Company Information

Address

100 King Street West

Suite 5600

Toronto, ON

M5X 1C9

Phone number: 1-855-223-9313

Email: [email protected]

Business hours:

Monday to Friday: 8:00 am to 1:00 am EST

Saturday: 10:00 am to 4:00 pm EST

Sunday: 10:00 am to 4:00 pm EST

Types of loans offered

Eastern loans has a very straightforward business model. They offer their customers one type of loan in three different amounts. These loans are intended to cover an emergency or temporary shortfall in the client’s budget.

Loan amounts

The loan amounts are $500, $750, and $1,000. You can apply for the amount you need, and if approved, the money will be in your account the same day.

Costs

There is no fee to apply for a loan from Eastern Loans. These loans have an approximate annual percentage rate of 23%.

Clients need to be aware, however, in addition to the interest rate, there is a surety fee that is charged. The surety fee can vary because the surety company sets it. For example, a $500 loan paid back in 6 biweekly payments can cost the borrower $750.45. The amount breaks down like this:

- $500 principal

- $27 in interest

- $223.45 surety fee

In this example, a client borrowing $500 and repaying the money biweekly would have 6 payments of $175.66.

If you miss a payment, you will be charged an NSF fee of $48. It can be possible to delay a payment if you contact Eastern Loans. You’ll have to pay a $28 fee to defer your loan payment. Delaying your loan payment is not available to residents of Manitoba.

If your loan defaults due to non-payment, the interest charged is 1.74% per month.

General terms and requirements

So, what do you need to apply? You must be able to meet the following requirements to be eligible for a loan:

- Canadian citizenship or Permanent Residency status

- You have an active bank account at a Canadian financial institution

- You are paid by direct deposit

- You are at least 18 years old

- You have held a steady job for 3 months (minimum) or more

- You earn at least $1200 per month

- You have had very few NSFs

- You have had very few payday loans

Some people might have income coming from a job and other sources. If your primary source of income is not from steady employment, your maximum loan amount may be capped at $500. Income sources not accepted for qualification purposes are:

- CPP

- Welfare

- Child tax benefit

- Income from self-employment

- Disability income

- Student loans

Repayment

Unlike a payday loan which you repay with your next paycheque, Eastern Loans has a three-month repayment schedule. You can choose to repay your loan in either 3, 6, or 12 installments to match your pay period. You can repay your loan ahead of schedule by increasing your payments if you have the cash available. Doing this will reduce your interest costs.

Documents required

To be approved for a loan at Eastern Loans, you need to fax some documents to them. The paperwork they require are:

- A sample cheque

- Your most recent pay stubs

- A bank statement

- Your identification

How the loan is funded

Eastern loans will deposit the money to your bank account the same day if you’re approved. In addition, they have recently added the option of receiving your loan by e-transfer.

Pros

- Quick application process-the online application takes about 5 minutes to complete

- Choice of applying online or over the phone

- Longer repayment period than typical payday loans-you have three months to repay the money you borrowed

- Bad credit doesn’t disqualify you from being approved

- You don’t need to secure the loan with collateral

- APR of about 23%

- Get the cash the same day you apply if your application is received before 10:30 am EST.

Cons

- Loans have a surety fee which makes them very expensive

- Paperwork required

- Amounts cannot exceed $1,000, which is not enough for some borrowers

- You must meet their income requirements

- Payments can be high and trap borrowers in a cycle of expensive, short-term loans

Why choose Eastern Loans

Eastern Loans provides small loans for people experiencing a financial shortfall or emergency. Some reasons to choose Eastern Loans are that they offer their services to almost every province. Their application process is fast. They have a longer repayment period than traditional payday lenders, and their customer service is rated highly.

Canada Wide

Eastern Loans are available to borrowers in almost every province, so you can apply regardless of where you live. In addition, they clearly specify on their website that their hours are Eastern Standard Time, so applicants know the time frames they are dealing with.

Fast application process

It only takes about 5 minutes to complete an application online. Once Eastern Loans has your application and documents, they can decide whether to approve your request or not. If they have received your application by 10:30 am EST and you are approved, they will deposit your money the same day. You don’t have to wait for a cheque to arrive in the mail.

Longer repayment term

Most payday lenders want the total amount they loaned paid back with the borrower’s next paycheque. This can make things financially difficult for some borrowers, causing them to take another payday loan. Eastern Loans gives the borrower three months to repay their loan so people can budget for their payments.

Excellent customer service

Eastern Loans prides itself on its customer service. They allow customers to deal online for comfort and convenience or to deal in person by calling an agent. They are rated 4.7 stars out of 5 on their website by 522 reviewers.

How to sign up

You can apply for a loan by calling or applying online.

By phone: Call 1-855-223-9313

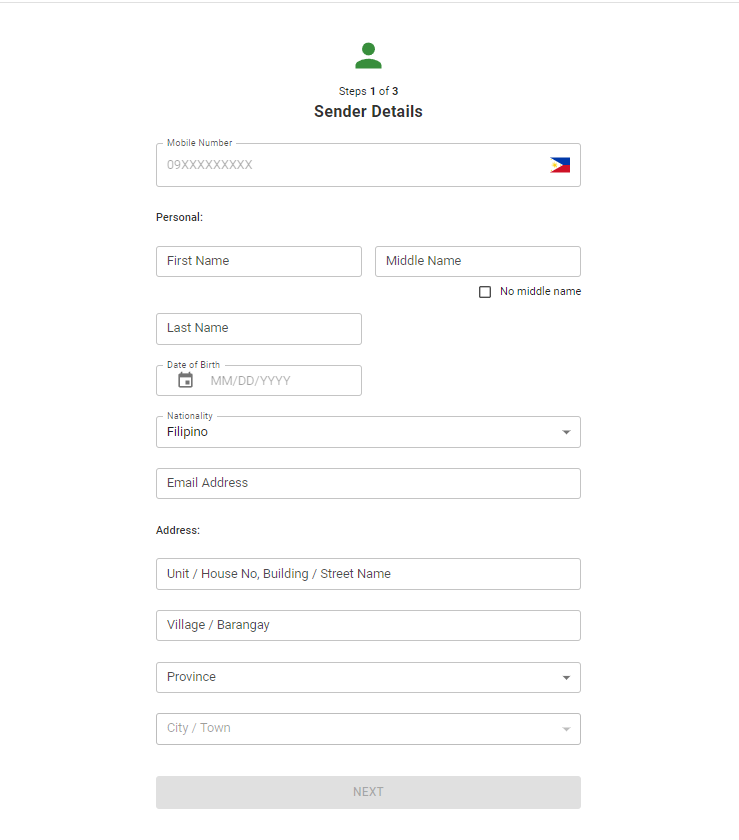

To apply online:

Select “apply now”.

Choose the reason for the loan.

Enter your email and choose “continue”.

Fill out the rest of the information and submit the required documents.

Frequently asked questions

How can I apply?

Can I get another loan from Eastern Loans?

What happens if I miss a payment?

Why was my loan declined?

When do I get my money?

Can I pay off my loan faster?

Conclusion

Eastern Loans offers borrowers a fast, easy way to get a small short-term loan. These loans are available to customers even if they have a poor credit score. Having a three-month repayment term allows borrowers more time to pay off their loan than they would have if they took a payday loan. Eastern Loans also provides excellent customer service to ensure that their clients are taken care of.