You can explore their services available at their site: Www.Fairstone.ca

Main Offices:

630 boul. René-Lévesque West Suite 1400

Montréal, QC H3B 1S6

666 Burrard Street, Park Place Suite 1700

Vancouver, BC V6C 2X8

With several ways to connect with a lending specialist; they can be reached by:

Phone: 1-888-638-2274

Agents are available

Monday to Friday 8 am-8 pm EST

Phone: 1-800-995-2274

Agents are available

Monday to Friday 8 am-8 pm EST

They also can be reached through their Facebook Monday to Friday, 8 am-5 pm EST.

Clients and potential borrowers can also use the IVR (Interactive Voice Response) System 24/7

Branches

With over 240 branches located in Canada, potential borrowers can walk into any location for service and apply in person:

- Alberta (26 locations) North West Territories (1 location) Saskatchewan (7 locations)

- British Columbia (23 locations) Nova Scotia (12 locations) Quebec (57 locations)

- Manitoba (10 locations) Ontario (75 locations) Yukon (1 location)

- New Brunswick (14 locations) PEI (2 locations) Newfoundland (15 locations)

- To find more information about your location, visit Www.Fairstone.ca.

Loans Offered by Fairstone

Personal Loans

Fairstone brings innovative solutions to Canadians by offering various loan options for different borrowing needs.

Secured Loan

A secured loan with Fairstone is an equity-backed borrowing strategy. Clients can use their home’s equity as collateral for securing funds from Fairstone. By securing the loan with the equity in your home, Fairstone can offer lower interest rates to higher-risk borrowers.

Using their easy online application platform can get you an approval on the same day. A Fairstone specialist receives your application within minutes. There is also no impact to your credit score to explore your borrowing options with Fairstone.ca.

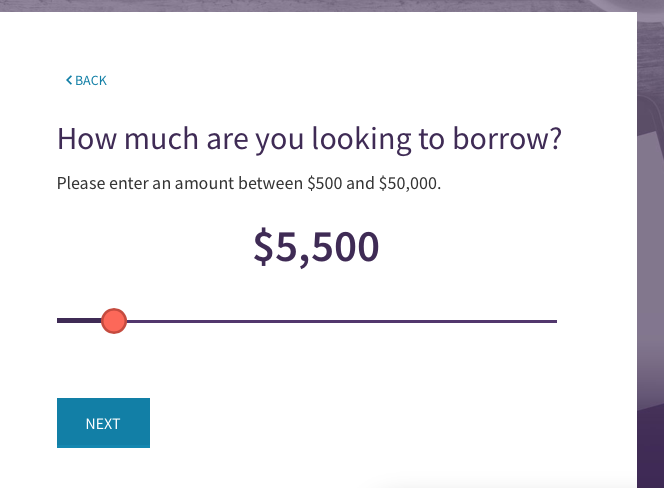

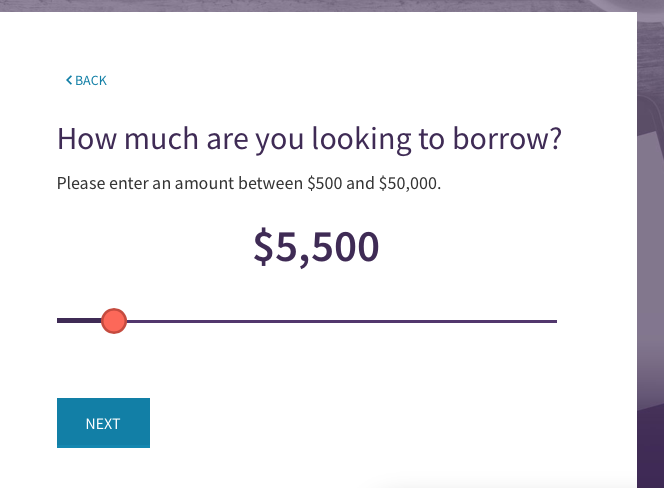

Amounts Offered: $5000-$50000

Terms: 36-120 Months

Interest Rate: 19.99-23.99%

Secured: Yes

Home Ownership Required: Yes

Prepayment Penalty: Yes

Payments: Fixed

Fees: vary by province

Application Processing Time: 3+ days

Guarantee: 3 days

Unsecured Loan

Fairstone’s borrowing model allows Canadians with a fair-to-good credit score an unsecured loan option for their funding needs. There are no added fees when you apply for an unsecured loan, and qualifying applicants can expect a same-day decision and funds from the loan if all requirements are met.

Amounts Offered: $500-$20000

Terms: 6-60 Months

Interest Rate: 26.99-39.99%

Secured: No

Home Ownership Required: No

Prepayment Penalty: No

Payments: Fixed

Fees: None

Processing Time: Less than 1 day

Guarantee: 14 days

Mortgages

Fairstone offers affordable mortgage financing options for Canadians, with two simple programs to help you achieve your financial goals.

First-Mortgage Refinancing

Loan Amount: Up to $400 000

Interest Rates Start At: 12.49%

Amortization: Up to 25 years

Terms: 1-5 years

Secured Loan: Yes

Fees: Yes

Prepayment Penalty: Yes

Time to Process Application: 2+ days

Second-Mortgage Refinancing

Loan Amount: Up to $125 000

Interest Rates Start At: 15.85%

Amortization: Up to 20 years

Terms: 1-5 years

Secured loan: Yes

Fees: Yes

Prepayment Penalty: Yes

Time to Process Application: 2+ days

Interactive Calculator

Regardless of what type of loan you are considering, you can explore several options with Fairstone to design the perfect loan for you. By using the interactive loan calculator on their site, you can select specific information pertaining to your unique situation.

Potential clients can choose their loan amounts and even enter their credit scores. The system immediately generates a loan payment estimate based on your request. Fairstone.ca advises in the fine print that the quote is subject to all criteria being met and that the information you provided is accurate.

Criteria

Fairstone Financial offers a simple application process. However, borrowers need to meet the following requirements to be considered for funding.

Personal Identification

Applicants must provide valid identification. Fairstone Financial accepts the following as proof of identity for application processing:

- Valid Canadian Driver’s License

- Canadian Permanent Resident Card

- Valid Canadian Passport

- Canadian Citizenship Card

- Valid Non-Driver Identification Card, where applicable

They also will accept two pieces of secondary identification if clients are unable to meet the first form of identity validation:

- Government-issued Canadian birth certificate

- Certificate of Indian Status Identity Card/Indian and Northern Affairs Canada Card

- Current Credit Card or Debit Card with an embedded photo

- Military ID Card with accompanying government-issued photograph

- Current bank statement

- Utility bill from the last 30 days containing your full name and current street address

- Notice of Assessment from CRA (Canada Revenue Agency)

- Provincial Health Card

Employment and Income Verification

For the loan application’s qualifying process, potential borrowers must provide a current pay stub with a detailed breakdown of their income. The paystub must be dated within 30 days or future-dated no more than 7 days; it must also show your year-to-date income.

The pay stub must have the CPP and E.I. deductions broken down for review. The name and logo of the company you work for must be on the pay stub. Your latest T4/T4a can also be used for income verification. For Canada Pension Plan (CPP) recipients, a statement dated within the last 12 months is required as proof of income. For self-employed individuals, applicants must provide a CRA Notice of Assessment from the past 2 years; and one of the following as added proof of income:

- Business License

- 411 or Yellow Page Listing

- Bank statement showing business name

- Residents of Quebec must also provide the Notice of Assessment issued by Revenue Quebec.

Housing Information

As part of the loan approval process, applicants must verify their housing situation. Applicants must verify their rental arrangements for unsecured loans if they do not own their home. For the application process, potential borrowers must submit the following:

- Current lease agreement (within 5 years)

- Any of the following dated within 3 months:

- Rent receipt

- Canceled cheque

- Bank statement or electronic fund transfer

- Typed or hand-written letter showing rent amount and landlord’s signature

Applicants must disclose their current mortgage details to apply for one of Fairstone’s mortgage refinancing options, including the financial institution the mortgage is currently held with.

Applicants must provide the latest mortgage statement that shows:

- Current balance

- Monthly payment

- Payment status

- Your name and address

- Annual mortgage statement dated within 30 days

Once applicants have gathered the required documents for consideration, the approval process is done and, in some cases, approved the same day.

Loan Insurance

Fairstone understands that circumstances can arise that limit your ability to pay back borrowed funds. To protect clients from possibly defaulting on their contractual obligations, Fairstone offers an insurance protection plan for those unexpected emergencies.

A triple protection plan covers disability, job loss, and life insurance. Fairstone’s protection plans adds peace of mind so that if an unfortunate circumstance arises, you or your loved ones will not suffer any financial hardships because of your Fairstone loan payments during this difficult time.

The loan insurance is a requirement to secure any funds taken. This safeguard helps protect Fairstone and the client from any financial loss.

Flexible Payment Options

Fairstone has 4 available options for their clients to arrange repayment for any loans that they secure:

- Clients can utilize the automatic- payment plan where the funds are automatically withdrawn from the borrower’s bank account on their paydays without any inconvenience or added fees.

- Clients can also create a user profile and make direct payments through the site’s customer portal.

- As a trusted lender across Canada; Fairstone is an available payee on your bank’s vendor list. You can simply select Fairstone as a payee and enter your 7-digit account number. Once added, you can send your regular payments through your bank’s platform.

- Lastly, Fairstone accepts in-person payments at their locations or through the client’s financial institutions branch.

Direct payments can be made to branch tellers. You can pay by cash, cheque, money order, either through one of the methods mentioned or by mail. Payments mailed must be received 3-5 days before the loan payment is due to ensure payment is posted on time.

Special Features

Fairstone offers more than just lending solutions to Canadians. They provide potential security for any emergency with their Home & Auto Security Plan.

Roadside Assistance & Emergency Towing

This service is available for applicants who require roadside or emergency assistance while traveling anywhere in Canada, the USA, or Puerto Rico. Clients are covered for up to $150 of any expenses incurred.

Hazardous Weather benefits

Suppose a client is stranded more than 80kms from home due to hazardous weather conditions. Fairstone.ca will reimburse clients up to $750 for costs incurred from hotels, meals, and even personal necessities that are required.

Ambulance, Paramedic & Emergency Medical Reimbursement

Injuries and accidents occur every day. The Fairstone security plan will reimburse 100% of all ambulance, paramedic, and medical expenses not covered by your provincial or private insurance policies.

Coverage is guaranteed for clients while in Canada and the U.S. There is also 48 hours coverage of any outpatient expenses while in the U.S.

Travel Interruption Benefits

If your vehicle is damaged due to an accident or mechanical breakdown, the Home & Auto Security Plan will reimburse any unexpected expenses you incur up to $75 per day. This can be for renting a car and $225 per day for meals and lodging.

On average, this coverage can save clients $750 per trip if they experience a trip interruption due to vehicle issues.

Home Deductible Reimbursement

The Home & Auto Security Plan will cover the out-of-pocket expense of homeowners who have insurance deductible payments, covering up to $500 for emergencies, like damages caused by bad weather, fire, water damage, or theft.

Professional Locksmith Services

This is for applicants who require emergency professional help for lost or stolen keys or retrieving keys locked inside a house or vehicle.

This service also can be used to rekey locks when moving into a new home. Borrowers are reimbursed up to $150 per call.

Everyday Expense & Travel Savings

Accessing My Savers discounts through the customer portal; clients can access discounts at over 55,000 restaurants.

Explore other deals on travel, attractions, and entertainment in over 10,000 cities in Canada and the U.S. On average, this can save members up to $1,054 per trip.

Pros and Cons

Pros

- Fairstone.ca creates a personalized loan option based on individual circumstance

- Secure and easy application process

- Fixed rates and terms for added savings

Cons

- Qualifying for any secured loan requires your home’s equity as collateral

- Higher interest rates than traditional lenders for refinancing loans on mortgages

- The interactive calculator does not really help design the loan you want to apply for. The final decision is under the complete discretion of Fairstone.ca and involves assessing your risk of any possible default.

How to Apply

Click “Get A Loan Quote.”

Choose the “Get Started” icon.

Slide the icon until you get to the amount you want to borrow.

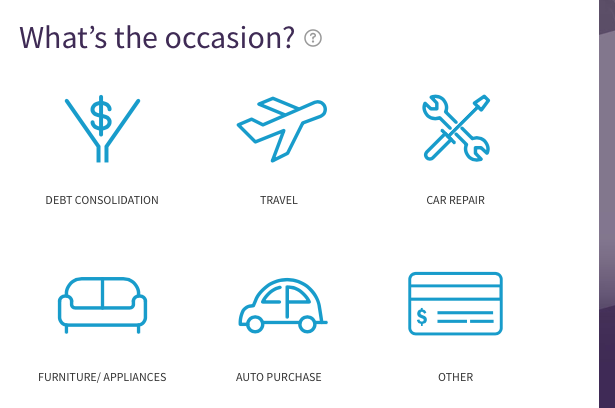

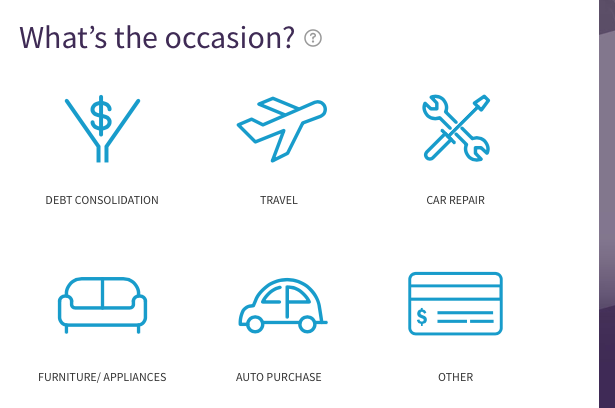

Select the reason you want the loan.

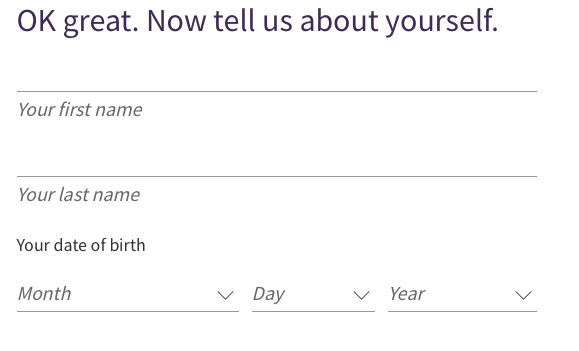

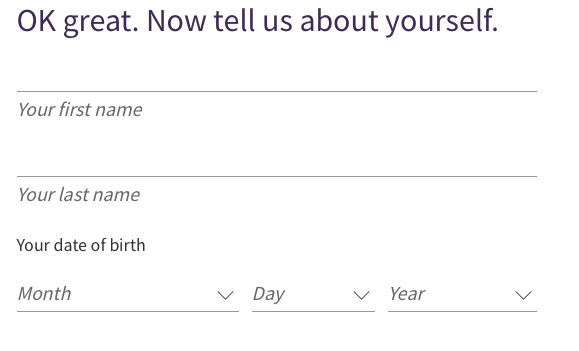

Fill out your information on the following screens.

Get started. Requesting a quote will not impact your credit score. Follow the required steps to complete your quote. A loan specialist will contact you to finalize the loan if you are interested in your quote.Once approved, you can complete your borrowing documents and get your cash.

Frequently asked questions

What can I use the loan for?

Can I pay the loan off early without penalty?

My loan is due today; Can I pay it online and be on-time?

What is Fairstone Financial?

Who owns Fairstone Financial?

How to pay off Fairstone loan?

What is my Fairstone account number?

What is Fairstone interest rate?

Best Choice

Fairstone.ca is offering Canadians a full spectrum of lending options that can suit almost anyone’s needs. As a leader in responsible lending, potential clients can complete the online application and expect to hear from a Fairstone.ca specialist within a day with loan offers based on the requirements being met and the applicant’s credit score.