The Royal Bank of Canada is one of the largest financial institutions in Canada, offering a wide variety of products and services while incorporating multiple business lines. RBC operates globally and continually works to build a reputation for excellence with their customers, employees, and investors.

Written by: Piggyy

Personal Loans

Car Loans

Personal Line of Credit

Home Equity Line of Credit

Student Line of Credit

Bank services

RBC has provided financial services to Canadians since its incorporation in 1869. It has grown to be one of the largest financial institutions in Canada and has expanded internationally. Currently, RBC has 86,000 employees and serves 17 million customers worldwide. The bank offers products and services for personal, commercial, wealth management, capital markets, investment and treasury, insurance, corporate, and investment banking. RBC is also, by market capitalization, one of the largest banks in the world.

A board of directors governs the company, following the Bank Act and all regulations, including those in the Canadian Securities Act, The Toronto Stock Exchange, the New York Stock Exchange, and the US Securities and Exchange Commission. RBC’s continuing success is due, in part, to being strategic in their business practices and focusing on their purpose, vision, and values.

RBC , 88 Queen’s Quay West , 12th floor

Toronto, ON , M5J 0B8

Business hours will vary depending on the branch and location. Contact your branch for their hours. Typical hours are:

Monday: 9:30 am-5:00 pm

Tuesday: 9:30 am-5:00 pm

Wednesday: 9:30 am-5:00 pm

Thursday: 9:30 am-5:00 pm

Friday: 9:30 am-6:00 pm

Saturday: 9:00 am- 4:00 pm

Sunday: closed

The call center is open 24/7 to assist you.

RBC is closed for all federal holidays.

1-800-769-2511

People borrow to meet specific needs. For example, it may be to consolidate debt, buy a car, renovate a home or buy a home. RBC has lending products designed to meet the needs of borrowers to help them achieve their goals. Types of loans available are personal loans, car loans, home improvement loans, RRSP loans, energy saver loans, lines of credit, and mortgages.

You can use a personal loan for many things. You might want to consolidate debt, buy furniture or appliances, take a vacation, pay for a wedding or have another purpose. RBC personal loans can be a great option because:

RBC has several options for borrowers who want to finance a vehicle purchase. RBC offers financing for vehicles through their branches and dealerships for new or used vehicles, newcomers to Canada, electric vehicles, or vehicle(s) for business purposes.

Features of RBC car loans are:

RBC’s Newcomer Automotive Loan Program is for borrowers who have been in Canada for three years or less.

Features of the program are:

Many buyers are considering an electric vehicle for environmental reasons or to reduce their vehicle’s operating costs. RBC has a financing program for borrowers who want to buy a battery-electric vehicle, plug-in hybrid electric vehicle, or hybrid electric vehicle.

These loans offer:

Businesses often need to purchase vehicles or add to the vehicles they have. RBC has vehicle financing for businesses that are incorporated, partnerships, not-for-profit, and registered charities. Businesses can use this program to finance one or multiple vehicles up to a maximum loan amount of $250,000.

Features of the business vehicle loans include:

RBC has financing specifically for boats and RVs. Borrowers can apply for these loans at dealerships by asking for RBC financing and providing the required information.

RBC boat and RV loans offer the following features:

The costs of home improvements can be very high, depending on what you choose to do. There are several ways to finance home improvements through RBC. First, consider how much you need to borrow, how long you want to take to repay the loan, and the terms and conditions of the loan. Options for financing home improvements at RBC include unsecured options like a personal loan which we have seen or a Royal Line of credit. Secured options include the Secured Royal Credit Line, RBC Homeline Plan, Mortgage Add-On, Built-In Mortgage Add-On, and a mortgage refinance.

A Royal Credit Line is an unsecured, revolving credit product. Lines of credit have a set limit, and a borrower can draw funds up to the limit, for example, $10,000. Once the limit is paid down or off, borrowers can draw funds up to the limit again without reapplying. The Royal Credit Line is a very flexible product that you can use for any reason, including home renovations. Having the ability to draw funds as you need them can be very helpful since you often don’t know exactly how much money you’ll need when you begin a renovation project.

Royal Credit Line features:

The Secured Royal Credit Line works the same way as an unsecured Royal Line of Credit. The difference is that the borrower uses the equity in their home or an investment portfolio as security for the credit line. This means that if the borrower defaults on making payments on the secured line of credit, the bank can take the asset to satisfy the debt.

Some advantages that a Secured Royal Credit Line has over an unsecured Royal Credit Line are:

RBC Homeline Plan is a type of mortgage that allows you to access the equity in your home. Once the Homeline plan is in place, you can access the credit that has been made available by paying down the debts secured by your Homeline Plan without reapplying. In addition, you can borrow up to 80% of the value of your home and use it for purposes such as home renovations.

Benefits of the RBC Homeline Plan include:

RBC’s Mortgage Add-On is a mortgage product that gives you the option to increase your mortgage balance to 80% of the appraised value of your home. The existing mortgage rate is blended with the current three-year fixed-term rate. Your monthly payment will change to accommodate the additional principal and the new rate.

Benefits of the RBC Mortgage Add-On include:

Any RBC mortgage funded on or after April 15, 1996 (except Quebec) is eligible to be considered for the Built-In Mortgage Add-On. This product works the same way as the Mortgage Add-On, except that you cannot exceed the original amount of the mortgage. An appraisal is required to determine the home’s value, but no legal fees are required. You can use this feature as many times as you like, and it can be a very convenient way to get the funds you need to renovate your home.

You can refinance your mortgage if the Mortgage Add-On or mortgage Built-In Add-On does not give you the amount you need for your home renovations or other financial goals you may have. This process usually involves an application for credit, an appraisal, and legal fees. Speak to your RBC advisor for more details.

RBC offers RRSP loans for customers who want to make their current year’s RRSP contribution or catch up on unused contribution room from previous years.

RRSP loans:

The Energy Saver loan is for loans of $5,000 or more that are used to make qualifying purchases for products or services to improve the energy efficiency of a home. Borrowers can get a 1% discount off the loan rate or $100 to help cover the cost of the required energy audit. The loan term can be from 5 to 10 years. The audit must be completed within 90 days of the borrower receiving the funds for the loan.

You can apply for either an unsecured or secured Royal Credit Line, as we have seen earlier. An additional line of credit that RBC has is the Royal Credit Line for Students.

The Royal Credit Line for Students is available for undergraduates enrolled in university, college, or a trade school and students in a graduate program not covered by the Professional Studies program. There is a Royal Credit Line for Students students in Professional Studies and a Royal Credit Line for Medical and Dental Students.

Royal Credit Line for Students features and requirements:

RBC has a wide range of mortgages available, depending on what you would like to do. We have already looked at the RBC Homeline, RBC Mortgage-Add-On, RBC Built-In Mortgage Add-On, and a mortgage refinance. RBC also has mortgages for new purchases, investment properties, and vacation homes.

Fixed and variable rate mortgages refer to the interest rate. A fixed-rate mortgage has the rate fixed for the term. The advantage of a fixed-rate mortgage is that your payments will be predictable for the duration of the mortgage term.

A variable rate mortgage has a rate that adjusts as the RBC prime rate adjusts. With a variable rate mortgage, your rate will increase if the prime rate increases, and if it decreases, your rate will decrease. Your payment will change if it is not high enough to accommodate the increase in the rate. A variable rate mortgage can have lower rates than a fixed-rate mortgage, and if rates are increasing, you can lock in your mortgage at the fixed rate for a term as long as or longer than your remaining term.

RBC has a mortgage to help you buy a vacation home. You can amortize it over 25 years if you have a downpayment of 20% of the property value or more or over 30 years if your down payment is less than 20% of the property value.

Borrowers who want to buy a rental, convert their own home to a rental, or begin building a portfolio of rental properties can consider this mortgage. Borrowers can get a mortgage of up to 80% of the appraised property value.

RBC mortgage features:

The RBC Cashback mortgage offers homeowners cashback when they buy a home. The money is advanced the day the mortgage is funded and can help cover legal costs, moving expenses, land transfer taxes or be used for anything else. This mortgage is beneficial for first time home buyers with a 5% downpayment. The cashback amount is based on the amount of the mortgage and can be a maximum of 7% or $20,000.

Current Mortgage Offers:

Different loans may have other criteria but, generally, you will need to be the age of majority in your province and provide:

RBC offers customers excellent service, a wide variety of products and services, and many ways to do your banking.

RBC has branches and ABM’s all over Canada for you to get advice and do your banking. In addition, customer service is available through the call center 24/7 to help you resolve any issues you might have.

RBC can meet all your banking needs. RBC has bank accounts, credit cards, loans, credit lines, mortgages, investments, and many tools to help you take control of your finances and plan your future.

You can do your banking at the branch, ABM, online, over the phone, or using your mobile app. RBC offers 24/7 banking convenience with banking options that are easy to navigate. You can choose when, where, and how to bank.

You can apply for:

Begin the process by clicking the “start online pre-approval” button.

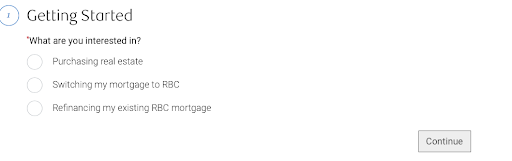

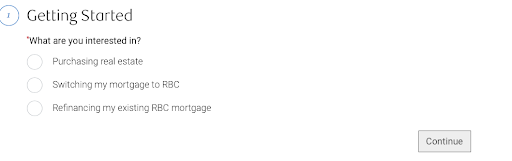

Next, select whether you want to purchase real estate, refinance your mortgage or switch your mortgage to RBC.

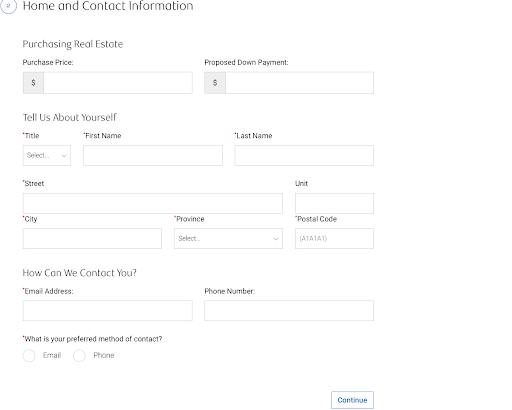

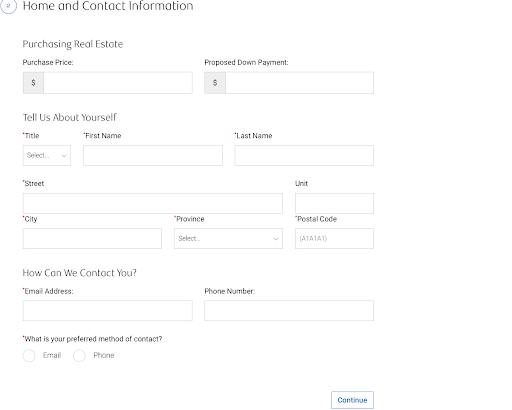

Fill out the all information on the following screen so that the RBC mortgage specialist can contact you:

The third screen will lead you to select a mortgage specialist.

RBC has provided banking services to customers in Canada and globally for over 150 years. The Retail Banker International has recognized RBC’s excellence in banking by granting them awards for the North American Retail Bank of the Year, the Best Loyalty/Rewards Strategy, and the Best Latin/ Caribbean Bank of the Year. Customers can expect excellent products, services, and advice from RBC.

Table of Contents

Table of Contents