What is SSS?

Social Security System (SSS) is social insurance in the Philippines that offers its service to private individuals and private companies. The regular SSS insurance coverage imposed two payment categories: compulsory and voluntary. The paying members under the compulsory category are private individuals who can be self-employed, employers & employees in a private company, house helpers, and OFWs. While those belonging to the voluntary payment category are the non-working spouses or separated members.

The benefits and services offered by SSS to its members are sicknesses, maternity, retirement, disability, death, funeral, and unemployment benefits. Also, SSS provides loan products to its active members such as salary or cash loans for private individuals, and business loans for business enterprises.

Loans Offered in SSS

SSS provides financial assistance to business enterprises through its Business Development Loan Facility program. It is a program of SSS that helps the government to increase the economy’s growth by offering financial assistance to business enterprises.

Eligibility Requirements

The business loan product applies to newly registered businesses and to existing private companies that also include Barangay Micro Business Enterprises (BMBEs). Listed below are the industries that are qualified for the business loan program:

- A Sole Proprietor, Partnership, Corporation, Cooperatives, and Non-government organizations which are Filipino-owned with at least 60% ownership.

- All business industries but not limited to:

- Agri

- Food Process

- Manufacturing

- Commercial Production

- Service Enterprises

- Tourism Projects

- Real Estate Projects

- Projects related to Sustainable Energy

- Industries focused on Extraction such as mining, etc.

- Projects in the Development of Forest

- Trading

- Leasing/Lending

- A report shows the profitability rate of the company for the last 3 years. If by any chance the company incurred a loss in any of the applicable 3-year periods, the computed average rate of profitability must still be positive. For an enterprise that is still new in the market and only has five (5) years of operation, the waiver of profitability record is allowed.

- The business enterprise has a good standing and is an SSS member-employer.

Note: Eligibility qualifications may vary depending on SSS requirements.

Loan Purposes

Listed below are the purposes applicable for business loan applications:

- Development of the company’s site

- Improvement of existing facilities

- Repair and maintenance of the building

- Repair and maintenance of the machinery and equipment

- To acquire existing facilities

- To acquire land (not more than 50% of the acquisition cost)

- Working Capital

Loan Features

Loan Amounts

The loan amount must not exceed the borrower’s debt to equity ratio of 3:1. The maximum loanable amount must be equivalent to 5% of the Investment Reserve fund of the SSS. If the condition is met, the maximum loanable amount must be the lowest of the following:

- Applied loan amount

- The actual amount needed by the borrower.

- The collateral’s market value

- The standard allowable maximum amount of P500,000 per loan applicant.

Interest Rates

- The basis of the interest rate will be on the current pass-on rate plus PFI’s spread of SSS to PFI. It can be a variable or fixed interest rate and is subject to monthly reviews.

Loan Terms

The maximum term is 15 years and an additional grace period of 3 years applies to the principal amount.

Listed below are industries that are allowed to acquire a loan term more than the maximum term and the additional grace period:

- Related forest development projects

- Extractive related industries

- Other exceptional cases

- That needs a longer repayment term with a maximum loan term of 25 years.

Collaterals Accepted

The collaterals accepted will be based on PFI and SSS’ discretion. It is only applicable for a fully secured loan.

Penalty and other charges

In terms of the pre-termination of the loan, the transaction will not be subject to any penalties or pre-termination charges.

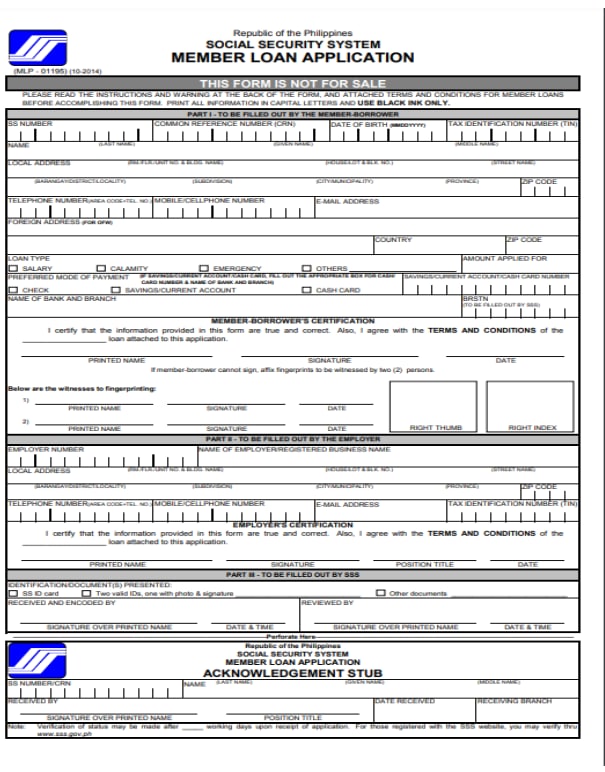

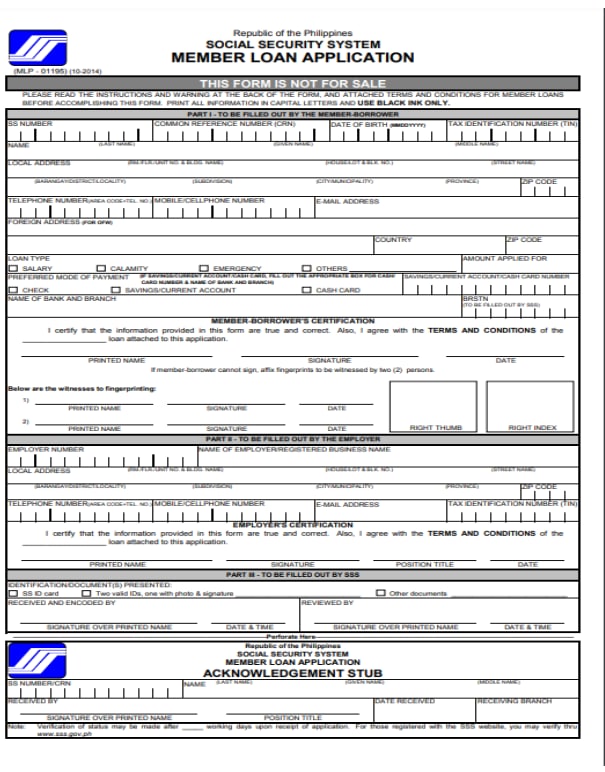

Application Form

Below is the sample loan application form. The form is downloadable on the SSS website, or you can get a copy at any SSS branch.

Part I of the form is intended to be filled out by the borrower, including personal and related details.

Part II is applicable for employed member-borrowers. It requires the employer’s details and approval. On pages 2 and 3, instructions are provided on how to properly fill out the form, and also a guide on what requirements are needed.

Conclusion

SSS designed a loan product that is intended to help business enterprises to be able to keep up with their business operations. While helping a business entity, it simultaneously contributes to the increase in the growth rate of the country’s economy. The SSS business loan application form is simple to fill out and will only take a few minutes to complete.