Citibank, a subsidiary of Citigroup, has received the Best Consumer Digital Bank by Global Finance and has been operating for a century in the Philippines. In December 2021, Union Bank of the Philippines bought Citibank’s consumer banking business for ₱55 billion to take the banking business to the next level. Citi offers banking services and credit cards, loans, investment, and wealth management services to help customers grow their money and build financial stability.

The Philippines is one of the 13 markets that Citigroup exits from retailing banking and plans to focus more on its key strength, institutional banking. Despite the changes, Citibank Philippines will continue to serve its customers and operate as usual. This brand review will walk you through Citibank’s essential features, services, and other financial products.

Written by: Piggyy

Personal Loans

Credit Insurance

Life Protection Insurance

Savings & Investments Insurance

Health Insurance

Money Market Instruments

Bonds and Notes

Investment Funds

Citi Grab Credit Card

Citi PremierMiles Mastercard

Citi Rewards Mastercard

Citi Cash Back Mastercard

Citi Simplicity+ Mastercard

Bank services

Citibank Philippines has been in the country for more than a century, and it’s one of the largest foreign commercial banks in the country. Citibank provides financial services to the public sector, top-tier Filipino corporates, multinationals, and financial institutions.

Citibank Philippines is a subsidiary of Citigroup that has over 200 million customer accounts and operates in more than 160 countries worldwide.

Recently, the Philippine Competition Commission approved the acquisition of Citibank Philippines’ consumer banking assets by UnionBank. All of Citicorp’s outstanding capital stock, as well as the real estate holdings in Citi Square in Quezon City and its bank branches, are included in the acquisition. It also includes the assets and liabilities of Citibank PH’s consumer banking division.

UnionBank has acquired Citibank Philippines’ consumer banking operations, including its credit card, retail deposit, personal and unsecured loans, and asset management portfolio. Institutional accounts, however, will continue to be managed by Citibank Philippines following the sale.

The Aboitiz Group owns and operates UnionBank, a commercial and retail bank in the Philippines. There are several of its subsidiaries, including City Savings Bank, Inc., First Agro-Industrial Rural Bank, Inc., Bangko Kabayan, Inc., UBX Philippines Corp., and UBP Investments Corp. The local affiliate of the major bank Citigroup is Citibank Philippines.

To contact any of the customer service representatives of Citibank, they can be reached through any of the methods listed below:

A Citibank personal loan is ideal for consumers who need funds for their personal or business goals, whether for big-ticket items, travel, business expansion, or home renovation.

Take advantage of maximum loan amounts and fast processing that only takes 24 hours as long as you have complete documents.

Loan Amount: ₱100,000 to ₱2 million

Loan Term: 12 months – 60 months

Annual Contractual Rate: 26.9%

For Foreign Nationals

Please submit a photocopy of either of the following:

Citicorp Financial Services and Insurance Brokerage Phils., Inc. is the insurance arm of Citibank designed to protect its customers from unfortunate events and emergencies that may threaten their financial stability. Building wealth requires hard work and sacrifices, which is why Citi’s products ensure the insurance products match its customers’ age, lifestyle, and goals.

This type of insurance will ensure that you are protected from any form of unauthorized credit transactions. In case of serious illness, permanent disability, or death, the payment coverage of this insurance will also cover outstanding balances and loans.

This insurance ensures that you and your loved ones are afforded comprehensive life-long protection.

The savings protection plan is set up to prepare for the biggest milestones in your life – your child’s education fund, comfortable retirement, or other major future expenses. This plan includes the option to grow and protect your wealth as the beneficiaries will receive the funds in case of your demise.

Prolonged and extended hospital confinement can affect your income and savings, especially if you are the breadwinner of your family. Health insurance covers income replacement and financial help for your family in the event of untimely death.

The following is an overview of the different investment products that Citibank Philippines offers. To start investing, customers may directly contact Citibank for more information.

There are different types of money market instruments, such as STIPs (Short-Term Incentive Plans), money market mutual funds, etc., that can be used for short-term lending and borrowing. Individuals or investors can lend and borrow money for one year or less in money markets. Typically, investors looking at investing in short-term securities that offer liquidity and returns go for this type of investment.

Bonds are safer forms of investment that allows investors to diversify their portfolio. When bonds mature, investors get the entire principal repayment. They are also considered fixed-income investment products that enable investors to raise capital and earn interest. Citibank offers investment products in bonds and notes that will surely help investors diversify their investment portfolios.

Citibank offers professional investment assistance to help its customers spread the risks of their investments through a diverse portfolio. It provides professional fund management and a wide array of investment options suited to the investor’s investment and risk profile.

Citi Credit Cards help cardholders enhance their quality of life and manage their expenses through promos, perks, and discounts. At Citi, there are different kinds of credit cards for every person’s different needs. You don’t have to be a depositor at Citi if you want to apply for a credit card.

As long as you are eligible and meet the following requirements, you can apply online:

| Card Type | Overview | Annual Membership |

| Citi Grab Credit Card | Ideal for cardholders who are living in the fast lane. | Free for the first year, ₱2,500 after |

| Citi PremierMiles Mastercard | Filipinos love to travel. This is the card perfect for them. | Free for the first year, ₱5,000 after |

| Citi Rewards Mastercard | For those who wish to collect rewards points every time they spend. | Free for the first year, ₱2,500 after |

| Citi Cash Back Mastercard | When you love to save each time you spend on something, this card is what will fit your needs. | Free for the first year, ₱4,500 after |

| Citi Simplicity+ Mastercard | Credit cards are meant to be simple. Therefore, this card does not have any overlimit or late payment fees. | No Annual Fee |

With over a hundred years of experience in providing quality financial products and services to Filipinos and people around the globe, they have made their mark in the financial and banking industry. Citibank constantly embraces digital innovation in its banking services for a more convenient experience.

Its digital banking makes it easier for people to make transactions online and through its mobile app. Its customers can also choose online and offline banking regardless of their locations.

Citibank provides loan products and credit card services to help Filipinos in their time of great financial need. It offers flexible terms and competitive rates to protect the financial security of existing clients whose goals are to grow and build their wealth.

Signing up for a loan or credit card is simple. Visit the website and click the Credit Cards tab to see the complete list and features. However, for insurance and investment products, you may call the customer service representatives of Citibank through CitiPhone or request a callback.

The first criterion for a personal loan is you must be a principal credit cardholder for at least three months. Otherwise, you can’t apply.

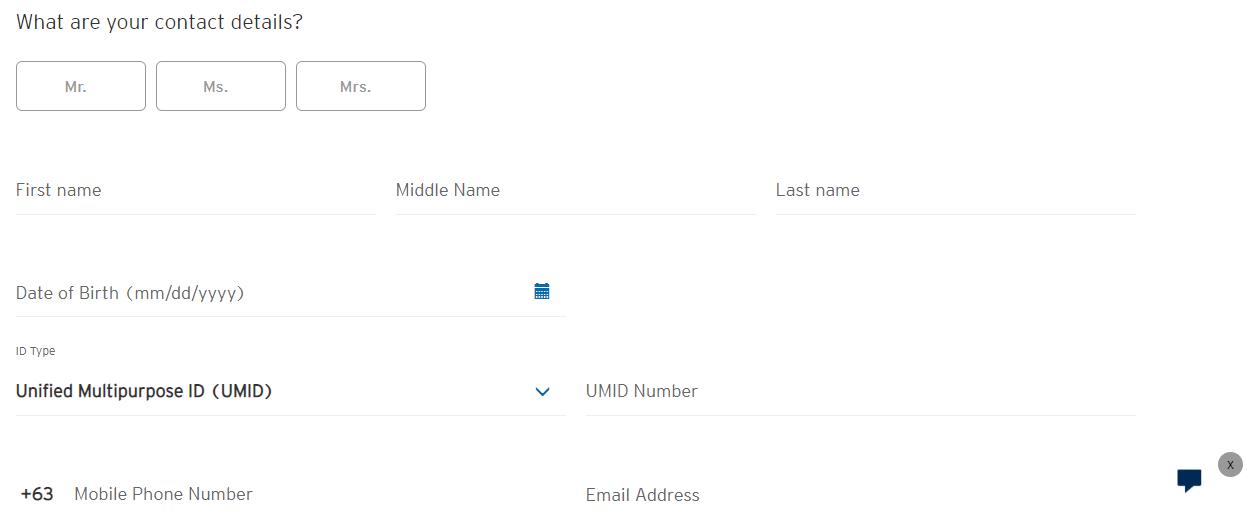

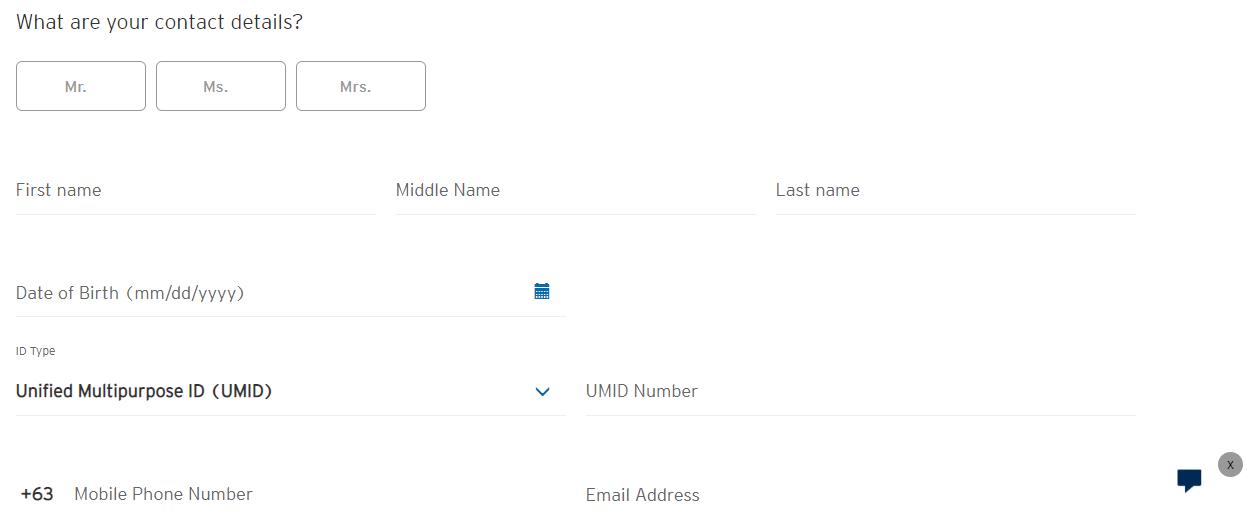

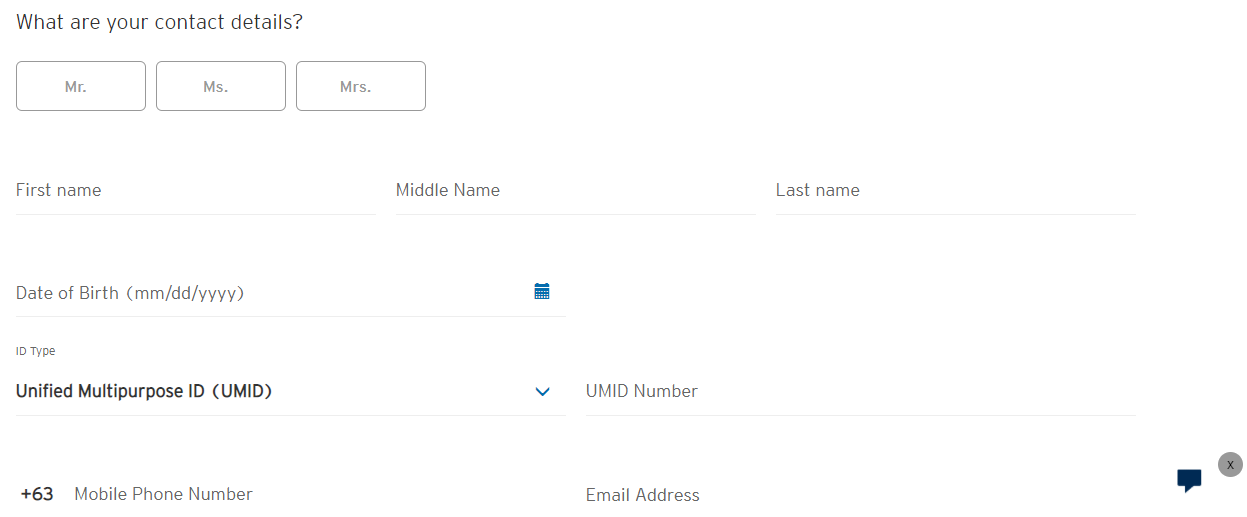

Provide your basic personal information and 1 government-issued ID. Once all the details are provided, you may proceed to the next step.

Provide your employment details, such as the nature of your work, position in the company, and gross annual income. After completing this step, a representative from Citibank will call you within the next three days.

When you click on apply for a credit card, you will immediately be redirected to the Credit Card page. You will see the Apply Now button on the right-hand side of the screen.

Answer a couple of eligibility questions before you can proceed with the application. Then you may proceed to fill in your personal information, contact details, and ID number.

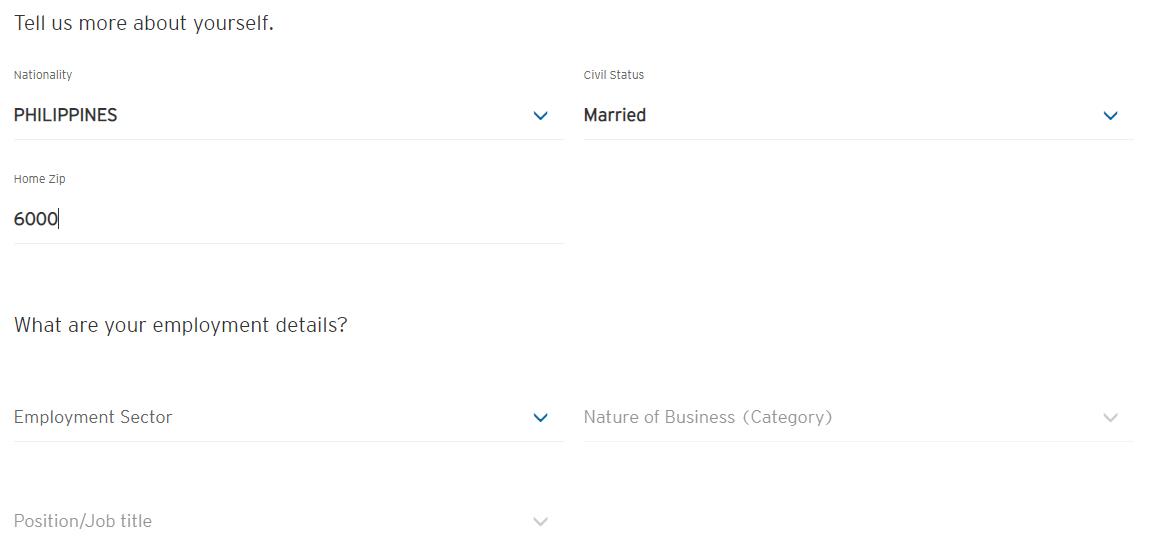

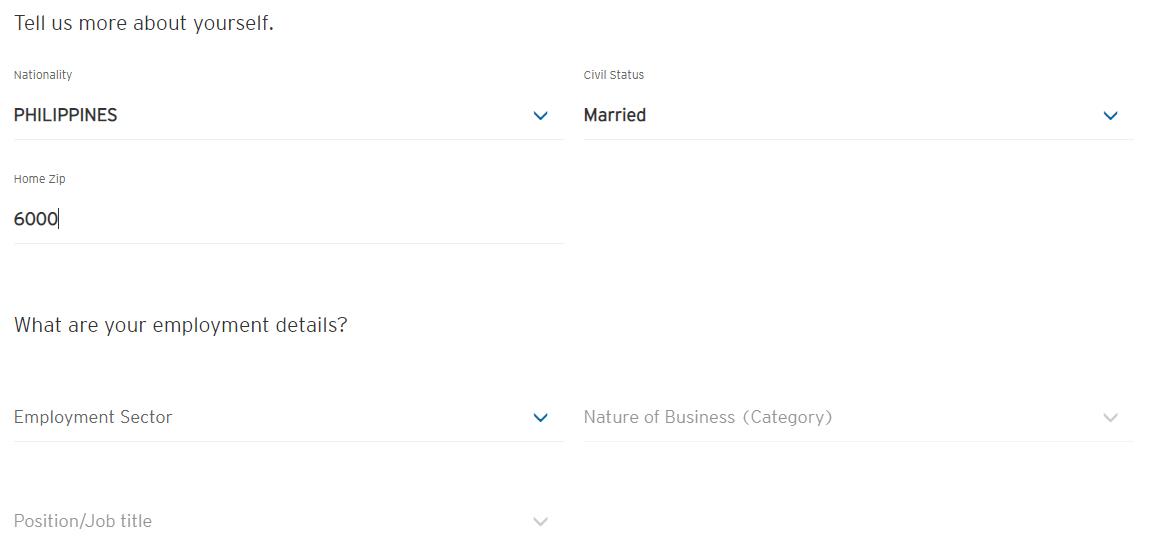

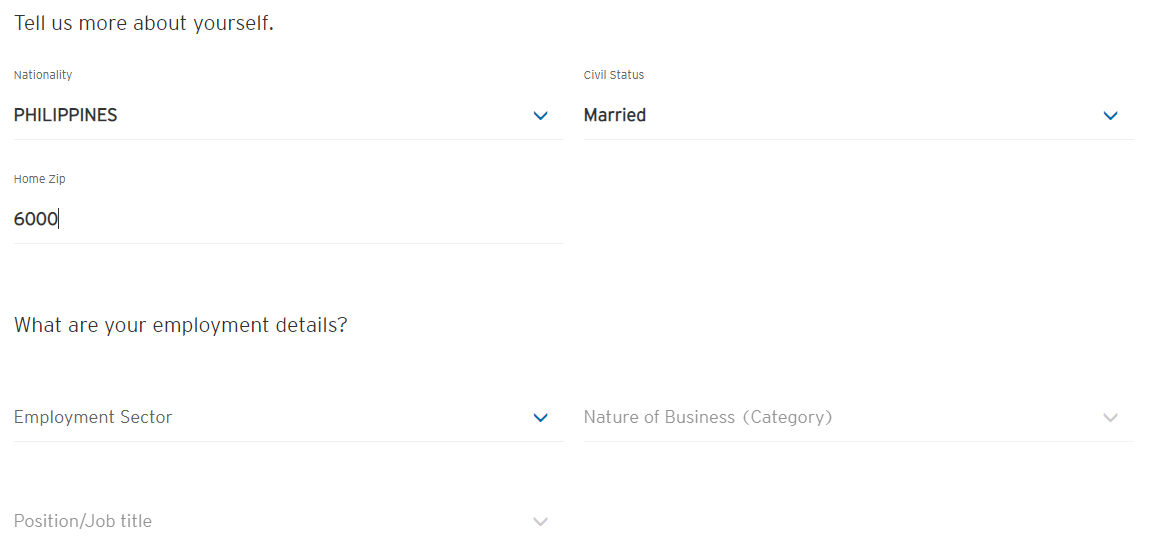

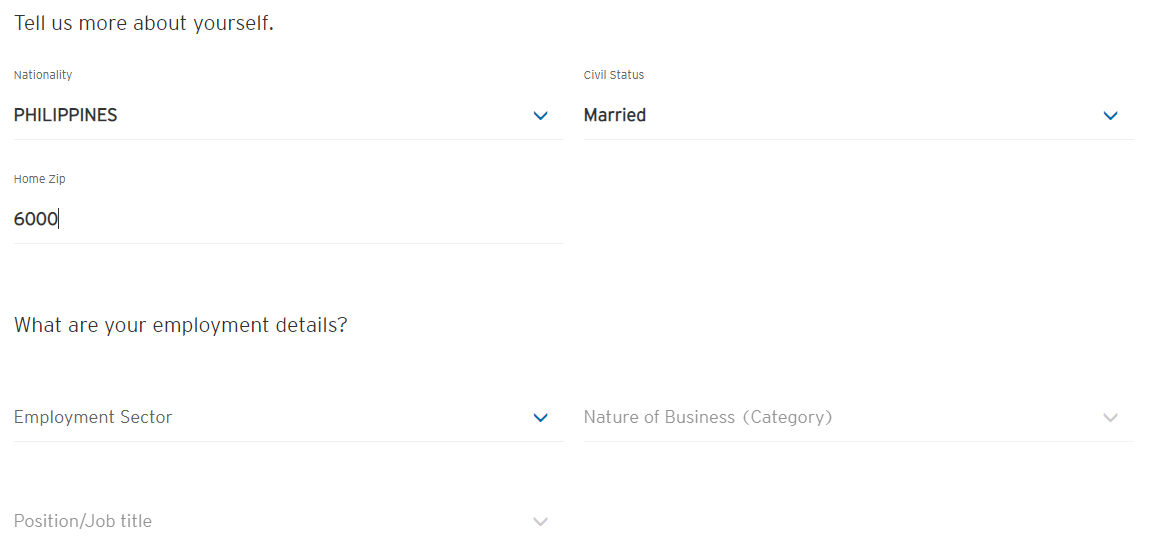

Provide your employment and salary details and your marital status and zip code.

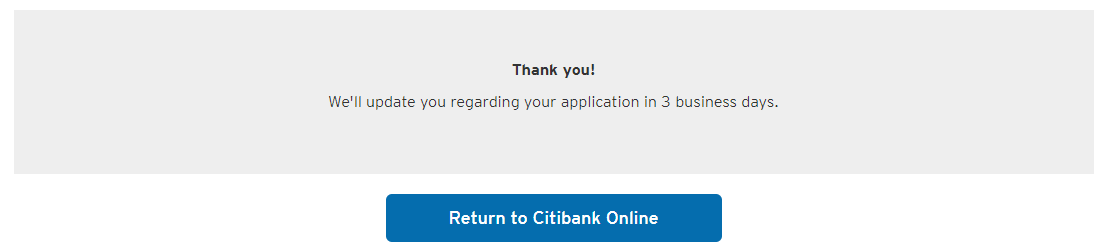

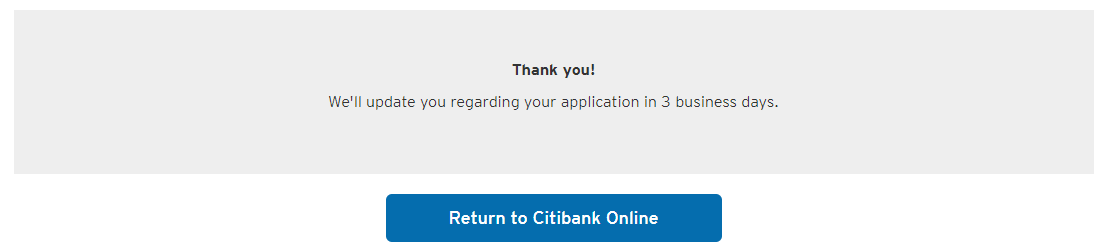

After submitting the form, you will see the screen below:

More than the access to financing, it is also crucial that people have easier access to insurance and investments to help people elevate not just the quality of their present lives but also their future.

When people have access to wealth-building, more and more people are empowered to live their best lives and this is what Citibank Philippines can definitely offer.

Table of Contents

Table of Contents