LendDirect information

Address: 400 Carlingview Drive Toronto, ON, M9W 5X9

Business hours: You can apply for a loan online at any time of the day and on any day of the week. However, the customer service department is available and respond to calls:

- Monday-Friday: 8:00 AM-9:00 PM EST

- Saturday-Sunday: 9:00 AM-5:00 PM EST

Customer Service

Email: [email protected]

Phone: 1-855-630-5363

Fax: 1-855-775-8225

Loan applications by phone: 1-855-630-5363

Fax: 1-855-775-8225

LendDirect has dedicated employees across its branches. They include customer care personnel responsible for guiding applicants and providing them with relevant information about the company.

LendDirect manages applicants’ personal information following the Personal Information Protection and Electronic Document Act (PIPEDA) of Canada. The company ensures that the personal data of each applicant is secure and protected.

Loans at LendDirect

Personal line of credit

LendDirect’s personal line of credit is a flexible personal loan. It is different from other loans because it gives you ongoing, continuous access to credit without the need to repeatedly apply for a loan. A personal line of credit is like a bank account where you can withdraw money multiple times. Once you pay it down after using it, you can access the line of credit again up to its approved limit. The amount of credit you have access to is based on your approved credit limit. Your creditworthiness determines your credit limit.

You are charged a fixed interest rate on the amount of money you use. For a LendDirect personal line of credit, you only pay interest on the amount you use.

Main Features of LendDirect Personal Line of Credit

LendDirect offers a quick and secure personal line of credit. Take a look at some of the main features;

- Loan amount: up to $15,000

- Interest rate: Between 19.99% and 46.93% APR, depending on your credit score and the province you reside in.

- Loan term length: Open-ended (no end dates)

- How repayment works: Automatic payment from banks on paydays.

- How you get the money: Interac e-transfer (up to $10,000), Direct deposit

Eligibility Criteria

To be eligible to sign up for a personal line of credit with LendDirect, you need to:

- Provide proof that you are a Canadian citizen who is between 18 years of age and 70 (government identification).

- Reside in Canada in Ontario, Alberta, Saskatchewan, British Columbia, New Brunswick, Newfoundland and Labrador, The Northwest Territories, Nova Scotia, or Prince Edward Island

- Proof you have been employed for a minimum of three (3) months.

- Provide valid documents stating a monthly income of at least $1500.

- Have an active bank account with direct deposit.

- Provide recent bank statements and bank account details. They include your branch transit number, bank number, and bank account number.

- Not be on any government assistance program.

Other documents you may be required to provide are your recent bank statements and a pre-authorized debit form.

Like most lenders, getting loan approval from LendDirect is linked to your income and financial history. LendDirect offers loans to people who may not have access to loans from traditional banks because of their poor financial history. The eligibility criteria for a line of credit are designed such that almost everyone can qualify for a loan.

Why choose LendDirect?

If you are interested in a loan with an offer of as much as $15,000, you can look into getting a LendDirect personal line of credit. A LendDirect personal line of credit can cover things such as paying bills, consolidating credit card debt, covering big expenses and handling emergencies.Additionally, there are many benefits to getting a personal line of credit from LendDirect.

Pay bills

Paying bills is a fact of life. However, problems can start when you begin to incur extra expenses that eat into your income, leaving you with a backlog of unpaid bills. Not only can unpaid bills damage your credit, they also affect how you live. A great way to solve the issue of outstanding bills is by getting a LendDirect personal line of credit. This way, you can pay all current and overdue bills and still have enough for other expenses.

Consolidating credit card debt

It’s easy to run into credit card debt because expenses keep coming up. However, you can reduce your credit card debt by consolidating it with a personal line of credit. This way, instead of worrying about paying off your credit card debt and all other outstandings bills you may have, you can combine them into one bill. You may have a better interest rate making payments easier.

Cover big expenses

Significant expenses like plumbing problems, a leaking roof, repairs and maintenance to your house or equipment, and a list of others can be covered with a personal line of credit. However, you might not be able to cover these expenses using your income alone. LendDirect’s personal line of credit can give you the additional funds you need to cover these costs and more.

Handle emergencies

Having a budget is necessary to keep your finances in check, but that doesn’t prevent emergencies from occurring. For example, you may face a medical emergency, or your car may suddenly need repairs. A personal line of credit from LendDirect can help to handle these emergencies.

Benefits of a personal line of credit from LendDirect

It is essential to find out information so you are aware of all the details of a lender and their loan products before making a final decision. You can find out information by reading about their loan terms from their official site and by speaking to a customer service representative.

The information you get, which includes the benefits and the disadvantages involved with getting the loan, will help you in your decision-making process.

There are numerous benefits involved in getting a LendDirect personal line of credit, some of which include;

- The whole application process can be completed online. However, if you encounter any issues while applying online, you can reach out to customer service for assistance.

- There are no fixed payment amounts. Instead, interest is charged on your outstanding balance.

- You can access the funds again after you pay off or pay down your balance. The amount you have access to depends on your credit limit.

- No origination fee, prepayment fee, or returned payment fee.

- You have a chance to save on interest by making larger payments.

- If you apply online during working hours, it takes a few minutes to 1 hour to receive the funds after approval.

- Automatic Repayment.

- On your loan due date, payments are directly debited from your account.

- Flexible payment options. You may get a courtesy payment extension when you have reasonable causes delaying your repayment. You can also make repayments before your payment due date.

How to Sign Up

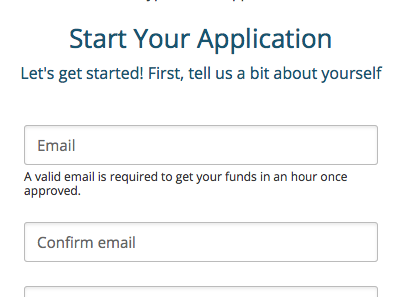

To apply online, Click on the “Apply now” button below.

Input and confirm your email address.

Fill out your personal information.

Choose the purpose of the loan (optional.)

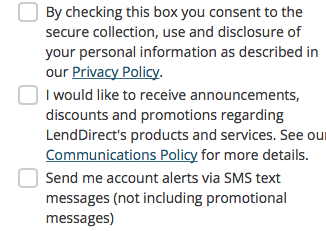

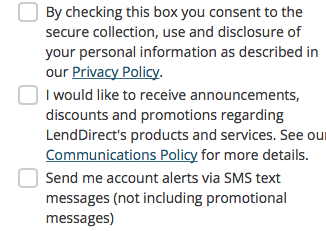

Check the boxes to consent to the privacy policy, if you would like to receive promotional material from LendDirect and account alerts.

Click “next” to continue with the application

Fill in your income details – For a decision to be made you will be required to submit a few specific documents to verify your income/employment status.

Application review – After you have filled in all the necessary information and submitted the required documents, your application will then be reviewed. Following the review of your application, you will then receive a decision within 24-48 hours. If you do not apply during business hours, your application will be processed on the next business day. Once you receive a decision, you can choose to accept or decline the offer.

Receive your money – Once your application has been approved, you will receive your money within 15 minutes to 1 hour. You can receive your money either by interac e-Transfer or by direct deposit. Receipt of money is faster via interac e-Transfer.

Signing up for a LendDirect personal line of credit is stress-free and the qualification criteria are relatively easy to meet. The application process is fast, especially during business hours. Their customer care mobile number and email address are provided on their website so interested applicants can call or send them emails if they have issues applying online.

Frequently asked questions

Is LendDirect a bank?

Is LendDirect safe?

What happens when I miss a payment?

How much does a lendDirect loan cost?

How do I access my credit after I get approval?

How fast can I receive my funds?

How do I make repayments at LendDirect?

Is LendDirect available in all provinces in Canada?

Conclusion

Few Lenders in Canada offer a line of credit of up to $15,000 as provided by LendDirect. The flexible eligibility criteria and the fast approval time make them an excellent option for getting a personal loan. The online application is very straightforward and contributes to making LendDirect one of the leading alternative lenders in Canada.

Aside from the high-interest rate and the fact that it’s not available in a few provinces and territories in Canada, a LendDirect personal line of credit can be used to cover any expenses you might have and help you achieve your financial goals.