Company Information

Address

33 City Centre Drive 5th floor

Mississauga, ON

L5B 2N5

Phone number

1-888-502-3279

Sales

Monday to Friday: 9am-10:30pm EST

Saturday: 10am-8:30pm EST

Sunday: 10am-6:30pm EST

Service

Monday to Friday: 8 am-8 pm EST

Saturday and Sunday: 10 am-6:30 pm EST

Send an email by:

Going to easyfinancial.com and choosing “contact us.”

Types of loans offered by Easyfinancial

Easyhome has a variety of loans available to meet its customers’ needs. There are personal loans, auto loans, home equity loans, and bad credit loans for personal needs, and they have small business financing as well. Each loan type has different minimum and maximum amounts, rates, and criteria to qualify.

Personal loans

You can use a personal loan for almost any purpose, including consolidating debt, home repairs, a vacation, or a wedding. Features of Easyhome personal loans are:

- Loan amounts from $500 up to $20,000

- You can apply if you have no credit history

- Take from 9 months to 84 months to pay off your loan

- Bi-weekly, semi-monthly

- or monthly payments

- Interest rates from 29.99%-46.96%

- Get your money by Interac e-transfer in as little as 2 hours after being approved

- 2% rate reduction if there is a co-applicant

How to qualify for a personal loan

You need to be at least the age of majority in the province or territory where you reside. Your employment status must be full-time, part-time, seasonal worker, on maternity leave, retired with a pension, or disabled.

You must be a resident of Canada and be a Canadian citizen, a Permanent Resident, have a valid Work Permit, or be a Foreign Student for at least 6 months.

The minimum monthly net income required is $1200, and at least $1,000 must come from full-time, part-time, self-employment, disability, or pension.

Documents needed to apply for a personal loan are:

- Two of your most recent pay stubs

- The last 90 days of your bank statements

- A recent bill that is addressed to your current residence

- One piece of government identification that hasn’t expired

Auto loans

Auto loans help borrowers get the funding they need to buy a vehicle. As a borrower, you can be pre approved, so you know exactly how much money you have to spend and what your payments will be. Auto loan features are:

- Amounts from 5k-50k

- Terms from 12 months to 84 months

- Rates from 11.9%-29.9%

- No fees to pay off your loan early

- No age restriction on the vehicle, but it must have less than 250k kilometres

Documents needed to apply for an auto loan are:

- Two of your most recent pay stubs

- The last 90 days of your bank statements

- A recent bill that is addressed to your current residence

- One piece of government identification that hasn’t expired

Home equity loans

Home equity loans use the equity in your home as security for a loan. Because the loan is secured, you can borrow a higher amount with lower rates. Additionally, you have a longer time to repay it. Some features of a home equity loan are:

- Borrow up to 75k

- Terms from 72 to 240 months

- Bi-weekly, semi-monthly, or monthly payments

- Interest rates start at 9.99%

- 2% rate reduction if you have a co-applicant

To apply for a home equity loan, you need to provide the following documents:

- Two of your most recent pay stubs

- Bank statements from the last 90 days

- A piece of government identification that has not expired

- A recent bill addressed to your current residence

- Most recent property tax statement

- Copy of your most recent mortgage statement

Bad credit (installment) loans

Sometimes things can cause you to miss payments or default on a loan. The good news is that you can still apply for a loan even if you have bad credit! Easyfinancial offers installment loans to borrowers who can’t get financing at traditional financial institutions. Generally, you need to expect that you will have higher rates and possibly additional fees than a borrower who has a good credit score. Installment loans have the following features:

- Loan amounts between $500-75k

- Repay the loan bi-weekly, semi-monthly, or monthly

- Terms can be up to 240 months

- Interest rates start at 34.99%

Small business financing

Easyfinancial partners with Merchant Growth to provide funding for small businesses. They offer a transparent, quick process with no fees for loans and lines of credit. Some details are:

- Loan amount between 5k-500k

- The minimum monthly revenue must be 10k

- The minimum time in business is 6 months

- Funds can be available in as little as 24 hours

Why choose EasyFinancial

There are several great reasons to choose Easyfinancial. They are an established company, have helped many Canadians get the financing they need and improve their credit score, are easy to access, and offer a variety of products.

Established company

Easyfinancial has been offering financing to Canadians for 17 years. They have won multiple awards for their corporate culture and technology.

Customer service

Easyfinancial has funded 8.2 billion dollars worth of loans and served over 647,000 borrowers. Their customer satisfaction rate is 94%, and they have helped over 60% of their customers to improve their credit scores.

Easy to access

Borrowers can deal with Easyfinancial in person at one of the over 400 branches they have across Canada. Alternatively, they can be contacted by phone or accessed online.

Loans offered

Easyfinancial offers unsecured loans, auto loans, mortgages, bad credit installment loans, and small business financing. While the rates are higher than at traditional lenders, many of their clients use their services because they can’t get the funding they need at a conventional lender. One helpful feature of their personal loans is that you have 10 days after being approved to return the funds and cancel the loan if you change your mind.

How to sign up

In-person: Visit the branch nearest you.

By phone: Cal 1-888-502-3279

Online:

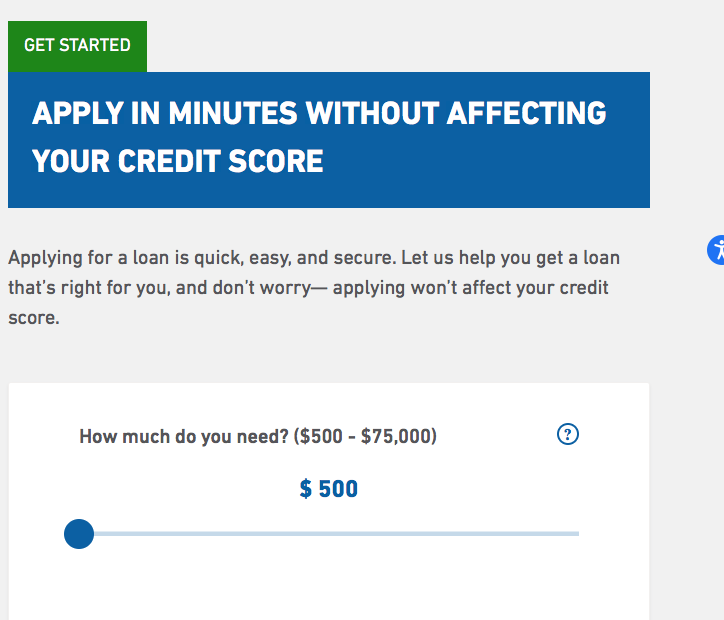

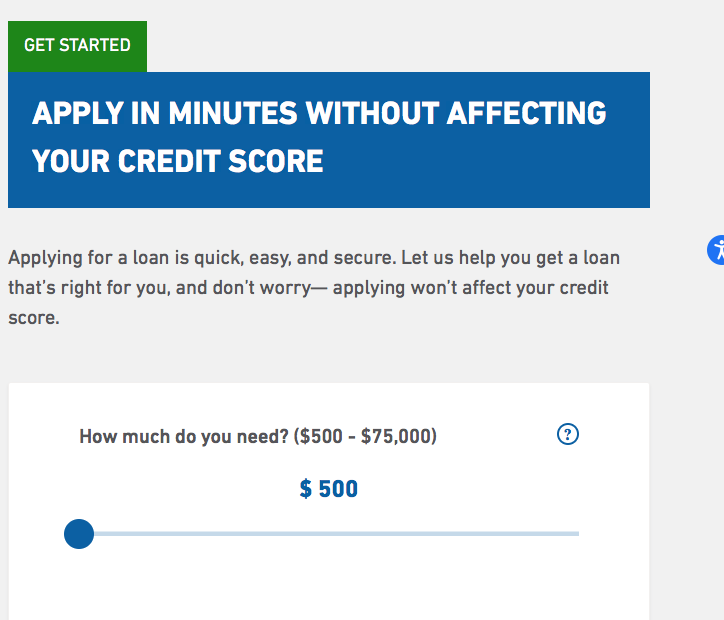

Go to Easyfinancial.com

Choose “apply now”.

Move the slider to choose how much you need.

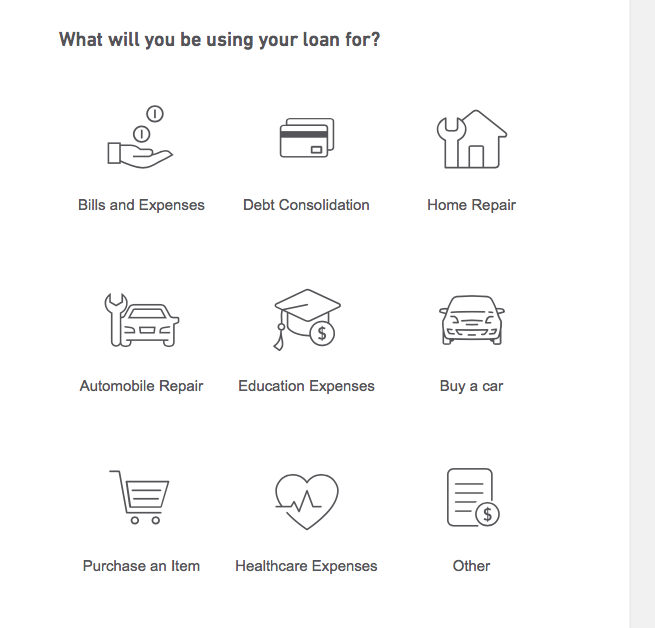

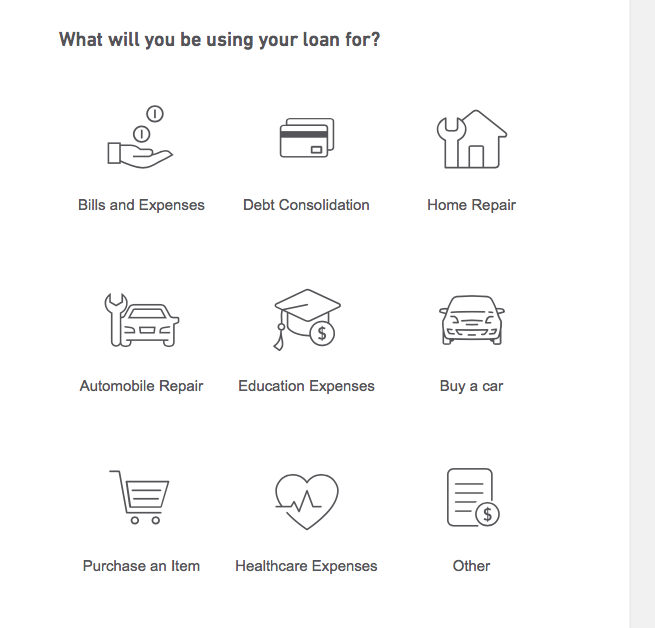

Choose the purpose of the loan.

Input your information on the following screens until you complete the process.

Frequently asked questions

Does applying for a loan at Easyfinancial affect my credit score?

How long do I have after being approved to accept the loan?

I have decided I don’t want the loan. How do I return the funds?

Can I pay off my auto loan early?

Can I get a payday loan from Easyfinancial?

How do I make my loan payments?

My payments are too high. Can I lower them?

Conclusion

Easyfinancial has been operating as an alternative lender for non-prime customers for 17 years. They offer a number of loans with amounts ranging from $500-$75,000. Their application process is quick and, if approved, a borrower can get their money in as little as 2 hours. Additionally, they offer financing for small business owners they can use to run their business. Easyfinancial focuses on helping Canadians improve their credit score and getting the funds they need to accomplish their goals. Once borrowers have improved their credit score, they can apply to traditional lenders for better rates, terms and conditions.