HSBC stands for Hong Kong and Shanghai Bank. While working for a shipping company, Thomas Sutherland saw the need for a more efficient banking system to accommodate growing trade between China and Japan. After creating his prospectus, he gained the backing of 14 of the largest companies in Hong Kong. The first branch of HSBC opened in Hong Kong in 1865, with a second branch opening in Shanghai a month later. In July, 1865, an office in London was opened to facilitate financial transactions between England, China and India. HSBC was incorporated in 1866.

Currently, HSBC is one of the largest financial institutions in the world. Globally, it serves approximately 40 million customers and operates in 64 countries and territories. HSBC became part of Canada’s banking scene in 1981. Through a series of acquisitions, it is now the seventh-largest and the most international bank in Canada. HSBC is a financial services leader providing commercial, global, wealth, and personal banking for Canadian consumers.

Written by: Piggyy

HSBC Personal Line of Credit

HSBC mortgages

HSBC Traditional Mortgage

HSBC Power Equity Mortgage

Bank services

HSBC Bank Canada

885 West Georgia Street

Vancouver, British Columbia

Canada V6C 3E9

Phone: 1-888-310-4722

Whether you want to buy a home, make a major purchase, fund your education, top up your RRSP or simply have access to funds if you need them, HSBC has a solution for you! HSBC Canada offers a variety of mortgages and loans to help you fund your dreams.

You can use an HSBC mortgage to buy a home, refinance debt, make a significant purchase or access the equity you have in your home in case you need it. Three types of mortgages are available to help you accomplish your financial goals: the HSBC Traditional Mortgage, the HSBC Equity Power Mortgage, and the HSBC HELOC.

An HSBC traditional mortgage is an excellent choice for first-time homebuyers or homebuyers who don’t have 20% or more of the purchase price for a downpayment. This mortgage helps buyers own their homes. In addition, this mortgage is great for borrowers who want:

Homeowners with more than 20% equity in their property can benefit from the HSBC Power Equity Mortgage. This mortgage can help you:

A HELOC is a home equity line of credit. The equity in your home secures the line of credit, and the amount of the HELOC is set by the value of your home less what you owe on it. With a HELOC, you can access the money you need up to the available limit, and you pay interest only on what you owe. A HELOC can benefit you if:

Mortgage rates are very low right now and you can get a great rate regardless of the type of mortgage you choose. Currently, special rates are offered for both fixed and variable rate mortgages. Current fixed rate mortgage APRs are as low as 2.77%, while a variable rate mortgage has an APR as low as 1.67%. Variable rates come with the additional feature of allowing the borrower to lock into a fixed rate if the borrower feels rates are rising too rapidly.

As an added incentive, HSBC is currently offering up to $3000 cashback for customers purchasing a new property or transferring in a mortgage from another lender. Applications must be processed between February 28, 2022 and September 30, 2022. The minimum mortgage amount to qualify for cashback is $200,000 and the mortgage has to be funded within 120 days of the application date or by December 31, 2022.

The HSBC HELOC currently offers a rate of prime minus .15%. While the rate is subject to change as prime rate changes, using the equity in your home can be an excellent way to get the funds you need at a low rate.

Personal loans are available for a wide range of purposes and can be a great way to help you reach your financial goals. You might need to buy a vehicle, pay for an upcoming expense, do home repairs or consolidate debt. Personal loans at HSBC have:

HSBC personal loans offer competitive fixed and variable rates. Variable rates currently range from HSBC prime plus 2.75% to HSBC prime plus 6.75%. Additionally, HSBC Premier and HSBC Advance clients have access to preferred loan rates.

An HSBC RRSP loan can help you meet your RRSP contribution goal or catch up on unused contribution room from past years. Contributing to an RRSP enables you to save for retirement, take advantage of tax-deferred growth, and may help generate a tax refund. HSBC RRSP loans have:

An unsecured line of credit from HSBC gives you the flexibility to manage unexpected expenses or take advantage of opportunities that arise. You can borrow up to the limit, and you only pay interest on the amount you use. Once you pay it down or pay it off, you can re-access the limit if you need it. Advantages of an HSBC line of credit are:

Interest rates on HSBC lines of credit are variable and tied to the HSBC prime rate. Customers who are HSBC Premier or HSBC Advance clients are eligible for special rates.

Overdraft protection is available in amounts ranging from $500 to $4999. This feature is added to your account to help you manage your expenses if you are short of funds. You can make debit purchases, automatic debits, account withdrawals and have cheques cleared up to your overdraft limit. will be honor Overdraft provides customers with:

HSBC overdraft protection charges a five dollar fee, except in Quebec, only when you have had your account overdrawn for a day or more in a month. Current interest rates for overdraft protection is 21% per year, except in Quebec.

The HSBC undergraduate line of credit will help you get the funds you need to pay for your undergraduate degree. You can access the line of credit while attending a university that is an HSBC eligible accredited university and up to a year after your graduation. Features of the HSBC undergraduate line of credit include:

The minimum limit per year for an HSBC Undergraduate Line of Credit is $5,000 and the annual maximum is $11,250. The student must provide proof of enrollment to be eligible for funding.

HSBC Canada has options tailored to meet your borrowing needs. Lending products are designed with your goals in mind. If you want to borrow to fund something specific, like funding your RRSP or buying a home, HSBC Canada has the products to help you.

HSBC offers several convenient ways to apply for the credit you need. You can start an application online, over the phone or in person at any HSBC branch.

The higher the interest rate, the more your loan or mortgage will cost. At HSBC Canada, you will find competitive rates for all your borrowing needs. You may be eligible for additional discounts depending on the types of accounts you have with HSBC.

Mortgages, loans and lines of credit offered by HSBC Canada have prepayment privileges so you can pay down or pay off your debt faster. These options are there if you want to use them, but if not, you can simply make your regular payments as per your agreement.

You can easily keep track of your banking using the digital banking options at HSBC. These services offer customers a great way to manage their finances. HSBC’s digital banking options are convenient and secure, allowing you the freedom to bank when and where you choose.

Apply for a personal loan, personal line of credit, overdraft or undergraduate line of credit at a branch, by phone or online:

By phone: 1-888-310-4722

Apply for a RRSP loan at a branch, by phone or online:

By phone: 1-877-840-4722

Apply for a mortgage or HELOC at a branch, by live chat or be prequalified online:

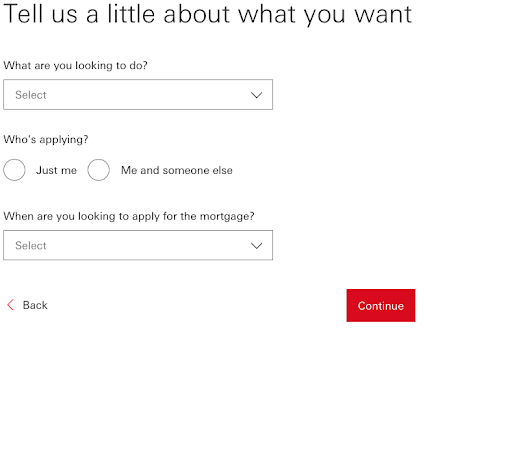

Click on “get prequalified”.

Then, click on “let’s start.”

Answer the following questions and click “continue.”

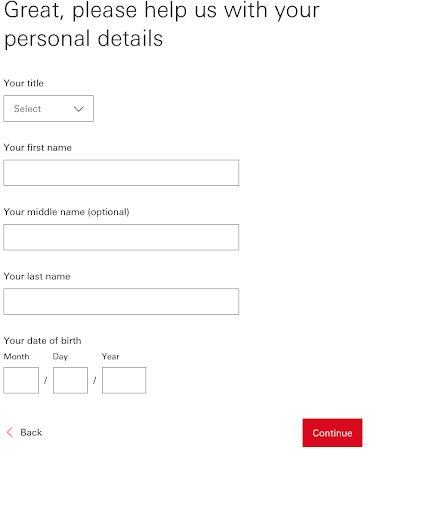

Fill out your personal details to continue to get prequalified for a mortgage.

HSBC Canada is an excellent choice for customers who want full-service banking and the advantages of an international bank. Customers will find a wide variety of products to meet their banking, investment, borrowing and commercial needs. You can access HSBC Canada’s products and services in person at a local branch, over the phone or by using the available digital banking options.

Table of Contents

Table of Contents