Company Information

Main Office: 555 Burrard St #505, Vancouver, BC V7X 1M8

Business Hours: 7 AM – 6 PM PST

Email: [email protected]

Phone: +1 888-781-8439

Spring Financial is a fintech company that focuses on offering fair-priced financial services and helping improve your financial situation. The company’s history goes back to 2014. Its main office is in Vancouver, British Columbia, and it gathers dozens of employees.

According to the information available, Spring Financial has had over one million applicants. They pinpoint their mission is to empower Canadians locked out of the classic financial system to find a way out.

Spring Financial describes itself as a team of innovators that look for new ways to serve customers. You can pick from a credit building solution to personal loans and mortgage deals.

Types of Loans

Spring Financial offers four different loan types:

- The Foundation

- Evergreen Loan

- Personal Loan

- Mortgage

The Foundation

The Foundation is the basic package designed by Spring Financial. It’s different from a classic personal loan because it doesn’t provide cash upfront. The Foundation isn’t even a loan, but rather a condition you need to access the Evergreen unsecured personal loan. If you have a bad credit score or could use a way to build credit, The Foundation is the right deal for you.

Here’s how this deal works:

- You sign up on the website and complete identity and bank ID approval. It’s paperwork because all requests end up getting approved after confirming your details.

- The company sets a trade-line loan on your credit report. It will show as an amount of $3.5K, but you don’t have access to these funds.

- You receive a payment plan that you arrange with the Spring Financial agent. The common plan is that you pay $55 on a bi-weekly basis.

- The total payment you’ll make is $750 during 12 months. Once you complete the year-long cycle, you receive the entire sum back.

The goal of this plan isn’t to receive a personal loan. You won’t get any money because the purpose is to build credit and grow savings. Think of it as a savings plan. You’ll save $750 over 12 months since you get all your money back. There are no fees involved unless you miss a payment per the schedule you agreed. If it happens you are late with the payment; there is a $30 fee.

The benefits of the program include:

- You’ll improve your credit rating and qualify for lower interest rates on bank loans.

- You qualify for the Evergreen unsecured personal loan plan after completing this program.

- It’s possible to request savings at any time if you need cash. You won’t pay any fees, but you also won’t qualify for the Evergreen loan.

The program is perfect for students, those new to Canada, and anyone who’s only building their credit score. It’s also convenient if you need to improve your credit score since Spring Financial reports all payments to relevant authorities. Each payment contributes to a positive credit score, which you need to obtain financing, rent an apartment, etc.

Evergreen Loan

Evergreen Loan is an upgrade compared to The Foundation. You need to complete the basic program to access these funds. The Evergreen loan is always the same. You can receive $1,500 without providing any guarantees. This is an unsecured personal loan, but you need to complete the Foundation program first.

It only takes signing up for this package to receive the Evergreen Loan. You get $1.5K, and the interest rate is 18.99%. The rate is much lower than on a personal loan. Your bi-weekly payment is anywhere from $44.4, meaning you’ll need to pay about $90 monthly. The loan period is always 18 months. The total interest you’ll pay is $229.2.

The good news is there aren’t any fees, except for the $30 charge if you miss a payment. The conditions are simple, and all it takes is to provide a couple of documents. Once you agree to the deal, you should receive funds in around 2-3 business days.

Personal Loan

Unlike The Foundation and Evergreen Loan, which are connected, the Personal Loan is independent. That means you don’t have to be a previous user of the platform to ask for these funds. The Personal Loan given by Spring Financial can be anywhere from $500 to $15K. As for the interest rate, it should be from 29.99% to 46.96%.

However, the actual sum you can take depends on numerous factors. That includes the following:

- Employment status

- Current credit score

- Current income and how long you’ve been at that level

The entire application process occurs via the Spring Financial website. After filling out the form, an agent will call you. It’s possible to agree on all details during the first phone call. If you sign e-agreements right away, you’ll receive the funds in up to two business days.

As for the interest rate, it varies depending on the sum, duration of the loan, income, and other factors. You can choose a loan from nine months to five years. Each payment will qualify toward your credit score, so you can use the loan to improve it.

Mortgage

Spring Financial has a Spring Mortgage Group that focuses on these loan types. The company operates as a brokerage and works with 40 chartered banks, including TD, Scotiabank, etc. Please note this service only has a license to do the work in Alberta, British Columbia, and Ontario.

You have three options with Spring Financial mortgage solutions:

- Buying your first home. You can do everything online or ask for an agent over the phone. They will guide you throughout the process and find the best deals from a network of over 40 banks. The rates and other details will vary depending on your financial situation.

- Home equity loan. If you are looking to consolidate your debt, this can be a smart move. You can use this loan to skip monthly payments for up to 12 months. There are approval options for all credit scores.

- Line of credit and mortgage combo. The combination allows you to boost your credit score with each mortgage payment.

Why Choose This Provider

Spring Financial tries to simplify everything, which is why its website is easy to use. Even if you are a beginner, you’ll find the platform user-friendly. Here are the main benefits why you should consider this company!

Online-Based Services

The great thing about Spring Financial is you can do almost everything from your home. All products have application forms on the website, and they only take a couple of minutes to complete. If you need consultations, you can also contact friendly customer support.

Suitable for All Credit Scores

It’s not easy for people with poor credit scores to qualify for personal loans. Spring Financial considers that, so they have a way to improve your score and build a reputation. Depending on the exact score, you’ll find different options available.

Guaranteed Approval

The great thing about Spring Financial is that you have guaranteed approval for The Foundation package. And if you fulfill that, you’ll receive the Evergreen Loan, no questions asked. As for the personal loan and mortgage deals, they come with certain conditions. However, they are still fairly easy to get, even with a questionable credit score.

Flexible Repayments

The repayment varies from nine months to five years. You’ll receive a payment schedule, but there’s an option to extend the loan or adjust your payment schedule. If you feel like there’s a risk you’ll miss a payment, contact customer service to try to find a solution.

How to Sign Up

The good news is that the signing up process for all Spring Financial services occurs via their website. Since the approach is similar for all loan options, we’ll focus on the Personal Loan. Check out the following steps to complete an application.

Launch the Application

The first step is to head to the page dedicated to Personal Loans (or any other desired service). Once you are there, you will notice the Get Started button. Use it to launch the application form. It’s a registration form that doesn’t take more than five minutes to complete.

Enter Basic Personal Details

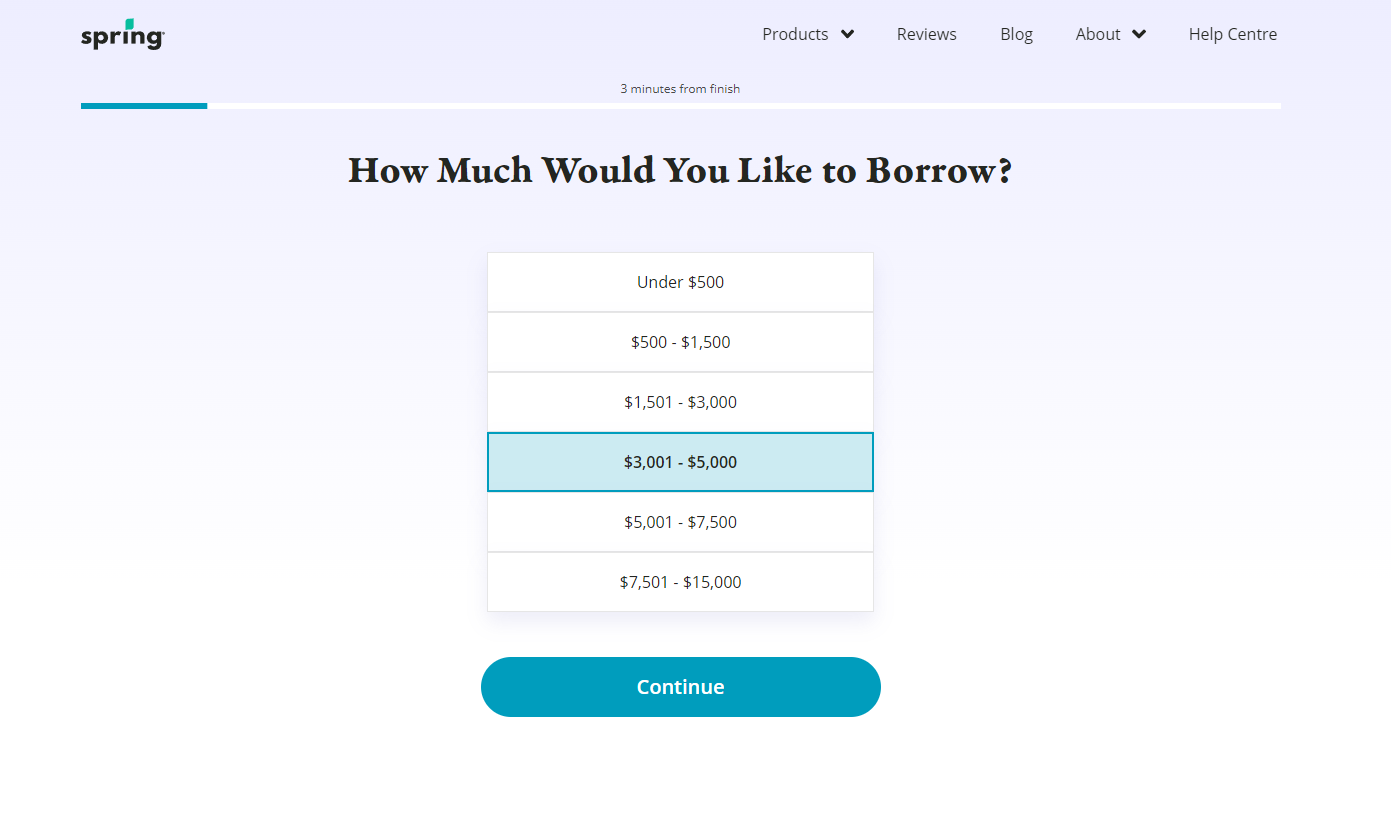

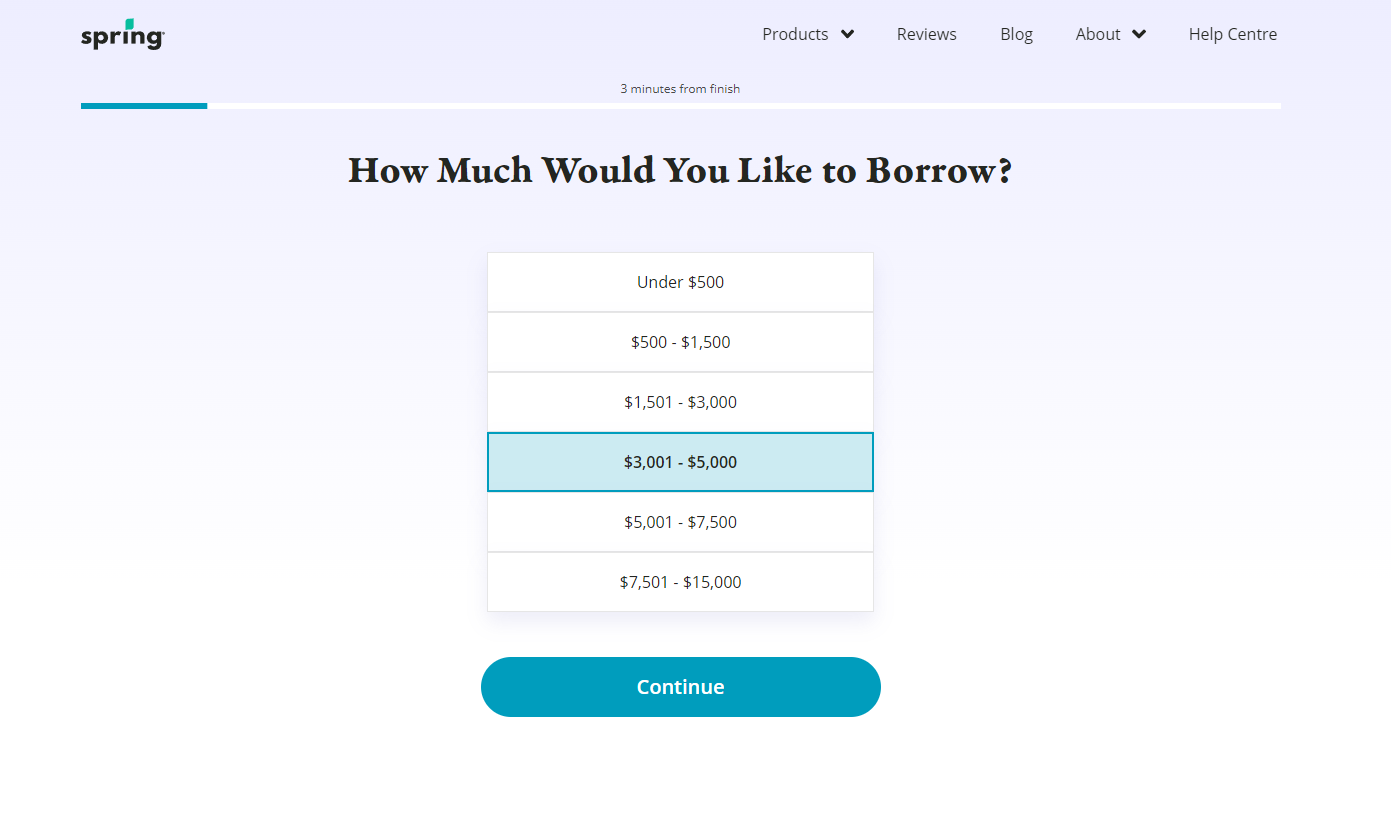

The first step involves providing your name and email address for contact purposes. After you click on continue, it’s time to answer questions related to your personal finance. The first question is how much you’d like to borrow. You’ll have several categories, ranging from under $500 to $15K.

The maximum loan will depend on your personal finance capabilities. It can help to be realistic, and please note the agent that contacts you might advise you it’s only possible to take a smaller sum.

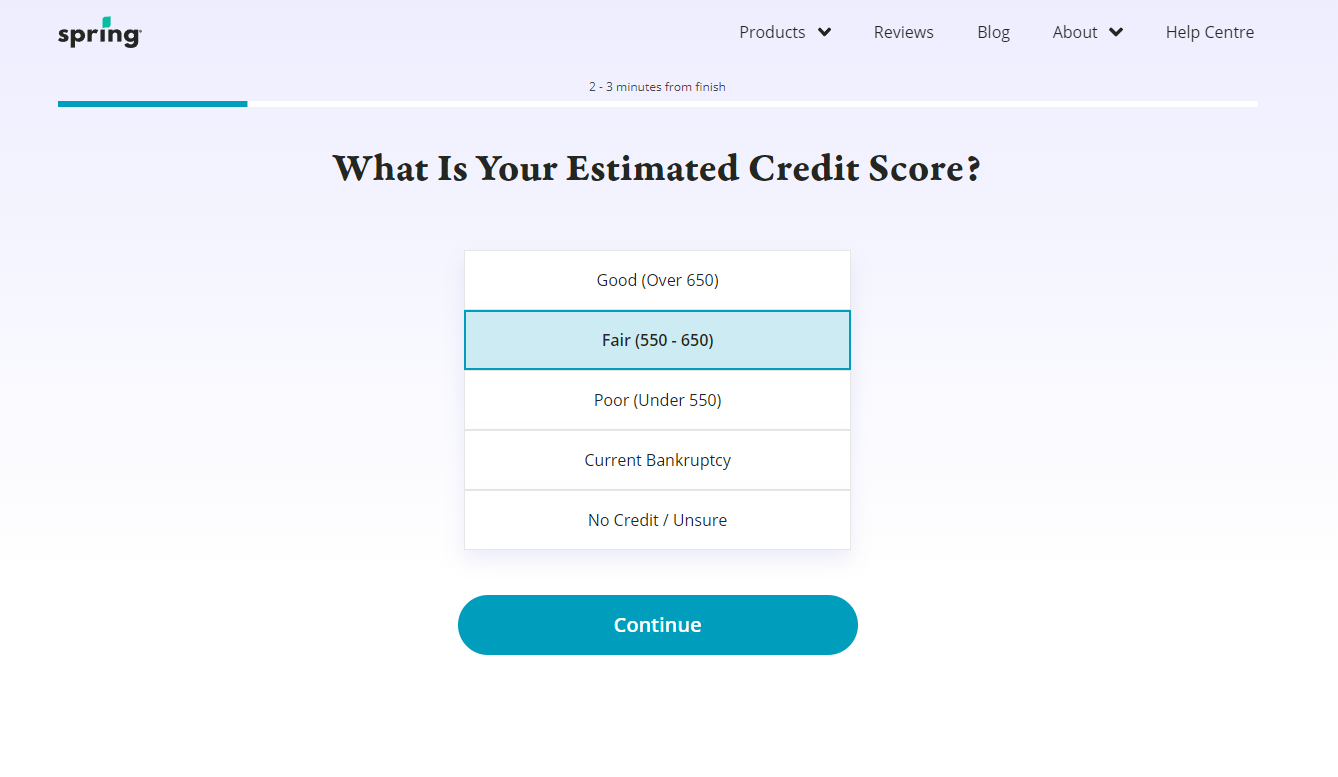

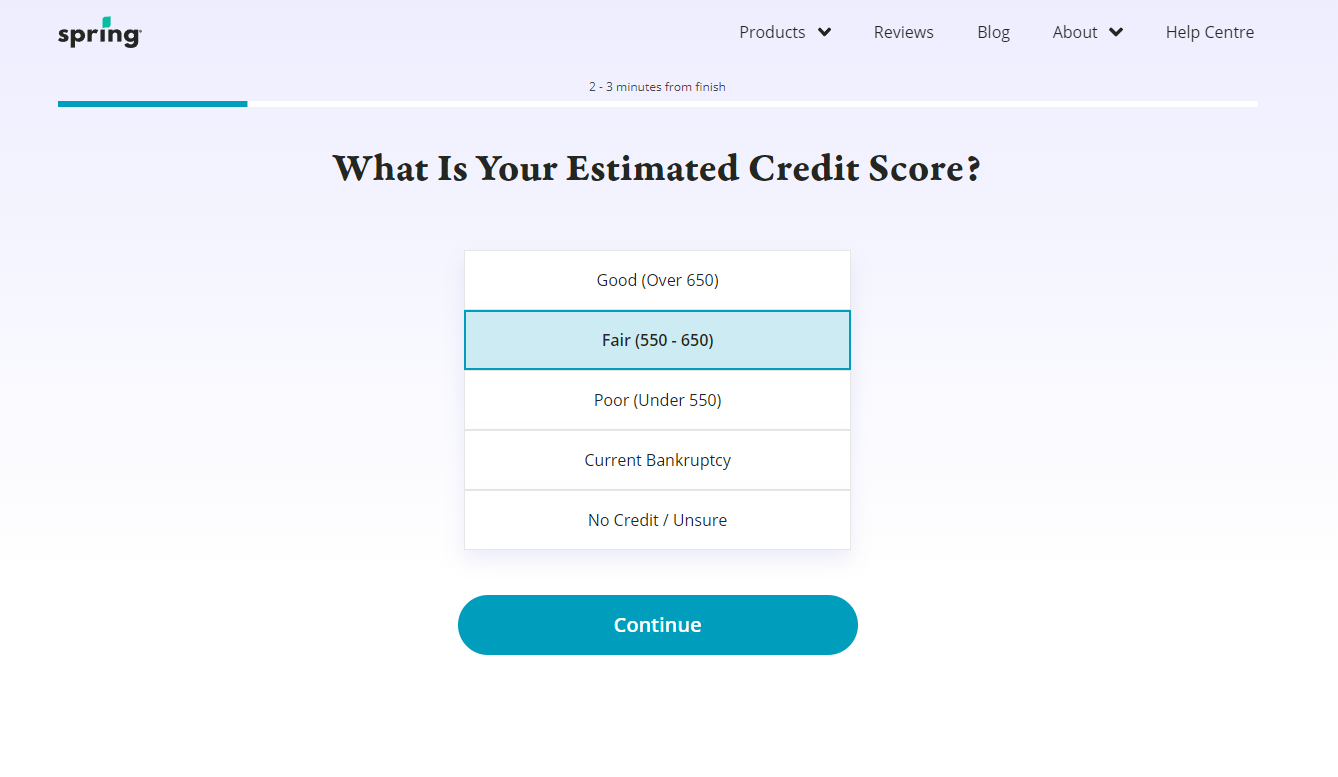

Check Your Estimated Credit Score

The next question is about your credit score. Some platforms offer a free appraisal of your current rating in case you are unaware of it. It’s also possible that you pick that you aren’t familiar with your credit score or don’t think you have one. Please note that a higher rating could qualify for a more generous personal loan.

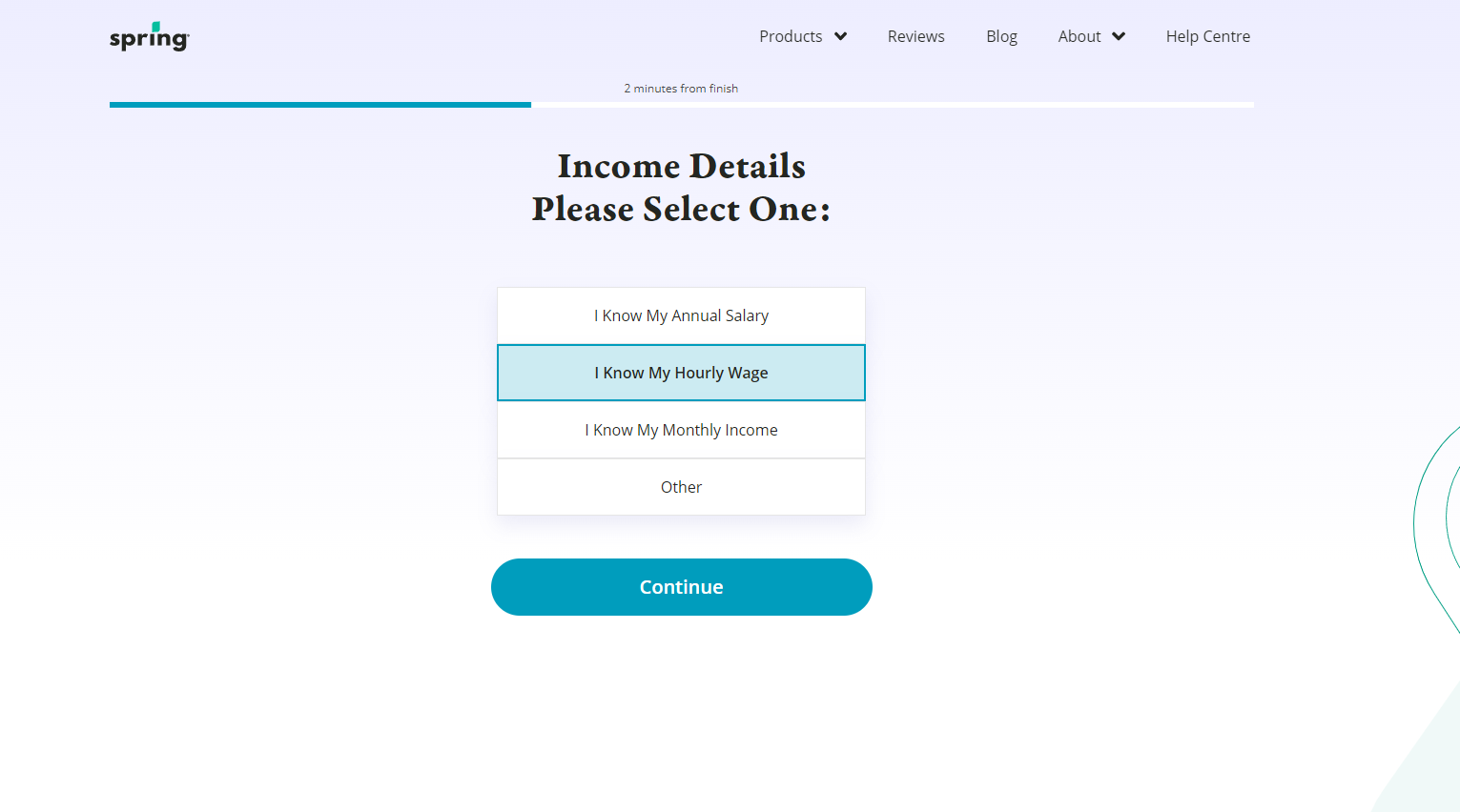

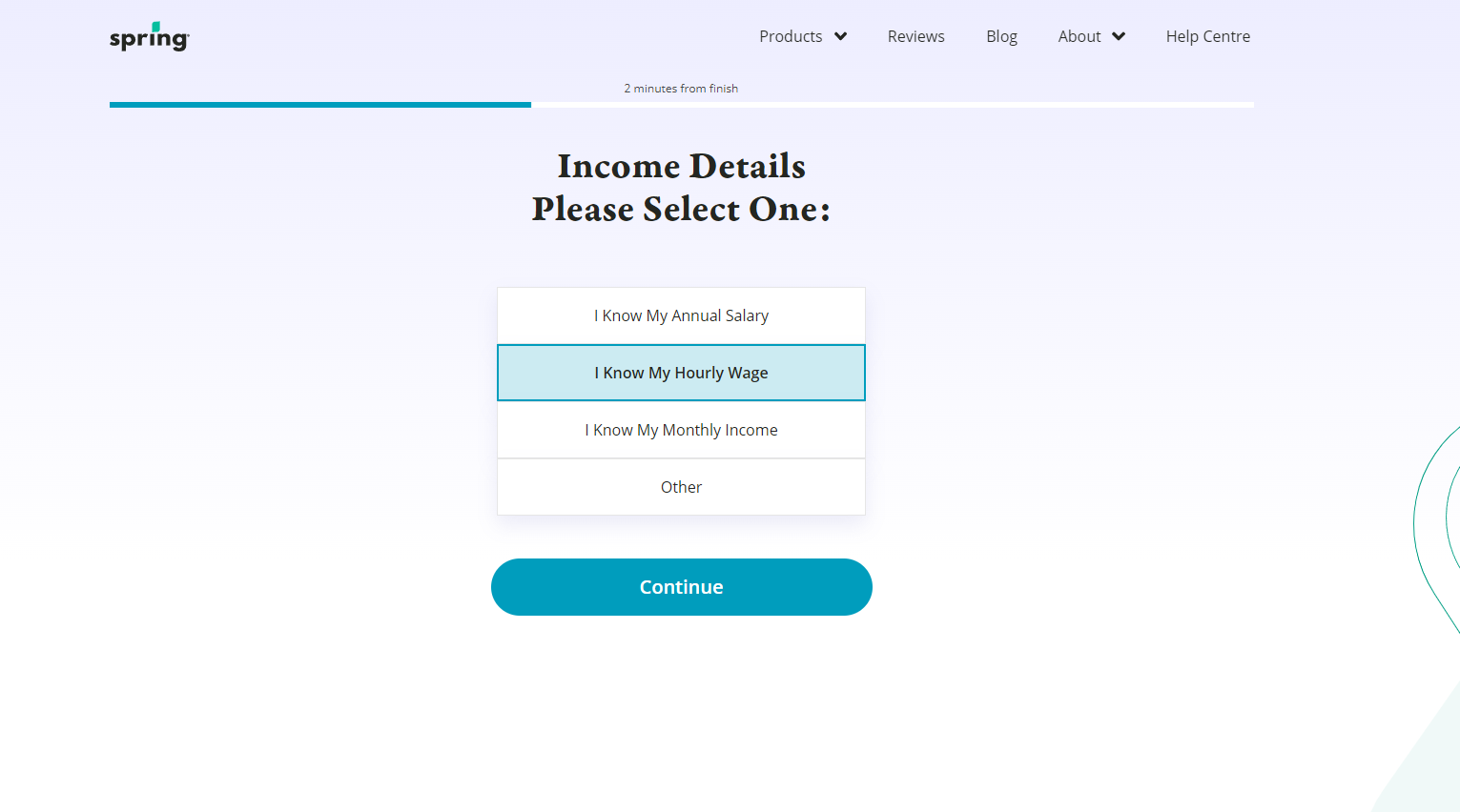

Pick Your Income Details

The crucial questions are related to your employment status and income details. The good news is you can pick from listing your monthly or annual salary or even an hourly wage. The system can calculate based on how many hours you work per week.

Finally, enter your home address and contact details. Once you complete everything, submit your application. It will take less than 24 hours for an agent to contact you. They’ll tell you about your personal loan options and explain the steps to finalizing the deal.

Frequently asked questions

How long does it take to get a Spring Financial loan?

How often will Spring Financial report to the credit bureaus?

Are there any fees with Spring Financial loans?

Can you get a Spring Financial loan with a low credit score?

How do I receive Spring Financial loan funds once approved?

Conclusion

Spring Financial offers a classic personal loan that depends on your income, employment, and other financial details. You can get up to $15K, which isn’t as impressive as the sum offered by some similar loan brands. The rates aren’t listed publicly, which means you’ll need to talk to an agent to receive them.

The main advantage of Spring Financial lies in unsecured personal loans via The Foundation and the Evergreen Loan. It takes patience since The Foundation is the starting package, and it’s actually a savings program. However, you’ll have the money you invest available at any moment. Once you complete The Foundation, you can qualify for The Evergreen Loan. That means you can ask for $1.5K in an 18-month deal and know the deal would get approved.

Overall, Spring Financial is a reliable platform for personal loans. Apart from loaning the money, you can use this company’s services to boost your credit score and get better deals for banks and other loans.