What is a Business Loan

Businesses, like humans, also have goals. And they often demand a lump sum of capital to cover early expenditures or pay for any potential developments. As a result, business owners seek financial support in the form of business loans. A business loan is a type of loan designed for business purposes only; it is a debt that the business must pay back as per the terms and conditions of the loan.

Types of Business Loans

Term Loan

Those who have taken out personal loans may be very well familiar with term loans since both loans work pretty much the same. A term loan is one in which the borrower receives cash upfront, which they must repay through regular installments with the agreed interest, over a certain period (repayment terms).

Term loans are suitable for both short-term and long-term financing, and are perfect for businesses, particularly for startups, who wish to have more manageable loan repayments.

Credit Line

A credit line is a type of business loan that provides a predetermined sum of money that businesses can draw from and repay afterward. They are revolving, which means the borrower can spend the money up to the permitted amount, then return what they have spent in order to make the funds available again. With a credit line, borrowers will be able to access funds without having to reapply.

Secured Business Loans

If the business owner qualifies for a secured business loan, the bank or other lender will demand collateral. It could be anything of value that the lender may confiscate should the borrower fail to repay the loan. The collateral tends to reduce the lender’s risk, while also providing better options for the borrower as they may be entitled to a higher loanable amount with longer terms which is perfect for any business goal.

In short, collaterals provide a guarantee to the lender and responsibility for the borrower concerning the repayment of the loan.

Unsecured Business Loans

Unsecured business loans are the opposite of secured business loans. Lenders do not need collateral from their borrowers, however, they usually only give smaller loan amounts with shorter repayment terms and hefty interest rates.

Because business loans often provide a lump sum of money upfront, qualifying for this type of company loan may be challenging given the lack of collateral. Borrowers will be evaluated mostly based on their credit ratings and capacity to repay the loan.

Qualifying for a Business Loan in the Philippines

While each bank in the Philippines has its own set of criteria to observe, applicants should be aware of the following standard business loan requirements before preparing to apply:

- The borrower must be a Filipino citizen at least 21 years old

- Have good personal and business credit scores

- Businesses must be legally operating in the country

- Business should meet the minimum annual gross sales and has at least a year of profitable business operation

- Business plan for startups

How to Take a Loan from Banks for Business

BDO SME Loan

Loanable Amount: ₱1 Million to ₱20 Million

Loan Tenor: Maximum of 10 years

Interest Rate: 6.25% to 7.25% per annum

Processing Time: within 10 banking days

Accepted Collateral: Real Estate Property

How to Apply:

Check your Qualifications

The borrower must be 21 years old at the time of loan application but not older than 70 years old at the time of loan maturity. The business has been profitable for at least 2 consecutive years, has an annual gross sales of at least ₱1 million, and is within a BDO serviceable area.

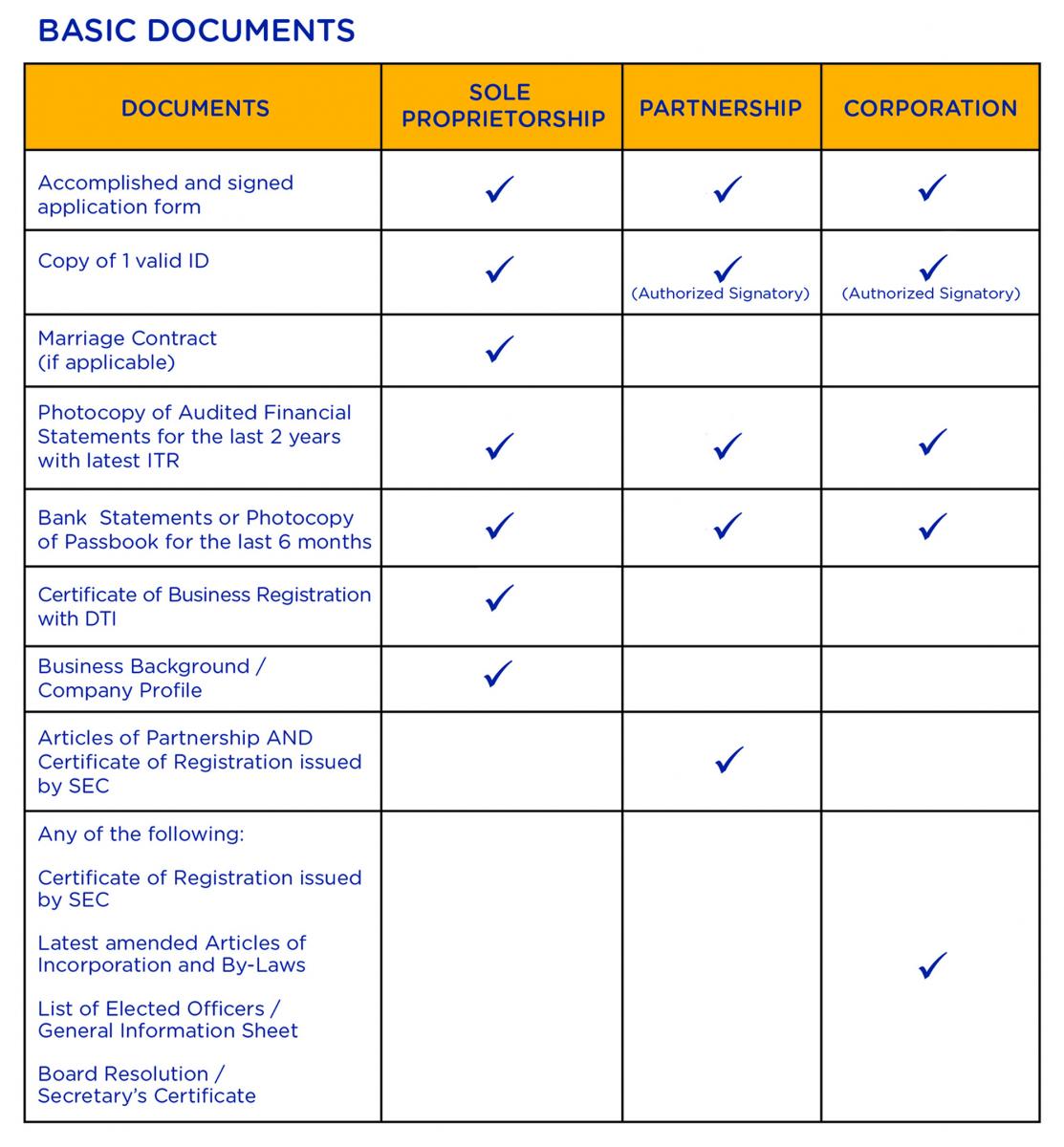

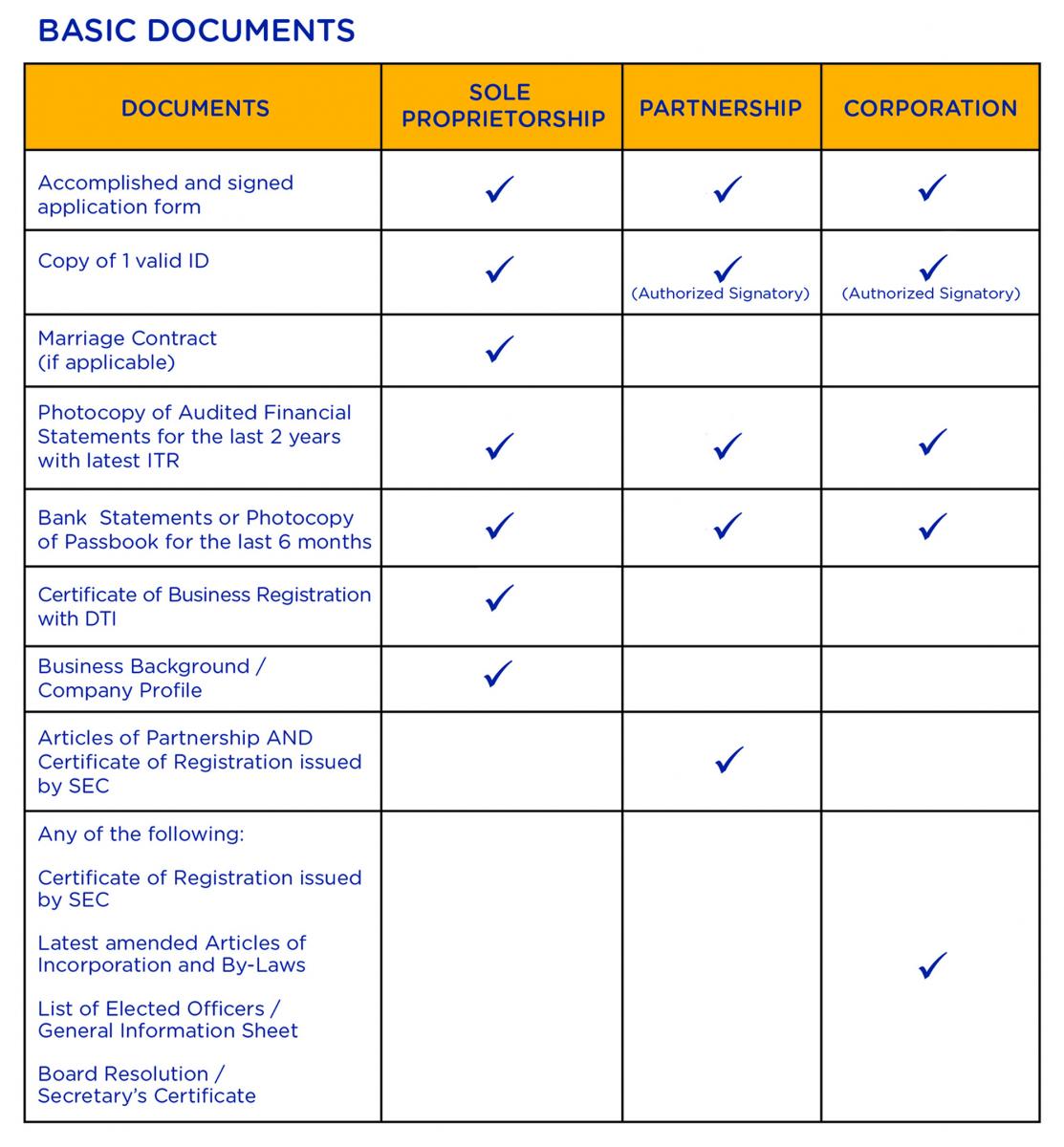

Prepare the Documents

The complete checklist of loan requirements is available on the BDO website. In the meantime, here are the basic documents.

Submit Application Form and Requirements

Applicants may submit the duly filled-up application form together with the complete documents through the following channels: online, any of the BDO SME Loan Provincial Business Centers, and more than 1,000 BDO Branches Nationwide.

BPI SME Term Loan

Loanable Amount: Maximum of ₱300,000

Loan Tenor: Maximum of 5 years

Accepted Collateral: Real estate mortgage, deposit, or investment

Processing Fee: ₱3,500

How to Apply:

Requirements and eligibility for the loan are all indicated on the bank’s website. To apply, applicants may choose from any of the following channels:

- Visit the nearest BPI branch

- Call at (02) 7918-2000 then press 2 for Business Loan; or

- Send an email at [email protected]

Security Bank SME Business Express Loan

Loanable Amount: ₱1 Million to ₱5 Million

Loan Tenor: 12 to 36 months

Interest Rate: 1.50% to 1.95%

Accepted Collateral: No collateral is needed

How to Apply:

The bank’s website specifies both qualifying and documentary criteria. Interested applicants may download the application form found on the website. Then, submit the duly accomplished form together with the complete requirements to the nearest branch of Security Bank.

Conclusion

Bank-provided business loans will always be an integral part of every business. But, before you get one, consider your business needs and what each bank has to offer. Consider the bank that will provide the fastest and easiest application process, review your selected lender’s website and/or contact them to receive a list of all required documents to assist you in making an informed decision.