Company Information

Main Office: 588 Danforth Ave Unit #4 Toronto, Ontario M4K1R1

Business Hours: Monday to Sunday, 8AM to 8PM

Email: [email protected]

Phone: +1 416-945-9241

Ontario-based Urgent Money is an alternative lending provider that specializes in bad credit installment loans. The company promises to provide its clients with fast and easy access to unsecured loans that will allow them to cover unexpected expenses and other financial emergencies.

A quick glance on Urgent Money’s website will tell you that they are somehow connected with other alternative lending institutions like 514 Loans, CashGo, and Prets514. They are also all powered by Green River Finance, a Canadian fintech company that provides state-of-the-art loan management software to non-prime lending providers in the country.

This means that Urgent Money has a lot in common with its competitors, but the company does have its own unique set of features that set it apart from the crowd. Let’s take a look at some of these features.

Some of the best-selling propositions of Urgent Money include fast processing time, no credit check, guaranteed approval, fund bank transfer, no collateral required, and so much more. With so many promises, can Canadians really trust Urgent Money to deliver on its claims? Let’s find out.

Types of Loans

Urgent Money, unlike other lending companies that offer a lot of confusing but similar financial products and services, only offer installment loans with no credit checks. Urgent Money asserts that their installment loans are the perfect alternative to payday loans, which are known for being ridiculously expensive and risky.

Installment Loans

Installment loans are a type of unsecured, short-term loan that is designed to be paid back over a set period of time. Typically, the length of the repayment period ranges between 6 and 12 months, depending on the lender.

Installment loans are typically used by individuals who are struggling to pay their bills on time, but don’t want to be tied up with the 14 day repayment period that are usually offered by payday loan providers. As such, installment loans give more flexibility when it comes to repayment, and perfect for those who are unable to qualify for a traditional bank loan.

Installment Loans with No Credit Checks

What makes Urgent Money’s installment loans very appealing, is the fact that they are completely free from credit checks. This means that even people with bad credit scores or no credit score at all can still get approved for a loan. This is because Urgent Money doesn’t care about your credit history.

In fact, the company has stated that it will approve even people with poor credit histories as long as they can demonstrate that they have the capacity to pay back the loan. Here are the top features of Urgent Money’s installment loans with no credit checks.

Loan Amount: $300 to $3,000

Interest Rate: $18 for every $100 borrowed

Sample Calculation: For a $700 installment loan with a bi-weekly payment of $153.41, you’ll pay a total of $1,227.28 at the end of the term.

Repayment Period: Up to 120 days

Credit Check: No credit check

Credit Score: Bad credit and no credit accepted

You simply have to meet the following requirements to qualify for an Urgent Money installment loan:

- Be a Canadian citizen

- You need to be 18 years old and above

- Have a steady job for at least 3 months (minimum income of $1,000)

- You are not bankrupt

- You have a low income to debt ratio

- You are not in the process of filing for bankruptcy or consumer proposal

- You can provide bank statements for the last 3 months.

If you fall into any of the following categories, you may find it difficult to get approved for an Urgent Money installment loan:

- You are self-employed

- You have student loans

- You receive disability income

- You are on a government welfare program

- You receive a private pension

- You are on child tax credits

- You are a student

- You are living off on retirement savings

While Urgent Money doesn’t do credit checks, they want to make sure that you have the financial capacity to repay the loan. Therefore, they may ask you to provide proof of income and assets.

Urgent Money’s installment loan application process is simple and straightforward. You can complete the form online, and if you have all the necessary information and requirements, you can expect to receive your money within the next 24 hours.

In the unlikely event that you encounter any problems during the application process, Urgent Money provides 24 hour customer support, so you can always get in touch with them and ask for help. They also have a chat bot to help you check your loan application status as well as answer any questions about your account.

Why Choose This Provider?

In addition to being a top rated lending company in Canada, the thing that sets Urgent Money apart from its competition is that they have a very high approval rate. This means that they are able to approve most applications, and have a good track record of providing fast and reliable service. Here are some other reasons why you should choose Urgent Money over other installment loan providers.

Network of Trusted Lenders

With a team of reputable lending companies to back them up, Urgent Money is in a strong team to position itself as one of the top alternative financial companies in Canada. With 514 Loans, Cash Go, and Prets514 by their side, there is no doubt that Urgent Money is a trusted and dependable lending company.

24/7 Customer Support

If you ever run into any issues while using Urgent Money, you can always reach out to their customer support team via phone, chat, or email. They will respond to your inquiries as soon as possible, and provide you with the information and answers that you need.

Affordable Than Payday Loans

Unlike payday loans, Urgent Money doesn’t charge any hidden fees or charges. You will only pay the interest rates that are set by Urgent Money. If you compare this to other payday loan companies, you will find that Urgent Money’s rates are much more affordable than other lenders.

Easy Application Process

The application process for Urgent Money is quick and easy. All you need to do is fill out the form online, upload any necessary documents, and wait for your money to be deposited into your bank account. It’s that simple.

Unsecured Loan

Unlike secured loans, unsecured loans are not tied to any collateral. In other words, you don’t need to put up any security or collateral to obtain an installment loan from Urgent Money. This makes it easier for you to apply for a loan, as you don’t need to worry about putting up your home, car, or other valuable items as collateral.

Flexible Repayment Plan

Urgent Money offers a repayment period ranging from 90 days to 120 days. If you need a short-term loan to cover an emergency expense, Urgent Money’s flexible repayment plan will be perfect for you.

How to Avail Urgent Money’s Services?

Below is a detailed step-by-step guide on how to apply for a loan through Urgent Money.

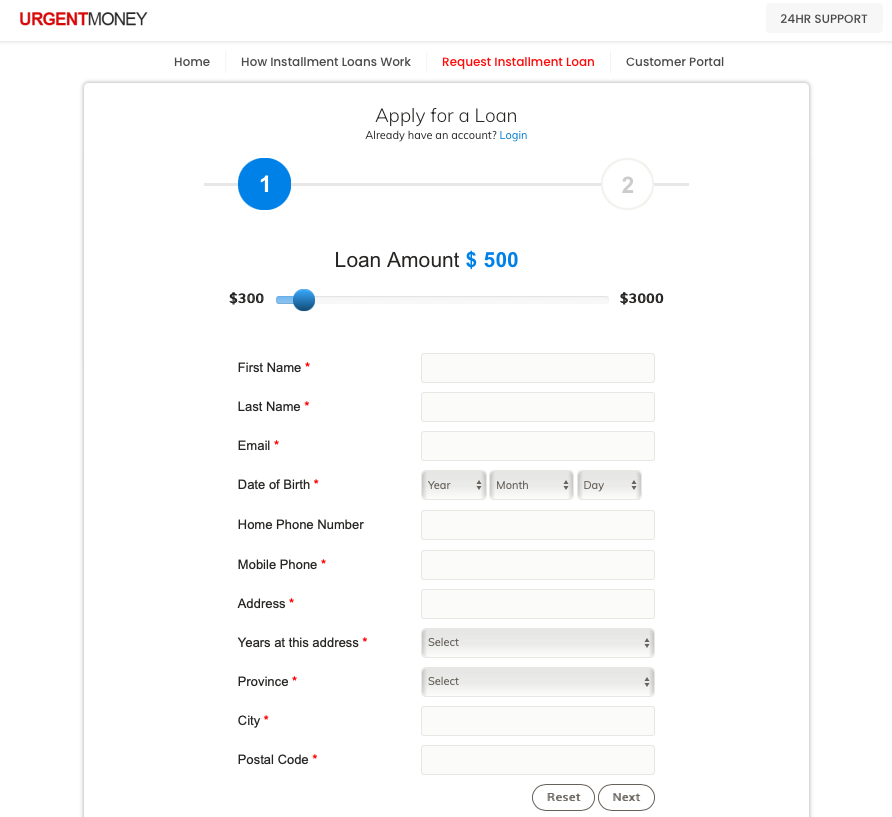

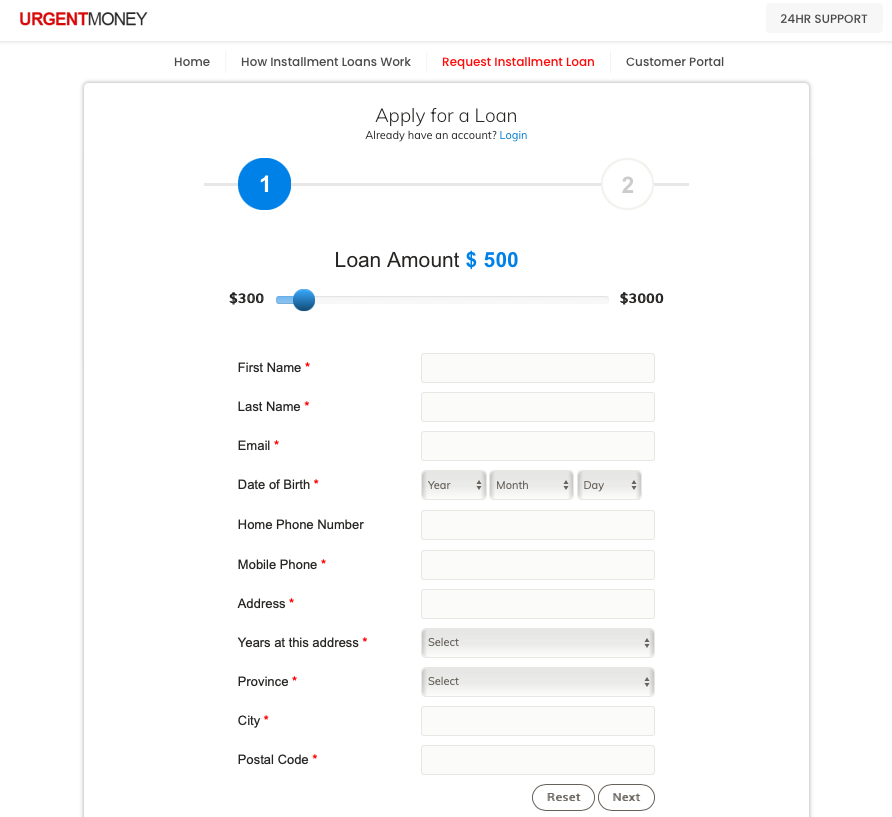

You’ll be redirected to a new window with an online form that will ask for your personal details, including:

Name

Email Address

Date of Birth

Home Phone Number

Mobile Phone Number

Address

How long have you been living in the said address

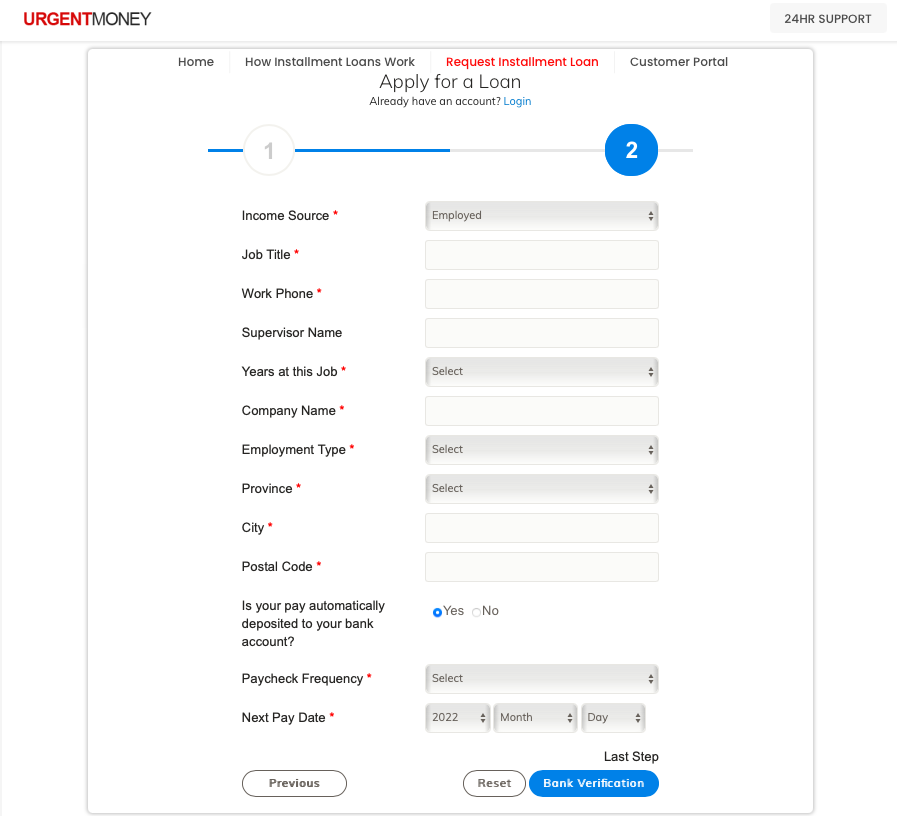

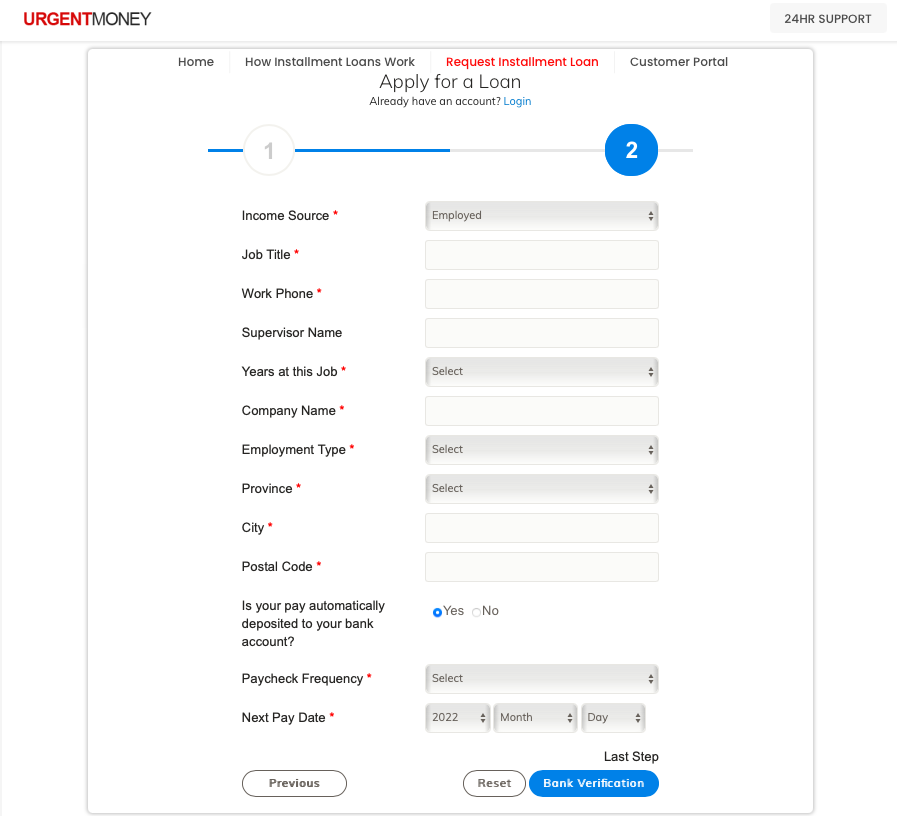

In the next window, you’ll be required to provide your employment particulars such as:

Income Source

Job Title

Work Phone Number

Supervisor Name

Company Tenure

Company Name

Employment Type

Province

City

Postal Code

Paycheck Frequency

Next Pay Date

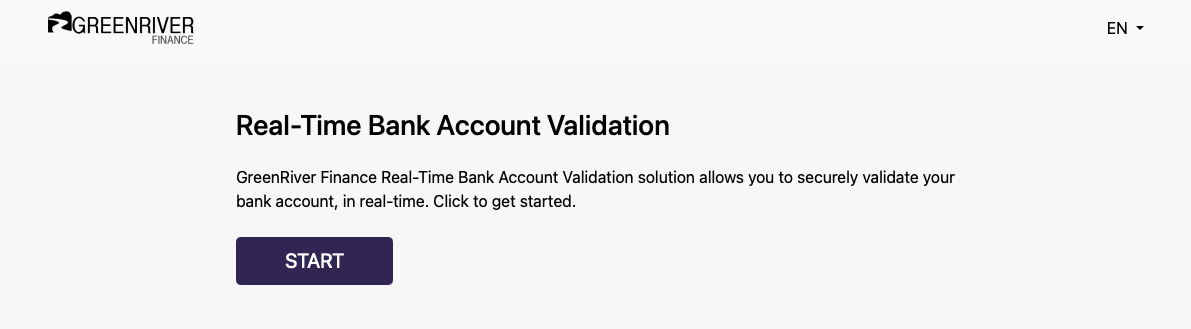

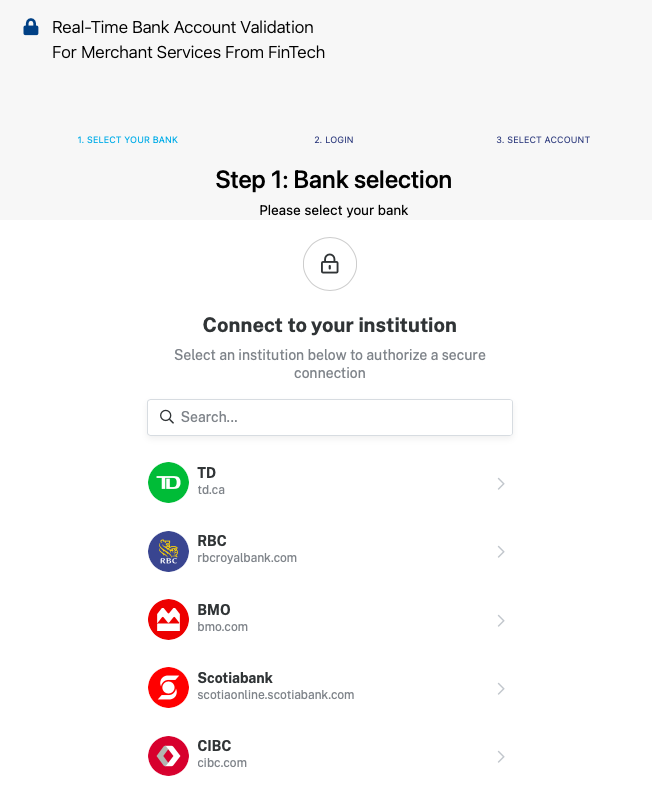

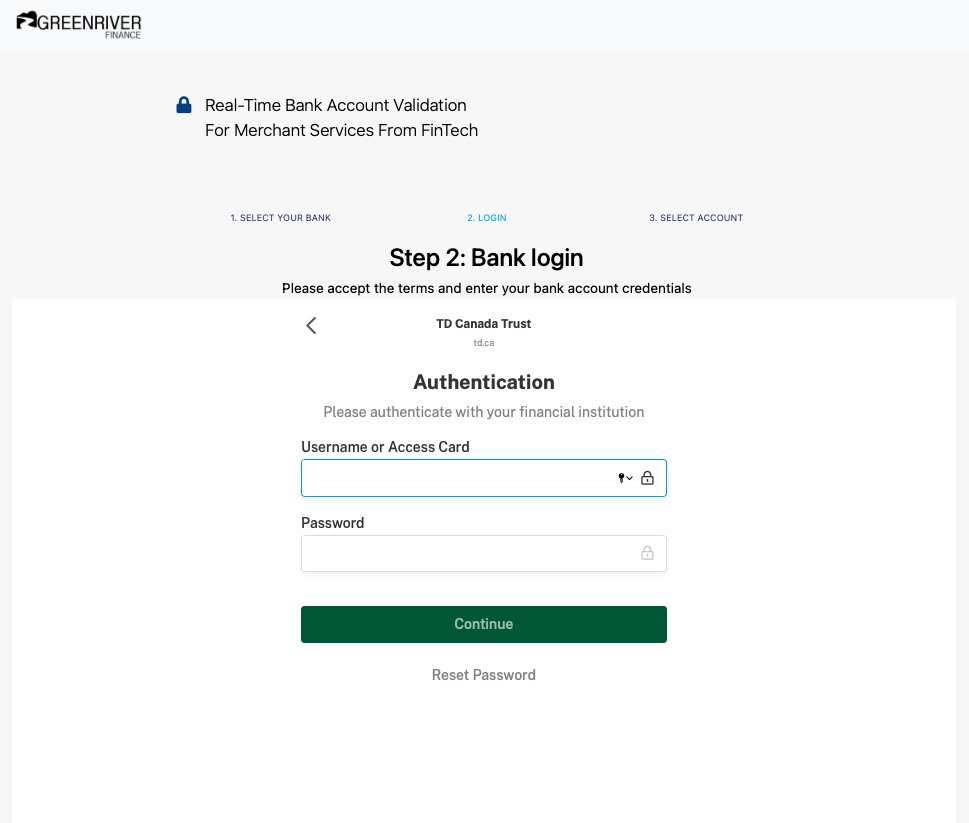

You’ll be redirected to Green River Finance’s real time bank verification system to validate your identity. Click the “Start” button to begin the bank account validation process.

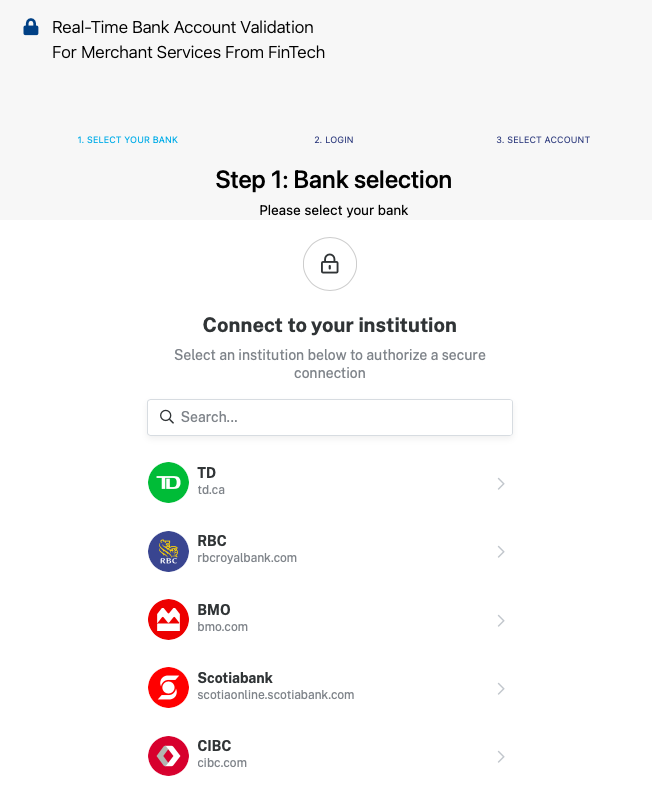

Select your bank, and you’ll be redirected to another window.

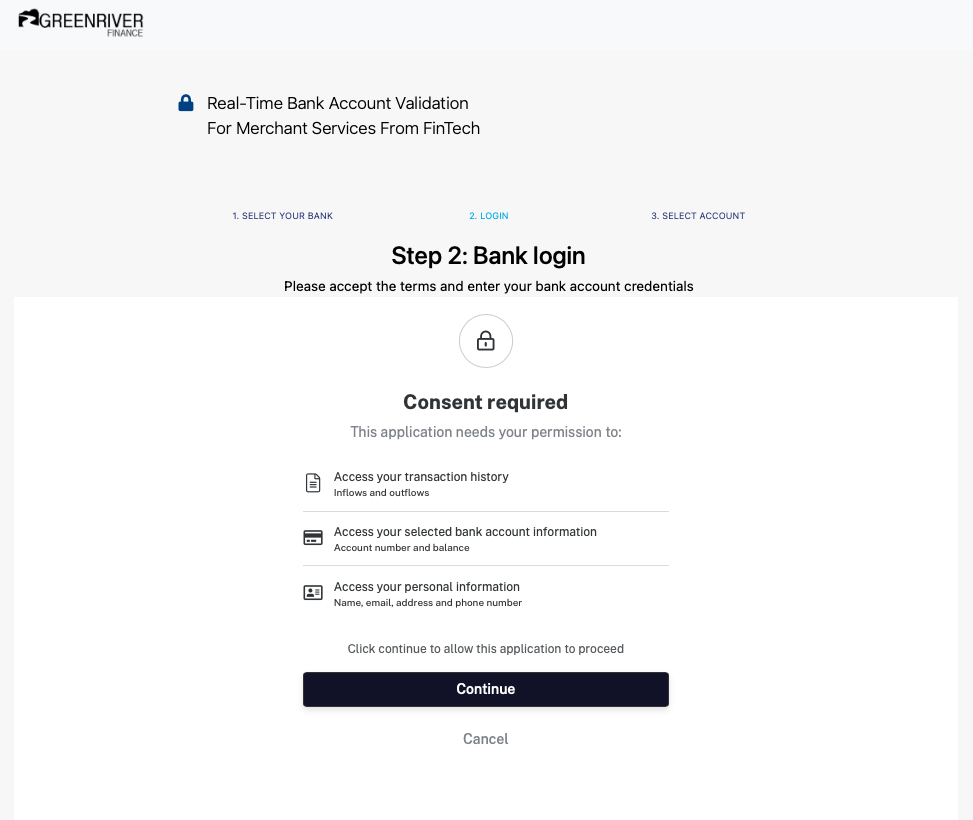

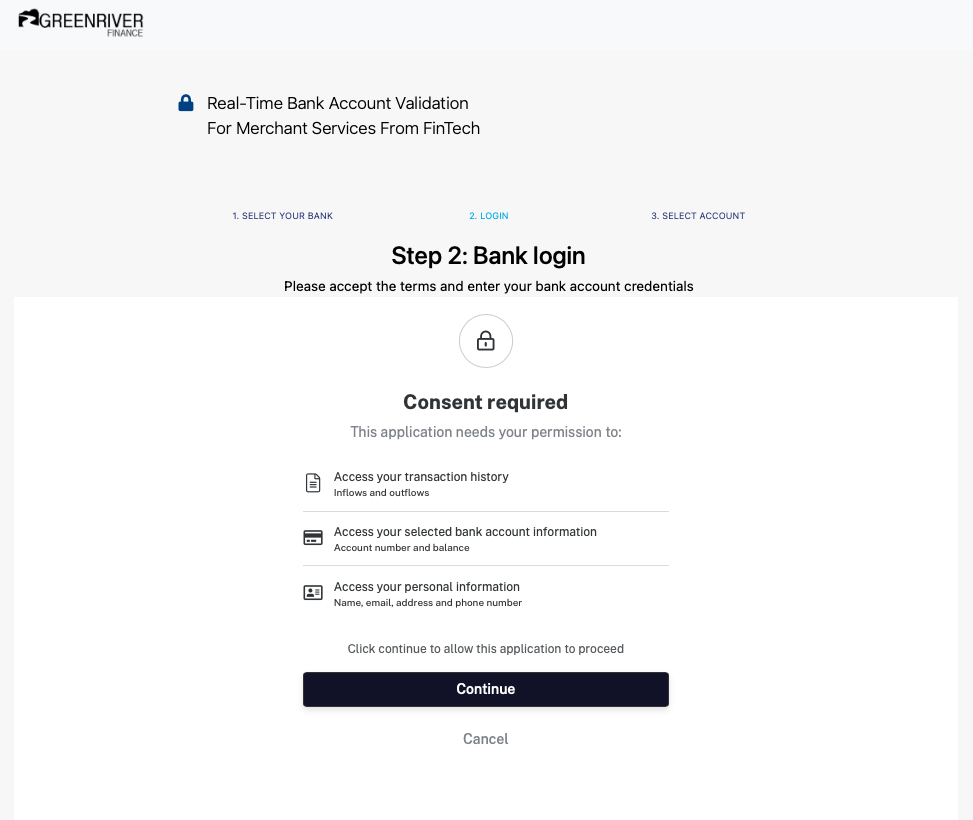

Allow Green River Finance to access your transaction history, selected bank account information, and personal information (name, email address, phone number).

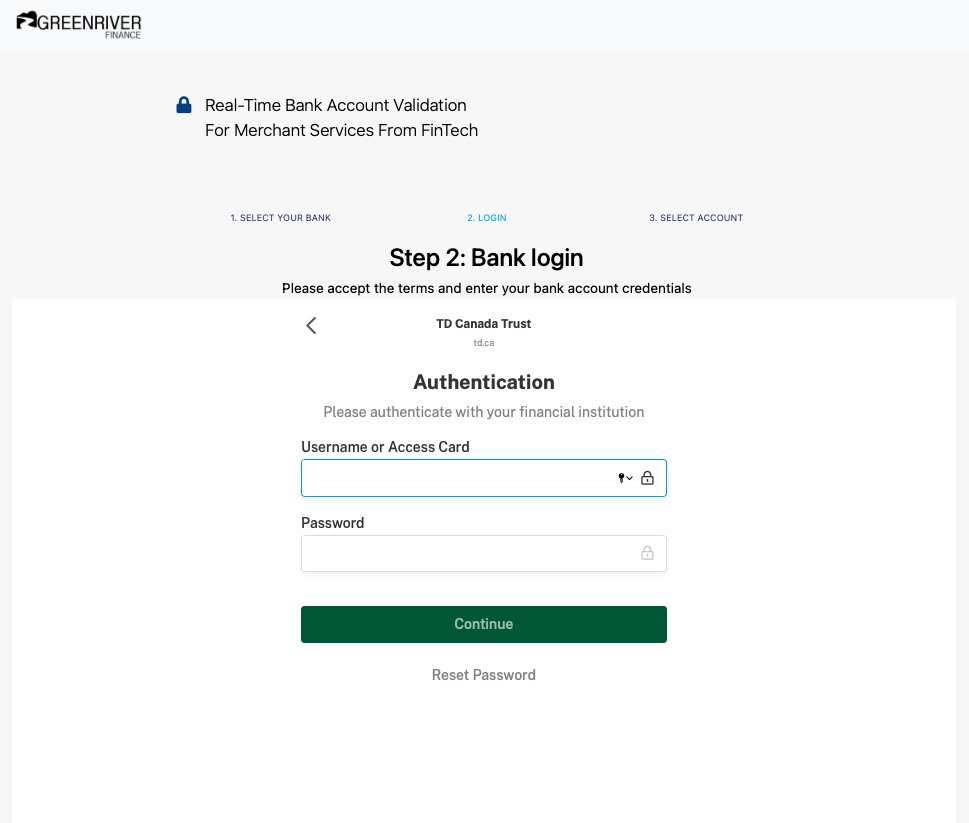

Input your username/access card and password, click continue, and you are ready to go.

Urgent Money’s installment loan application process won’t take more than 15 minutes to finish, and can be done through mobile, tablet, and desktop computers. You can rest assured that your personal and bank details are secured, because Urgent Money uses SSL and HTTPS encryption technology.

Frequently asked questions

Which is better, installment loans or payday loans?

How much can I borrow from Urgent Money?

Why do self-employed individuals can't qualify for installment loans?

Does Urgent Money offer same day installment loans?

Do I need to sign up to avail Urgent Money's services?

Are there any hidden fees?

Conclusion

When it comes to installment loans, Urgent Money is definitely one of the best options in Canada. They offer decent interest rates, flexible repayment terms, and a convenient installment loan application process. Urgent Money is also connected with industry leaders like Green River Finance, 514 Loans, Cash Go, and Prets514, so you can rest assured that you will get the best financial products and services in Canada.