Editor’s Note: Piggyy is always fact-checking the information of each brand. We have checked the credentials of Akulaku and found out that its main company, Streetcorner Finance Co., Inc. still registered on the Security Exchange Commission’s list of financing companies. However, Akulaku isn’t included in the list of recorded online lending platforms. The mobile apps are under maintenance, according to their Facebook post. When you download the iOS app, you will be directed to the Test Flight, while the Android app has received poor ratings on the Google Playstore. Therefore, we don’t recommend Akulaku and its services.

Company Information

Akulaku is the largest online financing company in the Southeast Asia Region. They also initiated the first online mobile installment application in the Philippines, Indonesia, Malaysia, and Vietnam. As a global e-commerce platform, its services include cardless installment shopping, cash loans, bills payment, mobile and game top-ups on installments, and travel leisure packages on installments.

Recognizing that not everyone has the funds on hand for most of their needs, Akulaku provides a solution for those who do not wish to get loans with short payment terms and high-interest rates. Akulaku also offers customers the opportunity to take advantage of installment payments when shopping online and for merchants to sell their products through the platform.

Akulaku is registered under Streetcorner Lending Corporation with SEC Registration No. CS201606603 and located at 24F IBP Tower, Jade Dr., San Antonio Pasig, 1605 Metro Manila.

They offer customer support in English and Tagalog at +63 02 5304 9120 to 29, and customers can send all queries and concerns via email at [email protected]. All customer service concerns are responded to by Akulaku every Monday to Friday from 8:00 AM to 5:00 PM.

Types of Services Offered

Sellers and buyers are welcome to sign up with Akulaku. It’s a good business partnership for those with a wide range of products offered to thousands of Filipinos browsing through Akulaku. At the same time, those seeking items for personal and business use and interested in the flexible payment offer are most welcome to join Akulaku.

Become a Merchant

Selling your products on Akulaku is just as if you were to sell your products on Shopee or Lazada. To become one, you don’t need to download the app. Instead, you can go to the website and register. Full details on becoming a merchant are discussed further in the section below.

Here are the few requirements that need to be prepared to become a Merchant:

- Shop Name

- Name of Owner

- ID Number

- Photo ID

- Email Address

- Phone number

- Bank Account Information of the Owner

- Save URLs on different business platforms

- Product category selling

Because of the increasing number of people registered with Akulaku, being a partner ensures that you get another source of income. You might realize your dreams of financial independence and security.

Credit Limit

When talking about credit limits, people can only think of credit cards. While that may have been true a few years ago, that can also pertain to a preapproved limit for installment shopping at Akulaku. A credit limit is key in availing of the services that Akulaku offers because you can only start shopping using the app once this is done. Once approved, you can use this to avail their services for a cash loan, installment shopping, or mobile top-up.

Cash Loan

Before applying for a cash loan, you must first have an approved credit limit. Once this is done, you can choose to pay for the loaned amount in 12 installments with an APR loan interest fee of 36%.

Installment Shopping

Like with a cash loan, you must have an approved credit limit before choosing the items you wish to pay on installment. This will also be subject to interest depending on the item chosen and the installment period.

Mobile Top-Up

Mobile top-up works like buying a prepaid load in convenience stores or malls, and you have to enter the network carrier of the mobile number you wish to purchase the load for, the mobile number, and the amount.

You can choose to fully pay for the loan or make a down payment and then pay the balance the next month with interest.

Why Choose Akulaku

Signing up with Akulaku ensures members of multiple benefits within the app. Imagine having all you need inside an app where you can transact with just a few clicks. Life can never be made simpler.

Here are the other reasons why you should choose Akulaku:

Multiple Benefits and Options to Utilize the Credit Limit

A preapproved credit limit ensures users a wide array of services they can choose from and are not limited to just availing one. As long as you have not maxed out your credit limit, you can choose what services you need, from a cash loan to installment shopping and purchasing prepaid loads. It makes Akulaku a one-stop shop for whatever it is that you might need.

Works Like a Credit Card Without the Actual Card

Credit cards exist for users to make purchases when they don’t have cash. When used responsibly, having a credit limit can ease up some people’s burdens when needs arise. The great thing about having a credit limit with Akulaku is unlike a credit card, you do not have to worry about your card getting lost and other people using it without your consent.

As long as your Akulaku account is secured and nobody else knows your account password, nobody can use your credit limit.

Ease of Transacting Online

Looking for what you need is easy when you do not have to travel to look for the items you need. Instead, you can easily browse through merchant shops and choose the items you need, pay through your credit limit, and choose the installment period that is convenient for you.

The same is true when you wish to apply for a cash loan, and you can also do it through the app.

A Revenue Source

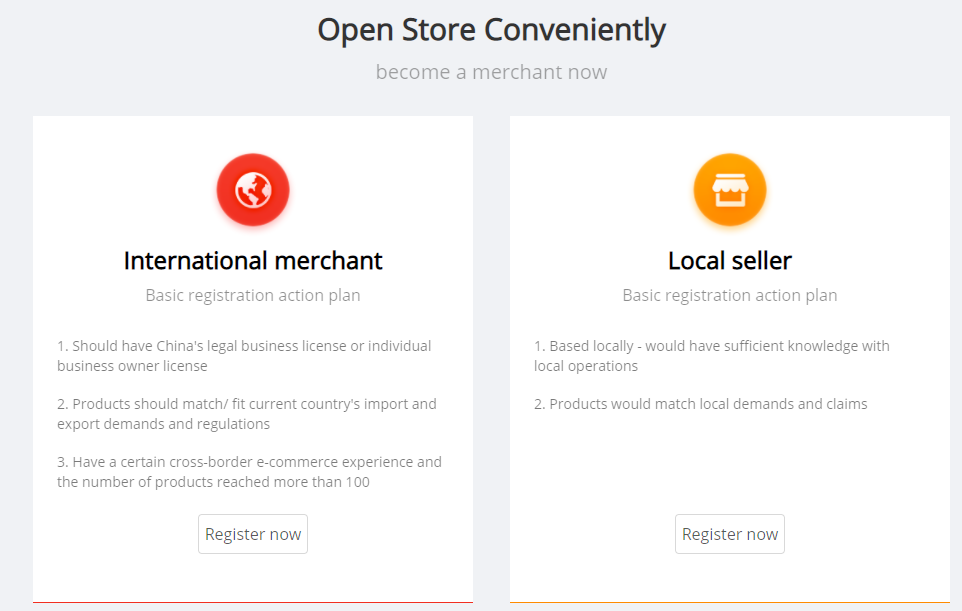

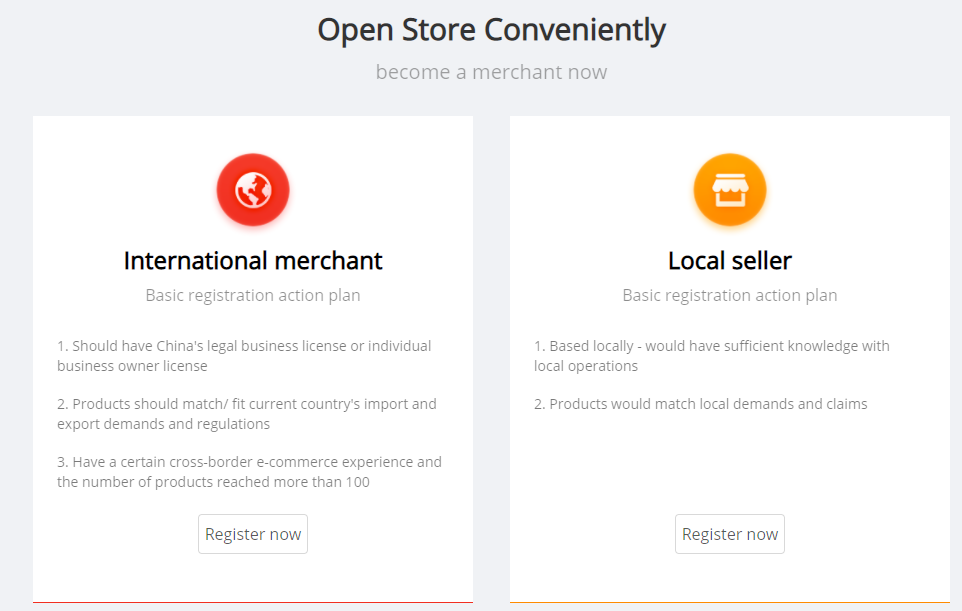

It is good to know that those who wish to join Akulaku are not only limited to those who want to apply for a cash loan or installment shopping. Those who have something to offer can increase their revenue stream by becoming local sellers or international merchants.

Convenient

Akulaku provides users with thousands of products that are available on installment. With their goal to financially empower Filipinos by providing technologically advanced e-commerce platforms, having an available app within reach is helpful.

Everything else available online changes people’s perspectives when it comes to purchasing. And so installment payments help those working on a very tight budget without compromising their overall financial health.

How to Sign Up

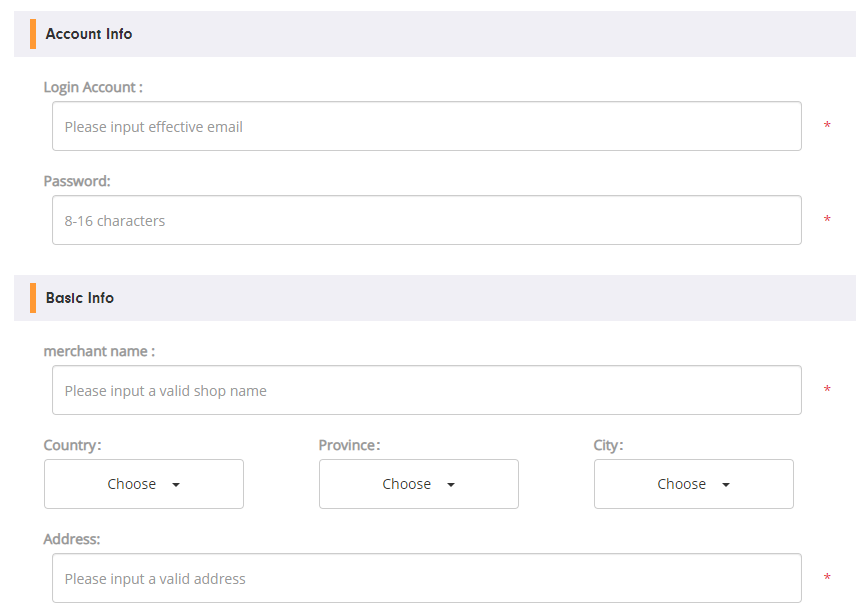

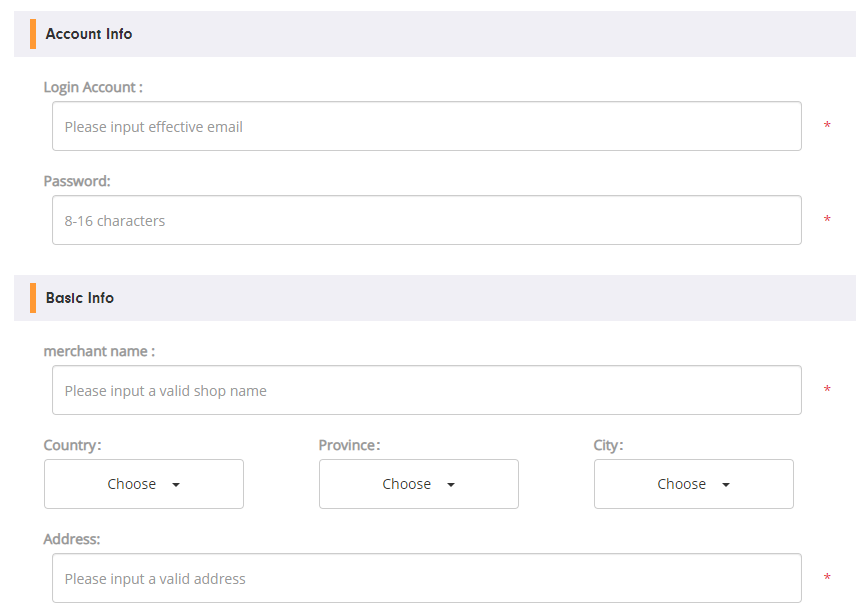

To become a Merchant, here are the steps to help you start your journey as a Merchant on Akulaku:

Go to https://merchant.akulaku.com and click “Register Now”.

Choose the type of merchant you wish to become: International Merchant or Local Seller.

Fill out the merchant application form which will need the following information:

Account Name and Password

Shop Information (Name, Address, Service Area)

Transaction Information for Payment

Submit your application form. Akulaku will contact you afterward to process your application and verify the supplied information.

Once verified, you may now log in to your Merchant Console to upload your products on Akulaku and start selling.

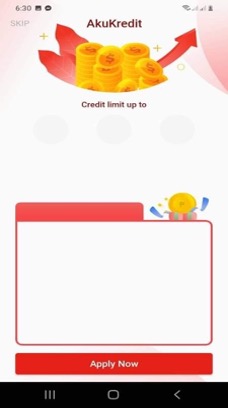

Should you wish to avail of the services that Akulaku offers, up to ₱25,000 credit limit can be approved simply by following these easy steps:

Download the Akulaku App and register for an account. Upon signing up, you will be prompted to create an account through your active phone number. Just make sure that you own the number you register with.

Apply for a credit limit, go to the Credit tab, and tap “Apply Now”.

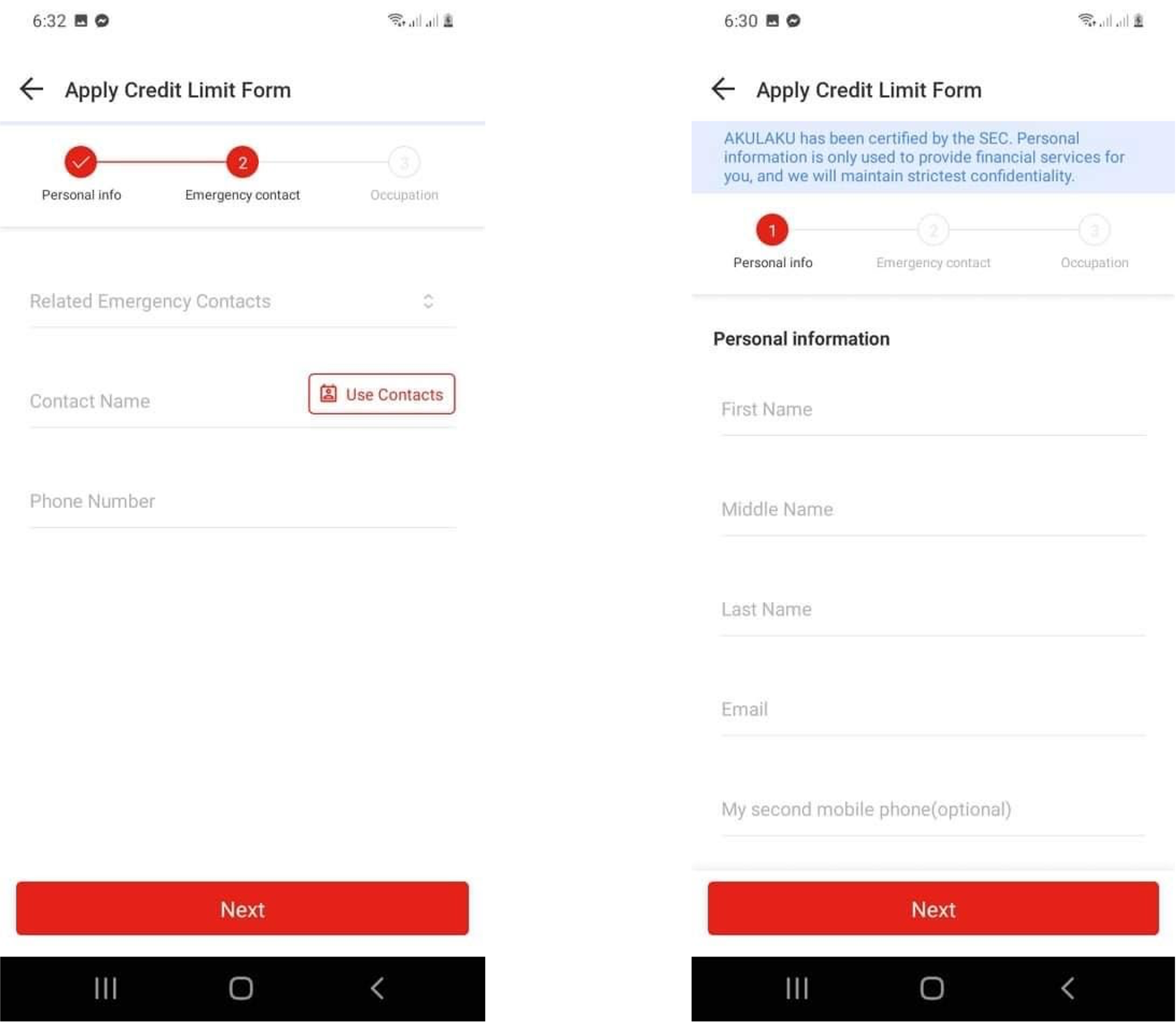

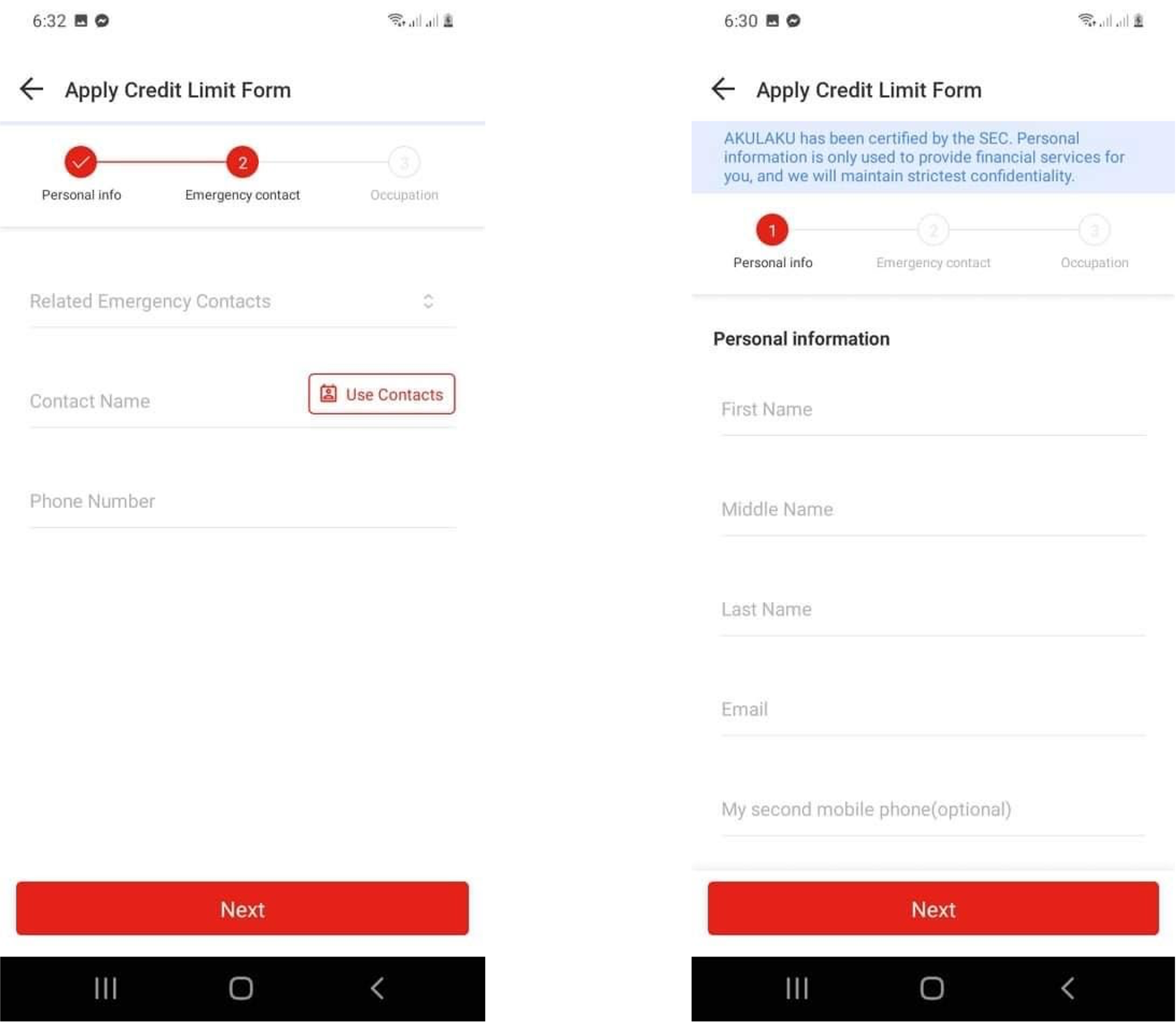

Fill out the application form and provide all the details required, including your emergency contact information and employment details. Once done, upload the following requirements for verification. You will immediately know the preapproved credit limit based on the income details you will submit. 3 copies of signature 1 copy of government ID Selfie with your ID photo of two recent payslips.

Submit documents and wait for a verification call. Ensure that all information entered is complete and correct to avoid Akulaku discrediting your application.

Once the Credit limit is received, you can now enjoy Akulaku Services.

Frequently asked questions

What is a credit limit?

What does a credit limit do?

How to increase your Akulaku credit limit?

Conclusion

With the stream of online shopping sites, Akulaku has the capacity to provide credit limits to its users. Having this feature helps people buy what they need without worrying about their cash requirements or stretching their budgets. And better than a credit card, having to pay for installments is more than anyone could ask for – it is easy to budget and convenient for the user.

It is not just the advancement of technology that Akulaku stands for and meets this change – it is their commitment to empowering Filipinos that makes them stand out financially. They do not just dream of addressing a current financial issue, but they also provide the means to address it using technology and reasonable means of handling it.

Now people do not have to look at credit limits as something that pertains only to credit cards. When people think of a credit limit, they will also think about Akulaku.