When it comes to banking, Filipinos usually have their preferred banking partners. One of these preferred banking partners is Metrobank. They have been around in the country, delivering one of the best and most meaningful banking experiences for Filipinos. As a result, families of different generations choose to stay with Metrobank to care for their money.

Written by: Piggyy

Home Loans

Car Loans

Working Capital Loan

Credit Cards

Bank services

Metropolitan Bank and Trust Company (Metrobank) was established in 1962. With over 5 decades of presence in the Philippine banking industry, they have become a premier universal bank and one of Filipinos’ most preferred banking institutions.

Metrobank’s product portfolio includes investment banking, thrift banking, leasing and financing, bancassurance, and credit cards, providing a meaningful banking experience to individuals and large multinational companies.

Listed in the Philippine Stock Exchange (PSE) as of 1981, almost 50% of Metrobank’s shares are publicly owned. To date, there are over 950 branches nationwide with over 2,300 ATMs, more than 170 Cash Accept Machines (CAMs), over 30 foreign branches, subs and offices.

The head office of Metrobank is located at Metrobank Plaza, Sen. Gil J. Puyat Avenue, Makati City. Their customer support may be contacted through the following:

Metrobank Contact Center

Metro Manila: (02) 88-700-700

Domestic Toll-Free: 1-800-1888-5775

Email: [email protected]

Corporate Customer Care

Metro Manila: (02) 8898-8000 (press 2, then 2)

Domestic Toll-Free: 1-800-10-857-9727

Email: [email protected]

Metrobank offers Home Loan products that can be customized according to the borrower’s needs, bearing in mind that the journey to owning your first home can be long and very meticulous.

Loan Amount:

Interest Rate:

| Fixing Period | New Booking Rates |

| 1-year | 5.75% |

| 2-year | 5.75% |

| 3-year | 5.75% |

| 4-year | 6.75% |

| 5-year | 6.75% |

Loan Term:

| Purpose | Maximum Term |

| Purchase of House and Lot | 25 years |

| Purchase of Townhouse | 25 years |

| Purchase of Condominium | 25 years |

| Purchase of Vacant Lot | 10 years |

| Purchase of Lot and House Construction | 25 years |

| House Construction on Owned Lot | 25 years |

| Reimbursement | 25 years or 10 years, if a vacant lot |

| Renovation/Expansion | 20 years |

| Refinancing/Loan Take-out | 15 years or 10 years, if a vacant lot |

| Personal Consumption | 5 years |

Eligibility

Requirements:

For locally employed individuals:

For Overseas Filipino Workers:

For self-employed individuals and business owners:

Collateral documents:

Having your own car ensures that you can travel from your home to any destination with comfort and ease. Driving your own vehicle is a necessity for many people, especially if you live far from your workplace or your children’s school. With pollution and heavy traffic, getting your own car may be the perfect solution for you and your family.

Loan Amount: Php350,000 to up to 80% of the car’s net selling price

Interest Rate: 4.63%-26.54%

Loan Term: 12 months to 60 months

Eligibility

Requirements

Pre-Approval:

Post Approval:

For Salaried Individuals and OFWs – Signed car loan application form

For Business Owners:

This is a loan facility available to business owners to finance receivables, inventory, and payables.

The loan amount will be based on a specific percentage not exceeding 80% of an invoice, purchase order, sales contract, billing statement, or simply through 30- to 360-day promissory notes.

Eligibility and Requirements – available through the company relationship manager or the nearest branch.

| Credit Cards | Promos and Offers | Annual Fee | Interest Rate |

| Metrobank Cash Back Visa | Get up to 8% cashback on groceries, telecom, school and bookstore spend. | Principal-Php3,500 Supplementary-Php1,750 | 2% |

| Metrobank Peso Platinum Mastercard | Get access to a wide range of world-class privileges – 24/7 VIP Customer Service hotline, Concierge Service, as well as other rewards and perks. | Principal-Php5,000 Supplementary-Php2,500 | 2% |

| Metrobank World Mastercard | It offers a credit limit that nearly sets no borders giving you the benefit of additional purchasing power whenever you need it. | Principal-Php6,000 Supplementary-Php3,000 | 2% |

| Metrobank Travel Platinum Visa | A complete travel card that lets you earn 1 mile for every P17 spent overseas and on airlines and hotels, unlimited airport lounge access, and exclusive travel offers. | Principal-Php5,000 SupplementaryPhp2,500 | 2% |

| Metrobank Femme Signature Visa | Women can enjoy triple rewards for hotel accommodations, hospitals bills, salons and spas, and the 24-hour VIP concierge service. | Principal-Php5,000 SupplementaryPhp2,500 | 2% |

| Metrobank M Free Mastercard | Enjoy the benefits of using a credit card without paying the annual fees. | Principal- Free Supplementary- Free | 2% |

| Metrobank Titanium Mastercard | Incorporates retail essentials by rewarding you with 2X Rewards Points on dining, department store, and online spending. | Principal-Php2,500 Supplementary-Php1,500 | 2% |

| Toyota Mastercard | Offers convenience to Toyota customers, dealership benefits, rebates with a fuel partner and other privileges. | Principal-Php2,500 Supplementary-Php1,250 | 2% |

| Metrobank Rewards Plus Visa | Offers 2X rewards on gadgets and electronics, telecommunications and transportation, and online spend. | Principal-Php2,500 Supplementary-Php1,500 | 2% |

| PSBank Credit Mastercard | One simple card takes care of your needs and helps you manage your expenses. | Principal- Free Supplementary- Free | 2% |

| Metrobank On Virtual Mastercard | Offers an end-to-end digital experience and a controlled limit for all your online purchases. | Principal- Php500 Supplementary-Php250 | 2% |

| NCCC Mastercard | Rewards shoppers for all their spending and enables them to convert their rewards points to their NCCC Loyalty Card, which can be used for purchases exclusively at NCCC stores. | Principal-Php1,500 Supplementary-Php800 | 2% |

The services that Metrobank offers their customers are catered according to their specific requirements. This allows them to apply only for exactly what they need and what they are looking for, making their experience seamless and specific.

Metrobank has a dedicated customer support team to take care of the needs of their personal and business banking customers. With a dedicated team, their personnel are trained to be experts in offering specific products.

With over 5 decades of presence in the Philippine banking industry, they have already understood the different needs of people. In doing so, their products and services are developed according to the changing needs of the Filipinos.

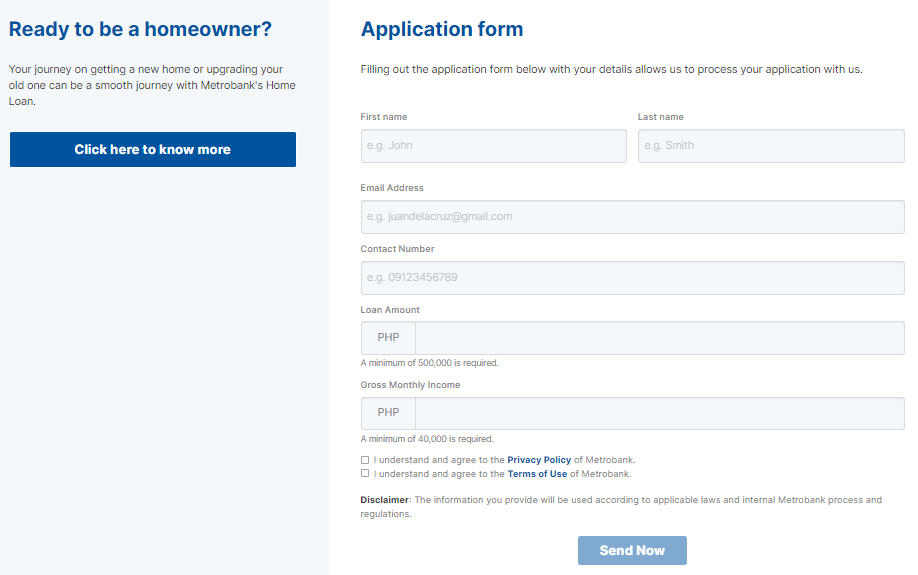

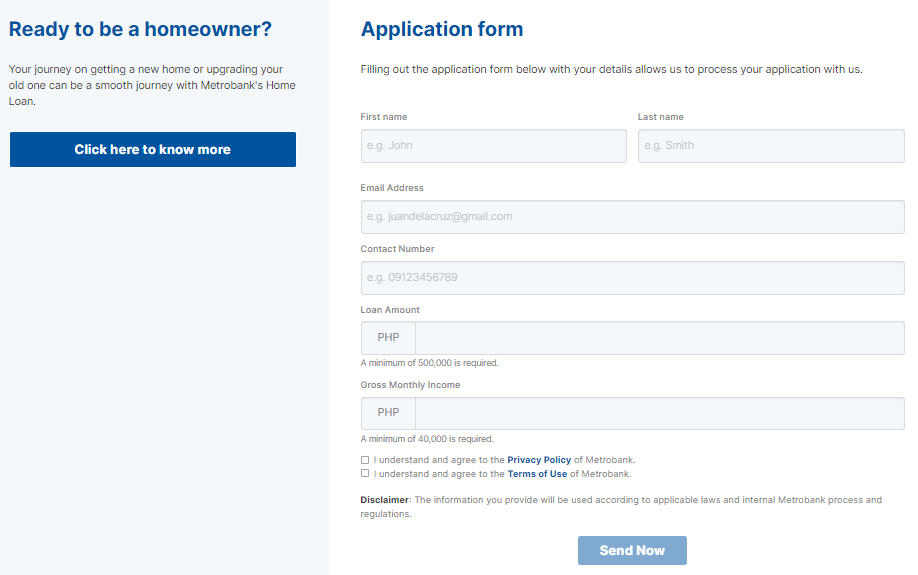

To apply for a loan or a credit card with Metrobank, customers can visit the branch directly or they can also apply for a loan online. For those who wish to make online loan applications, they can follow these steps:

Visit the Metrobank website and click on the specific loan product that you wish to apply for. As an example, for home loan applications, the loan applicant can click on Apply Now when they visit the Home Loan page.

Provide the details required such as basic personal and contact information and the loan amount required and click on Send Now.

Once your details have been sent, you will be able to see this information on your screen.

The email sent to the provided email address will contain the steps to complete the process. Based on the specific loan purpose that you need, you will have to scan the requirements and send it to [email protected].

The Metrobank home loan officer will get back to the loan applicant within 3 to 5 banking days after submission to discuss the submission and timelines.

Finding the perfect loan product for your financing requirements can sometimes be difficult given that some banks have standard products that they offer their client base and do not allow much for customizations. The great thing about Metrobank is that they offer their customers specific products which they need and in turn, they will only have to borrow what they need and for a specific period of time they feel they can pay off their loans.

Table of Contents

Table of Contents