The Bank of Nova Scotia received Royal assent to a bill that allowed it to incorporate on March 30, 1832. It became the first chartered bank in Nova Scotia. As time went on, it expanded throughout the Maritimes provinces and then to Winnipeg, Manitoba. Eventually, the Bank of Nova Scotia opened offices in Minnesota and Chicago and established operations in the Caribbean. After World War II, the bank grew rapidly, capitalizing on the post-war boom with innovative products like the public trading of gold and Scotia Plan Loans. International expansion began in the 1960s, starting in Asia and eventually developing a presence in Central and South America.

Written by: Piggyy

Scotia Plan Loan

Scotiabank Auto Loans

Scotiabank Grad Auto Loans

Scotiabank StartRight auto finance program

Bank services

Table of Contents

Scotiabank is one of Canada’s top five banks and the most international Canadian bank. It has almost 98,000 employees serving 25 million customers worldwide. The bank has a Chief Executive Officer and a board of directors. Scotiabank is a full-service bank offering personal, business, and corporate banking services.

Address Main Office: Scotia Plaza, 44 King Street West, Toronto, ON, M5H 1H1

Business Hours:

Hours vary, but many branches are open:

Monday-Thursday 9:30 am-4:00 pm

Friday 9:30 am-6:00 pm

Saturday-Sunday 10:00 am–2:00 pm

Phone:

1-800-4-SCOTIA

1-800-472-6842

Scotiabank has a full suite of loans to help customers achieve their goals. Borrowers will find mortgages, personal loans, auto loans, motorcycle and leisure vehicle loans, marine and boat loans, recreational vehicle (RV) loans, lines of credit, RSP lines of credit, and student lines of credit.

If you’re thinking of buying a home, investment property or cottage, Scotiabank has mortgage products that can help finance your purchase. You generally need 5% of the purchase price of the home as a downpayment. Scotia mortgages offer:

Scotiabank’s primary mortgage product is the Scotia Total Equity Plan (STEP). Once borrowers have at least 20% equity in their property, they can use the STEP to secure a variety of credit products. Features of the STEP include:

If you are thinking of buying a cottage, take a look at what Scotiabank has to offer for cottage financing. Features of cottage mortgages include:

Your secondary home can be either a Scotiabank Type A or Scotiabank Type B property. Both properties require that the same quality of building materials and construction is used as for residential properties but, a Type B property does not need year round road access or a standard heating system.

Scotiabank will provide the specifics of what you need to complete a mortgage application but you can expect to be asked to provide the following:

Borrowers can use Scotia Plan Loans for a wide variety of purposes. Some examples are:

Scotiabank offers three types of auto loans to suit various circumstances. The available loans are an auto loan, a Grad auto loan, a Start Right auto loan, and an Ecoliving loan.

You can get financing through Scotiabank to finance a new or used vehicle. The flexible terms, competitive loan rates, and loan amounts can make your dream vehicle a reality.

Graduating from a post-secondary institution is a significant milestone. However, once finishing school, grads often find themselves needing or wanting a vehicle. Scotiabank offers loans specifically for students graduating within 90 days of applying or who have just graduated.

Scotiabank offers auto loans for borrowers who are foreign workers or permanent residents. The Start Right Auto Loan can help people new to Canada finance a vehicle.

With skyrocketing gas prices and concerns about the environment, many people are considering purchasing vehicles that are not as dependent on gasoline. Scotiabank’s Ecoliving loan could be the right loan for you because:

Scotiabank offers loans for motorcycles, snowmobiles, quads, ATV’s (all terrain vehicles), personal watercraft and other leisure vehicles. The Motorcycle and Leisure Vehicle loan has the following features:

Scotiabank offers financing for customers interested in buying a powerboat or sailboat. Reasons you may want to consider a Marine and Boat loan from Scotiabank are:

Many Canadians want to travel using an RV, but RV’s are expensive. Scotiabank offers RV loans to help make the dream of owning an RV a reality. You may want to consider a Scotiabank RV loan because:

Lines of credit are a flexible option for borrowers who may not know exactly how much money they need, may not need the money right away, or who want the option of accessing their credit limit again without having to reapply. Scotiabank has a variety of lines of credit to help borrowers meet their needs. In addition to the Scotialine Personal Line of Credit, there is also the Student Personal Line of Credit and the RSP Catch-up Line of Credit.

Scotiabank’s personal line of credit is called a Scotialine. It can be unsecured or secured with the equity in your home. Scotialine gives borrowers convenient and easy access to credit when they need it without reapplying.

The Scotia Personal Line of Credit for Students provides a way for students to fund their education if they need additional resources. Students enrolled in Certificate and College programs, apprenticeships, or graduate programs are eligible to apply regardless of whether they are full-time or part-time.

Many financial institutions have RRSP loans, but Scotiabank offers a line of credit for investors who want to make their yearly RRSP contribution, catch up on contribution room from past years or do both. Using the Scotia RSP Catch-Up Line is a convenient way to maximize your RRSP contributions because, unlike a loan, you can use it year after year without having to reapply.

Scotiabank offers customers a wide range of products and services for their everyday banking needs. You will find bank accounts, credit products, investment solutions, and estate and financial planning services. If you own a business, there are business accounts, lines of credit, and credit cards to meet your banking needs. Additionally, Scotiabank has products tailored to the needs of those working in agriculture, such as the AgriInvest account.

Whether you bank a little or a lot, are a youth, student, or senior, Scotiabank has a bank account for you.

Scotiabank has credit products for almost every need if you are interested in borrowing. You can apply for:

You will find investment solutions at Scotiabank to help you meet your goals. Investment plans and products offered are:

Scotiabank has advisors to help you plan your financial future. Some services you will find at Scotiabank are:

Running a business can be complicated, but the right products and services can help make things easier. Scotiabank offers banking products and services for businesses that include the following:

Scotiabank has been providing banking services to farmers and those involved in agriculture for most of its history -over 180 years. The AgriInvest account is designed for those working in agriculture and has the following features:

The application process depends on what you are applying for. You can apply or sign up online for many products Scotiabank offers. Here’s how you sign up for:

The online application process looks like this:

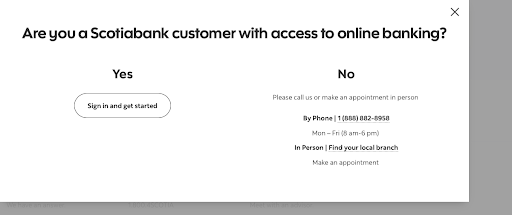

The system will ask you if you are already a Scotia Online customer:

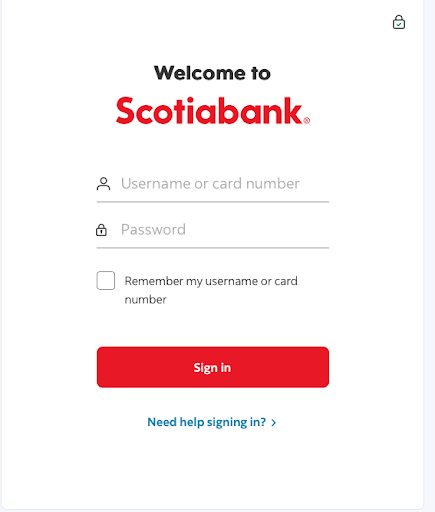

If you are, proceed to the sign in screen and then follow the prompts:

If you are not already a Scotiabank customer or you’re not signed up for online banking, call 1-888-882-8958 and they will assist you.

You can book an appointment to see an advisor in branch by calling 1-877-303-8879.

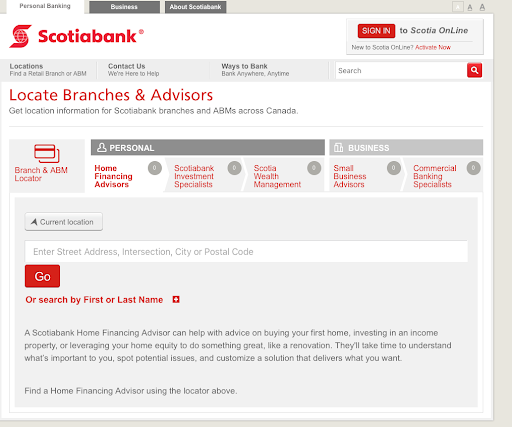

You can also apply with a Scotia Home Advisor. Use this form to be connected with a Home Advisor near you:

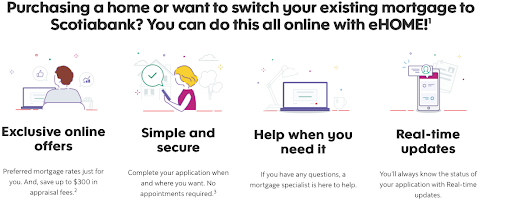

Scotia Ehome is available for those who would like to apply online. If you want a pre-approval, mortgage approval or want to switch your mortgage to Scotiabank, you can apply online using eHome. The benefits of applying for a mortgage pre-approval are outlined in the following screen.

Follow these steps to get started with your online application:

Click “get started”.

View the privacy agreement and then choose “accept and continue” if you are satisfied with Scotiabank’s privacy agreement.

You will then be asked to answer six questions to see if you are eligible to apply for a mortgage using Scotia eHome.

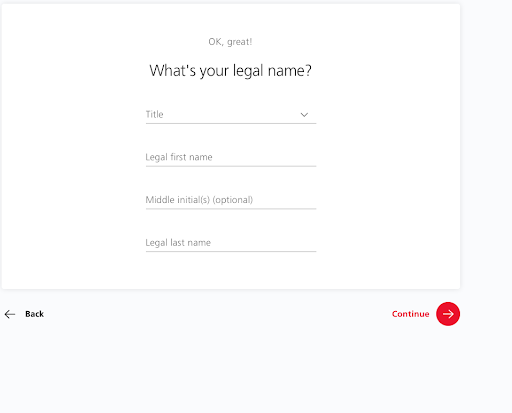

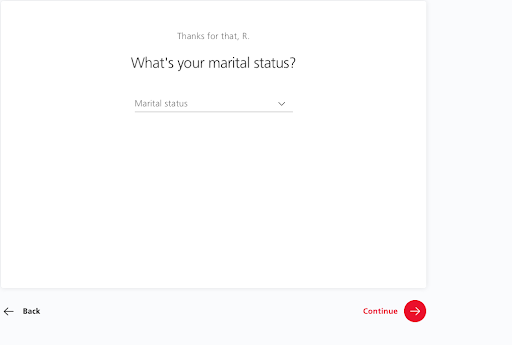

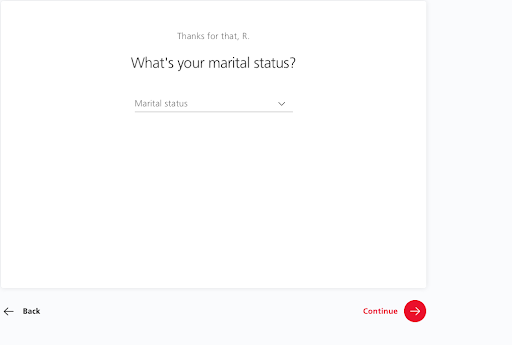

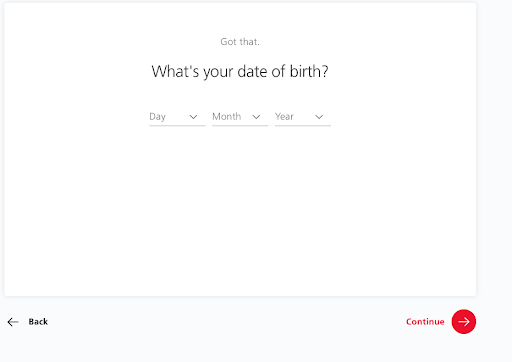

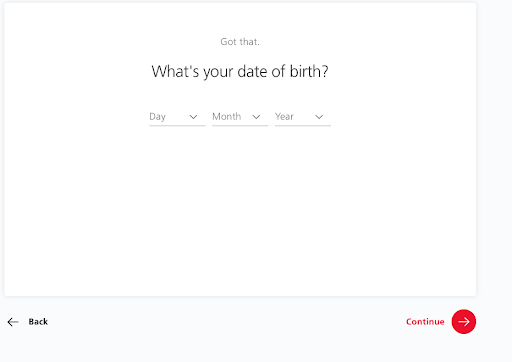

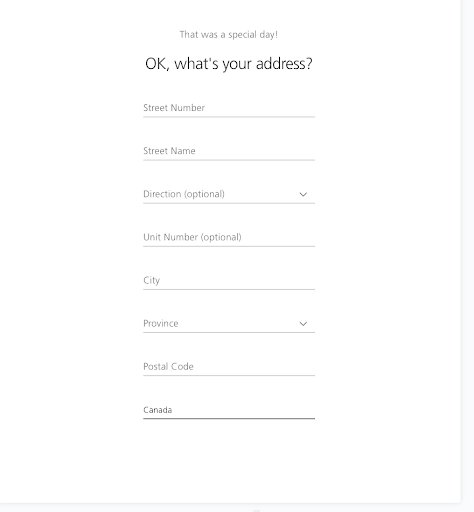

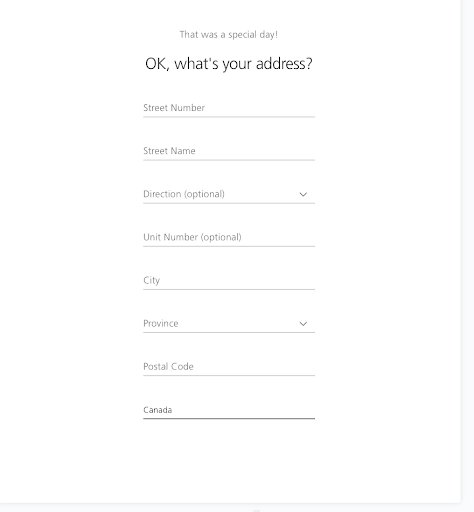

If you qualify to apply for a mortgage using eHome, you will begin the process by filling out personal information on the following screens:

First, your name.

Next, your marital status.

Then, your date of birth.

Followed by your address.

Scotiabank is a full-service bank that offers financial products and solutions for personal, business, commercial, and agriculture clients. Customers can manage their accounts online, or they can phone or visit a branch for service. Scotiabank offers competitive rates, convenient banking options and a wide variety of great options for their customers.

Table of Contents

Table of Contents