- Visit them online: www.home.consumercapitalcanada.ca

- You can phone from anywhere on this toll-free number: 1-888-554-4192

- Email them at: [email protected]

Personal Loans Offered from Consumer Capital Canada

Personal loans are offered through Consumer Capital Canada, and with one of the quickest applications and adjudication timelines, you might want to work with them. By using their streamlined system, you can benefit from receiving fast cash if you’re approved and the ability to repay the loan with flexible, comfortable terms.

The personal loans offered through Consumer Capital Canada are built with the consumer in mind. Easily walk through the process to obtain your quickly funded loan.

Pre-Qualifying Terms for Loans

To pre-qualify for one of the short-term loans through Consumer Capital Canada, you must meet specific requirements. Knowing these requirements will help you decide if this type of short-term loan is the right choice for you. The pre-qualifying terms are as follows:

- Be a resident of Canada

- Be 18 years of age or older (except those who are in NT, YT, QC)

- Make at least $1600 gross every month; this should be from a primary income source.

- Cannot have a previous bankruptcy, consumer proposal, or debt management case

Those who want to apply for these loans and agree with these terms can apply through the website. You may need to show proof of income, banking information, and a photo ID to verify who you are. Having all of these on hand or scanned is ideal for streamlining the application process.

Things to consider

Before applying for the loan with Consumer Capital Canada, you will want to know more of the specifics of repayments, interest rates, and any fees that you might come across. Knowing more about all three of these will be beneficial.

The interest rates or APRs are the most important things to consider. Getting the lowest APR that you possibly can is recommended because you want to make sure that you’re getting payments you’re comfortable with. With Consumer Capital Canada, you can expect to have APR rates between 19.99% to 34.99%.

Knowing your options for repayment terms is recommended. Generally, the longest term is 60 months. Some businesses that provide payday advance loans will request that you pay back the full amount you borrowed on your next paycheck. With Consumer Capital Canada you can expect repayment terms between 24 and 60 months .

The fees charged are something to think about as well. Any additional fees will be disclosed when you get the loan. Generally, if there are fees, they won’t be any higher than $100. These are usually not added to the cost of the loan from Consumer Capital Canada.

Why choose Consumer Capital Canada

Consumer Capital Canada offers a simple application process, accepts multiple income types and rates are reasonable for an alternative lender.

Borrowers can complete the entire application process online. This means the initial application, submitting documents and the funding can all be done electronically. This is great for people who don’t want an in-person meeting. The process is quick as well, with the application taking from 5-15 minutes to complete.

Consumer Capital Canada accepts more than just income from employment. Borrowers must have a primary income source of at least $1600 before taxes but in addition to employment income, it can come from self-employment, disability, maternity leave, EI or pension.

Interest rates range from 19.99%-34.99%. This is lower than many competitors who charge upwards of 40% for a loan.

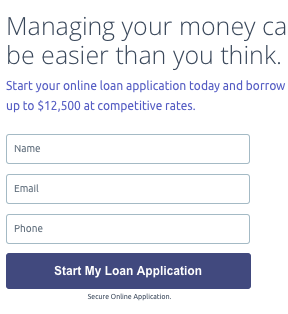

How to Apply Online

When applying for a short-term loan through Consumer Capital Canada, you want to ensure you are doing this correctly. The loan process is simple and will only take you a few minutes to complete.

Click the “Apply button” below”.

Fill out the form online through the website. This can take just a few minutes to do. If you have trouble or experience difficulties, reach out to the customer service staff with Consumer Capital Canada, and they’d be more than happy to provide you with the help you need. Call 1-855-646-0535 for further assistance.

They will call you to start the application and ask for the documents during this process once you’ve applied. Therefore, you will want to have those on hand. They are photo ID, proof of income, and your bank information. Give them this documentation, and then wait to see if you’ve been approved for the short-term loan.

The money will be deposited into your account as soon as you are approved. This only takes a short time.

Since there are only three steps to this process, it is easier than ever to get funded through Consumer Capital Canada. You can benefit from all they have to offer and more. Find out what else you can get from Consumer Capital Canada.

Frequently asked questions

What if the website is not working correctly?

What if I have a bankruptcy or consumer proposal on my credit report?

Is my personal information secure when I put in my information on the website?

What payment terms should I expect?

How long does this usually take?

How much could I borrow?

Conclusion

Consumer Capital Canada is an alternative lender that offers loans to people who need money quickly, don’t qualify at traditional lenders or who have poor or no credit. Applying for a loan with Consumer Capital Canada is simple and quick. Their interest rates are very competitive, especially when compared to similar lenders. Once you’re approved, you can receive your money almost immediately by direct deposit. Consumer Capital Canada offers fast service, good rates and convenience.