Company Information

Asteria is an online lending company that allows Filipinos to apply for loans from their computers and smartphones. When borrowers have submitted all the required documents, they just need to wait for the approval of the loan and for the money to be credited to their bank account. The process is made very simple to ease some of their customers’ burdens already have.

Asteria’s primary goal is to provide online, reliable, and efficient means to apply for a loan. It recognizes that not everyone will have the means or even the capability to approach banks or lending companies for their needs. It is a legal lending company that operates under SEC Registration no. CS201603853, customers are assured that they do not impose impossible interest rates and terms on borrowed loan amounts.

Here are the other pertinent details relating to Asteria:

- Main Office Address: 14th Floor, World Center Building, 330 Sen. Gil Puyat Avenue, Makati City

- Office Hours: Monday to Friday (9:00 AM – 7:00 PM)

- Email Address: [email protected]

- Contact #: 02 5318 8000

All the transactions relating to loan applications are only done online, even if they have a physical office. This ensures that you can apply no matter where you are in the Philippines.

Loan Types

Asteria currently offers two types of loans: Personal Loans and Salary Loans:

Personal Loan

The need for immediate funding when emergencies happen is unavoidable. Sometimes, it’s hard to reach out to your family or friends for financial help. For an urgent need, banks will not be able to provide your needs right away.

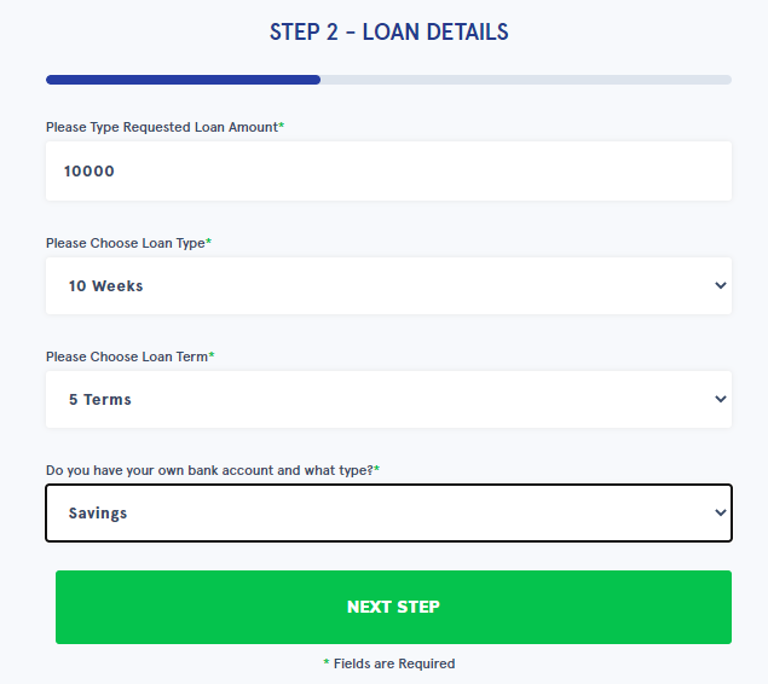

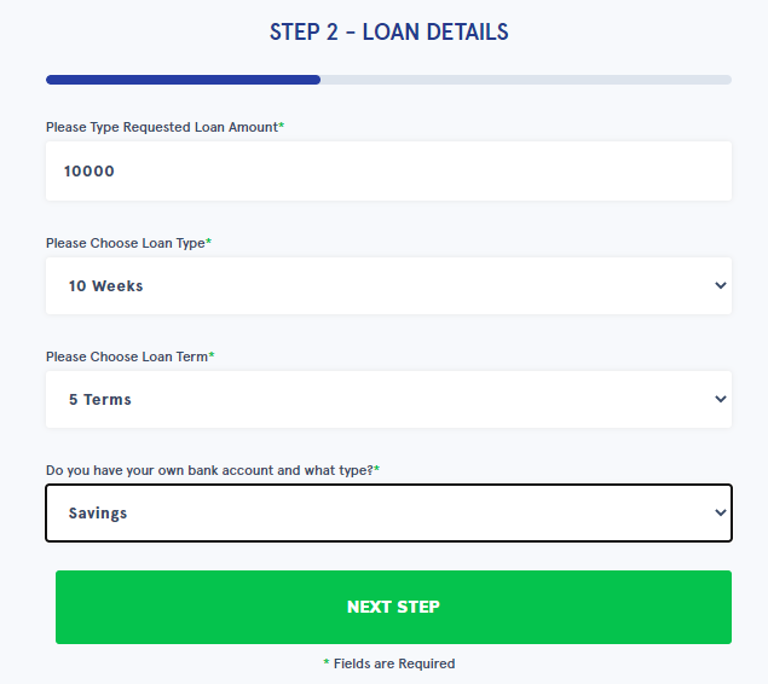

For emergency needs like medical bills, tuition fees, personal needs, and even major milestones in life, applying for a personal loan from Asteria is a perfect choice. First-time borrowers can apply for the maximum loan amount of Php 10,000 while existing customers can apply for up to Php 20,000—still depending on the applicant’s current salary and previous loan history with Asteria. The minimum loan amount is Php 2,000.

Asteria offers a fixed interest rate of 0.90% per day. In addition, the loan term is very flexible because customers can opt to pay it within 61 days to three months with installment terms of three to six terms, thereby allowing customers to assess their level of comfort on repayments. The idea is to provide a more straightforward repayment solution and avoid any stress.

Here are some of the eligibility requirements to check before you apply for the loan:

- Filipino Citizen

- 21 – 60 years old

- Minimum Salary of Php 10,000

- Own a personal bank account

If you meet all of the eligibility criteria, you can proceed with preparing the requirements:

- Government-issued ID (UMID, TIN ID, Philhealth ID, or Driver’s License)

- Credit Rating: bank specified credit score

- Proof of Billing

Salary Loan

Sometimes you might have obligations and commitments before your paycheck arrives, and you fall short of cash. Unfortunately, it can happen, and when it does, it causes anxiety. Good thing Asteria has a salary loan option. It is a temporary financing solution while waiting for your next paycheck.

To be eligible for a salary loan, you must satisfy only three criteria:

- You must be a Filipino citizen.

- You must be at least 21 years old, but not more than 60 years old.

- You are a salaried / commission-based employee.

The requirements for loan approval include:

- Government-issued ID

- Company ID

- Latest Payslip

- Personal Bank Account

- Proof of Billing

Like with the personal loan, the minimum amount you can apply for is Php 2,000 and the maximum amount is Php10,000 for first-time applicants and Php 20,000 for existing customers. The interest rate is also fixed at 0.90% per day, and the loan period can be from 61 days to 3 months, payable in 3 to 6 installment terms.

Salary loans are designed to help their customers address an immediate concern at the soonest possible time. Borrowers are less inclined to spend it on non-essentials because the purpose of a salary loan is specific.

Installment Terms

The repayment terms of Asteria are not so common, so here is a more detailed look into their installment terms:

61 days Loan (4 equal installments)

The first payment is due on the 15th day after the loan is deposited in your account. After that, you will have to make 3 more payments every 15 days.

10 Week Loan (5 equal installments)

You will make your first payment after 15 days from the date of receipt of your loan amount. And then you will have to pay 5 more installments every 15 days.

12 Week Loan (6 equal installments)

You will be making 6 equal installments over 12 weeks, with the first payment due 15 days from the date of deposit of your loan amount in your bank.

Note that these are the maximum installment period for the loan term you choose. Of course, you can always opt for a shorter installment period, depending on your financial capacity.

The disbursement of the approved loan in your bank account is usually within two days from the date of approval via Instapay. Upon submitting your application, the team from Asteria immediately processes your loan and verifies all the information received. Therefore, the approval happens only within 24 hours.

Repayment

Upon the approval of the loan application, Asteria sends repayment instructions to the customer’s email ID. The detailed instructions will include when, where, how much the customer should pay, and the penalties or consequences incurred in case of late payments. For example, a late payment will result in a penalty of 1% per day plus late payment charges.

The installments can be repaid through the Dragon Pay Payment Facilities available at every 7 Eleven, Cebuana, LBC, SM Payment Centers, Robinson Payment Centers, and Bayad Centers.

To make sure that you never miss any payments due, make sure that you log in to your Asteria account from time to time to make sure that your payments are posted against your loan account.

Why Choose Asteria

Asteria has a lot of outstanding qualities as an online lending company, and we have highlighted four of them:

Fast

Asteria recognizes the urgency of the financial needs of Filipinos. The applications are received as soon as they are submitted and worked on because everything is through online transactions. From submission to approval, the 24 hours processing delivers what is expected.

When it comes to the disbursement, the 2-day processing is not a long wait, too. Nobody has the time to go back and forth with the requirements and processing, which sadly happens to most loan applications in the country.

Upfront and Clear

There are no hidden fees. From the start of your application, you know exactly how much you will be receiving in your account, the charges you will incur for the loan application, and the interest. You will even know how much you will have to pay should you be late in your payments.

Customers should not be left with higher payments on fees and interests than the loan amount.

Competitive Rates

Asteria offers an interest rate that is comparatively lower than what is provided by other lending companies. By doing this, Filipinos are given a chance to work on their financial stability by not crippling them with fees they will face difficulty paying.

Moreover, returning customers can benefit from a higher loan approval with lower interest rates, even when you have not completed paying for your current loan.

Flexible Terms

With the broad array of repayment options Asteria offers, its customers can sleep better each night knowing they have a reasonable repayment period that matches their salary. That way, they will not have to face any difficulty budgeting their money.

Customers know exactly when they have to pay and how much they have to pay. It helps them foresee their expenses in the future and make all the necessary adjustments in their monthly budgets.

How to Sign Up

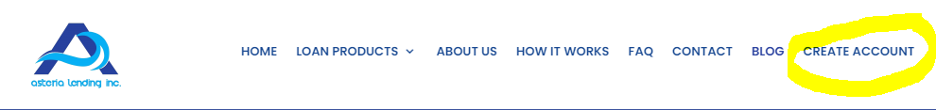

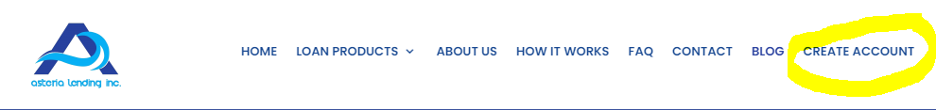

Click below and Visit Asteria’s website

To sign up for a loan, click on the “Create Account” button found on the right-hand side of the home page.

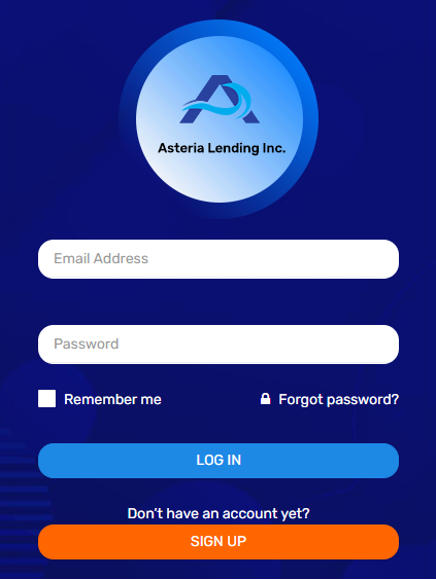

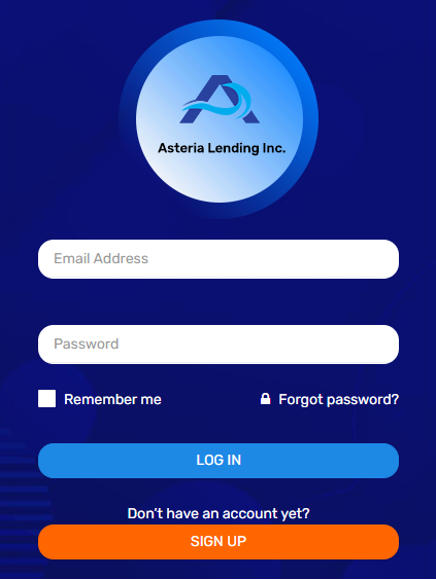

Click on the Sign-Up button. It will prompt you to create an account. Provide your name, phone number and email ID, and account password. When you get approved for a loan, it is easy to track the loan details and repayment schedule when you sign in. So you have to make sure that your password is secure and easy to remember.

The next step will require the details of the loan amount you need and the terms that work for you. After that, you will be required to enter your address details.

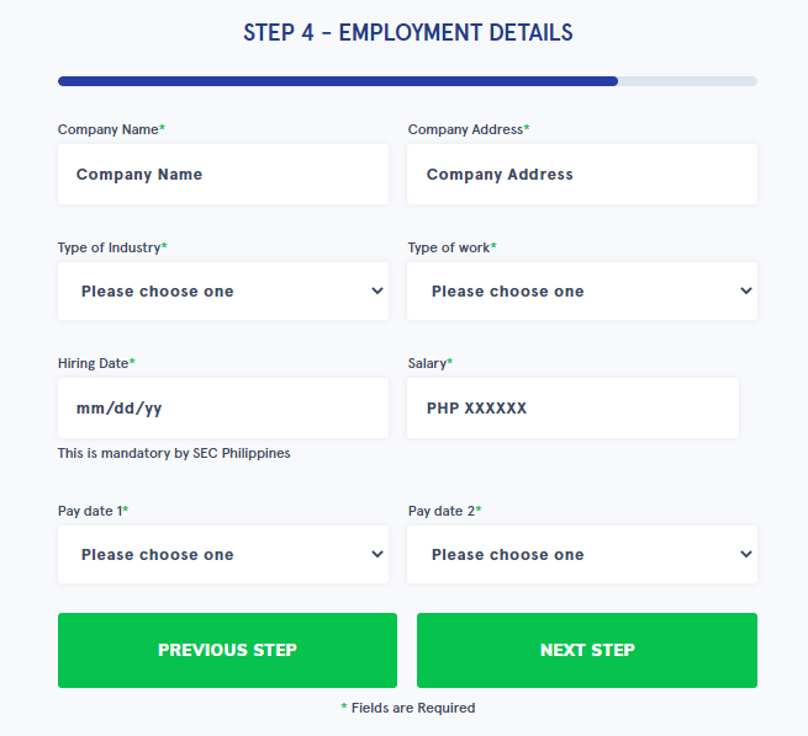

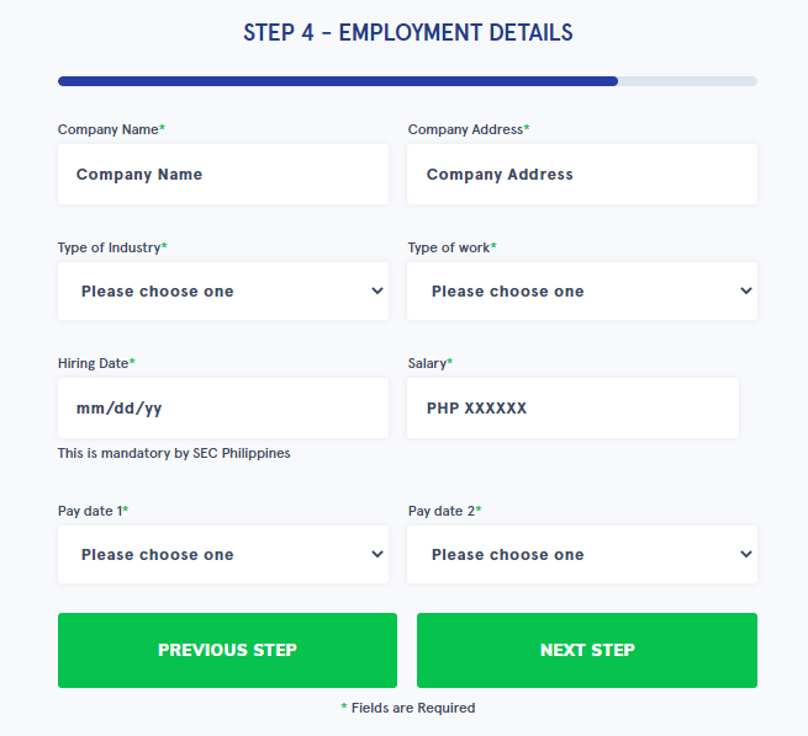

You will then have to enter your employment details. Have at least two months of your latest payslips scanned and ready.

After filling out the necessary information, accept the terms and conditions, click submit and then wait for their customer service to call you for verification of your account. From the time of submission to the verification and, eventually, the approval, this process is within 24 hours.

After the verification process, Asteria will notify you about the approval of your loan and repayment instructions through your email ID. These details are also accessible when you log in to your Asteria account.

Conclusion

No matter how good we are at budgeting, emergencies happen. And when they do, having a lending company like Asteria somehow provides comfort, especially to the working class Filipinos who earn less than the minimum wage and can’t afford to apply for a credit card or a bank loan.

Having a product made available to ordinary Filipinos with competitive interest rates and no hidden charges, flexible payment terms, and loan repayment period helps them manage their finances.