Company Information

Main Office:

2100-401 W Georgia St.

Vancouver, BC

V6B 5A1

Business Hours: 24/7

Email: [email protected]

Phone: 604.659.4380

We can trace the history of Mogo Inc. back to 2003. That was when the Feller brothers established the company. Today, David Marshall Feller is the Chairman and the Chief Executive Officer. Gregory Feller is the Director and the Chief Financial Officer of the company. Apart from the Fellers, Praveen Varshney is an important figure in Mogo. He’s also been around since 2003 and is currently in the position of Director.

According to reports, the founders noticed a credit crisis in 2003. Mogo was established with the desire to help Canadians to handle credit card debt. The company began issuing simple and transparent personal loans. It wasn’t until 2015 that the company expanded. The Fortress Investment Group offered support, and that enabled Mogo to offer loans up to $35K.

The initial public offering for Mogo also happened in 2015, so that’s when the company went public. Two years later, the lender also signed a partnership agreement with Visa. That enabled the launching of a prepaid card and a transaction account. The aim was to simplify the digital experience of receiving personal loans.

Mogo has received many awards for its services. In 2016, they got the Canadian Mortgage Award for the best use of mobile technology. The company was also the finalist in the marketing category in the Fintech Innovation Awards. In 2019, Mogo was among the Apps We Love in the Apple App Store. The tech giant itself picked it among the apps it recommends.

The main company’s office is in Vancouver. In Surrey, Mogo has a customer support and credit risk teams, and they also have a CEX hub in Winnipeg. According to the statistics on the website, Mogo currently services over 1.6 million Canadians.

Types of Loans

Mogo offers simple personal loans to Canadians that offer an alternative to going into debt with your credit card. The company works with different partners to secure a personal loan. You can also apply for high-ratio mortgages.

You need to sign up for a Mogo Account to use the company’s services. Registration is only available in the following territories and provinces:

- New Brunswick

- Newfoundland & Labrador

- Saskatchewan

- Nova Scotia

- Prince Edward Island

- Manitoba

- Alberta

- British Columbia

- Ontario

- Yukon

- Northwest Territories

- Nunavut

The desired loan option might not be available in all states.

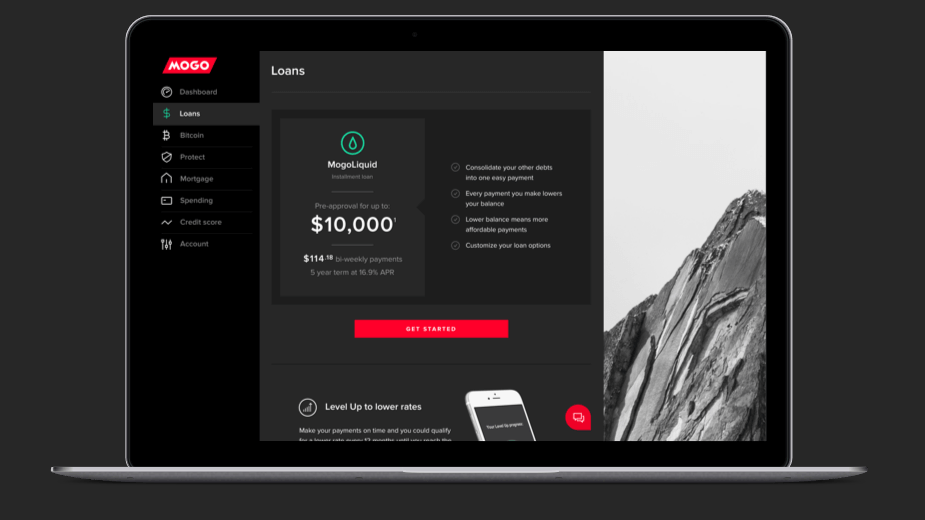

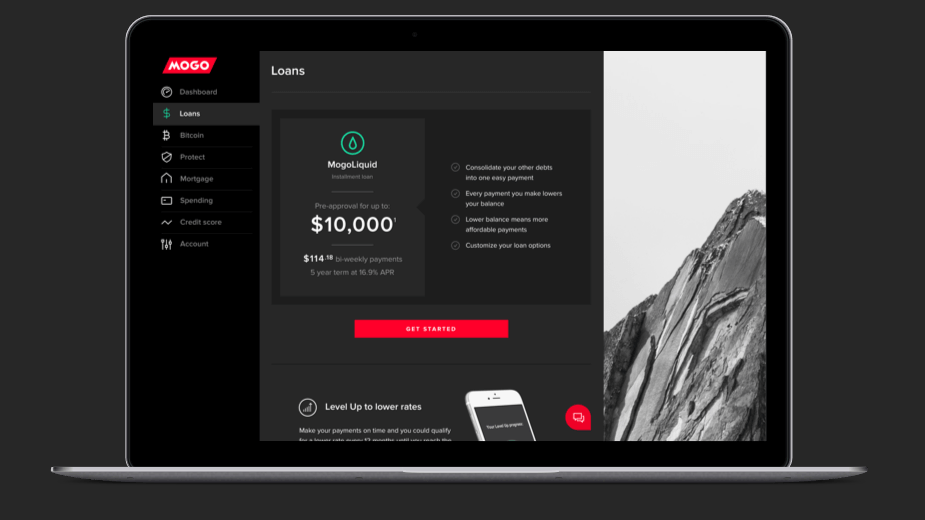

Mogo Liquid Personal Loan

The first option to go with is the Mogo Liquid Personal Loan. Mogo signed a deal with easy financial, which is a Partner Lender, to offer this service.

Here is the loan overview:

- You can apply for a loan from $500 to $15K.

- The term is approximately nine months to five years.

- The annual percentage rate is from 29.99% to 46.96%.

- This loan is available in British Columbia, Alberta, Manitoba, New Brunswick, Ontario, Prince Edward Island, Newfoundland and Nova Scotia.

The Partner Lender requires going through income and identity verification. Your loan or the maximum amount you can receive isn’t guaranteed. It could depend on your income level and other conditions of the deal.

Mogo Lendful Personal Loan

The other option for a personal loan via Mogo is available via the company’s partnership with Lendful. It’s a great choice for higher sums, but the verification process is more demanding. That means the company will assess your credit review and might have a minimum income requirement verification condition.

Here is a brief overview of this Mogo personal loan:

- You can apply for a loan from $5K to $35K

- The term is approximately from nine months to five years.

- Your APR will vary from 9.9% to 21.5%.

- The service is available in British Columbia, Alberta, Manitoba, Ontario, New Brunswick, Prince Edward Island, Newfoundland, and Nova Scotia.

Test Drive Your Loan

Mogo personal loans come with an interesting feature. They offer a 100-day test drive, meaning you can test if the loan suits you during that time. If you choose it doesn’t work, you can return the principal. The company promises to refund any interests and fees that appeared during the test drive.

It’s a convenient feature if anything unpredictable happens in the first three months of taking the loan. You might also come across a better offer, and that’s also a legit reason to give up on this loan. However, please note that the test drive only applies to Personal Loans and not to Mortgage and Mogo Liquid.

Mogo Mortgage

The third loan option offered by Mogo is used for mortgages. Mogo Mortgage is a relatively new service, so it offers high-ratio mortgages. These are deals where your home equity or down payment is less than 20%.

- The minimum credit score needs to be 640 to be eligible for this deal.

- You need to secure a minimum 5% down payment. It shouldn’t be from the proceeds of crime but only come from a legit source.

- The monthly income needs to show you are capable of handling the payments.

- You can use this service in British Columbia, Alberta, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland.

- The mortgage lender might need to confirm that the property chosen is something they agree to put the mortgage against. It should go smoothly since that just means confirming the property isn’t too old and dilapidated.

The interest rates on Mogo Mortgage depend on your personal details. However, you can expect them to be the following:

- 3.49% for 5-year fixed

- 3.19% for 3-year fixed

- 1.55% for the 5-year variable

You might get multiple mortgage offers from the same lender. These are all easy to check from your Mogo Account dashboard.

Why Choose This Provider

Mogo is a company that offers all-around financial services. Here is an overview of everything they cover:

- Mogo Trade – It’s a specialized digital trading app available to download on mobile phones.

- Credit Score – You’ll benefit from updates about credit score changes since these are a good indicator of your current financial situation.

- Mogo Wealth – The Company joined with Moka, and this investing tool is now available via the Moka app.

- Cryptocurrencies – if you want to invest in Bitcoin, and you are looking for a simple and eco-friendly way to do that, Mogo might be the solution.

- Mogo Card – It’s a prepaid Visa card for managing your funds. You get it for free, and it comes with an attractive rewards program.

Mogo Rewards

The loyalty program is a way for Mogo to award all its members for using their services. If you are a regular at Mogo and stick to the platform’s rules, you can expect the following benefits:

- Rockstar status – You achieve it with a free credit score rating of at least 850 at the beginning of every month. The reward is 1,000 satoshis (parts of Bitcoin).

- Bitcoin amount funding – It’s a one-time reward issued the first time you invest at least $100 for Bitcoin funding at Mogo. The prize is $5 in satoshis.

- Most improved monthly credit score – It’s only for the single member with the highest credit score improvement, and the reward is 250,000 satoshis.

- Card purchase reward – You’ll receive 50 satoshis per purchase.

- Referral milestone reward – You get 1,000 satoshis for every friend you recommend, and they become a valid MogoMember. The company will even plant eight trees as an additional boost.

Level Up Offers

You can qualify for a lower interest rate on personal loans. The condition is to have a satisfactory payment history and a respectable credit score. So, if you pay installments on time, you can qualify for benefits in the future. Apart from lower interest rates, you could get higher loan amounts. The downside is that this offer doesn’t cover any loans made by Partner Lenders. Also, it’s entirely up to Mogo to decide who has the right to a lower rate.

Protect Your Credit Score

Mogo works with Equifax to estimate your credit score after registration. That’s free, and they continue monitoring your credit score for 90 days without charging a single cent. There’s a way to keep tracking your score without paying additional money. It lies in taking the free Mogo Card. It’s a debit card that allows you to manage your funds more wisely than with a credit card. The company partnered with Visa to offer this card, and thousands of Canadians have decided to take it.

Flexible Terms

It could happen that you secure the funds required to pay back the loan early. Some services have penalties for early payments, but that’s not the case with Mogo. You can pay off your loan completely at any time without additional charges.

How to Sign Up

If you are interested in Mogo services, the good news is it’s easy to apply for a loan. Follow these steps to get your pre-approval today.

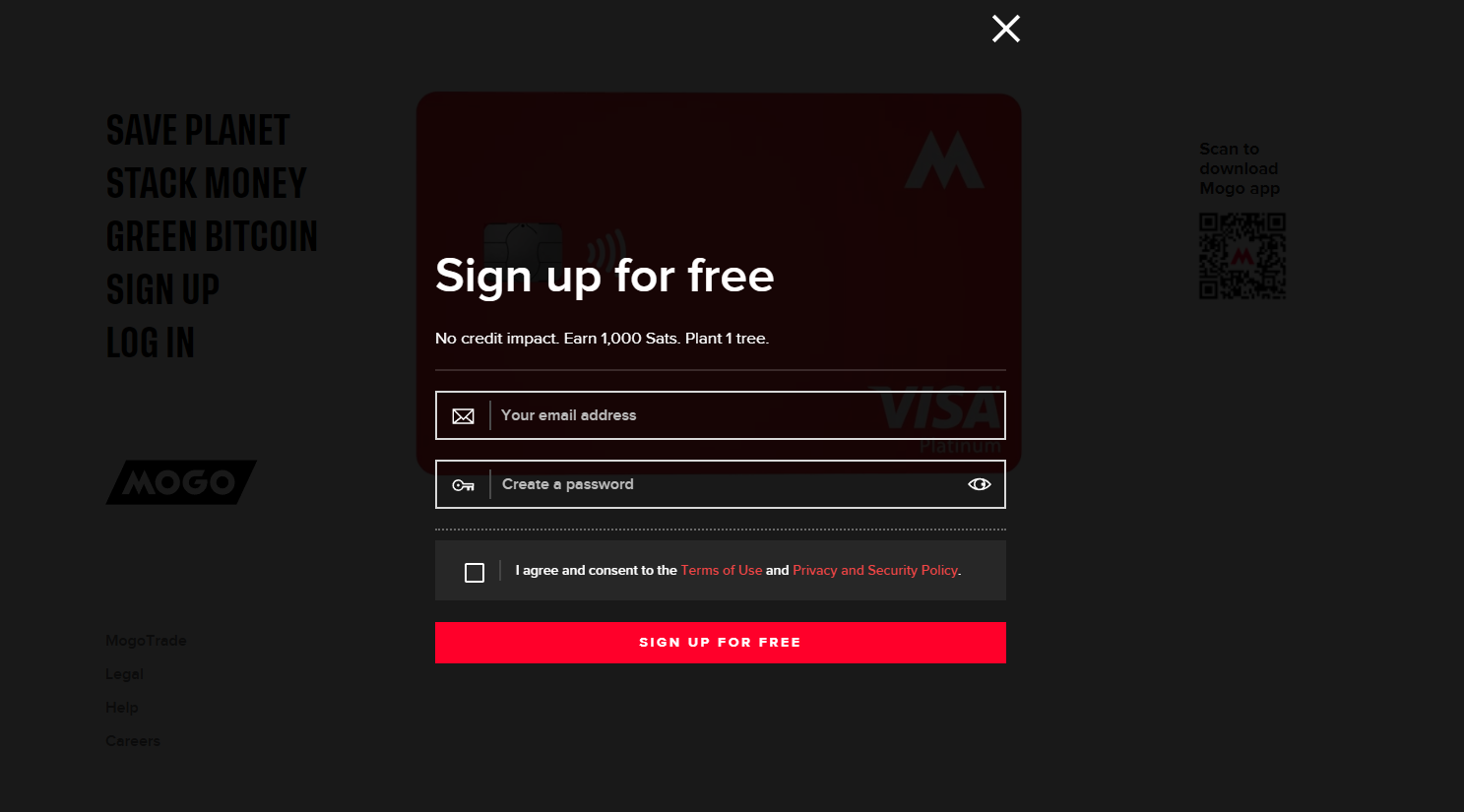

Register for an Account

The first step involves creating a Mogo Account. You’ll find the Sign-Up button on the Mogo website’s homepage.

Click the button to open a Sign-Up form. It will take less than a minute to complete. Enter your email address and the desired password. Don’t forget to agree to the Terms and Conditions.

After submitting the registration request, you’ll need to validate your email address. Finally, access your account.

Check Your Pre-Approval Offer

If you have a Mogo Account, you’ll receive a free credit score. Please note you’ll need to provide identity verification first. Mogo partners with Equifax to deliver the free credit score, and that company requires an identity check. Equifax has a proprietary model for estimating your credit score. The number is only an estimate and could be different from third parties because they could require additional information for a better appraisal.

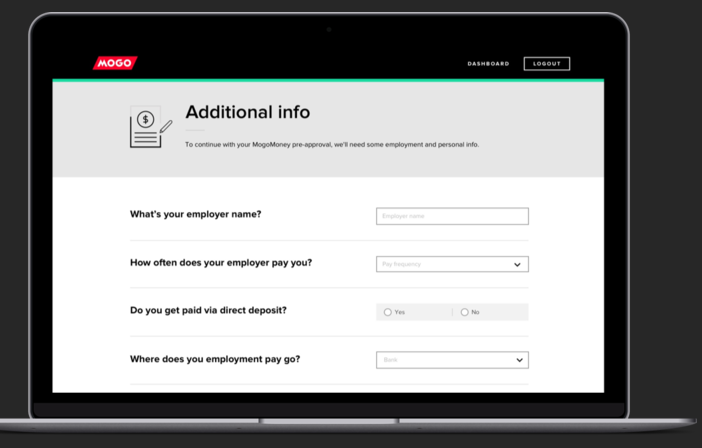

After receiving your credit score, you’ll notice the pre-approval offers. If they seem attractive, complete your Mogo application.

The form will require answering questions about your employer and salary. It’s also necessary to prepare a paystub and relevant ID to confirm your bank account.

Check If Everything Is Correct and Meets Your Expectations

Before you sign the deal, it’s time to double-check everything. You want to assess all the information you provided to ensure it’s accurate. Additionally, see if the payment dates and other loan info suit your preferences. If necessary, you can contact customer support. They are quite helpful and knowledgeable.

Once you are happy with all details, it’s time to sign the loan deal. Please note an e-agreement is enough for the Mogo personal loan.

Wait for the Funds to Arrive

You can see all active loans in your Mogo Account.

It shouldn’t take longer than a business day or two to receive the funds after signing the loan agreement. The company will send you reminders regularly but don’t forget to visit your Mogo profile to ensure you are on track with the payments.

Frequently asked questions

What is Mogo?

Why is Mogo stock dropping?

How accurate is Mogo's credit score?

How to delete the Mogo account?

Who owns Mogo?

How does Mogo work?

What Is the Mogo app?

Conclusion

Mogo has been around for a long time, and more than 1.6 million Canadians use its services. It achieved the reputation as a legit personal loan provider for those who don’t have a better option. Mogo offers different personal loan choices, depending on your credit score, income, etc. It allows choosing the deal that best suits you.

The platform does have higher interest rates, especially for new users with a lower credit score. But as you improve your rating and continue using Mogo, you’ll earn many rewards and qualify for lower rates.

Another benefit is that Mogo is an online-based service. You practically don’t have to leave your home to receive funds. There’s also the 100-day money-back guarantee policy that they call “a test drive.” Make sure to read all terms and conditions offered by Mogo before accepting the loan. As long as you are okay with any potential penalties for not paying on time, this provider offers a simple and smart way of getting a personal loan!