Company Information

Security Bank promises to deliver their promise to customers and its people a banking experience that they deserve, as their slogan says, “you deserve better”. It stays true to its name of providing security to its clientele, having been around in the banking industry for more than half a century. It has established its marks as one of the country’s top ten domestic universal banks.

Security Bank Corporation is regulated by the Bangko Sentral ng Pilipinas and is located at 6776 Ayala Avenue, Makati City. They offer 24/7 Customer Service accessibility to its customers and can be reached at:

- +632 8887-9188

- 1-800-1-888-1250 (Toll-free for PLDT landline)

- Email them at [email protected].

Types of Loans & Services Offered

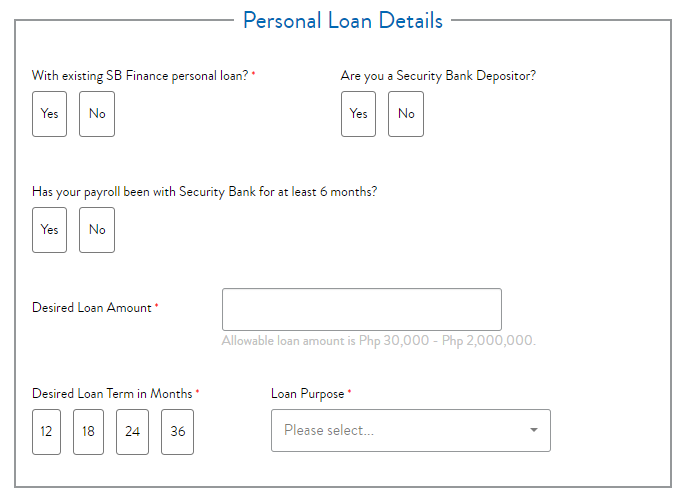

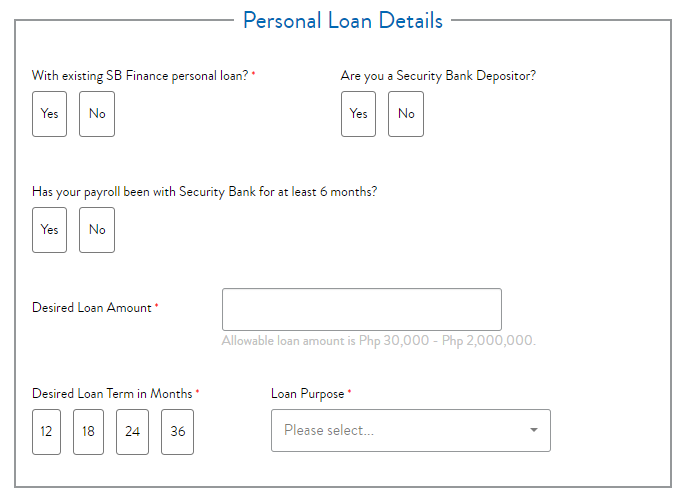

Personal Loan

Every person has a goal that they strive so hard to achieve. But, unfortunately, sometimes, a financial setback puts our plans on hold in attaining these goals. A personal loan is multi-purpose – it could be for a travel vacation to your dream destination, tuition fee for your kids, or simply to make your planned business come true. Whatever the purpose is, this low interest, affordable and flexible payment option loan is for you.

- Loan Range: Php30,000 to Php2,000,000

- Loan Term: 12 – 36 months

- Approval Time: within 5 banking days

- Estimated APR: starts at 39.53%

- Processing Fee: Php2,000

Eligibility

- At least 21 years old at the time of application but not more than 65 years old upon loan maturity

- Must be a Filipino Citizen

- Must have an office or residence landline.

- If employed, a gross monthly income of Php15,000 if residing within Metro Manila & Php12,000 for residents outside Metro Manila

- If self-employed:

- For Self-Employed or Self-Employed Professionals, the borrower must be the owner or a majority owner with at least 40% stake AND the business has been operating profitably for at least 2 years with at least 1 trade reference.

- Minimum gross monthly income: PHP100,000

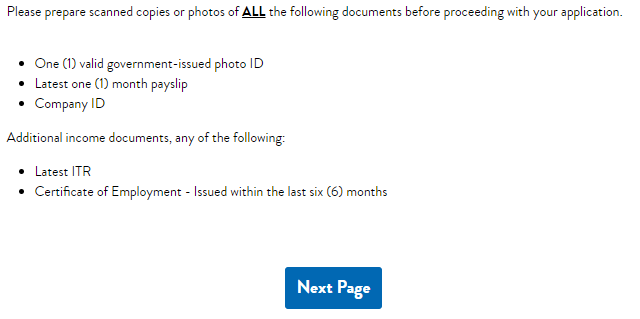

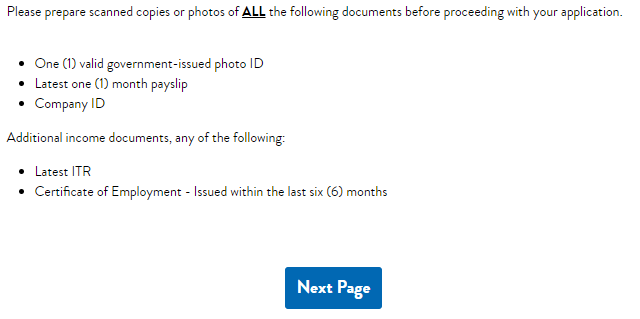

Requirements

- Filled out and signed the application form. For online applications, they can visit the website. Those who wish to apply at the branch, can download the loan application form in advance and fill it in advance.

- Additional Requirements:

| Employed | Self Employed |

- One (1) valid government-issued photo ID

- Income Documents, any of the following:

- Certificate of Employment and Compensation issued within the last six (6) months

- Latest ITR

- Latest one (1) month payslip

| - One (1) valid government-issued photo ID

- Latest 1-year Audited Financial Statement (AFS) with at least the previous year’s comparative financials

- SEC Registration / DTI Certificate

- Business Permit / Mayor’s Permit

- Latest three (3) months bank statements

- Latest GIS (if a corporation)

- List of 3 trade references (at least 1 supplier and 1 customer) with contact details

|

Home Loan

Owning your dream house should not be a complicated process, and you should never put it on hold just because it is expensive to own one. With Security Bank’s home loan, you will be able to own the house you have been dreaming of with only a few simple steps.

- Loan Amount: Php1,000,000 to up to 80% of the appraised value

- Loan Term: up to 20 years

- Approval Time: within 10 banking days

- Estimated APR: starts at 6.25% per annum

Loan Offerings

- Buy a House & Lot

- Build Your House

- Renovate Your House

- Refinance Your Existing Home Loan

Eligibility

- At least 21 years old, but not more than 65 years old upon loan maturity

- Earning a combined monthly income of P50,000

- Has been continuously employed for at least 2 years

- The self-employed must be operating a legitimate and profitable business for the last 3 years

Requirements

- Home Loan Online Application Form

- List of Required Documents available on the Security Bank website.

- Special Power of Attorney (SPA)

- Authorization Letter Template for Property Collateral Verification and Tax Mapping

Car Loan

Driving your own car is now a necessity, especially for those who take a long commute from their homes to their work sitting in traffic. Get comfortable traveling with affordable loan rates and fast approvals.

- Loan Amount:

- Brand New: up to 80% of the purchase price

- Second Hand: up to 70% of the appraised value

- Loan Term:

- Brand New: 12 – 60 mos

- Second Hand: 12 – 48 mos

- Approval Time: within 1 banking day

- Estimated APR: starts at 6.02% per annum

Loan Offerings

- Purchase of a brand new or second-hand car for personal use

- Reimbursement of a brand new vehicle

- Refinancing of a second-hand car/loan take-out

- Purchase of a brand new car for business use such as:

- Car Rental Services

- Transport Services (e.g., Taxi, Grab, UV Express, School Service, Company Use / Employee Service)

- Cargo (e.g., Trucks)

Eligibility

| Individuals | Partnerships & Corporations | Startup Businesses |

- Filipino citizens who are residents of the Philippines; or Foreign citizens residing in the Philippines, provided, accompanied with a positive endorsement from the company he is affiliated with & a qualified Filipino citizen guarantor or co-maker in place, or

- Filipino citizens residing outside the Philippines’ borders provided with qualified Filipino citizen guarantor or co-maker in place.

- Age must be 21 years old but not more than 65 years upon final maturity of the loan.

- Minimum joint monthly gross income with spouse of Php 40,000 (brand new) or Php 20,000 (2nd hand/used car)

- Employed for at least 2 years or officer position on a permanent/regular basis.

| - Must be duly registered to operate as a legal entity in the Philippines.

- The business must operate for at least three (3) years.

| - Start-ups or businesses operating for less than 3 years, co-makers / sureties are required.

- Must have strong business prospects/potentials based on the evaluation.

|

Basic Requirements

- Duly accomplished and signed Auto Loan Application Form

- Valid Government-issued ID (with signature and photo) of borrower/spouse/co-borrower/co-maker/signatories of the loan

- Latest Proof of Billing under borrower’s name

| Locally Employed | Employed Overseas | Self Employed / With Business |

- Latest Income Tax Return (ITR) / BIR Form 2316 (duly stamped by BIR), Or Pay Slips for at least 3 months

- Latest Certificate of Employment with Compensation

| - Latest Crew Contract (for seafarer/seaman); Latest Employment Contract duly authenticated by Phil. Consulate (for OFWs)

- Proof of Remittance (allotment slips) for at least 3 months

| - Latest Income Tax Return (ITR) / BIR Form 2316 (duly stamped by BIR)

- Latest Audited Financial Statements/Statement of Assets and Liabilities/Statement of Income and Expenses

- Certificate of Business Registration with DTI (sole proprietorship) or SEC (partnership/corporation)

- Bank Statements or photocopy of Passbook for the last 3 months

- Proof of Other Income (Certificate of Deposits, Stock/Bond Certificates, Lease Contracts, etc.)

|

Additional Requirements if Collateral is Used / Second Hand / Imported Vehicle

- Copy of LTO OR/CR under the name of the seller/applicant

- Deed of Sale

- PNP Clearance and Macro Etching Certificate

- Bill of lading and importation papers, including proof of payment on custom and duty taxes (for imported units only)

Car4Cash

Car4Cash is an unsecured loan that allows car owners to take out a loan based on their car just by presenting their vehicle’s ORCR.

- Loan Amount: Php100,000 to Php2,000,000

- Loan Term: 12 – 36 months

- Estimated APR: starts at 1.25% per annum

Eligibility

- At least 21 years old but not more than 65 years old upon loan maturity

- Must be a Filipino citizen

- With office or residence landline

- Residence or office is within the Bank’s service processing area

- If Employed

- Regular and permanent with current employer and employed for at least one (1) year

- Minimum gross monthly income of PHP 15,000 for Metro Manila and PHP 12,000 for outside Metro Manila.

- Additional Qualifications:

| Self Employed | For Vehicle |

- Must be the owner or a majority owner with at least 40% stake, and

- Business should have a positive net worth in the last two (2) years

- Minimum gross monthly income of PHP 100,000

| - Must be registered under borrower’s name or business name if the business is a sole proprietorship owned by the borrower

- Must be owned by a borrower for at least 6 months at point of application

- Should not be encumbered

- Car type must either be passenger or pick-up car e.g., trucks not allowed

- It cannot be for commercial use (e.g., used for Grab / TNVS) and cannot be a public utility vehicle / yellow plate (e.g., taxi, jeepney, UV express, FX, etc.)

- Can be brand new or used

- Maximum age of 10 years at point of application

|

Requirements

- Completely filled out an application form.

- If Employed

- One (1) valid government-issued photo ID

- Photocopy of OR/CR (must be under the borrower’s name, unencumbered and owned for at least 6 months)

- Screenshot from Google maps of home and company address

- Income Documents, any of the following:

- Certificate of Employment and Compensation– issued within the last two (2) months

- Latest ITR / BIR Form 2316

- Latest one (1) month payslip

- If Self Employed

- One (1) valid government-issued photo ID

- Latest one (1) year Audited Financial Statements (AFS) with at least the previous year’s comparative financials

- Latest three (3) months bank statements

- SEC/DTI Certificate of Registration

- Business Permit/Mayor’s permit

- Latest GIS (if a corporation)

- Photocopy of OR/CR (must be under the borrower’s name, unencumbered and owned for at least 6 months)

- Screenshot from Google maps of home and company address

Employee Loan

This type of loan is available for employees working for accredited companies with Security Bank and can be taken for the borrower’s varying needs. When loans are through Corporate Employee Loans, borrowers can take advantage of convenient and affordable payment terms.

The Corporate Employee Loan offers the following loan products:

- Salary Loan

- Housing Loan

- Car Loan

- Salary Advance

- Doctor’s Loan

Eligibility Requirements (Company Accreditation)

- Minimum of 50 regular employees

- Operating for at least 5 years

- Profitable for at least 3 years

- Registered business in the Philippines

Salary Advance (SALAD)

Some needs have to be addressed right away, and could not wait for the salary. With the salary advance, you will advance on your salary and receive the advance amount in your account within 10 minutes. But this product is only available for employees working for companies accredited with Security Bank.

- Loan Range: Php5,000 to Php30,000

- Payment Terms: 5 days to 30 months

- Approval Time: within 10 minutes on SMS request

Minimum Credit Score: Not Indicated

Cards

Rewards Card

| Card | Card Overview | Eligibility | Requirements |

| Mastercard Classic | A rewards card for every customer who wants to make every purchase count. | - Filipino Citizen and Philippine Resident

- Principal Cardholder must be between 21-65 years old

- Employed as a Regular Employee for at least 1 year

- OR Self-Employed Profitably for at least 3 years

- Gross Annual Income must be at least P180,000

- For First Time Cardholders: Gross Annual Income must be at least P360,000

- For Self-Employed: Must be a Security Bank depositor for at least 12 months

- Must have a landline number

| - Government-Issued Photo-Bearing ID

- For Self-Employed: 3 years AFS or ITR AND SEC/DTI Registration

- For Employed: Signed COE or ITR or 3mo Payslip with Company ID (front/back)

|

| Mastercard Gold | When you want to have a higher credit limit for your purchases, this is the perfect rewards card for you. | - Filipino Citizen and Philippine Resident

- Principal Cardholder must be between 21-65 years old

- Employed as a Regular Employee

- OR Self-Employed Profitably for at least 3 years

- Gross Annual Income must be at least P480,000

- For Self-Employed: Must be a Security Bank depositor for at least 12 months

- Must have a landline number

| - Government-Issued Photo-Bearing ID

- Other credit card details

|

| Mastercard Platinum | For those who enjoy exclusive lounge privileges, concierge services, waived fees and more | - Filipino Citizen and Philippine Resident

- Principal Cardholder must be between 21-65 years old

- Employed as a Regular Employee

- OR Self-Employed Profitably for at least 3 years

- Gross Annual Income must be at least P780,000

- For Self-Employed: Must be a Security Bank depositor for at least 12 months

- Must have a landline number

| - Government-Issued Photo-Bearing ID

- Other credit card details

|

Rebates Card

For those who enjoy earning rebates on their spending. Get this card each time you spend on 5 essential items: groceries, gas, utilities, dining, and shopping.

To avail of this card, check out if you are eligible and get ready to prepare the required documents.

Eligibility

- Filipino Citizen and Philippine Resident

- Principal Cardholder must be between 21-65 years old

- Employed as a Regular Employee for at least 1 year

- OR Self-Employed Profitably for at least 3 years

- Gross Annual Income must be at least P360,000

- Should be at least 1 year and above Existing Primary Cardholder

- For Self-Employed: Must be a Security Bank depositor for at least 12 months

- Must have a landline number

Requirements

- Government-Issued Photo-Bearing ID

- For Self-Employed: 3 years AFS or ITR AND SEC/DTI Registration

- For Employed: Signed COE or ITR or 3mo Payslip with Company ID (front/back)

Travel Credit Card

| Card | Card Overview | Eligibility | Requirements |

| Mastercard Platinum | Every Cardholder who loves to travel and wants a higher spending limit on their card that offers waived fees and free annual fees plus other deals in the Philippines and abroad. | - Filipino Citizen and Philippine Resident

- Principal Cardholder must be between 21-65 years old

- Employed as a Regular Employee

- OR Self-Employed Profitably for at least 3 years

- Gross Annual Income must be at least P780,000 (For Platinum Cardholders)

- Gross Annual Income must be at least P3,000,000 (For World Cardholders)

- For Self-Employed: Must be a Security Bank depositor for at least 12 months

- Must have a landline number

| - Government-Issued Photo-Bearing ID

- Other credit card details

|

| Mastercard World | For those who are constantly traveling and wish to go on vacations and spend like the locals. Also includes free travel insurance and secured online shopping. | - Government-Issued Photo-Bearing ID

- For Self-Employed: 3 years AFS or ITR AND SEC/DTI Registration

- For Employed: Signed COE or ITR or 3mo Payslip with Company ID (front/back)

|

Secured Card

Applying for a credit card is not very easy for all, especially those who lack the qualification criteria. But this does not mean that getting a credit card is entirely impossible. For example, with those who have not built a good credit score, are just currently employed, or stay-at-home wives, getting a credit card is possible with the Fast Track Secured Credit Card product by Security Bank.

Open a Savings Account and get a credit card approved too. Processing takes only 3 banking days, a credit limit that is 80% of the holdout amount, and enjoy waived annual fees for the first year.

Required Deposit

- All-Access Account: Php25,000

- Savings Account: Php25,000

- Time Deposit: Php100,000

Deposit Types

- Easy Account

- All Access Checking Account

- Build-Up Savings Account

- Money Builder

- Premium Build-Up Savings Account

- Time Deposit

Eligibility

- Fast Track Program is open to all existing Security Bank or New-to-Bank Clients

- Exclusive for Mastercard products only:

- Mastercard Gold

- Mastercard Complete Cashback

- Mastercard Platinum

- Mastercard World

- Next Mastercard

Requirements

- Must be at least 21 years old

- Completely filled out and signed Fast Track Application Form*

- Government-Issued Photo-Bearing ID

Installment Card

The Next Mastercard is perfect who wish to avail of easy 12-month installment payments on their purchases and no annual fee on their card.

Eligibility

- Must be 21 to 65 years old for Primary Cardholders

- Must be a regular permanent employee or owns a profitable business for the past three (3) years

- Must earn a minimum gross annual income of Php 540,000 per year if you have another credit card or Php 600,000 per year if you have no credit card

- Must have a home and/or office landline number

- Must have an email address and mobile number

- Must be in good credit standing

Documents

- Accomplished and signed Security Bank credit card application form

- Proof of Income (under BSP Circular 622)

- Employed applicants (ANY of the following):

- Copy of latest ITR stamped as received by the BIR (2316)

- Certificate of Employment & Compensation signed by the Company’s authorized signatory

- Latest 3 months payslip with front/back copy of Company ID

- Self-Employed applicants (ALL of the following):

- Copy of the latest one (1) year ITR stamped as received by the BIR (1701)

- Copy of the latest one (1) year Audited Financial Statements

- Copy of Proof of Ownership (DTI or SEC Certification)

- Proof of Identification (ANY of the following):

- Driver’s License

- Passport

- GSIS e-Card

- SSS ID (plastic card type with scanned signature and photo)

- Tax Identification Number (TIN) ID (plastic card type)

- For non-Filipino citizens, he/she must have a hold-out deposit or work contract/visa with a term of at least 3 years.

Card Fees and Charges

| Card Type | Annual Membership Fee (Primary) | Annual Membership Fee (Supplementary) | Interest | Late Payment Fee | Minimum Amt Due | Overlimit Fee |

| Next Mastercard | none | none | 2% / mo. | Php1,000 (USD20) or unpaid minimum due, whichever is lower | 3% of the total amount due or PHP 500, whichever is higher | PHP 500 per occurrence |

| Corporate | Php2,000 | n/a |

| Classic | Php2,000 | Php1,000 |

| Gold | Php2,500 | Php1,500 |

| Complete Cashback | Php3,000 | Php1,500 |

| Platinum | Php4,000 | Php2,500 |

| World | Php5,000 | First Supplementary card: waived for life Succeeding cards: Php2,500 |

Why Choose Security Bank

Security Bank is a proven and tested bank with decades of experience in the Philippine market. But that is not the only reason why Filipinos should choose Security Bank.

Offers Secured Credit Card to Build a Strong Credit Score

The problem that most people have when they approach banks for loans is their lack of credit history or a poor credit score. This is especially true when a person is a fresh graduate and has just started working. Or it could be that the person was unbanked before.

One way to strengthen the credit score is to access a credit card. When you fall short of the qualification criteria to own a credit card, there is always a secured credit card you can apply for based on the savings account you open with Security Bank.

World Class

Security Bank has earned global recognition for winning global banking excellence awards in London and Singapore in 2012.

Commitment to Excellence

Security Bank recognizes that their customers and employees only deserve exceptional management by staying true to their values and providing excellent customer service.

How to Sign Up

Signing up for a loan application is relatively easy and simple. Borrowers can download the loan application in advance and submit it in the branch, or simply complete your loan application online.

Here are the steps to the online loan application. First, click on the button below and go to their site:

Conclusion

Security Bank offers Filipinos loan and card products that are competitively low on interest and affordable payment terms. It provides Filipinos with access to quality banking experience and one that prioritizes them and their needs.

With Security Bank, every Filipino will have somewhere to go for all their needs – whether it is for taking care of their short-term needs or to make their dreams come true.