Their head office is located at:

180 Dundas Street West Suite 1508

Toronto, Ontario M5G 1Z8

They do not accept any walk-ins at this location. Instead, their entire service is offered through an online portal.

You can contact them by:

Phone: 1-855-360-5597

Monday to Friday 2pm-9pm

Sales Team: [email protected]

Submitting Docs: [email protected]

Complaints: [email protected]

Collections: [email protected]

Affiliates: [email protected]

Operating Hours:

Monday to Thursday 9 am-7 pm EST

Fridays 9 am-6 pm EST

During Covid-19, applications and documents can be accessed and signed entirely online. However, communication is still required to finalize any funds being issued. The team at LendingMate requires verbal contact with the applicant’s guarantor to ensure the terms are fully understood.

Loans at LendingMate

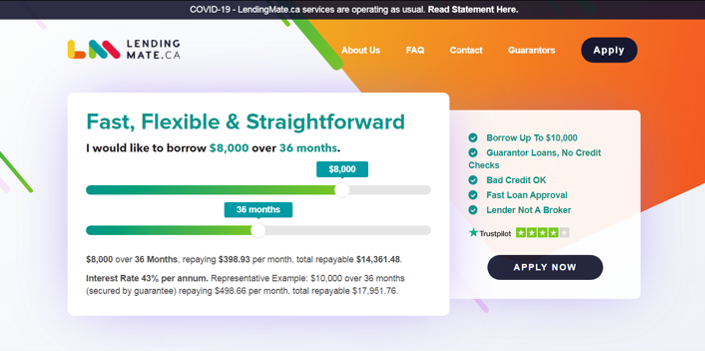

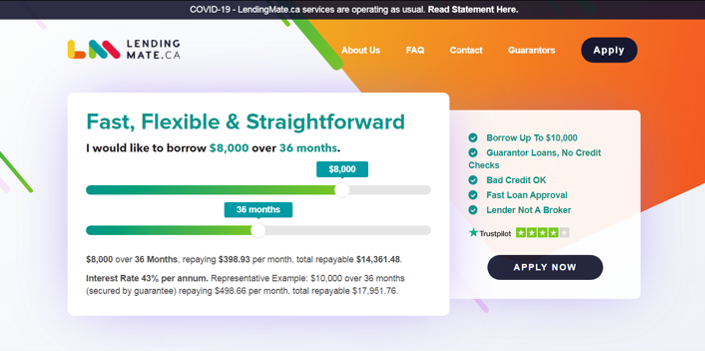

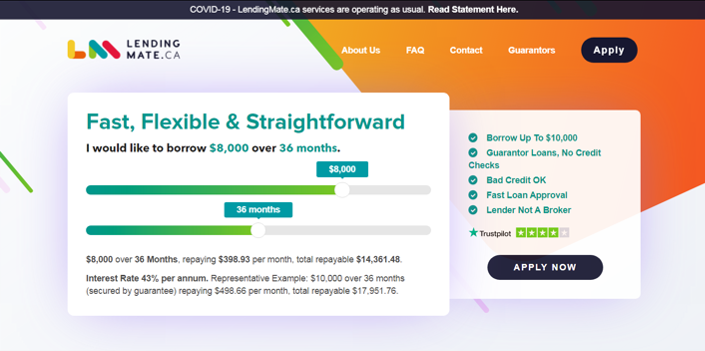

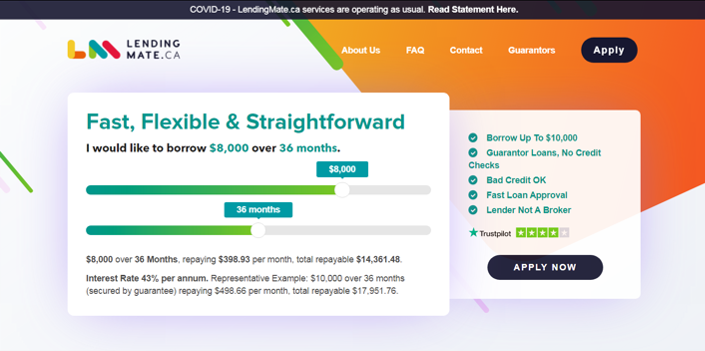

LendingMate is strictly a guarantor loan company so they only offer one type of loan. A personal, unsecured loan from LendingMate requires both the applicant and the guarantor to be approved. The steps detailing the process are simple and easy to understand. The easy application process ensures applicants have the required information ready before they begin the application.

Loan Limits: $2000 minimum, up to the maximum $10 000

Terms range: from 12 to 60 months

The interest rate is: 43% per annum

LendingMate prides itself on being upfront and fully disclosing all fees for the loan when you and your guarantor sign the contract. They clearly state that they never charge late payment fees. There are no charges for paying off the loan early.

There are never any added costs to the loan and you’ll only pay interest for the time you hold the loan. Interest is calculated daily and applied to any remaining balances on loan.

Requirements for the applicant

Potential applicants can begin the process through the application portal online. First, they are asked how much they would like to borrow and for how long.

They can select anywhere from $2,000 up to $10,000. Terms can be set from 12 months up to 60 months. Next, a specific link is sent to you for your guarantor so they can fill out their required information. Once your guarantor has entered their information and been approved, you will be instructed to complete the process.

To apply for a loan from LendingMate, applicants must be a Canadian resident in the provinces of Ontario or British Columbia. In addition, you must be between the ages of 19 and 75 and not be in the process of a bankruptcy or have an active consumer proposal.

You don’t need to be employed to apply for a loan, but you require an income to be considered for the funds. Once your funds are approved, they are deposited into your guarantor’s bank account. This is to protect them from fraud. After that, they can transfer the funds to you as per your arrangement with them.

Requirements for the guarantor

Guarantors must have a good credit score to secure the funds for the borrower. It is not necessary to be a homeowner to qualify as a guarantor for a potential applicant, but it does help with the approval process. As an unsecured loan, the guarantor’s home is not security for the requested funds and cannot be used as collateral.

There are very few reasons that LendingMate would decline a guarantor besides an obvious credit issue.

A guarantor cannot share an income with the applicant, but they can share a residence. They must meet the requirements of being between the ages of 19 to 75. They must also not be in any stage of bankruptcy or have a consumer proposal.

The guarantor must be a Canadian resident and cannot hold a current loan with LendingMate. Once they have met all the criteria, an authorized LendingMate representative will contact them and explain their rights and responsibilities as guarantors. The borrower’s funds will be directly deposited into the guarantor’s bank account. The guarantor is then responsible for transferring the funds to you as per your arrangements with them.

Repayment Terms & Conditions

The terms are fully disclosed when the applicant and guarantor finalize the loan. Payments are automatically withdrawn monthly from the borrower’s bank account.

All payments must be made on time, and any defaulted payments must be discussed with a collections representative immediately to ensure the account is brought back into good standing. If you default on a payment, LendingMate will try to collect the payment owed from your secondary method. If they can’t do this and the payment is still in arrears, a collections specialist from LendingMate will contact your guarantor. LendingMate will then attempt to collect any outstanding payments form your guarantor and inform them of their legal requirement to make the payments on your behalf.

Being a responsible borrower and ensuring that what you commit to will not cause any financial hardship towards your guarantor is advised. LendingMate discusses this thoroughly with potential borrowers and guarantors at the time of approval and document signing.

Debit Card Required

As an added safeguard to maintain a timely repayment schedule, LendingMate requires a copy of both the applicant’s and guarantor’s debit cards on file. This ensures outstanding payments can be collected should the applicant default on their preauthorized payments. If an applicant misses their scheduled payment, LendingMate will try to withdraw the payment using the applicant’s debit card. If the payment defaults again, a collections specialist will contact the applicant to arrange prompt payment.

If communication with the borrower cannot be established, LendingMate will contact the client’s guarantor to arrange payment. Should the guarantor default on the previously agreed terms, the collection specialists at LendingMate will then try to withdraw the funds using the guarantor’s debit card. If the funds are again NSF (Non-Sufficient Funds), the collection team at LendingMate will further their methods to include possible legal proceedings.

If the loan is in default, the payments will be reported to the credit bureau and will negatively impact both the applicant’s and guarantor’s credit scores.

Pros and Cons

LendingMate’s approach is an old-fashioned approach to lending. LendingMate is a guarantor loan company, offering loan approvals which are reviewed by their expert lenders. LendingMate offers their services to residents of Ontario and British Columbia. Applicants can apply through their online portal and submit all required documents for the approval process. All loans require a guarantor to secure funds for an applicant.

Pros

- Easy to understand terms and requirements

- Funding options for applicants with poor credit ratings

- Funding within 24 hours of approval

Cons

- Higher than traditional banking interest charges

- No applicants accepted without a guarantor regardless of credit rating

- The approval process requires an authorized representative to review the applicants file, this could entail a lengthy waiting time for the funds if all information required is disclosed during the application

Why choose LendingMate

LendingMate offers loans to people regardless of their credit score as long as they have an income and a guarantor. The online application process is easy and most loans are approved and paid out within 48 hours. LendingMate is transparent with their application process, repayment schedule, and interest charged. In addition, you can contact their customer service team who can help you with any questions or issues you may have.

Application

Click the “Apply now” button below and Go to LendingMate’s site

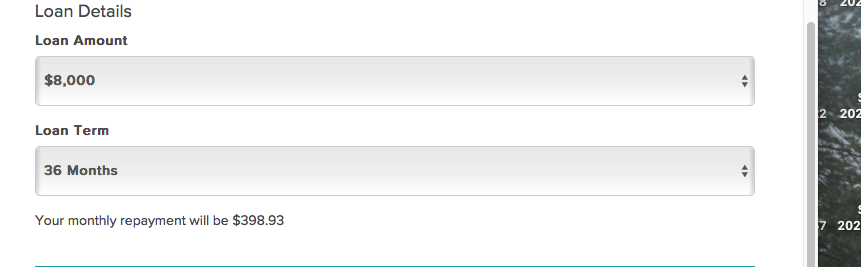

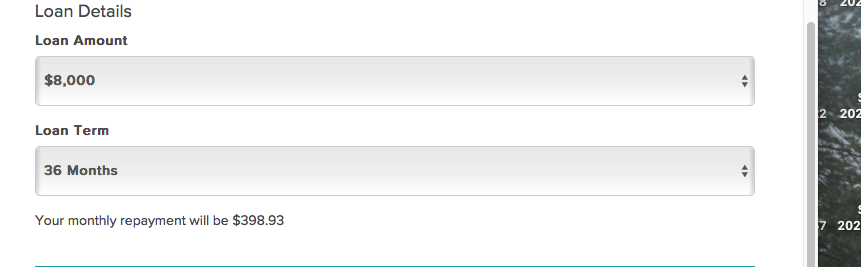

Slide the interactive widget to your desired loan amount and terms.

Fill in your personal information.

Fill in your contact information.

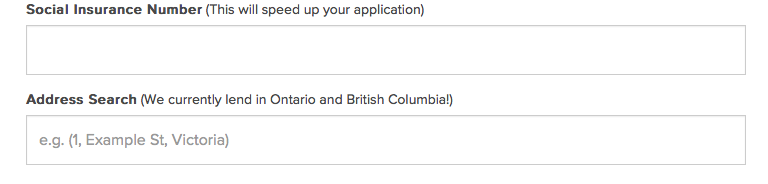

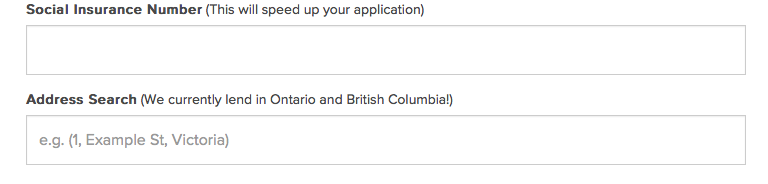

Fill in your social insurance number (optional) and address.

Select your loan details.

Complete the rest of the application with your guarantor and wait for instructions from LendingMate as they validate your, and your guarantor’s information.

Once approved, the funds are deposited within 24 hours to your guarantor’s bank account. They can then transfer the funds to you.

Frequently asked questions

How long after a defaulted payment is a guarantor contacted?

Can I change my guarantor?

Can a partner or family member be my guarantor?

Can I change my mind about being a guarantor?

Once the loan is paid in full; do I qualify for another loan?

Can I make extra payments towards my loan?

What does it mean to be a guarantor?

Why does LendMate require a guarantor?

Best Choice

LendingMate is offering an uncommon service to qualifying Canadians that other alternative finance companies are not. Every loan they offer, regardless of an applicant’s credit score, requires a guarantor for the funds. This basically means that the service is more geared towards applicants who know that their credit is not strong enough to secure the funds through more traditional lenders or without the aid of a guarantor.

Once a potential borrower has discussed the loan with their guarantor and they have reached their own personal understanding; LendingMate will develop a loan that will work with the borrower’s financial capacity. As a responsible lender, LendingMate looks at every possibility and does a thorough search of all applicants. This reduces possible losses to the company.

This is an exclusive business model that is still required in most cases today by banks or financial institutions. LendingMate keeps its focus on providing the service to qualifying Canadians with an old-fashioned spirit.