You Can Find Their Main Office At:

500 Danforth Avenue, Unit 304

Toronto, Ontario M4K 1P6

They Handle Customer Service Requests from:

Monday-Friday 8:30am-7pm

Saturdays & Sundays & Holidays 9am-5pm

Closed December 25

The application requests and approvals are available 24/7 by the automated management software and decisive modules.

Contact Information:

Call Them: 1-888-984-6329

Fax: 1-855-674-6329

Email: General Inquiries [email protected]

For Loan Applications [email protected]

Or utilize the sites chat widget, Explore Their Website: www.goday.ca

Many people are having the same challenges we all have, facing this new world. So, it stands to reason that financial difficulties have affected many Canadians. Unfortunately, sourcing a reputable and affordable lending service can leave you feeling overwhelmed and indecisive.

Company Information

As a leader in the short-term lending industry in Canada, GoDay is committed to ethical lending. They discuss all available options and what charges the borrower will have before they accept the terms of the loan so borrowers will know what they will have to pay before agreeing to the loan. They also limit loans to one per customer without the opportunity to borrow more until the initial loan is paid in full.

GoDay offers guidance by assisting those in need of consolidation services by providing information for budget planning, economic outreach assistance, and credit counseling. They host free webinars and education classes to help Canadians better plan financially so they can allocate funds to decrease their debt.

By exploring GoDay in-depth, you will see different loan options that offer various possibilities to get the cash you need through their services. They offer smaller, short-term installment loans and payday loans.

Types of Loans Offered

They offer just two types of loans. Of course, the amount you can borrow varies, but the conditions remain the same. The loan types are:

- Payday Loans – payday loans are generally used to take care of urgent financial matters that cannot wait until the borrowers’ next payday.

- Installment loans – After qualifying for your short-term installment loan, the only real concern is: what can you use the money for? You can use the money for almost anything such as eliminating accumulated debt, buying a car, paying off medical expenses, taking a holiday, or renovating your home. As long as you meet the qualification criteria, the lender does not control how you spend the money.

Payday Loans

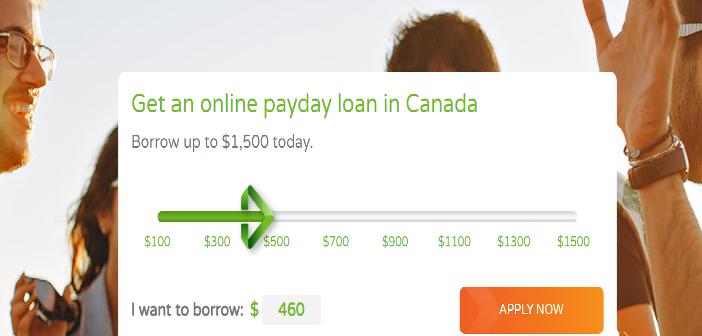

Borrowers can apply for payday loans from $100-to-$1500, with interest rates managed by legislation of the province. First-time borrowers may apply for up to $500 to establish a good GDTR (GoDay Trust Rating) with GoDay. The APRS (annual percentage rates) are:

- ON,BC, NB- 391.07% ($15 per $100 borrowed)

- SK, MB -443.21% ($17 per $100 borrowed)

- NS-495.3% ($19 per $100 borrowed)

- AB, PEI-$15 per $100 loaned

Installment Loans

A potential borrower can apply for installment loans from 1000-to-$15000. Installment loans are repaid over a period of time as stated in your loan agreement. There are no penalties for early repayment on installment loans.

The applicant’s risk factors are the top concern for a lender. Borrowers might not qualify for the amount they request if they are considered high-risk.

GoDay doesn’t disclose the APR for their loans because they may vary based on the borrower’s risk rating.

Instant Approval

Within moments of you signing the online documents and completing the IBV (Internet Banking Verification), the money could be in your bank account within an hour up to 24 hours. Using top-level encryption security software to conduct the process, be assured your information is safe.

Fees and costs

GoDay uses provincial standards to design appropriate loan offers based on your location. Rates can depend on the client’s borrowing profile and verification of the borrowing criteria.

GoDay may charge late fees or NSF fees if your payment is not made on time. An NSF fee (Non-Sufficient Funds) or late fee may apply if you don’t repay your loan as agreed.

Missed payments, lender’s fees, added costs, and a 30% per annum charge are also calculated against any outstanding balances you may have that are not repaid on time.

Repayment terms

There are a few criteria for a repayment schedule of an installment loan. The lending service representatives at GoDay will work with you to help you sort out any issues with the loan payment you may be having. Staying in communication will ensure your account remains in good standing. Repayments of payday and installment loans are:

- Payday loans have an immediate “due upon your next payday” term unless your payday falls within two days of your nearest payday.

- Installment loan repayment contracts can range from 6-to-60 months. For loans over $1000, longer amortization can be arranged.

- Installment loans are repaid over time in equal installments as outlined in the loan agreement.

- Loan payments can be made weekly, bi-weekly, or monthly

Repayment options are subject to the payee’s paycheque schedule, the established repayment plan, and terms set by authorized personnel.

There is no deferring any payday loan payments. Those are due immediately upon your next scheduled payday, providing it is longer than 2 days away. However, upon establishing an excellent GDTR (GoDayTrust Rating) with Goday, representatives may authorize a deferral for a loyal customer should an unforeseen emergency arise. Your GDTA also contributes to your borrowing limits with the company.

There is the possibility of added costs and fees if the borrower defaults on their contractual obligation.

Should the borrower default on their payment obligation, the team will contact the borrower to work out new payment arrangements. If communication cannot be established with the borrower, the account will go into arrears and go to collections. Having your payday loan or installment loan go to collections will damage your credit score and increase your borrowing risk factor with other lenders.

By communicating any issues you are having with the agents, you might be able avoid a negative impact to your credit rating.

Why choose GoDay

GoDay is a great choice for customers because it allows borrowers to customize their loan options, the application is done online wherever and whenever it is convenient for you, and your information is kept private and secure.

While there is a firm set of policies and procedures for each contractual arrangement between GoDay and their clients, each agreement can be distinct and customized to each circumstance.

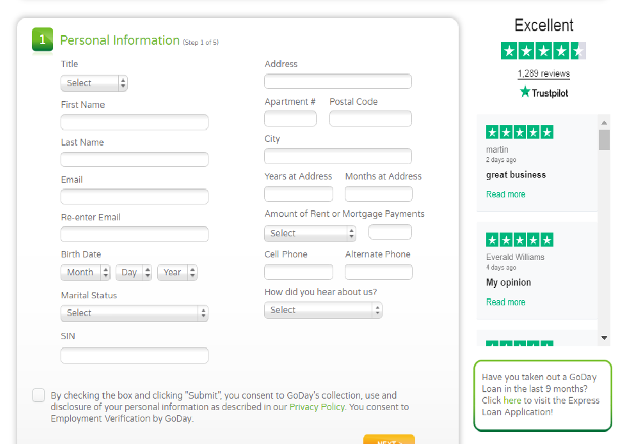

The general conditions do apply to all their clients. By submitting your application online, you consent to the process of verification and approval by the management system. This means you agree to a credit check, proof of your identity, and confirmation of your stated income.

GoDay does not share your information to any third parties for solicitation. Instead, they remind their clients that they are a general information resource for Canadians. This means that although they do offer many sources of financial advice and counseling, this is strictly to help the consumer and not an endorsement of any outside services provided.

Your contact information is also used to send you regular news or programs that may help you search for lending services or credit counseling. You can at any time opt-out of these communications via SMS or email.

Your information is also used to create company performance reports. This helps the development team improve their service for better functionality and accessibility of available funding for future clientele.

How to apply

Click the “Apply now” button below and go to GoDay”s website.

Slide the cursor to the amount you would like to apply for and select “apply now”. You will be immediately prompted to enter your details to help the lender verify that the information you provide is accurate. This process involves a credit check and your banking information.

Once you follow through the process, the fully automated management software processes and validates your application. This cutting-edge technology enables an almost instant approval time if all information required has been verified and deemed to be accurate.

For payday loans, the process is verified, and funds are dispersed instantly. The larger installment loans may require communication with one of the stellar agents at GoDay. Once any concerns have been addressed, authorized personnel have finalized your approval. You can expect to see your funds within 24 hours.

Frequently asked questions

Why choose GoDay.ca?

What makes them a trusted and reputable financial lending source?

What if I have bad credit?

Do I qualify if I am not employed full-time or I am self-employed?

How often can I get a payday loan from GoDay.ca?

What Do I Need To Apply?

Best Choice

With their entire application, approval, and disbursement of funds done 100% remotely, accessing emergency funds instantly could help you out of a challenging situation.

GoDay payday loans are a great solution to a temporary problem. However, they are not intended to be a long-term solution to accumulated debt. If consolidation services are required, discussing your concerns with a financial expert could help you get back on track.

By maintaining communication and working with your agent to repay and keep your commitments to the terms and conditions of the arrangement, you strengthen your borrowing relationship with Goday, increasing your GDTR (GoDayTrust Rating).

GoDay not only provides their customers instant emergency cash or a short-term installment loan, but in addition, their responsible lending strategy also helps many borrowers get their finances and budgets in order through expert financial advice.

With many interactive website features, you will find any help you need to develop a budget and fool-proof methods to regain your footing in the financial world.