Company Information

Their main office is located at:

372 Bertha Street

Hawkesbury, Ontario K6A 2A8

You can reach them by SMS at 1- 647-952-6644

There is no walk-in service available at the main office as they are an online service.

They do, however, accept walk-ins for Nova Scotia residents who can visit their storefront located at:

215 S Foord Street

Stellarton, Nova Scotia B0K 1S0

You can contact an iCash account manager to discuss your application at 1-833-422-1234 or by SMS: 1-647-952-6644

by email at: [email protected]

For office inquires you can email: [email protected]

For Customer Service email: [email protected]

Website: Www.iCash.ca

The customer service representatives at iCash are available:

- Monday to Friday, 24 hours a day.

- They are also open Saturdays and Sundays from 7 am to midnight EST.

- They are even open on holidays and weekends during the mentioned hours.

Types of loans offered

iCash is a short-term unsecured loan provider that offers two options to repay the loan they offer. There are no hidden fees within and the terms and conditions are the same for each loan. The criteria for each loan type differs slightly depending on the repayment selection of the applicant through the interactive application.

The automated system reviews the application and, by using their decisive-module technology, a loan amount for the eligible applicant is generated. So, while you might not necessarily get what you requested on the initial application, if you meet the requirements you will be presented with a loan offer that may be close to the desired amount.

The iCash account managers cannot alter or change any data for your loan agreement. However, you can contact them with any concerns if information appears incorrect. iCash advises any inquiries to be directed to the correct department as staff in customer service are not trained in account management and vice versa. You can contact them by email, and an authorized representative will contact you promptly.

Cash Advance (Payday) Loan

A cash advance loan, also known as a payday loan, is a cash advance on your next paycheque. You will receive a lump sum that is generated by the automated software. You can request a cash advance in amounts ranging from $100-$1500. The cash advance loan must be repaid in full in one payment on your next pay-day.

Flexpay loan

The initial terms are the same as a cash advance. First, you select the amount you would like to borrow through the interactive online application. The difference between a cash advance loan and a Flexpay loan is the repayment terms. With a Flexpay loan, you can repay the borrowed amount in two or three installments instead of in one installment. Both options offered by iCash have the same interest rates on their contractual documents.

Flexpay loans are available to customers based on the province they live in. Government regulations in Ontario and Nova Scotia only allow loans to be repaid in one installment, while Alberta allows loans to be repaid within 2-7 installments.

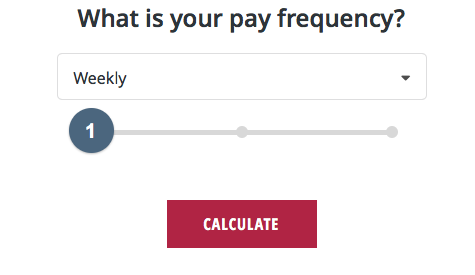

In order to be eligible for a 2-payment loan, customers must be paid weekly, bi-weekly, twice a month or receive 2 monthly government incomes. A 3 payment loan requires a borrower to be paid weekly, bi-weekly or twice a month from the same source of income.

With easy-to-understand options, selecting the right plan for you is simple and the application should require no more than a few minutes to complete.

First-Time Customer

iCash has implemented the TRS (Trust Rating System) for preferred clients with a rewards incentive program. There are some restrictions for first-time applicants but, once customers build their TRS, they can possibly increase their borrowing capacity with iCash.

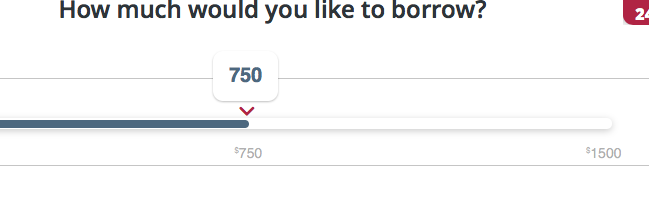

First-time applicants are only eligible for a maximum of $750. However, as the TRS increases, clients can gradually increase their borrowing limit to the maximum of $1500 if they meet all the requirements.

Lending criteria

The iCash system uses multiple algorithms to generate the loan offer. The minimum criteria for eligibility are:

- The borrower must be 19 years of age or older.

- A Canadian citizen, residing in the provinces where iCash offers service.

- The same income source for a minimum of three months or a minimum of three months with the same employer.

- A net income of $800 a month, minimum.

- Your income is deposited by direct deposit into your bank.

- A Canadian bank account which has been open for a minimum of three months with online banking access.

- A valid mobile number, home address, and email address.

Incomes Accepted

As an option for Canadians to access immediate funds as a cash advance payday loan, iCash accepts the following as proof of income for the automated system:

- Employment Income

- Employment Insurance

- Child Tax Benefit

- Disability Pension

- Old Age Security

- Canada Pension Plan

- Provincial Disability

- Worker’s Compensation

- Company Pension

- Veterans Disability Pension

- Armed Forces

- Social Benefits Income

Application Denied

The results are entirely generated by automated system software and decisive modules. If an applicant is rejected, the system has deemed the borrower to be a high risk. Essentially you are beyond your repayment capacity, and to further your debt load would not be responsible for iCash.ca. The system reviews your payment history, your credit (although the score does not affect the system’s decision), your bill payments, and your income.

Fees and terms

Provincial and federal legislation dictates the exact interest rates iCash’s lending service must adhere to. All provinces have different pricing in place.

- In Alberta, it costs $15 for every $100 borrowed.

- In BC, it costs $15/$100

- In Manitoba, it costs $17/$100

- In New Brunswick, it costs $15/$100

- In Nova Scotia, it costs $19/$100

- In Ontario, it costs $15/$100

- In PEI, it costs $15/$100

- In Saskatchewan, it costs $17/$100

iCash also charges an APR of 109.5% on all loans.

Example:

- Borrow $300

- Payback in 14days= $345

- Cost $45

This includes all fees and interest and there are no hidden charges. You can also pay off your loan early without any penalties or fees. All loans have a term limit of 7 days to 62 days maximum. There are no extensions or altering of payment days. The automated software and decisive model analyze the entire application. The system then generates the entire contract with an approved amount and the payment dates. The dates specified in the agreement are based on your bank verification of income and the coinciding pay dates.

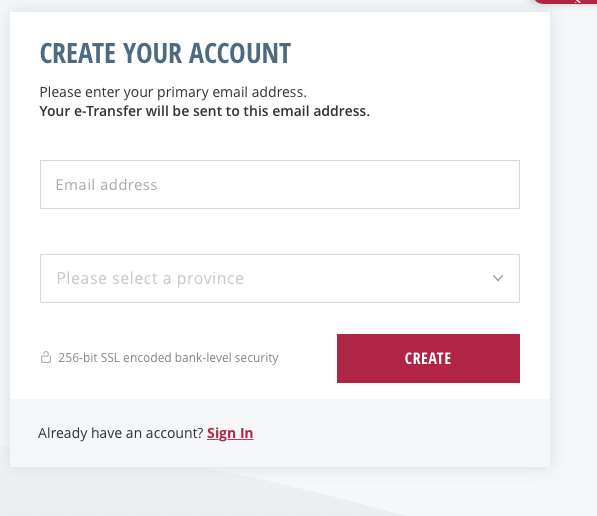

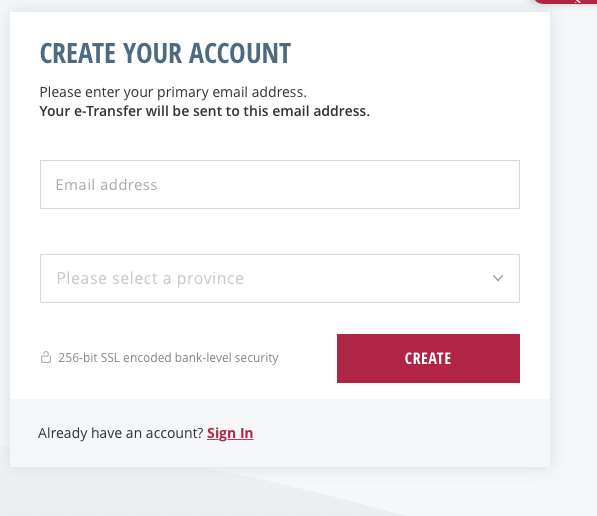

iCash provides an easy process where you select your amount, choose your terms, and provide your details. The system generates an immediate response and you sign your loan contract electronically if you’re approved. Then, the funds are sent to you via e-transfer within 2 minutes. Funds and services are conducted 24/7 online.

NSF (Non-Sufficient Funds) Fees

Legislation differs for each province and, in turn, the NSF fees that are charged. An NSF fee is charged when a request for payment is returned to iCash because the bank account was short of funds to make the payment. The following NSF fees are charged by iCash and your financial institution may charge additional NSF fees:

- BC $20

- Alberta $25

- Manitoba $5

- Ontario $ 25

- Nova Scotia $40

- New Brunswick $20

- PEI $48

Loan repayment

iCash uses pre-authorized debits to apply payments to your loan. For early or missed payments, they accept e-transfer or credit card payments but this is strictly for clients that have defaulted.

As the entire process is approved and generated by the automated system, the payments must be made directly from your bank. Under no circumstances can payment dates be changed. If you default or anticipate problems with your payment, you are advised to contact an iCash manager to resolve the matter as soon as possible.

A copy of the loan contract is emailed to the valid email you provided when the application was completed for all payment dates required under the loan contract.

As a short-term loan provider, your Cash Advance Payday Loan will not affect your credit rating unless you fall into default.

Why choose iCash

iCash is a great choice for borrowers who need a small loan. Their online application process is fast and, if you’re approved, you can have your money very quickly. They are committed to being responsible lenders, offer bonus resources and a rewards program which helps borrowers lower their costs.

Easy application

Borrowers apply online for an iCash loan. The application can be completed in as little as 10-15 minutes. If you’re approved, iCash can process an e-transfer to you in as little as 2 minutes after signing the loan agreement.

Responsible Lending

iCash is committed to helping Canadians and adhering to federal regulations. With these regulations in place, the system will not allow applicants to borrow more than their repayment capacity.

There are stipulations regarding when you can reapply for another loan. Your current loan must be paid in full before another loan will be considered. By repaying early through e-transfer, you cannot immediately reapply if you live in Alberta, Manitoba, or Nova Scotia.

- In Alberta and Nova Scotia, you must wait until the original final day that the loan was paid. Then you can reapply for another loan.

- In Manitoba, you must wait until the 7th day after the loan was paid before you can reapply.

Bonus Resources

The site has a few available resources for financial education available for viewing; some are interactive, like the budget loan calculator. In addition, there is an education center on the site where you can learn budgeting tips and all the definitions for financial terms. Knowing this information can significantly improve your financial understanding and possibly your budget.

Cash Back Program

iCash offers a fantastic reward incentive for their clients. As you borrow with them, you save at the same time. Once your loan is repaid in full, you will receive 20% cash back on the cost of borrowing which is deposited directly to your bank account. While the Cash Back Program isn’t available to residents of Manitoba, it is available for borrowers elsewhere.The Cashback Program can help lower the cost of borrowing significantly and provides an excellent option for Canadians looking for an extra incentive when deciding on a possible lender.

The Application

Click the “Apply now” button below and Go to iCash’s website

Select amount.

Choose your payment frequency.

Where do you live?

Create an account and provide personal information. (baking, proof of income)

Await email or SMS with your approval offer.

Sign Documents.

Receive funds within minutes of signing.

Frequently asked questions

Does iCash do a credit check?

Does iCash share my information with anyone?

What is your phone number?

As iCash operates through mainly electronic communications; how is their customer service?

I was approved. How do I receive my funds?

How long does Icash approval take?

How does iCash work?

How to pay back iCash?

Where is iCash located?

Best Choice

iCash.ca is an excellent solution for Canadians who need emergency funds or are facing some extra expenses. With flexible repayment terms and a much lower APR than the traditional payday loan companies, iCash.ca is a definite front-runner in loan options for interested applicants.

With service 100% online and an instant verification system, ICash.ca provides its clients with access to the funds they need within minutes of signing the contract. That kind of service can be a deciding factor on where to apply for a loan for many Canadians.

Applicants are encouraged to download and register with the iCash.ca mobile application from Apple Store or Google Play. Applicants can use the app to apply, review, and access all their account information from the mobile app anywhere from their mobile device.