Loans Products

Auto Loan

Anyone who’s ready for an upgrade and plans to purchase a brand new car can check Bank of Commerce’s Auto Loan interest rates for great deals and discounts.

Loan Features

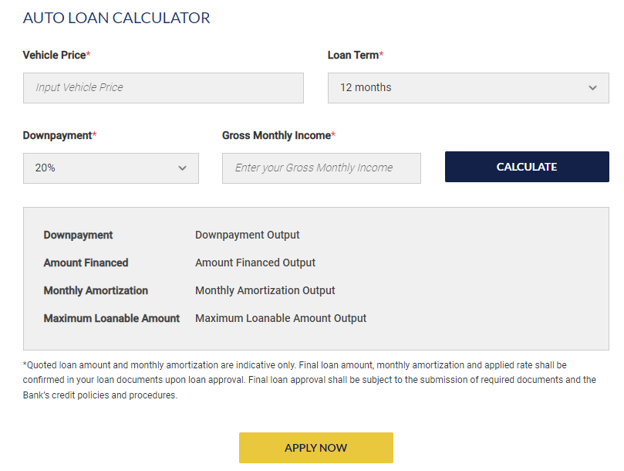

Loan Amount: minimum of Php100,00

Loan Term: 12 months to 60 months

Downpayment: 20% to 45%

Interest Rate: will depend upon the bank’s approval of the loan

Requirements

General

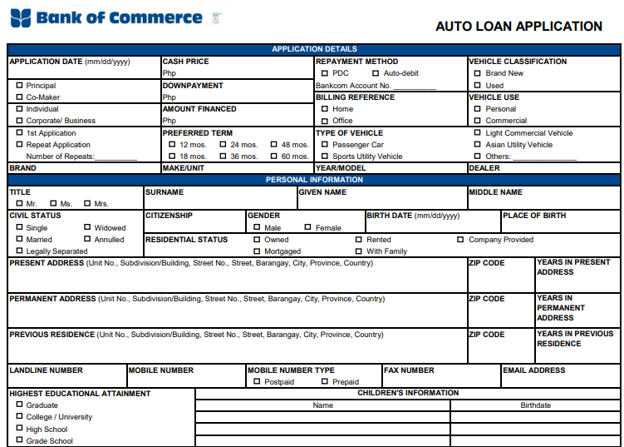

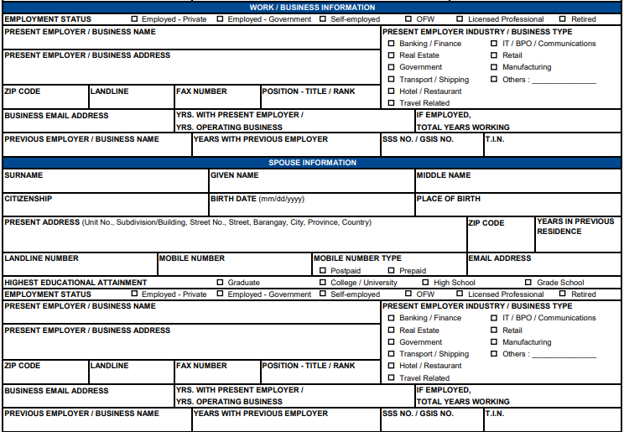

- Auto Loan Application Form

- Photocopy of valid ID (individual if employed and self-employed/authorized signatories if corporation and partnership)

- List of acceptable ID: Driver’s License, Passport, SSS ID, Company ID (if Top 5,000 Corporation), Postal ID, PRC ID

- Photocopy of deposit passbooks or bank statements (6 months)

- Billing statements (cellphone, utilities, etc.) (latest 1 month)

- Vehicle quotation from the dealer (if available)

Employed

- Copy of Income Tax Return (ITR) with BIR or bank stamp (latest 1 year)

- Certificate of Employment stating applicant’s position, income, and length of stay in the company (original copy only)

Self-Employed

- Copy of business registration papers with DTI (if single proprietorship) or SEC (if partnership or corporation)

- Copy of Audited Financial Statements (latest 1 year)

- Copy of Income Tax Return (ITR) with BIR or bank stamp (latest 1 year)

Corporation / Partnership

- Copy of business registration papers with DTI (if single proprietorship) or SEC (if partnership or corporation)

- Copy of Audited Financial Statement (latest 1 year)

- Copy of Income Tax Return (ITR) with BIR or bank stamp (latest 1 year)

- Secretary’s Certification / Board Resolution

Home Loan

Whether you’re planning to buy a new condo unit or build a new home, you may do so through the Home Loan product of Bank of Commerce. Among the many loan purposes that borrowers can avail of are the following:

- Purchase of house and lot, townhouse, or condominium unit

- Construction of house on a lot already owned by the borrower

- Major repair, improvement, or expansion of an existing house

- Refinancing / take out of existing housing loan

Loan Features

Loan Amount: minimum of Php500,00

Loan Term: 10-20 years

Down Payment: 20% to 50%

Interest Fixing Rate:

- 1 year fixed at 8%

- 3 years fixed at 8.25%

- 5 years fixed at 6.75%

Requirements

General

- Home Loan Application Form

- 2 x 2 Photos (both spouses / co-obligor)

- Photocopy of valid ID

- List of acceptable ID: Driver’s License, Passport, SSS ID, Company ID (if Top 5,000 Corporation), Postal ID, PRC ID

- Photocopy of deposit passbooks or bank statements (3 months)

- Marriage contract (if applicable)

Employed

- Copy of Income Tax Return (ITR) with BIR or bank stamp (latest 3 years)

- Certificate of Employment stating applicant’s position, income, and length of stay in the company (original copy only)

- Copy of payslip (last 3 months)

- Proof of other sources of income, if any

- Proof of billing address and Original copy of Latest Contract of Employment (OFW/Seafarer)

Self-Employed

- Copy of business registration papers with DTI (if single proprietorship) or SEC (if partnership or corporation)

- Copy of Audited Financial Statement for the last 2 years

- Copy of Income Tax Return (ITR) with BIR or bank stamp (latest 3 years)

- Company / business profile

- List of major suppliers / customers

Small Business Loan

Bank of Commerce understands that businesses will need financing to achieve additional working capital requirements to either sustain their day-to-day operations or to support the company’s growth expansion plans. That’s why Bank of Commerce has come up with a small business loan for entrepreneurs.

Loan Features

Loan Amount: Php 1 Million to Php 15 Million

Interest Rate: at the prevailing bank lending rate

Loan Term: 1 to 5 years

Eligibility

- Sole Proprietorships who are Filipino citizens; Corporations and Partnerships (at least 60% Filipino-owned)

- Depositor of Bank of Commerce or other bank/s for at least one (1) year and who maintains an ADB of at least P200,000

- Must have at least 3 years of profitable operations

- The owner is not more than 65 years old upon maturity of the loan

- No derogatory record related to credit and/or deposit

- Business must be registered with DTI or SEC

- Must offer acceptable real estate collateral and/or peso or foreign time deposit with any Bank of Commerce branch

Requirements

- SBL Application Form

- Photocopy of any 2 valid IDs with photo and signature

- Copy of ITR & AFS of the business for the last three (3) consecutive years

- DTI Certificate of Business Name Registration for sole proprietorship / SEC Papers for partnership and corporation

- Business/ Mayor’s Permit

- Bank Statements for the last 6 consecutive months

- Signed Authority to Bank Check

Collateral Documents

- Copy of TCT/CCT, updated Tax Dec & RETRs

- Vicinity Map/location plan/lot plan/building plan

- Master Deed of Restriction (for condos)

- Copy of Deposit Instrument (if secured by deposit)

Why Choose Bank of Commerce

Bank of Commerce has become a preferred banking choice for many Filipinos in the country because of the following:

Convenient Banking and Loan Applications

People love convenience when it comes to banking because they want to save time when making transactions such as payments. That’s why Bank of Commerce makes an ideal option for banking and loan applications. They have many branches and ATMs located nationwide, making it easier for depositors to visit the nearest branch.

In addition to that, loan and credit card applications may be initiated online without having to visit the physical branches.

Completely Transparent – No Hidden Charges

Bank of Commerce values transparency in all of its dealings with its customers. All the fees and additional charges are disclosed in the terms and conditions. This ensures that the customers will not be surprised with charges when they fall due.

Online Banking Available

To facilitate a better banking experience for their customers, Bank of Commerce has made available its online banking to help people transact faster, easier, and more conveniently. With online banking available, depositors can simply access their accounts through the website or mobile app. They don’t have to visit the branches to make transactions.

How to Sign Up

To avail of any of the loan products of Bank of Commerce, customers can visit the website and head on over to the loan product they wish to apply for. At the bottom of the page, the borrower will be able to see the loan calculator, and have an idea of whether or not he or she will be able to afford the down payment and monthly amortizations.