The Toronto-based contact center is available by phone:

7 days a week at 1 877-526-6639

or by Fax: 1 855-493-8103

By Email: [email protected]

Their corporate office is located at:

Cash Money & Online Customer Service

400 Carlingview Drive

Toronto Ontario M9W 5X9

With hours of operation:

Monday to Friday 8 am to 11 pm ET

Saturday and Sunday from 9 am to 5 pm ET

Their temporary operating hours are Monday to Saturday 10 am to 6 pm in-store.

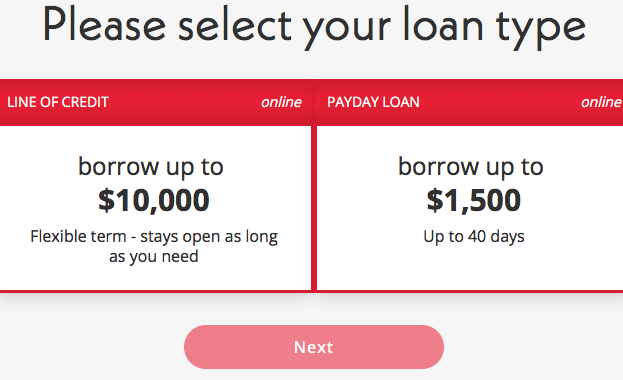

Loan types offered

Payday Loans

Payday loans offered to their customers vary by provincial regulations. These loans provide a temporary solution for customers and are not intended to be a credit rebuilding tool. Payday loan amounts can range from $100-$1,500. As a member of the CCFA (Canadian Consumer Financing Association), Cashmoney is committed to being a responsible lender- offering their services to their clients under regulated control through legislation. Your residing province determines lending rates with no promotional rates provided to residents in the regions of Alberta, Manitoba, New Brunswick, and Saskatchewan.

Rates

For payday loans in British Columbia, a 15% interest rate and APR of 391.07%.

For payday loans in Manitoba, residents can expect to pay a 17% interest rate with an APR of 517.08%.

Residents of Nova Scotia can apply for a 19% interest payday loan with an APR of 495.36%.

Ontarians can apply for a payday loan with a 15% interest rate and a 391.07% APR.

Saskatchewan residents are subject to a 17% interest rate with an APR of 443.21%.

APR rates detailed are that of a 7-day loan. For a 14-term payday loan, the APR was half the above value. In addition, those provinces that qualify for the promotional payday loan option can receive their first payday loan of $300 for a $20 fee.

Installment Loans

Installment loans are available for amounts from $500 to $10,000 with amortization periods ranging from 6 – 60 months. These services from CashMoney are only offered to the residents of Alberta, Manitoba, and New Brunswick at this time. CashMoney offers their future clientele a same-day approval decision providing all information is accurate and they have met the eligibility requirements.

Online Installment Loans

With minimum borrowing set at $500 and maximum available to $10,000. They offer their clients payment terms ranging from 6 months to 60 months.

In-Store Instalment Loans

With the capacity to borrow smaller amounts, clients have the option to borrow less to save money if they need it. Ranging from $100 minimum to a $10,000 maximum. The terms are 6 months to 60 months. The annual interest rate is 46.93% – essentially costing you almost double your initial loan. They suggest using their service when you need it.

Lines of Credit

Because provincial restrictions apply for the line of credit services offered by CashMoney, currently, only Alberta, Manitoba, and New Brunswick clients have access to this product, with different options depending on how you apply.

Borrowing Criteria

To qualify for the15-minute funding, applicants must be 18 years or older. In addition, you must have a valid government-issued ID.

Health cards are considered identification everywhere except those issued by ON, MB, NS, and PEI. You must also have an open chequeing account in your name, and you must provide proof of income. Accepted income types are the Child Tax Benefit, Disability, Canada Pension Plan, employment, Employment Insurance, and Social Assistance.

Social Assistance is not considered a form of income for borrowing services in Manitoba. You must also have a working phone number and a valid email address.

Repayment

Accepting various forms of repayment for their payday loans, CashMoney will accept cash in-store, a cheque, or payment through pre-authorized debit.

Clients can access the due date extensions feature via the online portal or through the CashMoney application, which can be downloaded from Apple or Google Play. Extensions are only granted to those with installment loans or lines of credit. Payday loans are due immediately upon your next payday, although there is some wiggle room for extensions on payday loans for preferred customers with a borrowing history.

Once your loan is paid you can reapply for another loan if you need to. If there is a situation that could prevent you from making your payment, you should contact customer service to discuss your options. This way, you can resolve any issues and avoid possible collections or added interest and charges.

Customers who have defaulted on an installment loan can expect to pay an NSF charge of $25. This NSF charge is only payable once regardless of the number of defaults the client has accumulated for the loan term. In addition, default interest of 30% per annum is charged on the outstanding balances of the loan.

Protection Plan

As an example, a $3500 installment loan with a monthly payment, has a monthly protection coverage charge of $47.25. This coverage provides peace of mind for potential borrowers. It covers the following:

Loss of Employment

Should you be laid off without cause, payments are made as per your regular schedule. Whether monthly, bi-weekly, or weekly. You are required to submit a statement from EI (employment insurance) every 28 days or a monthly bank statement showing you are receiving EI from the government. Providing you supply the necessary paperwork, your loan payments can be made by the protection plan and can be paid for up to 6 months.

Injury or Illness

Should you suffer an injury or illness leaving you unable to work and pay your loan, Canada Premier Life’s coverage provider will make your payments as per your regular payment schedule for up to 6 months. You are required to submit a doctor’s note every 30 days stating that you still suffer from the injury or detailing why you cannot work.

Death

If you should pass away, 100% of your outstanding loan balance will be paid off. This eliminates any worry or concern about your estate having to pay off the debt.

You can submit any claims for your account through your online account or the mobile app. Claimants are reminded that claiming coverage will not increase any of your premium payments for protection.

General Features of Cash Money Personal Loans

- The amount loaned out does not exceed $10,000.

- The annual Percentage Rate is 46.93%.

- Loan terms range from 6 to 60 months.

- Cash Money only offers unsecured loans.

- Repayment schedules depend on the amount borrowed

- Cash Money places a penalty on late payment and a returned payment fee.

- Funds are received within 24 hours of approval.

OPT+ Prepaid MasterCard

CashMoney is an exclusive provider of the OPT+ Prepaid Mastercard. With a low monthly fee of $7, you can use the card for all your online and in-store purchases. Anywhere MasterCard is accepted, simply load cash at a CashMoney store. You can also choose to pay your loans with this method. This makes loading and spending cash easy.

Any CashMoney store will happily help you with the task. There is no fee for purchase transactions, and you can manage your account on the app or through your online customer account. Free with the card sign-up is customer service alerts. As well, you have access to instant card-to-card transfers with other OPT+ Prepaid MasterCard holders.

Why Should you Apply for a Cash Money Loan?

CashMoney offers their customers several borrowing options, multiple easy ways to apply, several different types of services and excellent customer care.

Customers who want a small amount of cash for a period of less than two weeks, can apply for a payday loan. Those who need to borrow more for a longer period might benefit from an installment loan. Finally, clients who might need access to cash in the future or who want a product where they can access the limit after they pay it down, will want to consider a line of credit.

Customers can choose to apply online and take advantage of CashMoney’s easy online process. Those who want more personal contact can apply over the phone or at one of CashMoney’s many branches.

In addition to lending products, CashMoney also offers cheque cashing, Opt+ Prepaid Mastercard®, currency exchange, and Western Union Money Orders and Money Transfers.

CashMoney customers will find helpful agents whether they deal in-person at a branch or call the 1-800 number.

How to Apply

The online application procedures are pretty simple to follow. Here are the steps to follow when applying for a cash loan:

Choose your province and “apply now.”

The next page will require you to select loan type from the available options.

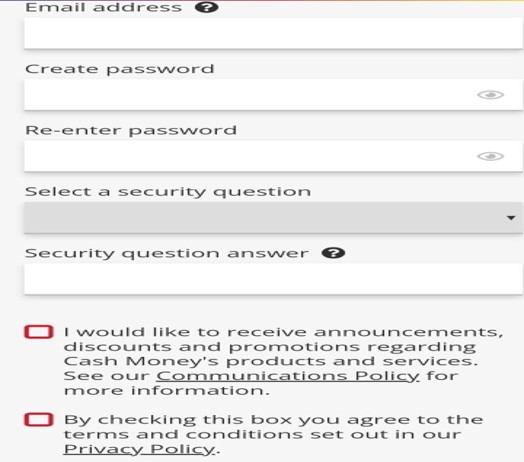

You will be asked to input your email address, password, security question and security answer.

After that you will be asked to provide personal information and a means of identity verification such as a Canadian driver license, birth certificate, or passport, and provide information about the level of your income and source(s).

At this stage, Cash Money will review your application, consider the information provided and issue a decision.

If your loan application is approved, you will receive the funds through Interac e-Transfer or direct deposit.

The application is subject to the verification and approval process. By giving your consent upon application completion you agree to their terms and conditions. A credit check is conducted for installment loans and lines of credit.

Frequently asked questions

Can I pay off my loan early without penalties?

Can I extend my due dates?

What kinds of payments does CashMoney.ca accept?

What other services does CashMoney.ca offer in-store?

What is Cash Money?

Is Cash Money safe?

What products and services does cash money offer?

Does lending from Cash Money affect your credit?

How much can I borrow from Cash Money?

What is the Interest rate in a Cash Money loan?

What is the Term Period for a Cash Money Loan?

Can I Apply for a Cash Money Loan Online?

How can I be Eligible for a Cash Money Loan?

How fast will I receive the loan applied for?

How do I pay back my loan?

How can I extend my repayment date?

Where can I find Cash Money stores?

What type of Customer Support does Cash Money provide?

Resource Centre

The folks at CashMoney understand that not everyone has perfect credit or unlimited funds. Therefore, they offer several resources for those who may require additional help with credit counseling services:

- Canadian Bankers Association: You can browse various banks and discover financial issues or solutions that could impact your life.

- Canadian Consumer Finance Association (CCFA): Here, you can find free credit counseling services for Canadians, narrowed down by your location.

- My Money Coach: Free online workshops to help you create a wealth management plan.

- Get Smarter About Money: A site that answers every question about money. How to manage it? To detailed information about different types of bank accounts. They also will help you formulate a plan to put your goal in motion.

- Office of Consumer Affairs (OCA): An entire plethora of information related to money management.

Plus, numerous others worth exploring. Especially if you feel you might require the assistance of a professional expert to help, you overcome any financial hurdles in your life.

Best Choice

With strict adherence to federal regulations, CashMoney is an excellent alternative to someone needing instant, emergency cash. Their longer termed loans are an option, although they also have higher interest rates than most lenders. They require little information besides you meeting the eligibility requirements. Once those have been met, your funds are available instantly. So, if you need that money today, CashMoney could be a great option as a lender for you. They do offer sound borrowing advice. Being a responsible lender and borrower is required for the system to work.

- Borrow what you need.

- Understand the terms and the costs.

- Look into alternatives.

- Make sure you can pay back the loan.