HSBC is a bank that is present and known globally. With their purpose of opening doors of opportunity for many people, their presence in the Philippines has opened a wider door for Filipinos who look at realizing their goals and dreams. With their financial products and services that are more accessible for Filipinos, they make their purpose a reality for those who wish to step up their financial standing in life.

Written by: Big Piggyy

Personal Loan

Home Loan

HSBC Gold Visa Cash Back Credit Card

HSBC Red Mastercard

HSBC Platinum Visa Credit Card

HSBC Premier Mastercard

HSBC Advance Visa Credit Card

Bank services

HSBC was founded in Hong Kong in March of 1865 to provide financial needs internationally. More than a century later, they have become one of the largest banking and financial institutions in the whole world. Their global businesses include Wealth and Personal Banking, Commercial Banking, and Global Banking & Markets. They are present in 64 countries in Europe, Asia, the Middle East, Africa, North America, and Latin America.

HSBC’s presence in the Philippines can be traced back to 140 years ago. Now they have several branches across more than 7,000 islands and have even locally incorporated the HSBC Savings Bank located in the biggest economic areas of the country in Metro Manila, Cebu, and Davao.

The main office of HSBC in the Philippines can be located at HSBC Centre, 3058 Fifth Avenue West, Bonifacio Global City, Taguig City. For customer service concerns, their team is available 24/7 and can be contacted at:

A Personal Loan is meant to address a person’s needs for tuition fee payments, medical emergencies, starting a small business, family travel, etc. HSBC provides personal loans that are approved within just 5 banking days and convenient payment channels.

There are currently 2 Home Loan options available with HSBC, and loan applicants will be able to choose which ones are applicable for their needs. The 2 loan home loan types are Home Mortgage Loan (HML) and Home Equity Loan (HEQ). The difference between the two are discussed below:

The amount of the loan that will be approved and the term will be based on the bank’s credit evaluation that is typically based on your credit rating, the capacity pay of the borrower, and the value of the property that will secure the mortgage.

For employees to be eligible of the EPP, he or she must:

The HSBC Asset Link allows you to leverage your deposits and investments on a low-interest credit line but still allows your assets to continue earning interest.

The percentage of the credit line that you can avail of will depend on the type of security you have. Percentage details are as follows:

All HSBC Advance and HSBC Premier Clients can apply for an AssetLink. However, non-residents will only be eligible to apply for foreign currency loans, which will be subject to a different set of requirements.

HSBC provides a card that opens up a world of rewards for all of its cardholders. If you are still undecided on which card you wish to apply for, here are the basic information on HSBC’s credit cards:

| Credit Card Type | Eligibility | Nominal Interest Rate | Annual Fee |

| HSBC Gold Visa Cash Back Credit Card |

| 2% per month | Waived from the first year. Subsequently, Primary: PHP2,500 Supplementary: PHP1,250 |

| HSBC Red Mastercard |

| 2% per month | Waived from the first year. Subsequently, Primary: PHP2,500 Supplementary: PHP1,250 |

| HSBC Platinum Visa Credit Card |

| 2% per month | Waived from the first year. Subsequently, Primary: PHP5,000 Supplementary: PHP2,500 |

| HSBC Premier Mastercard | You must be an HSBC Premier customer in the Philippines | 2% per month | Waived |

| HSBC Advance Visa Credit Card | You must maintain a minimum Total Relationship Balance of PHP100,000 or a mortgage loan of at least PHP2,000,000 to become an HSBC Advance customer. | not available | not available |

HSBC has long stamped its place in the world of banking and financial services. But for customers who are still thinking about signing up with HSBC, here are some reasons why they should choose HSBC.

Most banks take several days to approve a loan, but with HSBC, it will only take up to 5 banking days, provided that all the required documents are entirely submitted.

There are several ways for customers to pay for their loan repayments. It could either be through an Auto Debit Arrangement (ADA), salary deduction, or through any of the HSBC payment centers located in all the different branches in the Philippines.

Pay your loan amortizations based on what is most convenient for you. The maximum term will depend on the kind of loan you wish to apply for.

Signing up for a loan can be done through the phone, online, or any of their branches. As long as you have checked whether you are eligible for a loan, you can prepare the loan requirements in advance to ensure that the process is swift.

Customers can apply for a personal loan through the nearest bank. Another way to apply for a loan is through the phone by simply calling (02) 8858-0000.

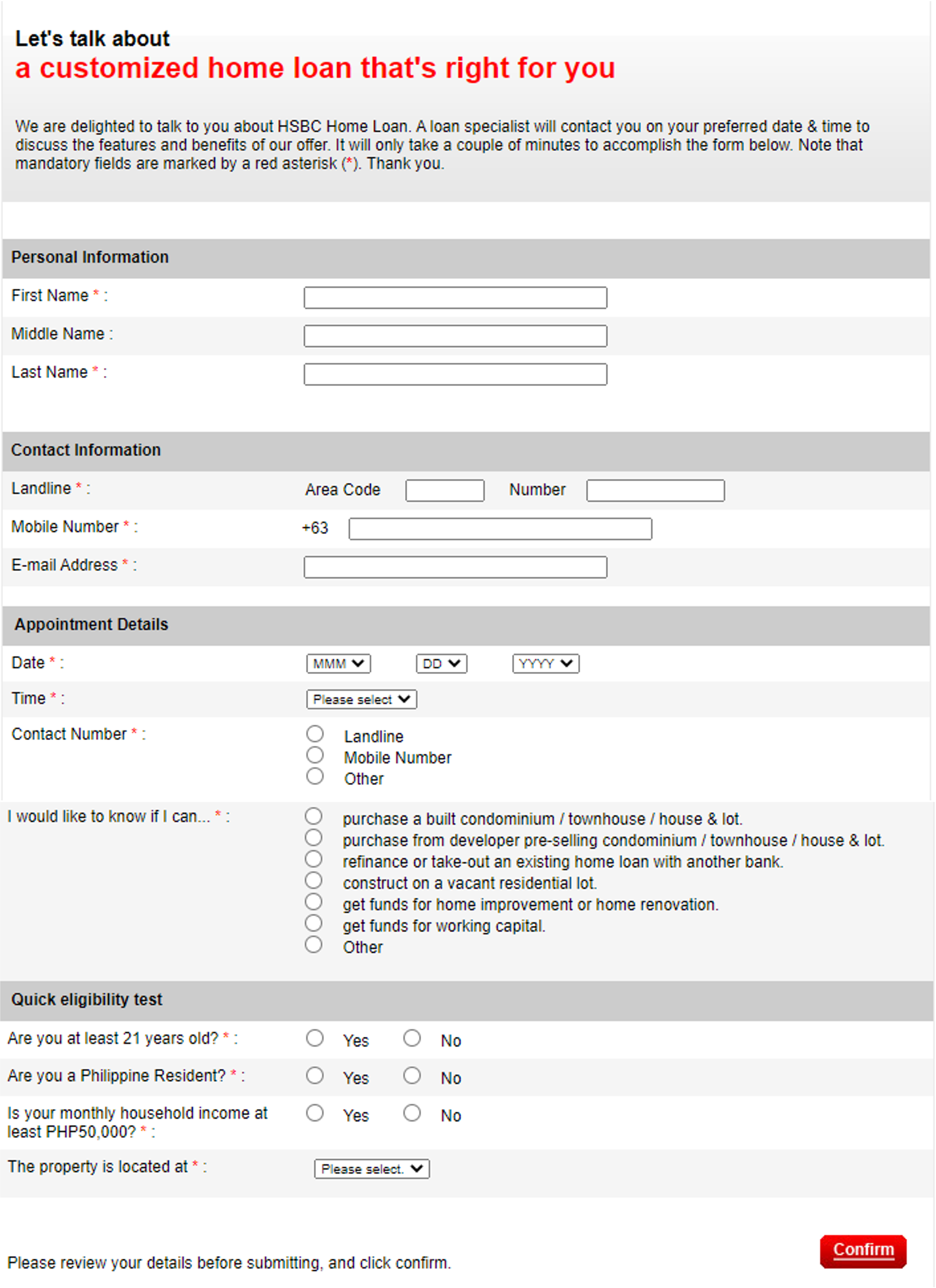

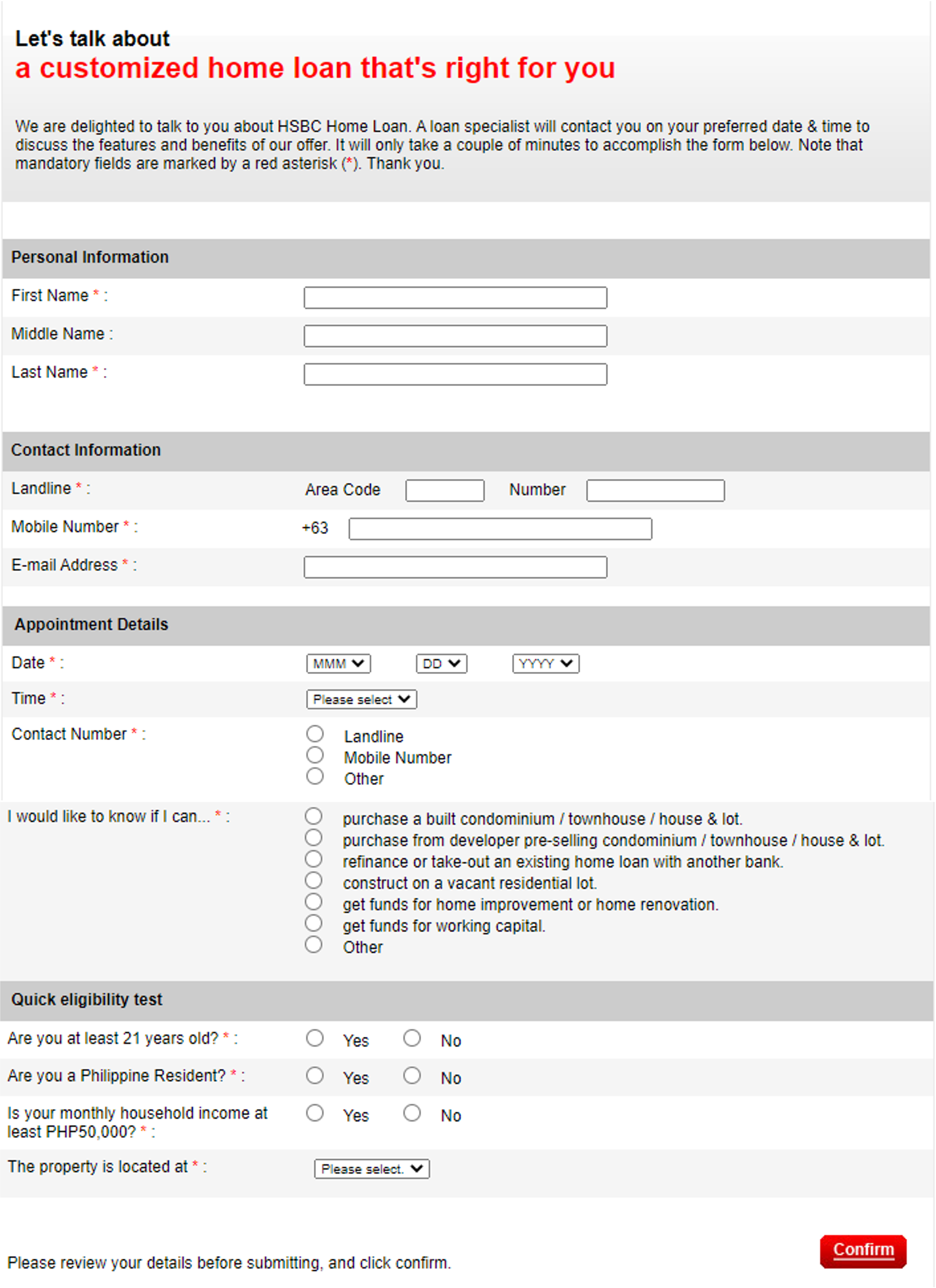

To start your journey to owning your own home, you can create your loan application through two steps:

The Loan Specialists of HSBC will be happy to assist you. Contact them through any of the numbers shown below:

For online loan applications, visit the HSBC website at https://www.hsbc.com.ph/ and request for a call back.

Once this form is submitted, the loan specialists of HSBC will call you back and provide instructions on how to proceed with your home loan application.

To be able to proceed with this loan application, you can accomplish the following:

To be able to proceed with an Asset Link application, customers can directly visit any branch nearest them or they can contact their Relationship Manager for premier clients.

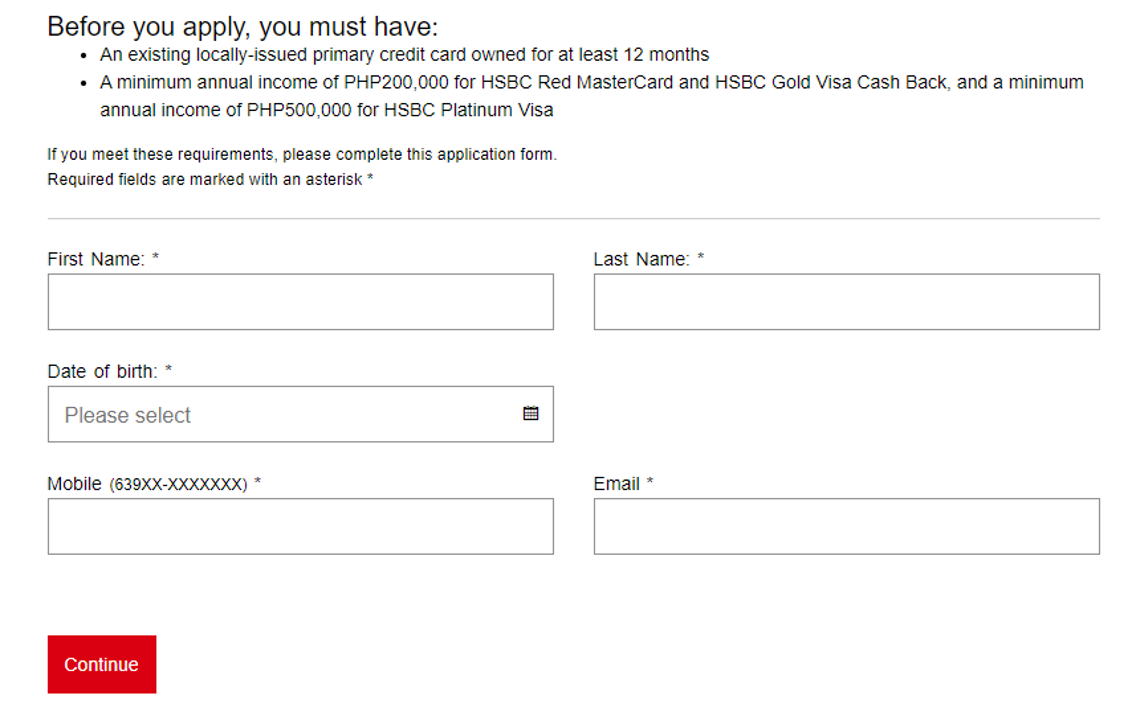

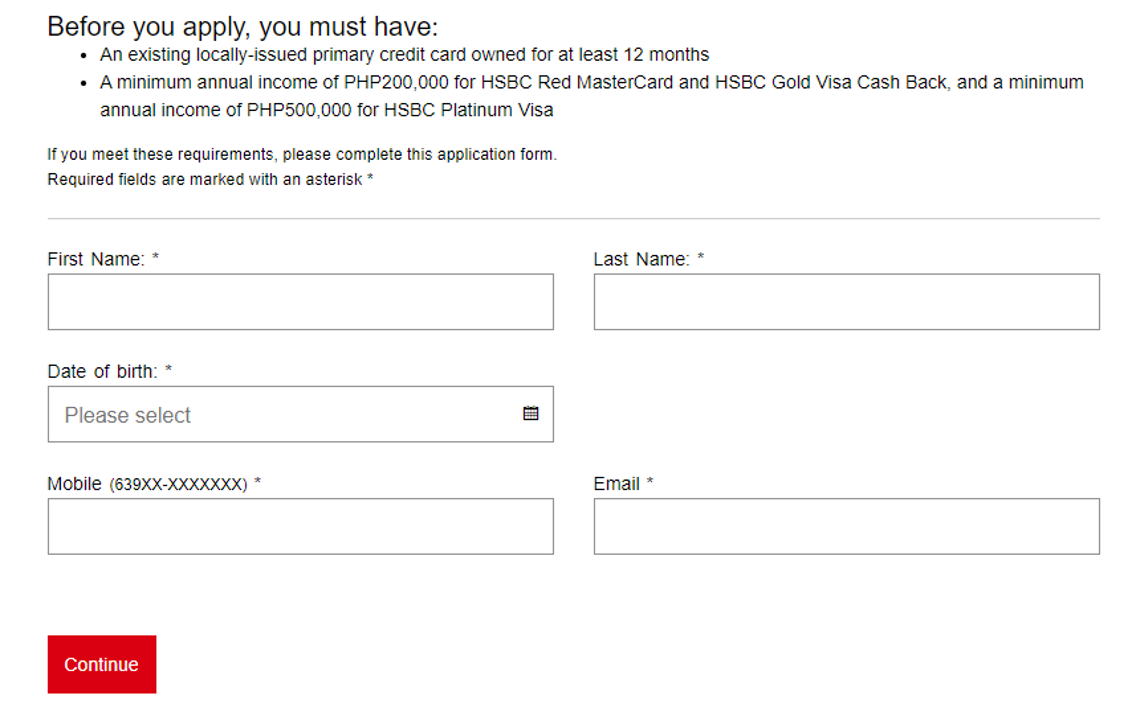

Credit Card applications can be done online (which will only take 2 minutes) or through their branch. For online loan applications, customers can visit the website and click on Apply Now to start the process.

Once the form is submitted, HSBC will get back for verification until the approval.

Customers who choose to bank with HSBC are assured of a good working relationship and better banking offers and privileges. They have not made a mark in the banking industry by circumstance alone but through proven service to their international market.

Table of Contents

Table of Contents