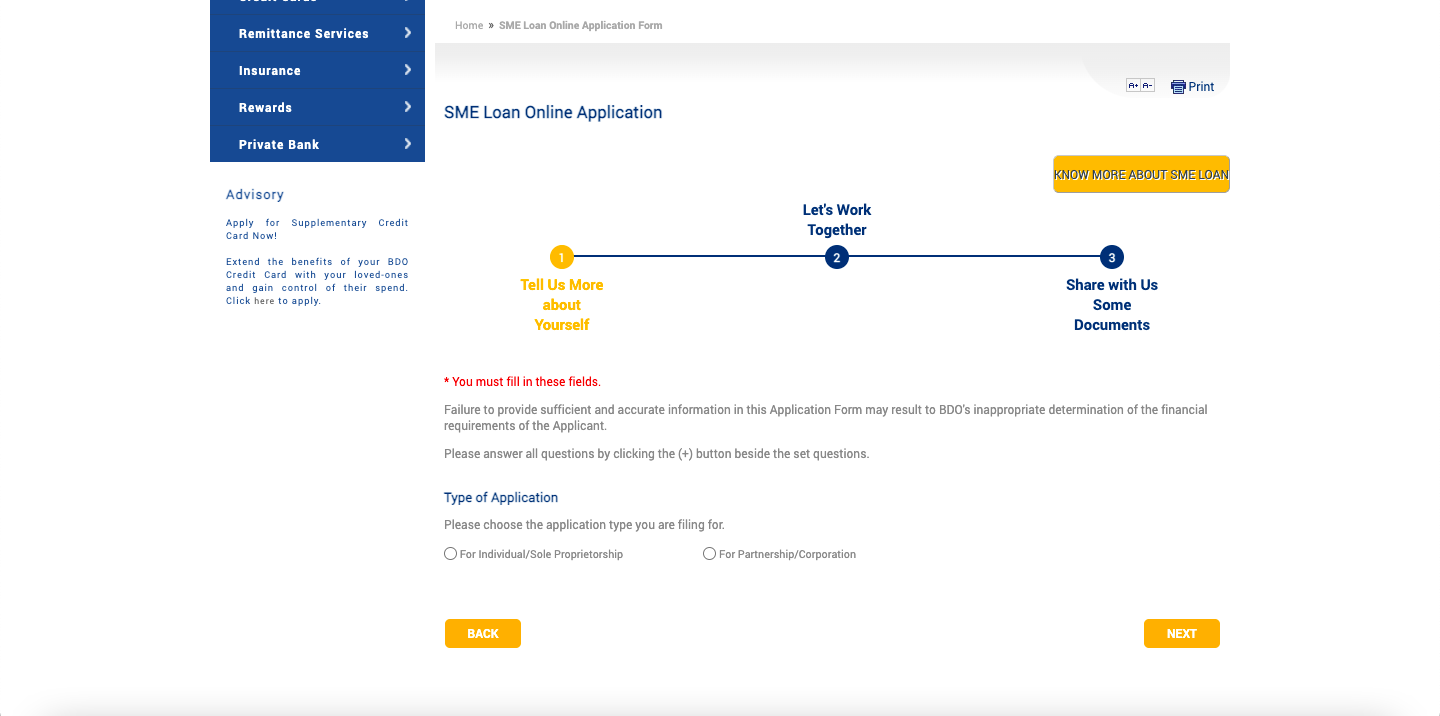

Here’s SME Loan application page.

Business owners can apply for an SME loan either through the branch or online. Those who wish to proceed with their loan application online may simply fill out the online application form and submit it.

BDO offers multiple doors of opportunity for individuals and business owners who wish to achieve their personal or business goals. Achieving financial flexibility will sometimes require an extra boost in the cash flow and in this case, BDO is more than willing to provide a lending hand to people and businesses who are in need. And true to their slogan, they find ways.

BDO offers a wide range of credit cards that you can choose from that can match your financial spending.

Recommended for individuals with a gross income of Php180,000 and above.

| Card Type | Principal Membership Fee | Supplementary Membership Fee | Finance Charge | Exclusive Perks |

| ShopMore Mastercard | P150 per month | P75 per month | 2% | Get a free SMAC and earn higher Rewards Points for your purchases. |

| Standard Mastercard | P150 per month | P75 per month | 2% | Pay in hassle-free installments and enjoy special deals when you shop anywhere. |

| Visa Classic | P150 per month | P75 per month | 2% | Get exclusive treats and pay in hassle-free installments when you shop anywhere. |

| Bench Mastercard | P200 per month | P100 per month | 2% | Enjoy 10% OFF at Bench Online Stores. Earn 2x Credit Card Points for purchases made at any Bench/Partner Global Brand nationwide. |

| Blue from American Express | P150 per month | P75 per month | 2% | Exceptional selection of year-round offers and fantastic savings. You may also avail of emergency medical and legal assistance anywhere. |

| Diners Club International | P250 per month | P125 per month | 2% | Earn one (1) Travel Mile for every P50 spend and exchange your Travel Miles for exciting trips here and abroad. |

| JCB Lucky Cat | P150 per month | P75 per month | 2% | Enjoy FREE access to JCB Plaza Lounges located in tourist shopping areas in 9 major cities across the globe. |

| Installment Card | P1000 per year | NA | 3% | Convert 100% of your credit limit to cash and enjoy light installment payment options of 6, 12, 18, 24 and 36 months. |

Recommended for individuals with a gross income of Php420,000 and above.

| Card Type | Principal Membership Fee | Supplementary Membership Fee | Finance Charge | Exclusive Perks |

| Gold Mastercard | P200 per month | P100 per month | 2% | The best card to use for your everyday essentials in-store and online. Earn cash rebates for bigger savings! |

| Visa Gold | P200 per month*. Free for the 1st year. | P100 per month*. First Supplementary is free for life | 2% | Enjoy discounts and savings year-round for your in-store, online or dining spends. |

| American Express® Credit Card | P150 per month | P70 per month | 2% | Get instant savings through the exclusive American Express Selects Program, free treats for your purchases, and avail of emergency medical and legal assistance anywhere in the world. |

| American Express® Gold Credit Card | P250 per month | P125 per month | 2% | Enjoy the best offers and get instant savings through the exclusive American Express Selects Program and get free treats for your purchases. |

| American Express® Cashback | P250 per month | P125 per month | 2% | Enjoy the best offers, get instant savings through the exclusive American Express Selects Program or Taste from American Express Invites, and emergency medical and legal assistance anywhere. |

| Cathay Pacific American Express® | P200 per month | P70 per month | 2% | Get ready to take off and enjoy travel benefits, earn Asia Miles points automatically from your regular spending and use it for flight rewards, upgrades, ticket purchases, and hotel stays. |

| JCB Gold | P200 per month | P200 per month. Free for the first three (3) years. | 2% | Get a comprehensive travel accident and inconvenience insurance of up to Php 5 Million. |

| Gold UnionPay | P100 per month | P100 per month. First supplementary card is free for life. Succeeding four (4) supplementary cards are free for the first three (3) years. | 2% | Get a free travel accident and inconvenience insurance coverage of up to Php 5 Million. |

Recommended for individuals with a gross income of Php1,000,000 and above.

| Card Type | Principal Membership Fee | Supplementary Membership Fee | Finance Charge | Exclusive Perks |

| Titanium Mastercard™ | P4,500 per year | First 6 Supplementary Cardholders are FREE for Life | 2% | Year-round shopping and dining discounts and travel insurance with coverage of up to P20M. |

| Platinum Mastercard™ | P4,500 per year | First 6 Supplementary Cardholders are FREE for Life | 2% | Year-round shopping and dining discounts and travel insurance with coverage of up to P20M.Y |

| Visa Platinum | P4,500 per year | Up to six (6) supplementary cards: Free for life. | 2% | Get access to over 1,300 VIP airport lounges worldwide and enjoy up to six (6) Free Lounge Visits with Priority Pass. |

| JCB Platinum | P4,500 per year | FREE for Life for the six supplementary cards | 2% | Get a comprehensive travel accident and inconvenience insurance coverage of up to Php 20 Million. |

| American Express® Platinum | P5,000 per year | P2,500 per year | 2% | Enjoy payment flexibility for your local and international purchases in Philippine Peso or US Dollar, complimentary airport lounge access when you travel, free enrollment to the Frequent Traveller Program to convert Membership Rewards Points to air miles. |

| Cathay Pacific American Express® Elite | P5,000 per year | P2,500 per year | 2% | The only Card that converts your spend into Asia Miles automatically. |

| Diamond UnionPay | P5,000 per year. Free for the first three (3) years. | Up to six (6) supplementary cards: Free for life. | 2% | Get a free travel accident and inconvenience insurance coverage of up to Php 20 Million. |

| Diners Club Premiere | P4,500 per year | P2,500 per year | 2% | Earn one (1) Travel Mile for every P30 spend and enjoy double miles on all dining transactions, whether local or overseas. Redeem your Travel Miles for exciting trips here and abroad. Plus, get two (2) Free Airport Lounge Access per account per year to more than 1,000 airport lounges in over 125 countries and territories. |

| Word Elite Mastercard | $1,500 | $750 | 2% | By invitation only credit card. Cardholders will take advantage of e-commerce purchase protection insurance, comprehensive travel insurance of up to $2M, lifestyle assistance in hotels, resorts, airports, clubs and spas, and peso rewards for every overseas purchase. |

Some people may find it difficult to apply for a credit card because they don’t meet some of the issuer’s requirements. Fortunately, a secured credit card is available to customers with a BDO deposit account. This account will serve as a security and be held back by the bank. The credit limit for a secured credit card is 90% of your peso deposit or 80% of your dollar deposit.

Eligibility

Requirements

Table of Contents